May was another fantastic month for dividend investors. The stock market continues its insane march upwards due to the resilient economy and the AI Boom. Finding stocks to buy is becoming harder and harder. That said, while we are waiting for buying opportunities to identify themselves, we are also letting our other investments do work for us. This article talks about our strong May dividend income!

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income with dividend income. One day, my dividend income will be large enough to cover my monthly expenses and allow us to retire early. That is why we are always relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We save a high percentage of our income each month, to help fuel our dividend stock portfolio. Having a high savings rate is a key pillar of our strategy and helps fuel the fire and push the snowball further down hill. While we are waiting to invest our money in the market, it is earning a high interest rate in accounts. There is NOTHING more critical than maximizing EVERY DOLLAR in your savings account.

READ: How To Maximize Your Cash – 4 Simple Methods!

The 3 primary savings accounts I use are:

- SoFi – 4.6% APY on all savings accounts (lower for your checking account). The race for deposits is INTENSE! Banks and credit unions are offering great savings rates.

- Capital One 360 Savings – 4.25% APY – We use Capital One for our checking and savings account.

- Wealthfront – 5.0% without promotion. 5.5% with an extra .5% by signing up using my referral link (Click Here).

Read: Interest Rates on High Yield Savings Accounts Are SOARING!

Bert’s May Dividend Income Summary

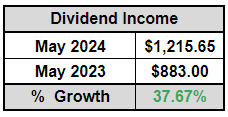

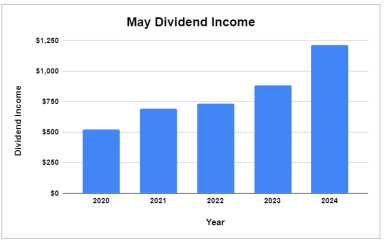

We closed out the month in style, that is for sure. In May 2024, we received $1,215.65 in dividend income! This was a strong 38% increase compared to last year.

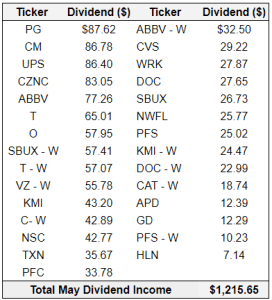

The following chart details our individual dividend stock holdings. This shows every single dividend we received during the quarter!

Dividend Income Observations

It is always fun to take a microscope to our dividend income totals to see what is really going on. After all, the devil is in the detail, right?!

UPS Delivered a Nice Surprise

First, our dividend income was slightly inflated this month due to United Parcel Services, UPS. UPS typically pays a dividend at the beginning of June; However, for some reason, management decided to pay its dividend on May 30. I’ll never complain about receiving a dividend a few days early! As a result, their dividend payment shifted months and really juiced up our May dividend income. We received this $86.40 extra dividend in May and will see the other side of this timing change in June. Luckily, June is one of my highest dividend paying months!

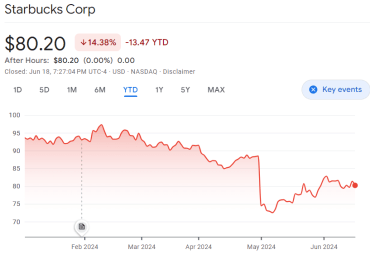

Starbucks added two shots of espresso to our income

We have been building our Starbucks position while the stock is down over the last several months. Starbucks is a major holding in both my portfolio and my wife’s portfolio. The results of this have been pretty amazing. Combined, we received over $84 in dividend income from the coffee chain this month. At Starbucks’ current share price, that means we DRIP’ed over 1 combined share. This is one of my favorite holdings in my portfolio. We walk by our local Starbucks multiple times per week and the line is always packed. My wife and I smile ear to ear every time knowing we are shareholders of this company.

All Stocks, except one, paid us at least $10

This year, we have been on a kick to either add more to positions or to start cutting them out of our portfolio. Lanny and I both have a lot of individual stocks in our portfolios. At a certain point, it becomes too much to manage. For me, I have targeting getting rid of the positions that pay less than $10 per month in dividend income. In May, I was excited to see that I only had one stock that paid a dividend less than $10! That position was Haleon (HLN). We received shares of this company in a spin-off from GlaxoSmithKline (GSK). Why do I still hold it? I don’t know! Maybe it is because of the strong consumer brands.

Summary

Another month of strong dividend growth. My wife and I couldn’t be happier to see the fruits of our frugal living labor. The chart below shows just how much our dividend income has grown over the last five years. We are blessed and fortunate to see our dividend income double in 5 years. Plus….this is in an “off month.” This fact would still be true even if we removed the UPS dividend too.

Seeing these results continues to motivate us to keep pushing ourselves. Financial freedom is a long journey. There are many surprising twists and turns that we will face. The important thing is to stay focused and stay consistent. Keep saving and keep investing. Let the power of compounding do the work for you!

How much May dividend income did you earn? What was your highest paying stock?

Bert

Nice month, Bert! Topping $1K on such impressive YoY growth is terrific. Sure you got the pulled-forward dividend from UPS, but you would have still posted an outstanding month regardless. I like your additions of SBUX at current levels, too. Lastly, you’ve got quite the dogfight going for your top dividend payer this month… they should all be delivering $100+ in a year or two, even without additional purchases. The progress is amazing… keep it up.