Shocker. I am getting right to the point here. You do not need to buy individual dividend stocks in order to be a dividend stock investor. This could be part of the reason why investors or beginner investors are afraid to jump into the stock market, because the fear of having to pick individual stocks.

Therefore, I really want to hone in on that fear and debate. There are many ways to build a passive income stream on your journey to financial freedom, with dividend income being one of those streams. Hence why I repeat, you do not need to buy individual dividend stocks to be a dividend investor. It is time show you why and how you can be a dividend investor without buying dividend stocks. .

Buy Exchange Traded Funds that PAY Dividends

You can be a dividend investor by simply buying Exchange Traded Funds (ETFs) that simply PAY dividends! What is an ETF? I’ll keep it short and simple. An ETF is a bundle or basket of stocks that tracks an index/sector/whatever it may be and can be traded during the day like a normal stock. There is an expense ratio, typically, to the asset manager that manages the ETF. What are big names in the ETF space? Names such as Vanguard, Charles Schwab, Fidelity, BlackRock are a few big names that manage the biggest ETFs in the world.

ETFs can track large indices and pay a dividend, such as those that tack the S&P 500. What are a few examples of dividend ETFs that follow these characteristics?

Vanguard’s S&P 500 ETF (VOO): Vanguard sports a 0.03% expense ratio on this almost $1 trillion in assets exchange traded fund. The dividend yield is almost 1.25% and grows, on average, each and every year.

Charles Schwab Large Cap ETF (SCHX): Schwab here has compared well against Vanguard. They also yield 1.2% with a, you guessed it, 0.03% expense ratio.

BlackRock’s iShares S&P 500 ETF (IVV): BlackRock also is a HUGE staple in the investing community. They also have an S&P 500 ETF, tracking the top 500 companies, producing a dividend yield of l.25% at, you guessed it again, a 0.03% expense ratio.

These 3 ETFs listed above allows you to invest in the stock market, without picking individual stocks and reduces your commitment of checking in daily. The 3 ETFs pay a quarter dividend to you and that dividend can be reinvested into more shares. In addition, these 3 ETFs can be traded almost on any platform – such as Robinhood, SoFi, Fidelity and Ally; to name a few. You can invest automatically on many platforms, with as low as $1-$5.

**You can also receive a free share of stock at Robinhood above or up to $50 for signing up for SoFi via the link above**

What about dividend growth, though?

Dividend growth is always a hot debate, too, with ETFs. Investors believe that as long as you buy an individual stock, such as Aflac (AFL), you will always receive 20% dividend increases, year after year, after year. Not to be the bearer of bad news, as I do love my Aflac stock, but that is not always the case. In fact, a few years ago, Aflac was only raising their dividend 3-5% per year.

Then, there is a concern that you won’t receive strong dividend growth with an ETF, as individual stocks, such as the example above, may produce higher dividend growth rates. That’s just not the case every time. Here are a few examples of high dividend growth this year!

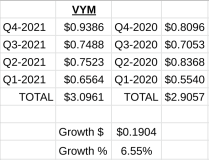

Vanguard’s High Dividend Yield ETF (VYM): Everyone knows, I’ve been buying VYM each and every week since LAST JULY of 2020. Total dividend announcements this year, have far out paced where they were last year. Here is a chart for example:

We actually recorded a video about Vanguard tearing the cover off the ball with their ETFs, from a dividend growth stand point. The video is below. However, for ETFs like VYM a 6.55% dividend growth rate is not too bad, for a low risk, equity ETF.

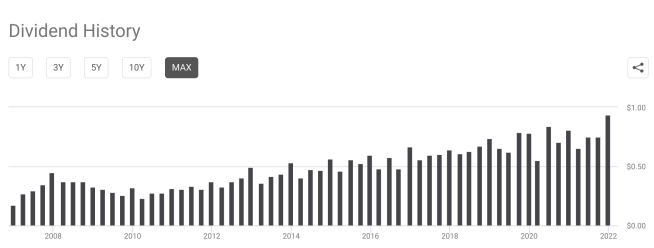

Therefore, a consistent dividend growth of 6-8% is easily achieved by owning a well diversified ETF. Here is a depiction to show you evidence of the life of Vanguard’s ETF – VYM’s dividend history since inception:

You can easily see that over time the dividend grows on a nice upward swing, approaching $1.00 per share, per quarter. You can see evidence of slight dips during crisis time periods – such as 2009 for the financial crisis and 2020, during the early stages of COVID-19.

my real life vanguard vym example

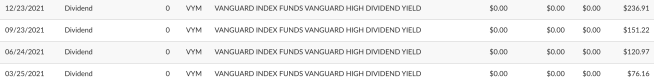

Even though I buy Vanguard’s High Dividend Yield ETF (VYM) weekly, here were my 4 quarterly dividends in my taxable stock account (shown below).

What you’ll notice is that the amounts are consistently growing. Not only is the dividend payout growing, but I am also enjoying the wonder of compounding or dividend reinvestment with VYM, in addition to buying shares weekly.

The dividend has grown from $76 per quarter, all the up to almost $250 in dividends per quarter from VYM!

This is just one of MANY, what could be thousands, of examples out there that show you can be a dividend growth investor by owning an exchange traded fund or ETF.

Investing in an ETF provides me diversification, limits me timing the market and stock picking; while generating an above average yield and solid dividend growth rate!

conclusion – it works

In a nutshell, buying Exchange Traded Funds (ETFs) works, if you want to be a dividend investor. You can buy a combination of 1 or many ETFs and be a dividend investor. You will receive a passive income stream from the ETF and, hopefully over time, that dividend continues to grow.

If you are a beginner investor and want to start dividend investing, an ETF isn’t a bad way to start. In fact – dividend investing by buying ETFs could be the best way to start, arguably. This provides you a simple way to diversify your portfolio, while building a passive income stream, to help you on your journey to financial freedom.

What do you, the readers, think of being a dividend growth investor by way of buying ETFs? Do you agree that it does work and you can be considered a dividend growth investor? Do you see other risks involved vs. buying individual stocks? I would love to hear your feedback!

As always, appreciate the stop by! Good luck and happy inveseting!

-Lanny

Nice post. I think that investing in dividend stock ETFs is a legitimate way to call yourself a dividend growth investor as long as you pick the right ones like VYM.

Thanks Kody, I obviously tend to agree as well ; ) haha

-Lanny

Just wondering your thoughts on the covered call ETF’s like JEPI and DIVO?

Hey Lanny,

There’s definitely plenty of merit to adding some ETF exposure within a portfolio. Even a dividend growth portfolio.

As you mention, this is basically what I suggest to beginning investors who come to me with the question, “I have five hundred bucks, which stock/crypto should I buy?” I just say to get started with an ETF to see what it’s all about without having the company-specific risk to worry about. In the early stages when would-be investors lack the knowledge, it’s a good thing to start simple to learn the process.

Take care,

Ryan

The short answer is yes but I think the passive income stream is higher on a stock basis and costs may be lower since there are no commissions at most brokerages now.