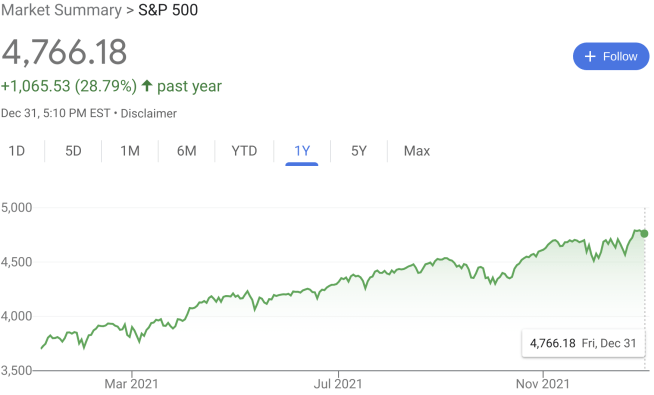

Happy New Year! The stock market finished on a strong note, hitting 4,800 quite a few times in the S&P 500. The year had many ups and downs, high points and low points, but we are thankful to be here, healthy.

The winners of 2021 appear to be crypto and NFT investors, not to mention that growth stocks still performed decently well. You know what else was a strong metric in 2021? Dividend Growth baby! Across the board, dividend stocks, mutual funds and ETFs lit up the charts, no doubt!

Therefore, as I do every month, here is the Dividend Stock Watch List for January 2022!

Dividend stock watch list

Welcome back to another dividend stock watch list and I’ll share with you the stocks hot on my radar, potentially stocks I will be buying THIS MONTH. The turbulence in the market is still high, with recent events, such as: Omicron-Variant, inflation, the hot cryptocurrency market and the like. In addition, inflation is so high that I know gas by me is nearing $3.50 per gallon. Lastly, the news is still calling this the great resignation time period. What a world we are in.

The stock market, specifically the S&P 500, still is high, and I am curious if 5,000 will be reached in the S&P 500. Chart is below:

Interest rates are significantly low on your savings, including high yield savings, accounts, as well as money market accounts & funds. In fact, Ally Savings reduced my interest rate to 0.60% back in September 0.50% in mid-December of 2020. Luckily, I can still say that I am earning 0.50% on my savings account as of January 2022. Will that stay, though? I am taking matters in my own hands… HOW you ask?

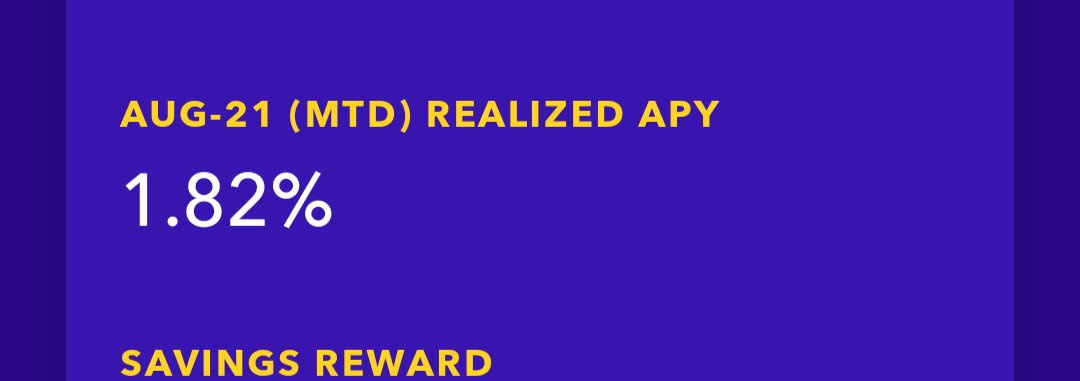

I keep MORE savings in my Yotta Savings Account, that has earned 1.82% in August and over 1.4% in September 2021. The account is FDIC-insured, of course. Definitely sign up if you want to have fun and earn more yield on your savings account!

Related: Sign Up For Yotta Savings

What else has been going on? I have been investing more and more into Fundrise, as of late – finally crossing over $10,000+ invested there. See my Q3-2021 review. In addition, I have been LOVING the SoFi financial app and platform. In fact, check this article out, as I showcase how SoFi has helped me build wealth this year. You can earn bonus money for opening an account, as well as free stock! Definitely check it out.

As a dividend stock investor, it’s been harder and harder to find an undervalued dividend stock.

See – Why I Don’t Time or Predict The Market

In addition, given the uncertainty, I continue to make smaller, weekly investments into Vanguard Exchange Traded Funds (ETFs). The specific ETF my wife and I have been loading up on is Vanguard High Dividend Yield (VYM). We are investing $400-500 per week into Vanguard (pending the VYM stock price), to stay invested in the market, during the uncertain times.

Related: Why I’m Investing $500 Weekly with Vanguard ETFs

Therefore, on the road to financial freedom, acquiring assets that produce cash flow or income is the goal! Like I always say, there is always a diamond in the rough. How do I find an undervalued dividend stock? Time to introduce our beloved Dividend Diplomat Stock Screener!

Dividend Diplomat Stock Screener

If you don’t know already, we keep the stock screener metrics to THREE SIMPLE items. They are:

- Price to Earnings Ratio – We look for a price to earnings ratio < than the overall Stock Market.

- Payout Ratio – We aim for a payout ratio between of less than 60%.

- Dividend Growth – We like to see history of dividend growth in a company.

See the video below, for further details and explanation. If you don’t like to watch videos – see our Dividend Diplomat Stock Screener page!

Time to find the answer to… how did the dividend stocks on my watch list grade on the stock screener?

Dividend stock watch list

Here is the list of dividend stocks that are on my radar going into the month of January 2022. I typically like to keep it at 3 dividend stocks, keeping the focus locked in. Finding dividend stocks isn’t easy, but there are also other factors, such as composition of my portfolio by industry (such as – am I overweight/underweight in an industry), as well as exposure to one stock and the concentration there.

There, the dividend stocks on my list cater to those other facets when building a dividend stock portfolio. This is a fairly defensive, consumer-goods intensive, dividend stock watch list!

Store Capital (STOR)

This dividend stock STAYS on my dividend stocks to buy list for another month and heading into 2022! Store Capital (STOR) is a single tenant operating real estate company. Hence, their acronym and ticker is STOR. STOR was formed in 2011, went public in 2014 and even Warren Buffett invested over $375 million into the company in 2017, holding (at the time) almost 10% of all shares outstanding.

STOR almost has $10 billion in market capitalization, steadily growing over their 7+ years of being public. The stock is up about 3% since last month and finished off 2021 up 7.17%.

Now they are a Real Estate Investment Trust (REIT) and, as such, payout in dividends ~90% of their earnings and you are taxed at the ordinary income rate for dividends received from a REIT, if held in the taxable brokerage account.

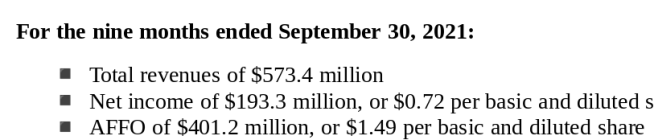

Therefore, when looking at REITs you do want a little bit higher on the yield, to make up for any increase in tax burden you may have. However, owning a REIT or combination of REITS, offers you the potential for exposure to real estate! In addition, we evaluate REITs by using the Adjusted Funds From Operations (AFFO) vs earnings per share.

First, however, we MUST run them through the Dividend Diplomats Stock Screener, which is focused on these 3 metrics (with AFFO replacing EPS)

- Price to AFFO Ratio: AFFO was $1.49 through 9 months/year-to-date for 2021. To keep it simple, we will simply annualize that and estimate that they will earn $1.99 AFFO for the year. The share price is $34.40 as of 12/31. This equates to a price to AFFO ratio of 17.30. Earnings is higher than anticipated vs. my last review. Not expensive, not cheap. However, fairly good value here.

- Payout Ratio: STORE Capital currently pays a quarterly dividend of $0.385 or $1.54 per year. This equates to a dividend payout ratio of “only” 77%, which is lower for a REIT. Therefore, we should see signs of dividend growth for Store Capital going forward.

- Dividend Growth: Increasing their dividend since they’ve been public, Store Capital (STOR) has been fairly consistent in this department. The average dividend growth rate is right at 6%. The best part, the last dividend increase was above this average rate and was ~7%. I like where STOR is heading.

Lastly, STOR’s dividend yield isn’t too shabby at 4.48%! I would say that is definitely higher than Realty Income (O) and is far higher than your average yield, which you typically should require for a REIT.

I currently own 94 shares, but I have a goal of reaching 100 shares of Store Capital. The position may go beyond that, so long as they stay under $37.50 per share! I discussed my investment strategy at a previous article about two Dividend REITs we are investing into weekly, including Store Capital (STOR)!

anthem (antm)

NEW to my dividend stock watch list is Anthem (ANTM). Who is Anthem? Anthem is a fortune 500 company and is one of the largest health insurance companies in the United States.

In fact, we recently showcased a YouTube Video about this High Dividend Growth stock! Definitely worth checking out at this video from last month.

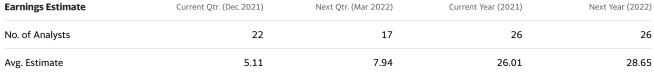

This could be a great stock to buy, as we go through the metrics, as they could add a steady stream of passive income with a high growth rate to that passive income source. Anthem stock crushed 2021, well beating the S&P 500 return of 28%. See the chart below.

How could this almost $500 stock be on my dividend stock watch list? Let’s run them through the Dividend Diplomats Stock Screener to find out!

- Price to Earnings Ratio: Anthem is trading at $436.54 to end the year. Now that analysts project $28.65, this equates to a very nice price to earnings ratio of only 15.23. Now do you see why they are on the list?

- Payout Ratio: Earnings are projected to be $28.65 and the dividend is $1.13 per quarter or $4.52 for the year. The payout ratio is insanely low based on the expectations the company has. The payout ratio is 16%. Bottomline, extreme safety in the dividend with this payout ratio. Also – I expect high dividend growth from Anthem.

- Dividend Growth: Anthem has been increasing their dividend around 10 years. In addition, the 5 year dividend growth rate stands at 12%. The most recently increase was over 18%! Therefore, Anthem gracefully passes this dividend stock metric.

Somehow, if the stock market drops a little bit and takes Anthem with it, I will be adding Anthem to my stock portfolio.

Leggett & Platt (LEG)

A dividend king is on the list! Bert recently wrote an article about Leggett & Platt (LEG) and that had me intrigued. It’s been over a year since I’ve been looking at them, and glad they are back on my stock watch list.

LEG innovates, develops and produces certain parts/materials for your automobile, certain items within your home, such as bedding, and other furniture/textile products.

This dividend king finished the year down 5%. Therefore, it’s time to add them to the dividend stock watch list.

Time to see how Leggett looks through the fundamental stock metrics. Here we go.

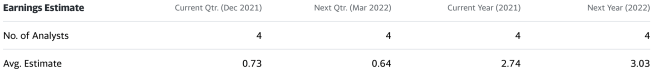

- Price to Earnings Ratio: Analysts are currently expecting $3.03 on a share price of $41.16 for Leggett (LEG). This calculates out to a price to earnings ratio of 13.58. Definitely lower than the S&P 500 p/e ratio, which is at 30x earnings.

- Payout Ratio: LEG pays $0.42 per share, per quarter or $1.68 per year. Analysts projecting $3.03 in earnings, means their dividend payout ratio is 55%; right in the sweet spot.

- Dividend Growth: A dividend king, LEG has increased their dividend for 50 years. The 5 year dividend growth rate average is just under 5%. They did not technically announce a raise in 2020; but held their payout constant. The year of 2020 payout, though, was still larger than 2019, hence why their streak continues.

The dividend yield is over 4% and I would be a buyer at these levels. I’ve invested over $3k and wouldn’t mind an additional $1,000 on LEG.

Dividend Stock Watch List Conclusion

Dividend investing is real and is happening! Here is our video covering the TWO high dividend growth rate companies, such as Anthem above!

Of course, prior to making any purchase, I definitely will make sure to run them through the Dividend Diplomat Stock Screener once more.

Talk about great, every day dividend growth stocks. My order, right now, would be the order that you see them above! Store Capital (STOR) to round out that position, then Leggett & Platt (LEG), followed by Anthem (ANTM). How about you?

Related: 5 Reasons Dividend Income is the Easiest Passive Income Source

As you have noticed, I have trickled many articles on this page. The goal is to educate new dividend investors out there, or to sharpen the terminology for current dividend investors. As always, stick to your investment strategy and dividend stocks will be there. What do you think of these stocks above? Thank you, good luck and happy investing everyone!

-Lanny

leg is interesting for sure

nice starting yield for a king.

cheer

PCI –

Thanks for the comment; hard to argue against it. Let’s GO!

-Lanny

What do you think of the VTRS increase?

Scott –

I fricken loved it is what I thought. Pumped I went hard on VTRS the last 12 months.

-Lanny

Lanny,

Thanks for sharing. I added to LEG last week and it’s still a solid value despite a slight runup.

Kody –

NICE! Lets GO!!!

-Lanny

Great list, Lanny. I was looking into REITs recently after selling ESS in my parents’ account at the end of the year. STOR definitely looks interesting, fairly valued especially given the 2022 AFFO estimate of $2.18. Never heard of ANTM, but it looks interesting as well and is fairly valued. LEG is undervalued for sure.

DoD –

I do like all 3! Anthem has dropped about $30 per share this year so far, too!

-Lanny