Happy New Year everyone! 2021 finished off with a bang. There are some many things to be thankful for, from a personal and investing standpoint. 2021 was the year of the dividend. If that’s not the official name, well then, maybe it should be. Dividend investing is back and our dividend income definitely reflects that. In December 2021, we set a NEW RECORD and I cannot wait to share the results with the dividend investing community. Please read our December dividend income summary!

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income. One day, my dividend income will be large enough to cover my monthly expenses. That is why we are relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We save a high percentage of our income each month, to help fuel our dividend stock portfolio. Having a high savings rate is a key pillar of our strategy and helps fuel the fire and push the snowball further down hill. While we are waiting to invest our money in the market, it is earning a high interest rate in accounts such as Yotta (1% – 2% APY, on average) and BlockFi (Currently earning up to 9% APY). If you are looking to earn more on your cash, it is definitely worth checking those products out!

We use our dividend stock screener with every stock purchase. Our stock screener continues to help us find undervalued dividend stocks to buy. This simple, 3 step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Watch: Dividend Diplomats’ Dividend Stock Screener

Building a large dividend income stream takes time, consistency, hard work, saving, and most importantly, investing. I have been investing in dividend growth stocks since 2012. Saving a high percentage of my dividend income allows me to invest as much as possible, so we can retire as soon as possible.

Slowly, but steadily, my income has grown. Brick by brick. DRIP by DRIP. It is really exciting to see the growth and larger dividend checks trickle into my brokerage account.

Each month, we share our dividend income summaries to highlight our growth and progress. It is a fun and helpful excercise that holds us accountable. Further, it helps you, our followers, see the stocks we are purchasing.

Bert’s DECEMBER Dividend Income Summary

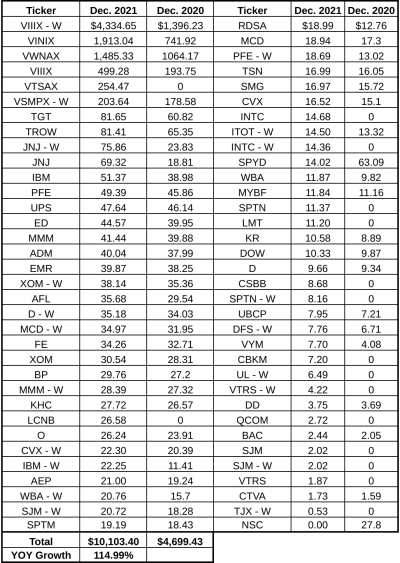

In December, we received $10,103.40 in dividend income! That’s right, we joined the five-figure dividend income total with this record setting month. We are eccstatic with the results and couldn’t be happier that we too the leap many years ago and began investing in dividend growth stocks. This $10k month was a 115% increase compared to last year.

The following chart summarizes each individual dividend payment we received during the month.

I always like to include a few observations in the remainder of the section about our dividend income, growth, and any trends worth highlighting!

Observation 1: Mutual Funds Steal the Show

This one is a no brainer. Mutual Funds and ETFs typically pay their dividends in the third month of the quarter. So my dividend income is always larger in the 3rd month because of this. December though, is different than the other months. Good old Santa Vanguard delivered some MASSIVE dividends and capital gains distributions under our Christmas tree this year.

Read: You Don’t Have to Buy Individual Dividend Stocks to be a Dividend Investor

In total, mutual funds paid us over $8,700 in dividend income in this month! Holy freaking cow. Last year, for comparison, the same funds paid us only $3,600 dividend income. The funds added $5,100+ in dividend income alone. No wonder we were able to cross $10,000.

The reason for the increase is two-fold. First, my wife and I maximize our 401(k) contribution every year. This strategy has been instrumental to automating our retirement savings and growing our dividend income at the same time. Maximizing our 401(k) contributions added just under $40,000 in mutual fund purchases alone.

Read: Why My Wife & I are Maximizing My 401(k) Every Year

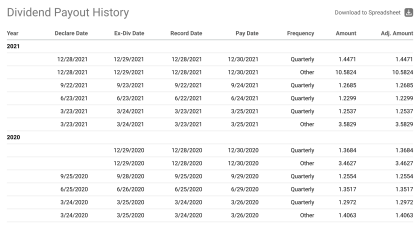

Second, two of our mutual funds just CRUSHED it this year. Their dividend and capital gain distributions were out of control (in a good way). The funds are VINIX and VIIIX. Rather than typing out the growth for each fund. Let the following chart showing VINIX’s dividend history from 2021 and 2020 show the growth. A picture is worth 1,000 words after all.

This year, VINIX and VIIIX paid us $6,700 in dividend income compared to $2,330 last year. The power of maximizing our contributions, along with the insane dividend growth, helped our income surpass $10,000 and set a NEW RECORD.

Observation 2: We Own A Lot of Individual Holdings

Putting our December dividend income chart made me realize on thing. We own a lot of dividend stocks. Between my wife and I, we received 67 individual dividend checks this year. Now, some are duplicates, as my wife and I own the same companies in our respective portfolio. Still, it is a lot of freaking dividend payments.

Last month, I simplified my bank account. I closed 3 bank accounts, reducing my savings accounts from 5 to 2. I’m also jealous of Lanny, who recently sold 3 stocks and reinvested the capital into other positions. This strategy was awesome, because he reallocated the $6,000+ into 3 companies and substantially grew his dividend income at the same time.

Watch: Why Lanny Sold 3 Stocks and Reinvested His Capital In These 3 Other Companies Instead

Not wanting to add a new company to my portfolio will never drive an investing decision. It all comes down to numbers and buying stocks that meet our metrics. However, I would love to add as few new stocks as possible in 2022.

The Impact of Dividend Increases

We love dividend increases. We can’t say it enough (trust us, if you see our Twitter feed – you know EXACTLY what I’m talking about). Who doesn’t love the feeling of seeing your dividend income grow without lifting a finger? That’s part of the reason why we think dividend investing is the best, and easiest, form of dividend income. That’s why we are always writing about dividend increases and recording videos about the recent dividend increases announced!

Watch: YouTube Playlist – Recent Dividend News

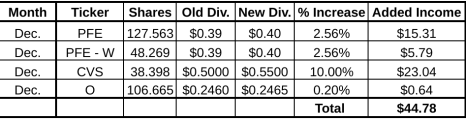

Each month, in our dividend income summaries, we demonstrate the impact each dividend increase has on our forward dividend income. The following chart summarizes the impact of each dividend increase:

Obviously, the largest impact was from CVS. That surprise 10% dividend increase helped signal that THEY ARE BACK! It had been a few years since CVS increased its dividend. Post Aetna acquisition, management stated they would maintain the current dividend and use the excess cash flow to improve the company’s balance sheet. It would take a few years to start increasing its dividend again.

Well, enter December 2021. CVS delivered a Hulk Hogan leg drop and dominated with a 10% dividend increase. That added $23 to my forward dividend income. That accounted for over half the additional dividend income my wife and I earned from dividend increases in December. I’ll take it!

Summary

We are all smiles here. Over $10,000 in dividend income is stunning. It really reinforces that our strategy of saving a high percentage of our income and investing every dollar possible is working. Our house is even more motivated in 2022 to keep pushing ourselves, so we can achieve financial freedom. We are getting one step closer with each dividend received. The time is now to push harder and keep on investing. That’s what it is all about.

Did you set a record in December 2021? What was your dividend income total this month? Are you a lucky dividend investor and own sahres of VINIX or VIIIX?

Bert

Holy Cow!!! You super crushed it last month! Congrats are crossing 5-digit territory! That is just amazing! 🙂

Thanks MDD! It was definitely an anamoly; however, I’ll take it!

Congrats on to you and your wife on surpassing $10k in dividend income last month! I had a record month by far as well, which is par for the course with DGI. Let’s keep pushing!

Thanks Kody, very much appreciated. I’m excited to swing by your income summary and check out this record. I suspect that many people crushed it this December.

Wow, this is not what I expected to see when I clicked on the post. Absolutely amazing progress.

Glad we kept you on your toes SD Growth!

Mic Drop! Incredible results. I am so pleased to see you getting such great returns.

hanks DGJ! Much appreciated.

Great achievement! I would not be able to keep track of 67 stocks! Wow

Thanks Richard. Sadly, that is just the payments for companeis that paid in December….not every month.

Congrats on the insane dividend payout this month!

Thanks Dreaming of Dividends!

Congratulations! In the interest of accuracy it might be wise to refer to these December windfalls as Distributions in order to include both dividends and cap. gains. I always have mixed feelings about high cap.gains since they are a taxed event and yet they are a sign of a funds good economic health. Reinvestment gives me a big boost for my monthly income in the long run, but in the short-term, it does not provide a boost in value. Perhaps the best way to carry funds that kick out cap.gains is in a retirement account.

Kudos for your milestone. May you have many other happy returns. 🙂

Thanks Eric – appreciate the feedback here. That’s why I wanted to at least call it out in the narrative.

Nice Bert,looks like you are moving into Mr Tako arena with 5 digit dividends.

Haha I have a LONG WAY to go before I enter that arena.

Awesome stuff. It’s a shame we don’t have something like that 401k here in the Netherlands.

Besides that, this is all thanks to your own consistency of the years. Congrats!

Congrats on the huge growth! Btw, any chance you and Lanny will update your Dividend Income spreadsheets to show 2021’s dividends in their entirety?

Great stuff Bert! That’s incredible to see you guys up over $10k for a month. Sadly we’re still very far away from reaching that milestone although it we’re making progress on getting a second month of the quarter up closer to $1k. We won’t get there in 2022 but we’re definitely much closer. Are your 401ks with Vanguard? Mine is with Fidelity but we have like 12 options that I’m not that impressed with and it doesn’t break out the dividends each year. I asked them about it not long after I started working and they just said it’s all re-invested and kept within the fund or something. And I hear you on the not wanting to add new companies/holdings to the portfolio, but I’m also very hesitant to sell. The trims that I have done have been pretty poor decisions. Haha! Got to be more like Terry Smith.

You smashed it this month. Way to go.