Finding the best savings account and best certificate of deposit to maximize the interest earned on your cash is critical. This is more important than EVER today given this high inflation environment. Costs are rising. It is a simple fact. So your goal needs to be to maximize the interest your cash is earning to fight off the impact of rising costs!

For the majority of savers, they aren’t earning enough on their hard earned, hard saved cash. National Savings account average is .57% (Bankrate; as of October 9, 2023). That’s PATHETIC! The reality is though….you can do so much better than the average. In fact, we are going to show you how easy it is to earn over 4.50% on cash. That is more than 7X the national average!

Our goal on this website is to help you reach financial freedom. We have championed our simple approach to dividend investing and finding undervalued dividends stocks to buy using our simple 3 Step Dividend Stock Screener. Heck, we even have a page dedicated to Financial Freedom Products. These are products that will help you either GROW your income or REDUCE your expenses.

See: Our Financial Freedom Products to Help Improve YOUR Finances

Now, we are going to help you start maximizing your cash. This page will provide a simple, 3 Step Strategy for How To Maximize Your Cash and start earning more TODAY!

The best part is this. Executing this strategy is easy. VERY EASY. In fact, you can open a new account IN MINUTES at some banks, credit unions, Neobanks or fintechs. The rest of this page will teach you about how you can maximize the interest earned on your cash in three simple steps. Plus, after we share the 3 simple steps, we will share the accounts we use to execute this strategy and the best savings account and best certificate of deposit rates available today!

Step 1: open a High-Yield Savings Account

In today’s high inflation environment, institutions are fighting for your deposits. We have recently seen high yield savings account rates soar, providing a huge benefit to customers. It sure as heck beats the .5% APY we were receiving at the start of 2022.

We recommend to everyone to open a high-yield savings account. This is the easiest action one can take to improve their financial position and start earning more on your cash. High-yield savings accounts are FDIC Insured and can typically be easily opened with the bank, credit union, or fintech.

Below are some of the pros and cons of opening a high-yield savings account:

- Pros

- Federally Insured up to $250,000 per account. If the institution fails, you are insured up to $250,000 per account.

- Easy to Open. Some accounts take minutes to open. Most accounts are relatively simple to open online.

- There are a ton of options. We include a list of some of the high-yield savings accounts we monitor regularly below. These are one of hundreds of high yield savings accounts available to savers!

- Cons

- Rates may change quickly. As fast as an institution rises rates, it can easily lower them as well.

- Open another bank account. For some people, setting up a new bank account and login may not be worth the hassle

- May require a large minimum balance to achieve highest rate. Some institutions may require a minimum deposit, or other terms and conditions, in order to achieve the advertised interest rate.

Best High Yield Savings Account RATES (May Contain Affiliate Links)

We can’t include EVERY high-yield savings account offer on the internet (Yet). Therefore, we wanted to provide a list of some of the high-yield savings accounts that are best in the industry today at banks, credit unions, or fintechs that we are monitoring regularly. We even put asterisks (*) by the institutions we use today! Further, w e included links to the website and/or affiliate sign-up links for each.

- SoFi*: 4.60% on your Savings Account (Sign-Up using one of our links. Bert’s Link and Lanny’s Link. Pick your favorite Diplomat and sign up using their link 🙂 )

- LendingClub Bank: 4.65% APY (Sign-Up)

- Wealthfront: 5.00% APY on December 27 (Increase the APY to 5.50% for 3 Months using This Link)

- Upgrade: 5.07% APY (Sign-Up)

- Capital One*: 4.25% APY (Sign-Up)

- Ally Bank*: 4.35% APY (Sign-Up) and 3.8% in the Money Market Account.

- Marcus (by Goldman): 4.50% (Sign-Up)

All the institutions listed above are FDIC or NCUA insured. Therefore, we would have no problem using or sending a friend or family member to the financial institution to open an account. Let us know if there are other offers we should add to the list.

Note: Rates last updated October 2023 and may be subject to change

Step 2: Build a CD Ladder

Before we talk about building a CD ladder, we should probably talk about certificates of deposit(CD). A CD is a savings product offered by banks, credit unions and financial institutions. Unlike a savings account, a CD offers a fixed savings rate for a fixed period of time (maturity date). CD maturities can be short term (months) or long term (years). The savings rate earned on the CD will increase with the maturity. The higher rate offered compensates you for the lost access to your cash, without penalty.

What is a CD Ladder? a CD ladder is a strategy that calls for investing in multiple CDs at different maturity lengths. The blend of short-term and long-term CDs allows you to increase your yield by purchasing longer, higher earning CDs in conjunction with short-term CDs that will mature quickly. The blend results in a higher-interest rate than what you would earn in your high-yield savings account.

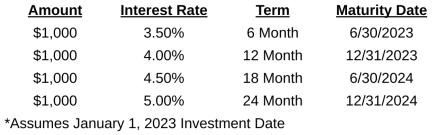

The following chart demonstrates what a CD ladder would look like if you purchased 4 CDs for $1,000 each on January 1, 2023 with maturities in six-month increments.

The goal is to reinvest the funds in a new certificate of deposit when the previous one matures. You will have constant access to your cash as well, since an old CD will be maturing every six months. If you need the funds…great! If you don’t need the funds…even better, just reinvest the funds into another one and keep the ladder going.

Below are some of the pros and cons of opening a certificate of deposit:

- Pros:

- Federally Insured up to $250,000 per account. If the institution fails, you are insured up to $250,000 per account.

- Higher Interest Rate Than Savings Accounts (Historically). This may not be true in all instances, especially since the places referenced in the section above offer amazing savings rates.

- The CD Ladder Provides Consistent Cash Flow with Staggered Maturities

- Ability Reinvest Maturing CDs in Higher Interest Rates if Interest Rates Continue to Rise

- Cons:

- Open another bank account. Same con as the high-yield savings account above. Sometimes, it just sucks to open a new account and have to remember another log in.

- A lot to Monitor. Setting up a successful CD ladder involves opening multiple CDs with staggered maturities. As you can imagine, this will require you monitoring and shopping for the best yield when each CD matures.

- May require a large minimum balance to achieve highest rate. Read the fine print carefully. In order to achieve that SICK promotional rate, you may be required to deposit a certain dollar amount. $5,000? $10,000? Or maybe even more?

- Not as liquid as a High-yield savings account. May incur a penalty or lose interest if you withdraw a CD early. That’s why its important to understand the potential penalties (if any) that you may incur if you need access to the funds and have to close the CD early.

- Ability Reinvest Maturing CDs in Lower Interest Rates if Interest Rates Fall

If you are are looking for WHERE to shop for Certificates of Deposits (CDs) to capitalize on your high rates, the following websites or locations are great places to start your research:

Step 3: Open A Money Market Fund

Now many of you may be asking….isn’t opening a money market fund the same thing as opening a high-yield savings account? There are some similarities; however, there are some key differences as well. Money Market Fund accounts is a a great way to earn more on your cash in a relatively risk free manner.

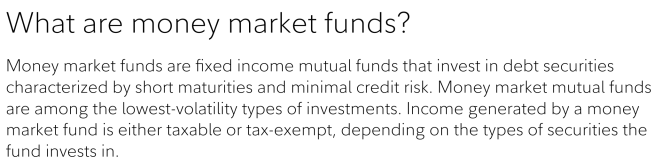

What is a Money Market Fund Account? Fidelity provides the following definition of money market funds on its website.

Money market funds are technically investments, not a savings account. The risk is mitigated by investing in short-term, low risk investments such as government treasuries, municipals bonds and other dollar denominated instruments.

The yield on money market funds also fluctuate with the current yields for the securities the fund invests in. In late 2022, the yields on money market accounts rose rapidly with the interest rate environment. Now, it is common to earn a yield over 4%!

Below are some of the pros and cons for opening a money market account.

Pros:

- Higher interest rate. As stated above, the yield on your money market account is typically higher than a high-yield savings accounts and definitely higher than the rate earned on a checking account!

- Investments are short-term, low risk investments. Investments are in short-term, low risk treasury bonds, municipal bonds, and other government investments.

- Fast changes to interest rates when rates rise. The yield earned is based on the underlying investments. In today’s rapidly rising rate environment, money market account yields are soaring. Not only that, the rates are changing quickly! Just like the treasury market.

- Most brokerage accounts offer a money market account. The major brokers all have money market accounts for idle cash. It is very easy to put your excess cash in the brokerages money market account option. In Fidelity, it took less than a minute to turn this option on!

Cons:

- Requires an investment account. Opening a money market account will require a brokerage account. If you don’t have one, you will need to open one. Further, if your current broker does not have a money market account option, you will be required to open one!

- May require a large minimum deposit for highest yield. Like CDs, brokerages may require you to pony up and deposit a large amount of money to earn the highest yield on your money market fund.

- The is some risk, although the risk is minimal. The risk is VERY low. However, we would be remiss if we didn’t mention that there is more risk to a money market fund compared to a high yield savings account or certificate of deposit.

- Fast changes to interest rates when rates fall. This is the opposite of the “Pro” discussed above. When rates fall, the money market account will downward adjust its rates quickly.

Investment Brokers That Offer Money Market Accounts

Where can you invest in a money market fund? The list below includes several brokers and websites that offer solid money market fund options. This list is not all-inclusive, so please share other great options in the comment section!

- Fidelity – currently is up to 4.98% (as of October 13, 2023)

- Charles Schwab

- TD Ameritrade

- Vanguard

- SoFi

Step 4: Treasury Bond/Treasury Bills

Ah, yes, the old government Treasury Bonds / Bills. Currently, you are actually able to purchase from the government, their debt. What rates can you get? Better than the high yield accounts noted above. Why?

It’s actually quite simple. Instead of putting your money with a bank, whom still has to earn a spread and is the middleman with the government, you can go straight to the government. Hence, higher yields.

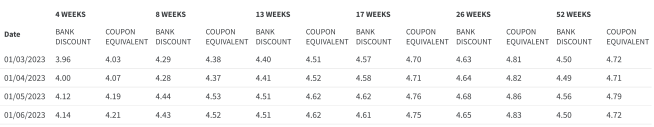

See the chart below. For a 2-3 month treasury bill, you can earn anywhere from 4.2-4.5% easily. How do you go about acquiring a Treasury Bill or what is commonly referred to in the industry and investing arena – risk-free investment?

- (1) You can either buy directly from the Treasury at TreasuryDirect.Gov. However, there’s an easier option if you don’t want to have an account there.

- (2) You can also use your Fidelity or Vanguard investment account and buy Treasury Bills and Bonds right on their platform. That is what I have done. In fact, I’ve been buying short-term treasury bills the last 2-3 months with idle cash, to earn more than my high yield savings account.

Therefore, buying US Treasuries is another way to make the most of your idle cash, versus having within a banking institution.

- Pros:

- Government guaranteed / risk-free. Government can always call the Fed to print more money to pay you back.

- Higher Interest Rate Than Savings & Money Market Accounts. During inflationary times that we are in, T-Bills and Bonds typically pay higher. Due to cutting out the middle man.

- Ladder Treasuries. Similar to CDs, you can stagger your investments based on expectation of rates and need.

- Ability Reinvest Maturing Treasuries in Higher Interest Rates if Interest Rates Continue to Rise

- Cons:

- Open another account. If your brokerage currently doesn’t offer, you will have to either open a TreasuryDirect or Brokerage account.

- May require a large minimum purchase. Typically at the brokerage sites, like Fidelity, may require a minimum $1,000 to buy a treasury bill.

- Could lose value. Could lose value in a declining rate environment but you will only receive a loss if you have to sell, due to needing the funds.