Earning more on your cash in 2021 is easier than ever. The goal is to maximize every dollar by investing and mobilizing your cash to the right places. With so many online fintechs, along with traditional banks and credit unions, fighting aggressively for your hard earned dollars, there are some great opportunities to earn a high interest rate on your cash. I’ve always been a fan of opening accounts and parking your emergency fund and excess cash where the highest interest rates are. This article will review the 5 online savings accounts I currently have, why it is becoming to much, and how I will actually increase my income by closing two of the accounts!

This exercise is going to be exciting. Lately, I’ve been frustrated with the number of online accounts I’m checking on a regular basis. My cash is spread out at too many places, chasing small bonuses, random promotional rates, and other items to earn a few extra dollars. Some of these accounts earn me hundreds of dollars while others sometimes earn me as little as ten dollars.

See our Financial Freedom Products!

As we barrel towards the end of the year, now is as good as a time as ever to take a step back, put some music on, relax, and review my accounts to reassess my strategy and trim the fat. The goal for 2022 is to focus on opening accounts that will add hundreds of dollars versus promotions that earn less than three figures.

Before we can proceed with finding new accounts, I need to review my current accounts and find where I can trim the fat!

Current Savings Account Situation

Lets first start by sharing the current savings accounts, along with their current interest rates and the intent of the account. You will quickly see why I am excited about the opportunity to slim down my savings account portfolio. I also think it is important to discuss and understand the intent of the account. Is it for our emergency savings, excess cash, or an investing alternative? It all matters.

Note: For some accounts, I’ll include sign up links that may contain referral bonuses. I’m only sharing the links because it is a product we use that can help you grow your passive income!

Capital One Savings Account: .4% APY

We use Capital One as our primary bank. Despite the fact there is not a branch within a couple of states, we love Capital One’s interface, free nationwide ATM network, and quite frankly, the ease/simplicity of their online banking platform. If you’re going to be a fully online bank, at least make it easy and simple to use. They have achieved that in my mind and will be a customer until it is no longer the case.

Capital One offers high yield savings accounts, comparable to Ally Bank, American Express, and others. Hilariously, last year I went through this exercise and planned to move all savings accounts to Capital One. The bank was offering a .5% savings rate promotion. Excellent at the time. Then, out of nowhere, rates were slashed and I put my plans to consolidate everything into Capital One on hold.

I still use the savings account today for a few purposes. I keep some emergency cash in the account due to the easy ability to transfer to my checking account if needed. The account is also used to hold the cash set aside for property taxes. We pay taxes semi-annually. So each month, we move some cash from checking to savings to earn more on cash that will eventually be forked over to the local government. Might as well earn SOMETHING on our taxes, right?

Ally Savings Bank: .5% APY

Ally has been my “go to” high yield savings acount for years. Back in the day, Ally used to offer 1% – 1.5% rates on their high yield savings accounts. That, of course, was back when banks were not flushed with deposits. I long for those days again.

Since Ally was at the forefront of the high yield savings game, I used the online bank for my emergency savings. I loved earning 1%+ plus on my emergency fund when it was available. However, as we know, it has been a race to the bottom for interest rates for all banks, cedit unions, and fintech companies.

Don’t Miss the 3 Financial Products Lanny Uses to Maximize His Income!

Still, Ally’s reputation for having one of the highest interest rates on its high yield savings account remains true. Their rate of .5% APY beats competitors such as American Express, Marcus, Capital One, and almost all other banks and credit unions.

Digital Federal Credit Union (DCU): 6% APY up to $1,000; .25% APY For $1,000+

Years ago, we stumbled on Digital Federal Credit Union while building our emergency fund. It was great find, especially before fintechs really began to take off. This was a credit union that accepted members nationwide and offered an aggressive interest rate to lure yield shopping users like myself to open an account.

If you open a member savings account with DCU, you earn 6% on the first $1,000 deposited. Then, you earn .25% for every dollar after. The 6% rate is insane, but lets not lose sight of the fact that you can still earn .25% on every additional dollar. That is still higher than the largest banks’ savings rate.

Naturally, I opened up an account for $1,000 at DCU. Then, periodically, I transfer the monthly interest earned to Ally so I can earn .5% on the additional cash instead of .25%.

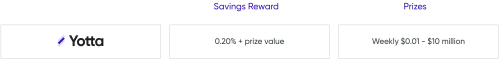

Yotta Savings: .2% APY + Prizes. Typically Earn Between 1% – 2% APY each month

Yotta Savings is an app that is truly “gamifying” savings and I absolutely LOVE IT! Rather than just parking your cash in an account to earn a set interest rate, Yotta Savings found a way to make saving money exciting.

Here is how it works. Every dollar deposited to Yotta earns a .2% base rate. Each week, Yotta conducts raffles. The more tickets you have in the raffle, the more opportuntiies you have to win larger prize amounts. How do you earn tickets? You guessed it, based on the dollars you have deposited in Yotta. You earn 1 ticket every week for every $25 deposited into Yotta (Note: After $10,000, the tickers per dollar deposit ratio changes).

I’ve enjoyed Yotta for a few reasons. I opened an account several months ago to see how I liked the experience. In advertisements and articles I read, I was told that I would typically earn between 1% – 2% after prizes. If I proved this out, I’d consider moving my emergency fund to Yotta. If not, I didn’t lose anything, and I’d simply close the account and move on.

Sign-Up Here for Yotta Savings (Referral Link Included)

Yotta Savings has absolutely delivered for me. Each month, I earn between .8% APY – 2% APY. Heck, there was one month where I even earned 3% because I crushed it in the raffles! This has been a huge win for me. Not only is it fun, but the results back up the product. What’s not to like about this FDIC insured savings account?

BlockFi: 9% APY on Stablecoins; 4.5% APY on Bitcoin, 5% APY on Ethereum, and Other Opportunities

Here is probably the most shocking revelation of all. After discussiosn with Lanny (and learning a lot from him along the way), I opened an account with BlockFi to potentially learn high interest rates on my savings account. Please note, this is the only option on this list that is not FDIC insured. The risk is increased, but I was ultimately okay with accepting the risk personally for the higher interest rates after learning more about BlockFi an cryptocurrency.

Sign-Up Here for BlockFi (Referral Link Included)

This is more of a hybrid investment and savings account opportunity for my portfolio. That is why I opened a Block Interest Account. The account allows you to buy stablecoins or cryptocurrencies, such as Bitcoin, Ethereum, Litecoin, and others, and earn interest on that investment. The interest you earn depends on the investment you select.

In my account, I own 3 cryptocurrencies: Gemini USD, Bitcoin, and Ethereum. Each investment pays the following interest rate for every dollar invested: Gemini USD (9% APY), Bitcoin (4.5% APY), and Ethereum (5% APY). The largest investment is in Gemini USD, a stablecoin issued by Gemeni Trust Company. Here is a link to learn more about Gemini, that we used when conducting our own research prior to investing.

One other cool feature of the account is that your balance fluctuates with the value of the investment while the interest rate remains the sale. I’m now exposed to the crazy swings of the crypto market (although luckily, stablecoins don’t fluctuate in value).

Right now, my account has only $1k, as I am experimenting to see if I enjoy the experience. The results have been positive to date. I’m not jumping into the deep end yet. However, I’ll slowly walk from the shallow end of the pull to the deeper side.

Since it is not FDIC Insured, I’d definitely recommend doing your own research, checking BlockFi’s resource center, and getting comfortable before opening an account.

Consolidating From Five to 3 Accounts Immediately

Writing out my current savings account situation for this article has been a very helpful exercise for me. In my quest to earn the highest yield possible and make every dollar count, I created an inefficient system of 5 accounts and spread my money too thin.

Typing out the intent of the high yield savings account was a great reminder of why I started this high yield savings account journey. It was to maximize the interest yield on my emergency fund. Plain and simple. My typical philosophy is to invest every extra dollar above what is needed into my dividend stock portfolio. So I have to keep that in mind as I re-tool my savings accounts.

See: Our Full Dividend Stock Portfolios

So let’s discuss the emergency account. There is zero reason why my full emergency fund shouldn’t be in Yotta Savings instead of Ally Bank and Capital One. From a pure numbers standpoint, it is a no-brainer. Even on the low end of the Yotta APY range, .8%, I’m still earning more on my money than I am at Ally, .5%, and Capital One, .4%. That’s just the worst case scenario too, don’t forget. There will be plenty of months where I earn closer to 1.5% – 2%.

The decision is made, I’m going to close my Ally Savings account by the end of the year and transfer the entire balance to Yotta Savings. At this point, my entire emergency fund will be at an FDIC insured institution earning between .8% – 2.0%. Plus, with more raffle tickets as a result of the higher balance, I’ll have even more changes to win. This move becomes immediately accretive to my income stream!

Follow us on YouTube to watch our journey to Financial Freedom!

Now, let’s discuss the second account I am going to close. Say goodbye to Digital Federal Credit Union. When I opened the account, it was a part of my emergency fund. The credit union allowed me to earn 6% on a portion of my emergency fund. Great, right? At least for that potion of the fund.

Since my emergency is full and going to be in Yotta, I’m actually going to move the $1,000 at Digital Federal Credit Union to BlockFi. The goal is to invest every dollar possible, as I mentioned early. With a full emergency fund, I’m ready to invest the extra money. BlockFi allows me the opportunity to actually increase the interest earned from DCU and gain some appreciation. I’ll transfer the $1,000 to BLockFi next month and allocate the investment between GUSD, Bitcoin, and Ethereum. Once again, this move becomes immediately accretive to my income stream.

Summary – Savings Account

These moves are going to check a lot of boxes for me. Lately, I’ve been pushing to simplify my accounts and certain aspects of my life. Consolidating my savings accounts is an easy decision, one that I should have made a while ago. With these moves, I’m reduce my online log ins from 5 to 3, a big win in its own right. Then, on top of it, I’m actually increasing my personal interest income by shifting the funds to higher yielding accounts?!

The key in this is that I am still maintaing my emergency fund in a FDIC insured institution. I would not encourage putting your emergency fund in the market, as you never know when you will need the cash. So now that my fund is taken care of, I’m able to invest the remaining cash in BlockFi while I’m waiting to purchase undervalued dividend growth stocks. This is a win-win all around. I’m excited to make savings efficient and earn more cash along the way.

What do you think of my plan? Do you agree? Where do you hold your emergency fund and would you consider opening a Yotta account and moving it there? Have you heard of and opened an account at BlockFi too? Or is it too risky for you?

Bert

Lending Club offers a high yield savings account of .60% currently.

Great post. I’ve had an online savings account with Citibank for a couple of years now and earn 0.5%.

Blockfi pays out in one month more than basically everyone else does in one YEAR.

I’ve moved 100% of my cash savings to usdc in blockfi. So far, I’ve had it for two months and made hundreds of dollars.