We are BACK with another installment of our monthly dividend increase series. Dividedn increases continue to be the name of the game in 2022. Despite the noise, your passive income continues to grow, one dividend increase at a time. This article will summarize the increases in April, along with looking ahead to discuss 8 expected dividend increases in May 2022!

Why Dividend Increases Matter

Dividends are the foundation of our goal to reach financial freedom. We continuously invest in dividend growth stocks to grow our passive income. If you haven’t figured it out by now, we eat, sleep, and breathe dividends!

Read: 5 Reasons WHY Dividend Investing is the EASIEST Form of Passive Income

If the goal is to produce a passive income stream that will one day cover our expenses, making sure that income stream GROWS is critical. Without growth, your dividend income stream will lose purchasing power to inflation. In 2022, with sky-high inflation, building a GROWING passive income stream is as important as ever. Imagine how much you would lose if your income was sitting in a savings account earning 0% – 1% (at the best)?

That is why dividend growth is a major deciding factor in all of our stock purchase decisions. It is the 3rd metric of our Dividend Stock Screener for a reason. For each stock, we review a company’s history of increasing dividends (consecurtive annual dividend increases) and a company’s five-year average dividend growth rate!

We cover dividend news extensively on our Youtube Channel. Each week, we discuss the major dividend increases from the week before. Clearly, as you all are learning, we are passionate about dividend and dividend growth!

Actual Dividend Increases in April 2022

Before looking ahead to May, let’s discuss April 2022 and see how the companies featured in last month’s article performed (from a dividend increase perspective). Right now, trying to predict dividend increases is not easy. Especially with the madness that is occuring in the broader market.

Earnings are all over the place. Results were strong for Q1 for many companies. However, if you read the companies’ earnings release, earnings call transcript, and articles reviewing the results, companies are clearly concerned.

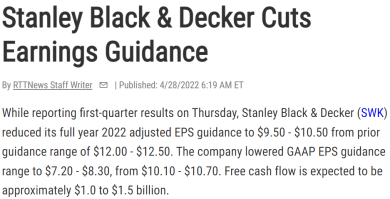

Earnings projections are being revised downwards to account for the impact inflation is having on costs and continued supply chain issues. Stanley Black & Decker, for example, slashed EPS duidance from $10.10 – $10.70 per share to $7.20 – $8.30! This is on the extreme end of the spectrum.

Not every company cut earnings this drastically (and some didn’t at all). Still, what’s going on with the economy is starting to have a real impact on your bank account, companies’ bottom lines, and even…dividend increases.

Here were the actual dividend increases from the 8 companies featured last month.

- Procter & Gamble (PG) – 5% increase

- Johnson & Johnson (JNJ) – 6.6% increase

- International Business Machines (IBM) – .6% increase

- W.W. Grainger (GWW) – 6.2% increase

- Apple (AAPL) – 4.5% increase

- Kinder Morgan (KMI) – 2.8% increase

- Costco (COST) – 13.9% increase

- Southern Company (SO) – 3% increase

From the 8 featured, there really weren’t too many increases that knocked your socks off. Procter & Gamble and Johnson & Johnson stood out in my mind due to their consistency. In times of economic uncertainty, these two Top 5 Foundation Dividend Stocks show why they are staple positions in most dividend growth investors portfolios.

Expected Dividend Increases in MAY 2022

With April officially behind us, lets look ahead to May! Hopefully, we can turn our dividend luck around and see companies announce some AWESOME dividend increases.

Dividend Stock #1: Chubb LTD (CB) – Let’s start this party off in the insurance sector. Chubb is a legendary, massive insurance company. The company’s dividend growth has been underwhelming of later. Their dividend growth rate is low and their 2021 increase was even lower than average. The market is not performing as well this year; therefore, I am not expecting Chubb to announce a dividend increase above their average. Sorry CB shareholders.

- Consecutive Dividend Increases: 28 years

- 2021 Dividend Increase: 2.6%

- 5-Yr Average Dividend Growth Rate: 3.0%

- Expected Timing of Dividend Announcement: Middle of the Month

Dividend Stock #2: Cardinal Health (CAH) – Cardinal Health is an infuriating dividend aristocrat to follow (at times). The company’s dividend growth and stock price performance (down 20% over the last five years) have been awful due to increased competition, costs, and legal issues. While I would love to be optimistic and declare a strong dividend increase for CAH, I simply can’t. Nothin has changed with the company that would point to a strong dividend increase this year. I hope I am wrong, as I am a CAH shareholder.

- Consecutive Dividend Increases: 35 years

- 2021 Dividend Increase: 1%

- 5-Yr Average Dividend Growth Rate: 1.81%

- Expected Timing of Dividend Announcement: Beginning of the Month

Dividend Stock #3: Clorox (CLX) – It is kind of crazy that Clorox is down 18% Year to date AND the company is still overvalued (34x P/E Ratio). This consumer staple giant continues to earn the premium, given the strong brand portfolio they have built in the cleaning sector. Interestingly, last year, this Aristocrat did not announce their dividend until the beginning of June. Let’s see if they return to back to their historical pattern and announce this increase at the end of May.

- Consecutive Dividend Increases: 45 years

- 2021 Dividend Increase: 4.5%

- 5-Yr Average Dividend Growth Rate: 7.75%

- Expected Timing of Dividend Announcement: End of the Month

Dividend Stock #4: Lowe’s (LOW) – Love the home improvement sector. Truth be told, I have never found a good time to buy Lowe’s or Home Depot. Instead, I have recently started building a position in Stanley Black and Decker (SWK). Surely you can find their products sold at this Dividend King’s store. In February, Home Depot announced a 15.2% dividend increase. It will be interesting to see if Lowe’s announces a similar increase, given the recent increase in interest rates has cooled the housing market slightly.

- Consecutive Dividend Increases: 60 years

- 2021 Dividend Increase: 33%

- 5-Yr Average Dividend Growth Rate: 18.36%

- Expected Timing of Dividend Announcement: End of the Month

Dividend Stock #5: Leggett & Platt (LEG) – Speaking of Dividend Kings that have taken a beating, next up on our list is Leggett & Platt. This company’s stock price cannot catch a break in 2022. Now, they are trading in the high $30 per share range. With prices so low, everyone once and a while I will grab a few shares here and there to lower my cost basis. My expectations are low for a LEG dividend increase. I would expect the increase to be LOWER than their five-year average dividend growth rate (4.34%).

- Consecutive Dividend Increases: 50 years

- 2021 Dividend Increase: 5%

- 5-Yr Average Dividend Growth Rate: 4.34%

- Expected Timing of Dividend Announcement: Beginning of the Month

Dividend Stock #6: Northrop Grumman (NOC) – The aerospace and defense sector has rebounded well this year due to the geopolitical conflicts (unfortunately). I wouldn’t expect the increased sales and prices to flow through to NOC’s dividend increase just yet. However, this is one of the few stocks this month I am feeling optomistic about. It wouldn’t shock me if the company announces a 10%+ dividend increase in 2022!

- Consecutive Dividend Increases: 18 years

- 2021 Dividend Increase: 8.3%

- 5-Yr Average Dividend Growth Rate: 11.82%

- Expected Timing of Dividend Announcement: Middle of the Month

Dividend Stock #7: Medtronics (MDT) – This medical products company is a titan in its sector. No one will ever get mad about purchasing Medtronics, setting it, and forgetting about it. The company has a solid dividend yield (~2.5%) and a strong dividend growth rate. Last year’s increase was right in line with their 5 year average. In 2022, the stock price hasn’t moved very much and continues to hover around $100. I’m expecting another increase right in line with the average.

- Consecutive Dividend Increases: 44 years

- 2021 Dividend Increase: 8.6%

- 5-Yr Average Dividend Growth Rate: 7.94%

- Expected Timing of Dividend Announcement: End of the Month

Dividend Stock #8: LyondellBasell (LYB) – Ah – one of Lanny’s favorite dividend stock. I never jumped on the LYB train…and kick myself many days for it. They are a great chemical company, with a great yield, and a great dividend growth rate. Let’s see if LYB will deliver ONCE AGAIN in 2022.

- Consecutive Dividend Increases: 8 years

- 2021 Dividend Increase: 7.6%

- 5-Yr Average Dividend Growth Rate: 5.91%

- Expected Timing of Dividend Announcement: End of the Month

Summary

Buckle up everyone. Get ready for another exciting May 2022. April was exciting, although the dividend increases could have been better. Let’s see if we can turn the corner in May. These 8 stocks aren’t as high profile as last month’s set, but that doesn’t mean the increases don’t matter! Let’s grow our income without lifting a finger. That’s what dividend investing is all about!

What dividend increases are you expecting in May? How many did you receive last month? What is your prediction for the coming months?

Bert

For May, I’m expecting LYB, LEG, CAH from your list. I am also looking forward to seeing PEP’s increase as well. I can’t get enough of dividend increases! Keep them coming! 🙂

Nice MDD! You’ll be in for a fun month then. I’m with you, can’t get enough of them either. That’s what its all about 🙂

Bert

I’m with you on CAH. What a troublesome stock to hold. There have been many times I just wanted to dump it. Aside from consistent dividend payments the stock has really gone nowhere for years. Happy to hold many of the names you mentioned. Let’s see what May brings.

Hopefully May will be great. At this point, I’m just holding CAH to see where this goes

Great post. I’m expecting raises from CLX, LEG, LOW, and MDT this month as well. I’m also expecting a raise from AMT and possibly from OMC since it kept the dividend the same last quarter.

It’s going to be a pretty slow month for us with just MDT and AQN in the taxable account and LOW in one of the retirement accounts. I expect to see 4-6% for both MDT and AQN and most likely 10%+ out of LOW. If I see those I’ll be just happy.