I’ve been dividend investing for over 10 years. The iconic Coca-Cola company has yet to enter the dividend stock portfolio. Coca-Cola has been around for almost 130 years and this company has weather all financial storms, such as COVID-19, Financial Crisis and even the Great Depression!

Time to see if Coca-Cola (KO) stock deserves a spot for your dividend investment portfolio! Could this be a dividend stock that adds to your passive income?

Coca-cola stock

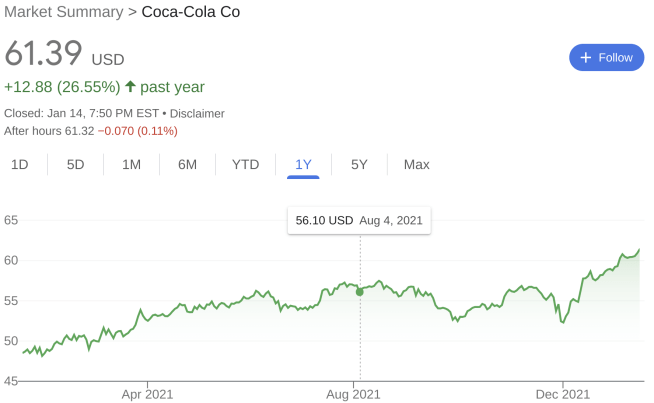

Overall, the performance of Coca-Cola (KO) stock has been strong in the last 52 weeks. In fact, they are outpacing the S&P 500, as the S&P 500 is up only 23% over the last 52 weeks.

If you go back into 2017 through 2019, Coke was not a significantly strong performing stock by any means. Their stock during that time period was fairly flat, therefore, it’s nice to see Coca-Cola doing well right now.

Financially, Coke’s performance has been strong in 2021 through 9 months. Revenue was approximately $3.5B higher than 9 months of 2020. Earnings is significantly higher than 2020, and Coca-Cola has also maintained a significantly clean balance sheet. The balance sheet is clean because Long-Term debt is down and the current ratio is 1.50x! Therefore, Coca-Cola is very liquid.

Given Coca-Cola is doing well financially and the stock price has performed well because of it – is Coca-Cola a dividend stock to buy now?

coca-cola stock dividend analysis

As you know it’s time to review Coca-Cola with the Dividend Diplomat Stock Screener! Here, we focus on 3 main dividend stock metrics:

1.) Price to Earnings Ratio (P/E): We look for the price to earnings ratio < the S&P 500 and the competition.

2.) Dividend Payout Ratio: The preferred dividend payout ratio is < 60%. In fact, we believe the perfect payout ratio is between 40% and 60%.

3.) Dividend Growth Rate: Given we are dividend investing on our way to financial freedom, as we believe dividend income is the best source of passive income, we look at the 5 year dividend growth rate. In addition, we review how many years the company has increased their dividend.

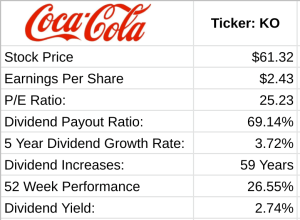

1.) P/E Ratio: Coke has a price to earnings ratio, as of January 14th, of 25.23. This actually is lower than the S&P 500, which is mid-26 and is slightly lower than Coke’s biggest competitor – Pepsi (PEP). Pepsi’s P/E ratio is 26. Ever-so slight undervaluation for this dividend king.

2.) Dividend Payout Ratio: Coke (KO) pays a dividend of $0.42 per quarter or $1.68 per year. Taking $1.68 over $2.43 in forward earnings, equates to a dividend payout ratio for Coca-Cola of 69%. This is above what we like to see, which is 60% at the highest level.

3.) Dividend Growth Rate: Coca-Cola has been increasing their dividend for 59 years. They are not just a dividend aristocrat (25 years) but Coke is also a dividend king (50 years)! However, the growth rate is low for Coca-Cola, as their average increase over the last 5 years is only 3.72%. The past year was a one-cent increase from $0.41 to $0.42 or 2.43%.

Lastly, we’ll take a look at the dividend yield. As an investor, you want to know how much owning this dividend stock pays you now! The yield for Coca-Cola is 2.74%, which is approximately 2x the S&P 500, no doubt.

Is coca-cola a dividend stock to buy?

Now that we’ve gone through the metrics, is Coca-Cola a stock to buy for the dividend stock portfolio?

There are strong positives about Coke stock. The price to earnings ratio is okay, the dividend growth history is impressive but there are a few downsides.

The negative factors for Coca-Cola come down to the higher dividend payout ratio. This high dividend payout ratio also correlates to the lower dividend growth rate we have seen from KO.

I’ve always wanted to own this dividend growth stock, one that Warren Buffett has loved forever, but I have a few reservations right now.

To start, the stock price is just a tad too high. They’ve outpaced the S&P 500, with a higher P/E ratio. In addition, the dividend growth rate currently does not outpace the rate of inflation, which is at near-highs. The inflation rate is well over 6% to 7% at the moment. Further, I do not see growth rate increasing in the near-term, based on the high dividend payout ratio.

Therefore, I will not be buying Coca-Cola stock at this time, sadly. I’ll continue to monitor this stock and if the price comes down or if earnings grows faster than the share price, I’ll re-look at KO stock.

If you head over to our YouTube channel, you’ll find other undervalued dividend growth stocks that are higher on my list for stocks to buy now!

How about you? Do you own Coke stock? Do you think Coke is a stock to buy now in this all-time-high stock market? Share your comments and feedback below!

As always, thanks for stopping by, good luck and happy investing!

-Lanny

Yup own and would buy more if it drops back into 50’s. They are number two in coffee behind Starbucks and have cleaned house by eliminating 200 brands and are rolling out these smart cafes across the US, Fits the coke model, put drinks wherever people congregate Plus launching coke with coffee.

KP –

Nice – is the coffee due to the acquisition of Costa?

-Lanny

Guessing yes makes sense to me line extension

Hey Lanny

I wish you a happy New Year!

Good article on one of my favorite consumer staples. Coca Cola has been in my portfolio for years and I enjoy seeing the climbing dividends. I like the strong brands and appreciate KO‘s efforts to get more diversified and also offer more healthy drinks. There are products for every consumer beverage taste. FCF will grow stronger over the medium run and that stock is for me one for the long run.

Cheers

No

My Financial Shape –

I agree, the product strength is deep and iconic. They continue to churn cash and the dividend continues to grow. Always hold this bad boy if you own it!

-Lanny

The two concerns that I have (over the ones you address) are:

1) The financial impact of the 21st Century Beverage Partnership model on their results. (artificially depress earnings in the early years and inflate earnings in the later years). The IPO of part of their interest in Coca-Cola Africa (perhaps this year) should essentially complete this transformation.

2) Their continuing court losses on the roughly $3B tax assessment from the IRS on transfer pricing allocations between (now mostly former) bottlers.

If inflation is indeed persistent, this third concern is most relevant to dividend investors. My holdings of KO (and its bottlers) are simply ancillary and as such, the mother ship is on watch to be jettisoned if their next increase (and resulting growth rate) continue to disappoint.

Charlie –

Definitely have to keep us posted with the moves you make post-earnings release! Very excited to hear what you end up doing!

With inflation, one would think they could pass it on to the consumer. Right?

Would like to see what they can do to reduce costs, i.e. a significant push to reduce expenses.

-Lanny

My money is on Buffet and Berkshire!!!!!!!!!!!

I currently don’t own KO and don’t plan to any time soon at these elevated valuations. There are better value stocks out there like in the financial sector that I’m looking at instead. 🙂 Great analysis.

Lanny,

Good post. Like you, KO is a stock I’ve wanted to own for years. The balance sheet is very solid with a net debt to EBITDA ratio of about 1.1 and a decent interest coverage ratio as well. A P/E ratio of 25 is a bit pricey, but not out of reach for me considering that analysts are expecting annual earnings growth to accelerate to 10% over the next five years. I’d like to see the yield get closer to 3%, so a pullback into the mid to upper $50s would make it very interesting for me given the payout will be raised in a few weeks. Otherwise, if KO stays around $60, I’m going to open a starter position and buy on any pullbacks.

Hi,

KO was one of the companies I bought when I first got into this (along with T, MCD, and JNJ). I was never able to have a dividend growth portfolio without KO in it. And it’s a company that is not going anywhere.

After 7+ years, valuation at purchase does not make a bit of difference to me. The income does.

cheers,

John

Bingo, Warren Buffet has always won out over all the young guns and impatient investors……………….A staple in his portfolio for a reason……………