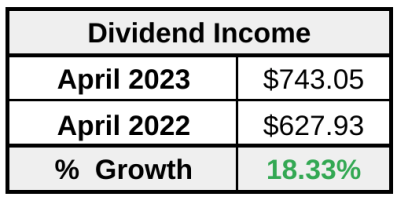

April showers brings dividend flowers. That’s how the saying goes, right? Every month we summarize the dividends received from the last month. My wife and I were able to grow our April dividend income 18%. In this article, we will detail our April dividend income and show you HOW we grew our dividend income 18% this month!

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income with dividend income. One day, my dividend income will be large enough to cover my monthly expenses and allow us to retire early. That is why we are always relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We save a high percentage of our income each month, to help fuel our dividend stock portfolio. Having a high savings rate is a key pillar of our strategy and helps fuel the fire and push the snowball further down hill. While we are waiting to invest our money in the market, it is earning a high interest rate in accounts. There is NOTHING more critical than maximizing EVERY DOLLAR in your savings account.

READ: How To Maximize Your Cash – 4 Simple Methods!

The 3 primary savings accounts I use are:

- SoFi – 4.2% APY on all savings accounts (lower for your checking account). The race for deposits is INTENSE! Banks and credit unions are offering great savings rates.

- Capital One 360 Savings – 4.00% APY – We use Capital One for our checking and savings account.

- Weathfront – 4.55% without promotion. 4.80% with an extra .5% by signing up using my referral link (Click Here).

Read: Interest Rates on High Yield Savings Accounts Are SOARING!

How Do We Find Dividend STocks to Buy?

That’s easy. We use our dividend stock screener with every stock purchase! This simple, 3 step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Watch: Dividend Diplomats’ Dividend Stock Screener

The three metrics of our screener are:

- Price to Earnings Ratio less than the S&P 500

- Payout Ratio less than 60%

- History of Increasing Dividends

- Dividend Yield (BONUS)

We use this stock screener for each purchase and have consistently done so for 10+ years on our journey to financial freedom!

Bert’s April Dividend Income Summary

We received $743.05 in April dividend income. This was a 18.33% dividend increase compared to April 2022. That is how you start the second quarter off in style. The beauty is that we are inching closer and closer to achieving at least $1,000 per month in ALL 12 months of the year.

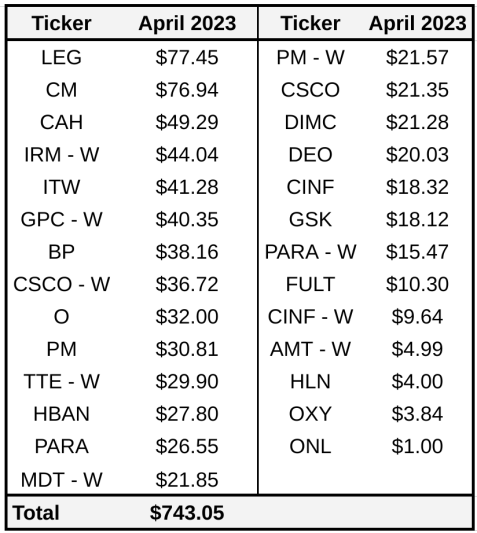

We received dividends from over 20 companies in April. In fact, we only received dividend from individual stocks this month. We did not receive a dividend from a mutual fund or ETF. The following chart shows all of the individual dividend payments received in April by me and my wife.

Each month, we share a few observations about our monthly dividend income. We note the following observations:

Observation #1: Banks Flexed Its Muscles

The banking sector has been on the top of everyone’s mind over the last few months. With Silicon Valley Bank already failing and First Republic Bank on the brink of failure, the sector continues to do soul searching in this high inflation, high interest rate environment. Over the last few months, I have not been shy about building positions in banks. I’ve built my Huntington Bank (HBAN) and Fulton Bank (FULT) positions significantly since the banking crisis began.

The larger dividend income was not fully reflected in the dividend income chart above. Several of the purchases occurred after the ex-dividend date. That excites me and should result in a larger July dividend income total!

In total, from banks, we received $136 in dividend income this month. That accounted for 18.3% of our monthly dividend income total! I love banks, but I have to avoid becoming too concentrated in the sector.

Observation #2: Leggett & Platt & Canadian Imperial Are the Clear Leaders

We just wrote an article about Leggett & Platt on our website recently to see if I should continue building my position in the Dividend King! When I wrote the article, I didn’t realize that LEG was the largest dividend payer in the first month of the quarter…BY FAR!

My top 2 positions, Leggett & Platt (LEG) and Canadian Imperial (CM) paid me $154 in dividend income. That accounted for 20.7% of our dividend income. It is crazy that two positions made up that large of a percentage of our dividend income total. Again, like the last comment, I have to avoid concentration risk. If LEG or CM were to ever cut their dividend, it would create a massive hole in our dividend income for the month. Luckily, I love the two stocks at the top and think they provide a strong dividend yield.

Observation #3: Couldn’t Be Happier We Quickly The New Positions

One of my goals going forward is to build larger stock positions. Rather than find myself in a situation where I have a ton of small positions (<$500) paying a few dollars each quarter in dividends, I wanted to start focusing on building larger positions that will pack a punch to my dividend income.

We’re finally starting to see the fruits of this labor. One example of this strategy is Medtronic (MDT). We own 32.404 shares at an average cost basis of $78.68 per share. Our current market value is $2.947 and the position produces $88 of income annually! The position is meaningful enough to produce a strong quarterly dividend.

In the chart above, I’ve continued to adopt this strategy with other positions. As mentioned earlier in a section, I’m using the banking crisis to build my position in Fulton Bank (FULT). We’ve been buying shares lately, after the ex-dividend date, so our position isn’t reflected in the chart above. We now own 160 shares and our position produces $72 of income annually. I would love to keep building this position to at least $100 annually!

Building large positions is not the end all be all. For earlier investors that are trying to grow their positions quickly, just invest and worry about building large positions later. However, for me, at this stage of my investing career, it is nice building large positions!

Summary – April Dividend Income

All in all, another solid month. We’re enjoying seeing our dividend income grow and push towards $1,000. Each month is another step towards financial freedom. That’s why we must stay focused, save as much as we can, and continue buying as many dividend growth stocks as possible.

How was your April dividend income total? Did you set a record? What were you two largest dividend paying stocks in April?

Bert

Goals are very important and I have no doubt you guys will reach yours.

Bert,

Congrats to you and your wife on another strong month. Keep it up!