2022 is in the books and we are racing into 2023. Happy New Year to all! Now that the ball has dropped and the calendar has turned, it is time to tally our family’s dividend income total from the previous month. This article will review our December dividend income and provide some key observations about this great month!

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income. One day, my dividend income will be large enough to cover my monthly expenses and allow us to retire early. That is why we are relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We save a high percentage of our income each month, to help fuel our dividend stock portfolio. Having a high savings rate is a key pillar of our strategy and helps fuel the fire and push the snowball further down hill. While we are waiting to invest our money in the market, it is earning a high interest rate in accounts. The two primary savings accounts I use are:

- SoFi – 3.75% APY on all savings accounts (2.5% on your checking account). The race for deposits is INTENSE! Banks and credit unions are offering great savings rates.

- Yotta – 1% – 2% APY, on average. They just updated their product as well. Now, instead of weekly drawings, they are offering daily cash drawings!

Read: Interest Rates on High Yield Savings Accounts Are SOARING!

How do we find undervalued dividend stocks to buy? That’s easy. We use our dividend stock screener with every stock purchase! This simple, 3 step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Watch: Dividend Diplomats’ Dividend Stock Screener

Building a large dividend income stream takes time, consistency, hard work, saving, and most importantly, investing. I have been investing in dividend growth stocks since 2012. Saving a high percentage of my dividend income allows me to invest as much as possible, so we can retire as soon as possible.

Slowly, but steadily, my income has grown. Brick by brick. DRIP by DRIP. It is really exciting to see the growth and larger dividend checks trickle into my brokerage account.

Each month, we share our dividend income summaries to highlight our growth and progress. It is a fun and helpful exercise that holds us accountable. Further, it helps you, our followers, see the stocks we are purchasing.

Bert’s December Dividend Income Summary

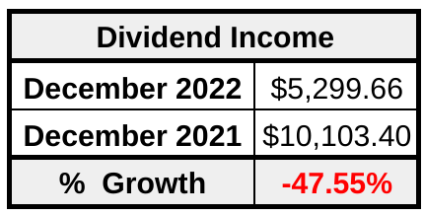

We received $5,299.66 in December dividend income! Holy freaking cow….we had over $5,000 in dividend income this month! Unfortunately though, this was a 47.55% DECREASE compared to December 2021.

There is more to the story though. After all, it is December. In December, mutual funds and ETFs not only pay their quarterly dividend, but also distribute capital gains as well. In this month, the results are always going to be skewed. Hence why I’m not overly concerned that my dividend income decreased nearly $5,000 compared to last year. The decrease is due predominately to the lower capital gains distributions from the previous year.

Taking a step back, it makes. The S&P 500 finished down nearly 20% in 2022. This was after multiple years of increases. So of course funds lost money like the rest of us, especially as the tech sector was hit especially hard during the year.

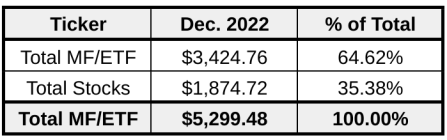

I was curious though. How much of my $5,299.60 of dividend income in December was from mututal funds and ETFs, which paid a distribution, and individual stocks? Nearly 65% of my dividend income was from mutual funds. Luckily, nearly $2,000 of my dividend income was from individual dividend stocks. Now that is the number I want to continue growing every December!

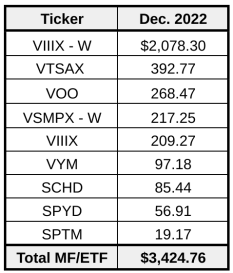

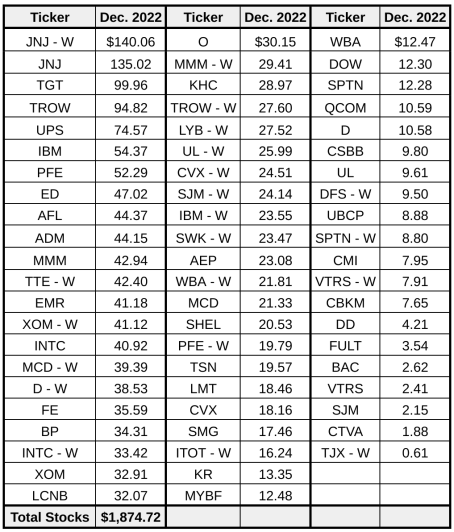

Now, let’s get to the individual stock breakdowns. I created two charts showing individual payments received. The first chart breaks down the individual dividend checks from mutual funds and ETFs while the second chart breaks down the dividend payments received from dividend stocks!

Per usual, I include a few observations regarding my dividend income for the month.

Observation #1: Funds Giveth and Funds Taketh

Just to emphasize one more time, mutual funds and ETF distributions are great in years where the market soars. That is what helped propel our dividend income to over $10,000 in December 2021. We still received a ton of dividend income from funds in this month. Heck, my wife received nearly $2,100 from VIIIX. It is not like we didn’t earn anything from funds, right?

Still though, our goal is to build a steady, growing dividend income stream. That is why it is so important to continue investing in dividend stocks with long term track records of consistently growing its dividend income. That will help me avoid the large swings that I experienced this month.

Observation #2: Johnson & Johnson Flexed Its Muscle

My wife and I finished our 100 share purchase challenge for Johnson & Johnson. Now, we’re starting to see the benefits of having such a large position in this Dividend King that is a Top 5 Foundation Dividend Stock. We own a few shares in other accounts too, so technically, we each own over 100 shares.

In December, we received over $275 from Johnson & Johnson. That is well over 1 share via DRIP. That’s why I’m so pumped up that we took on the challenge, bought one share per week, and now have built such a massive position. This has been a great experience for me and one that will help me shape future purchases, and the size of each position in my portfolio, going forward.

Observation #3: We Have Too Many Positions That Pay Us A Small Dividend

This will continue to be a theme, and focus, of mine in 2023. I don’t want to initiate new positions with tiny dividend payments. Looking at the chart above, we have 15 individual positions that paid us a dividend less than $10 in December. The total dividend from these 15 positions is $87.52.

That is just too many if you ask me. For each of the positions, we either started building the position and stopped because the price jumped up. Or, for some reason, I just stopped building the stock position and shifted my attention elsewhere, only to never revisit the stock.

Part of me what wants to just sell some of the positions and invest the proceeds in other stocks that I own. I’ll have to evaluate in the coming months and see what the best path forward is going to be for me and my wife.

Summary – December Dividend Income

Man, so over $5,000 of dividend income in December. That’s what I’m talking about. Even though our dividend income dropped by $5,000 compared to last year, I’m still excited about the progress we have been making. Individual stock dividends totaling nearly $2,000 in dividend income is an excellent foundation to continue building upon in 2023 and beyond.

Now, lets all keep moving forward and continue pushing ourselves harder this coming year. Let’s push, reach financial freedom, and most importantly, continue to make every dollar count.

How much dividend income did you receive in December? Did you set a December Dividend Income record?

Bert

Incredible end to the year, Bert!

Thank you Dreaming of Dividends!! Much appreciated.

Bert,

Congrats to you and your wife on another great month in spite of the drop in dividend income. $5K-plus in total dividends is still pretty darn good. Keep it up!

Thanks Kody! Very much appreciated. I can’t complain about the results and look ahead to the next month.

What a great story Bert. Something to be proud of.

Thank you very much Billy! Very much appreciated.

Talk about a great way to close out the year Bert! Over $5k is still a fantastic result. And love that JNJ challenge/goal. I’m in a similar boat as you with some smaller positions that just never got re-added/built up or came through via spinoffs. I keep going back and forth on whether to just close them out or let them ride and we’ll see what happens in the future.

Thanks JC! It’ll be exciting to see what you come up with for your portfolio as well. What are your target positions to clean up?