This article discusses the dividend stocks we purchased in June and the dividend income added as a result! The stock market was extremely volatile last month with rising inflation, interest rates, and soaring gas prices. Stock prices swung wildly, presenting many buying opportunities for eager dividend growth investors like ourselves.

Why Do We Buy Dividend Stocks?

Our goal is to reach financial freedom by building a growing passive income stream. That passive income stream is built on the back of dividend growth stocks. We have been adding to our dividend stock portfolios for over 10 years and are now closing in on $20,000 annual dividend income!

See Our Dividend Stock Portfolios. We are FULLY TRANSPARENT on our website!

We are able to purchase a large amount of dividend stocks because we save a high percentage of our income. We live frugally and play great defense with our hard earned dollars. When we aren’t investing the money, we park the extra cash in high-yield savings accounts at places like SoFi and Yotta.

See: SoFi Savings Account – Earn 1.5% on Your Cash

See: Yotta Savings – This Fun App Earns Me Between 1% – 2% regularly!

Each extra dollar is critical when building this dividend stock house. Brick by brick, we are working towards building this beautiful place to live. That’s why I’m excited to share our stock purchases from the last month. You can see the dollar impact of each and every purchase!

June 2022 Dividend Stock Purchases

This section is going to dive into our dividend stock purchases. We will share in greater detail the largest dividend stock purchases from June. Then, we will briefly mention the smaller stock purchases. Let’s dive in and share each purchase and the amount of forward dividend income added.

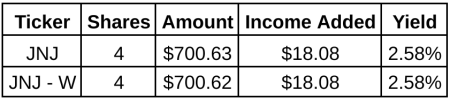

Dividend Stock Puchase #1: Johnson & Johnson (JNJ)

The first purchase should not be a surprise to anyone that follows our blog our YouTube Channel. Every week, my wife and I add one share each of Johnson & Johnson (JNJ). We love the Dividend King and are not shy about it. It is one of our Top 5 Foundation Stocks for a reason and is one of the G.O.A.T.S in the consumer healthcare and pharmaceutical sector.

Read: Top 5 Foundation Stocks for YOUR Portfolio

We started this weekly purchase journey in March 2021. Now, we both own 80 shares each. We recently talked about how we want to reach 100 shares each before re-evaluating this weekly stock purchase strategy!

So let’s look at how the month of June shaped up. We each added 4 shares of JNJ, or 8 in total. We added $1,400 combined in the Dividend King. In fact, our average cost per share was $175.16 per share. That’s definitely higher than it has been in recent months. The new dividend income added from the stock purchases was $36.16 and our averae dividend yield on purchases is 2.58%.

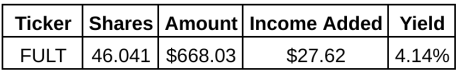

Dividend Stock Puchase #2: Fulton Bank (FULT)

We just talking about Fulton Bank on our latest dividend stock watch list video. We initiated a position in this $26B+ large community bank for a few reasons. First, it serves a huge market, in Pennsylvania, DC, New Jersey, Virginia, and the rest of the east coast.

Second, the company’s Price to Book Ratio is below 1X. Currently it is at .99X. That is right in our purchase zone, as we look for companies with Price to Book Ratios between 1X and 1.25X.

Thirdly, did we mention the dividend yield? Fulton Bank’s dividend yield is currently over 4%. That is based off of their regular dividend as well. The company also pays a small, special dividend in Q4 that adds a little extra treat for shareholders.

You know the two of us right now. We love banks. Therefore, it is natural that my wife and I started a position in another strong yielding bank. I love that this stock also pays a dividend in the first month of the quarter too. So we are increasing our income in a month that is typically lagging.

In June, we iniitated our position ahead of the June 30, 2022 ex-dividend date. We now own 46.041 shares after investing $668.03 total. This added $27.62 of forward dividend income at a yield of 4.14%! We are marching towards a position of at least $1,500 – $2,000.

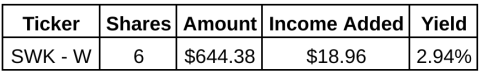

Dividend Stock Puchase #3: Stanley Black & Decker (SWK)

This is another stock we have been purchasing for my wife’s portfolio. This Dividend King has had a rough 2022. Stanley Black & Decker is down over 40% year to date. Supply chain issues and rising costs have taken a toll on the company. In fact, there is a new captain of the Stanley Black & Decker ship!

Stanley Black & Decker’s dividend yield has swelled to 3%, at moments, after the company’s downturn in 2022. At the moment, the yield is below 3%. However, we’ve benefitied from grabbing shares at 3% at certain points in 2022.

July should be a fun month for Stanley Black & Decker as well. Why? This Dividend King is expected to announce a dividend increase! I’m expecting the company’s dividend increase to be in the low to mid percentage point increases due to the tough year. Still, I’ll take it!

June was unique because the company’s stock price hit its lowest price. Look at the chart above. As you can see, there were moments when the stock price was kissing $100 per share. We added a few shares as the price was in that range. The following table summarizes our Stanley Black & Decker purchases.

We added 6 shares during the month at an average share price of $107.40. In total, we added $18.96 in dividend income, at an average dividend yield of 2.94%. We are closing in on 20 shares total. man, it would be fun to hit at least 30 shares over the next few months. Now, let’s cross our fingers and hope for a strong dividend increase in July.

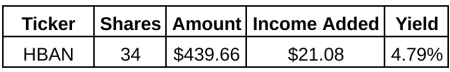

Dividend Stock Purchase #4: Huntington Bank (HBAN)

Back to the banking sector. For every reason we purchased Fulton, we purchased a larger bank with a higher dividend yield! Early in June (June 9th and June 10th), I added to our Huntington Bank position to push it over 100 shares. We now own 115 shares of the Columbus headquartered Top 20 Bank!

Huntington’s dividend yield is impressive. At the time of our dividend stock purchase, the average yield was 4.79%. Now, after the price has fallen further, their current dividend yield is well over 5% today. Maybe I should look to add more…right?!

Huntington’s current price to book ratio is currently 1.09X. It falls in our favortie 1.0x to 1.25X that we use when assessing whether a bank is undervalued or not. Compared to some of the larger banks, such as J.P. Morgan (JPM), this is definitely undervalued.

Our two purchased of Huntington are summarized in the table below. In total, we added 34 shares to our position, adding $21.08 to our forward dividend income. The average share purchase price is $12.93 per share. The stock’s price is currently sitting at $12.10 per share. Therefore, this may be another great stock to add to our watch list. It would be a cool milestone to increase our stake from 115 shares to 200 shares over time.

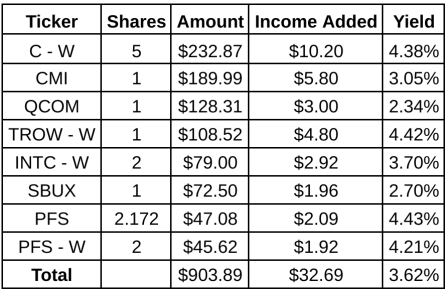

Other Dividend Stock Purchases

The four previously discussed stocks were the largest purchasese for the month. In this section, we will aggregate the rest of our stock purchases. Some purchases were for many shares while other purchases added just 1 share to our portfolio. The following table summarizes the remaining dividend stock purchases we made in June 2022.

The “Other” purchases added up to a healthy amount of dividend income, in aggregate. The chart above highlights the fact the “Other” purchases totaled $900+, adding $32.69 of dividend income.

Citigroup (C) was the largest purchase of the group. We started our position in 2021 and have continued adding to our position as the price gets slammed in 2022. Apparently our stock purchase articles and videos caught the attention of Mr. Buffett. Like us, he is building a position in Citigroup himself (although his stake is much, much larger)! After the 5 additional shares, we now own 43.018 shares. Getting to 50 shares would be fantastic!

The remainder of the list is well talked about on our Youtube Channel. Cummins (CMI), Qualcomm (QCOM), T.Rowe Price (TROW), Intel (INTC), Starbucks (SBUX), and Provident FInancial (PFS) round out the list!

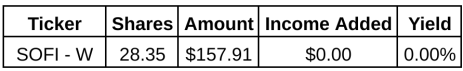

Bonus: Fintech Stock Purchases

Last, but definitely not least, some other small purchases to discuss. This section deserves a section of its own….because these stocks do not pay a dividend! Like technology stocks, there is another sector that is getting crushed in 2022. That sector are fintech stocks. After several hot years of astronomical valuations and rocket growth, some of the largest players in the sector are seeing valuations slashed and stock prices plummet. I do work in the fintech sector myself, so it is fun to pick up some stocks in the sector that you are monitoring daily.

The first Fintech stock purchased was SoFi (SOFI). This hasn’t exactly been the quietest stock purchase if you watched our YouTube channel. I’ve definitely hinted at the purchase for a while. SoFi has its doubters, clearly. The stock is getting hammered and the cmopany is working through some painful growth. Plus, the student loan payment freeze has taken a toll on this company’s top line in the short term. A massive source of revenue just disappeared. The company has diversified its revenue stream since then, growing to be a major player in personal loans, mortgages, and online banking in general.

They aren’t just a fintech now, they are a bank. They have a massive deposit base and are growing it rapidly in an effort to reduce its operating costs. Their deposit account interest rates are 1.5%. What’s crazy is that is still significantly cheaper than other sources of funding for fintech companies. I loved their full acquisition of Technisys and Galileo. They weren’t cheap, but they are building critical infrastructure for themselves and to provide banking as a service. Again, there are plenty of risks. Don’t want to discount that. But its a stock I like in a the growth corner of my portfolio.

See: SoFi Savings Account – Earn 1.5% on Your Cash

Our purchases in June were relatively small. I’ll keep grabbing small chunks of share while SoFi is below $6 per share. The table below shows that we grabbed 28.35 shares in June at an average share price of $5.57 per share!

We’ve been building our SoFi position since it was well above $10 per share. I’ve been averaging down my wife’s position like crazy this year. This position isn’t small, for the record. We now own 728.364 shares of SoFi at an average cost basis of $8.78 per share! Yeah, this is a growth opportunity in our portfolio. Let’s see if the company can turn it around.

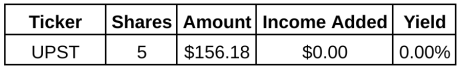

Lastly, I won’t spend a ton of time on this last fintech stock, since our position is relatively small. However, I;m adding a few shares here and there of Upstart (UPST). The personal loan fintech ocmpany that uses AI and machine learning to price each loan individually is also having a rough 2022.

They ran into some issues last quarter, when it turned out that company was balance sheeting loans that it could not sell. The stock was absolutely crushed after wards. That’s when we decided to nibble. While I don’t feel quite as strongly about the long term prospects for Upstart as I do SoFi, they have reached scale in the personal loans sector and have built a pretty impressive loan engine for banks and credit unions.

We purchased 5 shares at an average price of $31.24 per share. Now, we own a whopping 11 shares of Upstart! I’ll nibble here and there if the company continues to remain in the low $30 per share!

Summary – June Stock Purchases

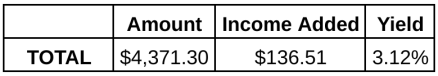

What a crazy month of stock purchases this was. In total, we added $4,371.30 to our portfolio, which will produce $136.51 in forward dividend income! Our Yield on Cost is 3.12%. That’s more than double the current yield of the S&P 500!

We’re pumped up and blessed to be able to add this much to our dividend stock portfolio in a given month. Its really going to help fuel our journey towards financial freedom. With each passing month, we are getting one step closer to reaching the end game.

What stocks did you purchase in June? What do you think about our dividend stock purchases? Are you buying any non-dividend stocks as well? How much dividend income did YOU add this last month?

Bert

Like SBUX down in the dumps. Also looking at troubled MMM. Nice list of buys and a mega chunk of cash put to work. No fear for you during these down days.

Nice series of buys Bert! I ended up buying TROW, MDT, and BEN in June. Now I am in reload mode for future stock buys. Even in the heat of summer, you keep that snowball growing! 🙂

Well I think there’s generally a theme to your purchases. Financials! Those look pretty interesting and you’ve got to love those starting yields. There wasn’t much in our portfolio, just continued with DCA into several companies. We’ve got a bigger chunk of cash to put to work after June and of course the markets have started rallying. Always how it goes.

Bert,

Congrats to you and your wife on deploying over $4K in capital last month. All of those dividend-payers are excellent. The only non-dividend payer that I added to in June was AMZN. Let’s keep it up!