We are in the heart of earnings season. Companies continue to share their results, and Mr. Market continues to react accordingly. This always presents us with the opportunity to find new undervalued stocks to buy or add to our dividend stock watch list! This article will feature 3 companies that I am going to keep my eye on for the rest of July 2021.

The Current Stock MArket

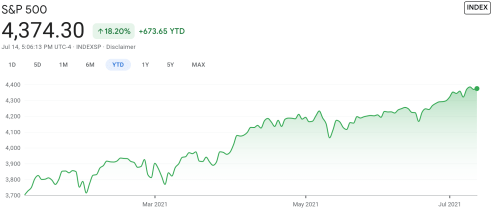

The S&P 500 continues to hit record highs. At the time of this article, the S&P 500 finished at nearly 4,375! Even with a few “red” days recently, the stock market has only known one direction lately…that is up. Look at the following chart showing the S&P 500’s year to date performance.

The record setting stock market isn’t the only major news. Inflation continues to be a major topic on everyone’s mind. Historically, inflation is between 2% – 3% annually. In recent months, inflation continues to post higher than usual results. This week, it was released that inflation was 5.4% annualized in June 2021 compared to the previous market. With spending at record levels, the inflation numbers will be monitored closely to see if this is a trend that is here to stay or a short term blip.

The record setting stock market isn’t the only major news. Inflation continues to be a major topic on everyone’s mind. Historically, inflation is between 2% – 3% annually. In recent months, inflation continues to post higher than usual results. This week, it was released that inflation was 5.4% annualized in June 2021 compared to the previous market. With spending at record levels, the inflation numbers will be monitored closely to see if this is a trend that is here to stay or a short term blip.

The more important question is, how will this impact the market in long run? Will it present purchasing opportunities for us dividend growth investors in the long run? After all, I am eager to put my cash to work and continue growing my passive income stream by investing in dividend growth stocks. Moving cash from the sidelines and into the market is the fastest way to grow my dividend income!

Related: 5 Reasons Dividend Income is the Easiest Passive Income Source

We don’t just purchase any dividend stock, however. The dividend stock must be an undervalued dividend stock. Like our personal finances, we are always looking for a great value after all! That’s why we are constantly running our stock screener to find see what new undervalued dividend stocks have popped up on our radar and are now considered dividend stocks to buy.

Dividend Diplomat Stock Screener

We run our dividend stock screener before every stock purchase. The screener helps us quickly assess if a dividend stock is undervalued and a potential fit for our dividend stock portfolios. If you don’t know already, we keep the stock screener metrics to THREE SIMPLE items. They are:

- Price to Earnings Ratio – We look for a price to earnings ratio less than the overall Stock Market.

- Payout Ratio – We aim for a payout ratio between of less than 60%.

- Dividend Growth – We like to see history of dividend growth in a company. So we look at a the company’s 5 year average dividend growth rate and the number of consecutive annual dividend increases.

See the video below, for further details and explanation. If you don’t like to watch videos – see our Dividend Diplomat Stock Screener page!

Bert’s July 2021 Dividend Stock Watch List

Now, let’s jump in and see the 3 dividend growth stocks that made the cut and are conisdered dividend stocks to buy! The stock prices used in our analysis are as of Wednesday, July 14, and the average EPS is gathered from Yahoo! Finance.

Company #1: J.M. Smuckers (SJM)

If you follow our YouTube Channel, this shouldn’t really be a surprise. Smuckers recently popped on our dividend stock watch list after we took a deep dive in a recent video. The consumer staple will always have a special place in our heart, as the company is also headquartered in Northern Ohio (like the Diplomats).

Smuckers’ strong brand portfolio always jumps out at me. Their brand portfolio includes Jif, Smuckers, Folgers, Meow Mix, and many other great brands. The brands can be found in many households and are recession proof, as people and pets always need to eat and drink coffee (well, not your pets)!

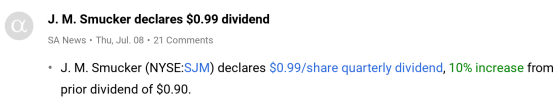

The company announced a very strong dividend increase in July as well. Their quarterly dividend was increased to $.99 per share from $.90 per share. That is a 10% increase based on my calculation. That dividend increase is well over inflation and looks even better when considering the company has a ~3% dividend yield!

Let’s see the metrics and how well the company performs in our dividend stock screener. Smuckers’ price is $130.29 per share and analysts are estimating $8.84 per share. The company’s annual dividend is now $3.96 per share after the dividend increase.

- Price to Earnings Ratio: 14.73X

- Dividend Payout Ratio: 44.8%

- Dividend Growth History: The 5 year average dividend growth rate is 6.14% and the company has increased its dividend for 11 consecutive years.

Hopefully you can see why this consumer staple giant is climbing up our dividend stock watch list.

Company #2: Citigroup (C)

Company #2 is taking us to the banking sector. We are entering the banking sector with a bang, especially given the fact that Citigroup is one of the largest banks in the country. We recently began building a position in Citi in my wife’s portfolio and may be looking to add once again, if the stock price continues to slide. There are two major stories that I want to discuss before reviewing the metrics.

Recently, as we featured on our YouTube Channel in a video, the banking sector announced some HUGE dividend increases after the Fed gave banks the green light once again. The Federal Reserve initially restricted dividend and share buyback programs at the onset of the pandemic for banks to help preserve capital in an uncertain time.

Well, a lot happened since that decision was made. The government flooded the economy with money and banks experienced significantly less losses than anticipated. After the Fed gave the green light to increase dividends, the largest banks all began announcing HUGE dividend increases. Interestingly though, there was one name absent from the list….Citigroup! Management decided to maintain their dividend at its current level and keep their strong capital position intact. While I was upset about the decision at first, I then realized the company’s dividend yield was still greater than most of the banks that just announced dividend increases. Suddenly, I was less upset about the company’s lack of a dividend increase.

Don’t Miss: Our Financial Freedom Products to Help Grow Your Income or Reduce Expenses

The second story was the company’s earnings release (dated July 14). The bank beat analyst expectations for revenue and earnings per share, which is always great. However, the company’s revenue declined 12% compared to last year. The company’s revenue was impacted by falling credit card loans and a decline in interest rates. This figure definitely caught me by surprise. Luckily, the bank recorded a $1.1 billion benefit for its loan provision for the period. Stronger loan quality and lower than anticipated losses helped allow the bank to reduce the reserves.

Even with a mixed earnings release, I’m still very interested in running the company through our stock screener. Citi’s price is $68.17 per share and analysts are estimating $9.00 per share. The company’s annual dividend is now $2.04 per share after the dividend increase.

- Price to Earnings Ratio: 7.58X

- Dividend Payout Ratio: 22.6%

- Dividend Growth History: The 5 year average dividend growth rate is 74.79% and the company has increased its dividend for 6 consecutive years. That 5 year growth rate is insane, but I also know that it is not sustainable!

In addition, for banks, we also review the Price to Book Ratio to assess the valuation of the company. Typically, we consider a bank undervalued if the Price to Book Ratio is less than 1.25X. This is where Citi really shines, in my opinion. The bank’s P/B Ratio is .75X. Clearly, this company performs well in our stock screener and is showing signs of undervaluation.

Company #3: Viatris Inc. (VTRS)

This is a company that I am excited to feature on my watch list. We both owned Pfizer prior to the Viatris spin-off that took place. Therefore, we each received shares of the new company in our stock portfolios. The position though, isn’t very large, and this may be a great time to add and start building our stake.

Viatris has a very strong brand portofolio that can be found in your medicine cabinet. Some of their featured brands are Lipitor, Zoloft, Xanax, Beutrontin, Viagra, and others. That is what jumps out to me about this newly formed entity. Pfizer didn’t just spin-off some of its poor performing brands. Rather, it was the opposite. The company spun-off some of its strongest brands.

Viatris’ performance in 2021 has not been great, to say the least. Especially when compared to the S&P 500 and so many other great dividend growth stocks. Their price is down almost 25% year to date. Now, their dividend yield is over 3% with the price decrease!

So let’s see how the company performs in our stock screener. Viatris’ price is $14.07 per share and analysts are estimating $3.53 per share. The company’s annual dividend is now $.44 per share after the dividend increase.

- Price to Earnings Ratio: 3.98X (Yes, that is very cheap compared to the market)

- Dividend Payout Ratio: 12.5%

- Dividend Growth History: N/A – The copmany just announced its first dividend after the spin-off. It is worth noting that Pfizer has increased its dividend every year post-financial crisis. The former combined company at least has a strong track record of increasing its dividend.

Summary

There we have it. Three great, undervalued dividend growth stocks on my watch list. Interestingly, each of the company’s are currently represented in my portfolio or my wife’s dividend stock portfolio. It is nice to add to positions that you own sometimes, rather than establishing new positions! Now, lets see if Mr. Market can help push these prices down further and make these dividend stock no brainer purchases for our portfolio.

Let me know your thoughts about the companies on my watch list? Are you also watching, or buying, the dividend stocks on our list? Looking forward to your comments and feedback!

Bert

Definitely want to buy some more SJM in the future. I was glad to see their 10% dividend increase earlier this month. Thanks for the post Bert! 🙂

LEG looks interesting to me as well for a bit of a higher yield. And wow Viatris is cheap. I haven’t really checked them out and sold off my shares when they were spun off to me, but it definitely looks intriguing. At that cheap of a valuation it’s potentially a takeover target as well.

I noticed Citigroup dividend yield and started a position earlier this week. SJM I’m already heavy in but might look to add more. COVID life has increased our peanut butter consumption and nothing beats Smucker’s simple ingredients of salt and peanuts! Go buy some!! 🙂

nice list there

Smuckers really came through with that 10% raise. That pfizer spinoff really does seem dirt cheap, gotta look more into that.

look forward to seeing which you decide

cheers guys

Love the picks, especially SJM and VTRS! SJM really surprised me with that 10% dividend increase. I’ll certainly take it after the small raises in 2019 and 2020, though!