We are back with another dividend stock watch list! After all, we are always on the lookout for undervalued dividend stocks to buy. Bert has identified two undervalued dividend stocks from his portfolio to add to his dividend stock watch list. In this article, he will run each of the two companies through the Dividend Stock Screener and let you know if he will be buying one, both or neither!

Earnings season is wrapping up. With it are the crazy surprises from companies, the Fed, and analysts that are looking for some optimism to cling on to. As a result, the market has performed better in 2023 than 2022. Frustratingly, finding an undervalued dividend stock to buy, and add to our dividend stock watch lists, has not been the easiest feat this year. Still though, this feat is not impossible. That is why Bert found two companies to run through our stock screener. First though, lets tell you about our stock screener in greater detail .

Dividend Diplomat Stock Screener

To find and analyze undervalued dividend stocks, we use 3 SIMPLE metrics to evaluate every dividend stock. The goal of our stock screener is to identify if a stock is an undervalued dividend growth stock to buy.

Watch: Our Simple, 3 Step Stock Screener

Here is a rundown of the 3 metrics of our stock screener:

1.) Price to Earnings Ratio Less than the S&P 500. Currently, the S&P 500 is trading at a P/E Ratio of 21.86X.

2.) Dividend Payout Ratio Less than 60% (Although we think a perfect payout ratio is 40% – 60%). The payout ratio measures the safety of the dividend. This ensures the company can continue growing its dividend during good times and bad. That’s why it is a critical metric in our stock screener that we must evaluate!

Read: Dividend Aristocrats with a PERFECT Dividend Payout Ratio

3.) History of Increasing Dividends. We review this metric by reviewing the company’s five-year average dividend growth rate and consecutive annual dividend increases. Since we are long term investors, it is important that a company increases its dividend consistently!

Bonus: Dividend Yield. We like to also throw in a bonus metric to our dividend stock analysis. Yield does not drive our decision; however, we would be lying if we said we completely ignore dividend yield.

See the video below, for further details and explanation. If you don’t like to watch videos – see our Dividend Diplomat Stock Screener page!

Dividend Stock #1: Pfizer (PFE)

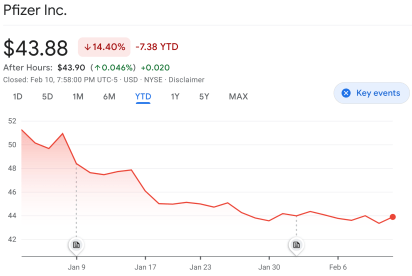

2023 has not been kind to Pfizer. Pfizer’s stock price is down over 14% year to date. Luckily for me, that is now part of the reason why this company is soaring to the top of my dividend stock watch list.

After the Viatris spin-off, Pfizer has solely focused on the biopharmaceutical business. Gone are the days of the company having the top, name brand drugs found in stores like CVS, Walgreens, etc. Now, the company just develops powerhouse brands that are huge names in doctor’s offices and hospitals.

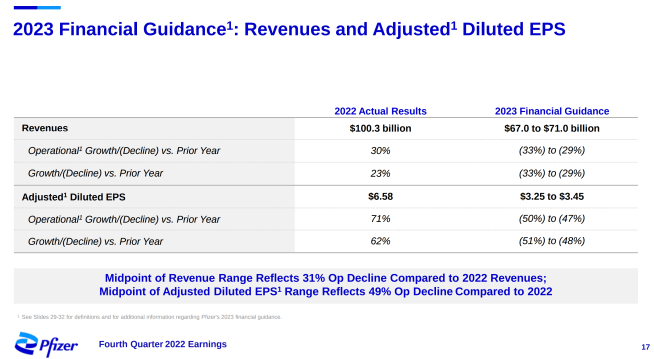

The company released earnings at the end of January 2023. Despite the fact that the company crossed $100B in revenue for the FIRST TIME EVER, the other news is what drove the company’s stock price down. Specifically, the company’s 2023 guidance caused the stock price to tank. Why? Pfizer benefited significantly from the COVID boosters. Their drug, Paxlovid, accounted for $18.9B in sales in 2022. Those sales totals will not hold in 2023. Instead, Pfizer is expecting Paxlovid sales, along with other COVID related sales and boosters, to decrease significantly in 2023.

The following chart shows how much lower 2023 guidance is compared to the record setting 2022 performance. Still, even with the lowered guidance, the company may be showing signs of undervaluation. That is why we are going to run Pfizer through our Dividend Stock Screener.

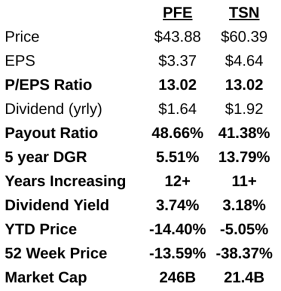

Pfizer’s stock price is $43.88 per share at the time of this article. The company’s forward EPS is $3.37 per share and the annual dividend is $1.64 per share. Let’s see how the metrics shake out.

1.) Price to Earnings Ratio: 13.02x.

2.) Dividend Payout Ratio: 48.66%.

3.) History of Increasing Dividends: Pfizer’s 5 Year DGR is 5.51% and the company has increased its dividend for 12+ consecutive years. Almost halfway to becoming a Dividend Aristocrat.

4.) Dividend Yield: 3.74%

Dividend Stock #2: Tyson Foods (TSN)

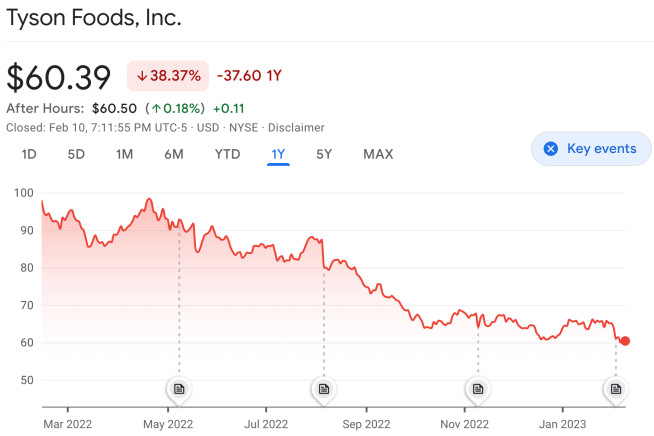

Unlike Pfizer, Tyson Foods hasn’t had the worst 2023. So far, the company is only down 5%. Rather, the damage was done to Tyson’s stock price in 2022. Over the last 52 weeks, Tyson is down 38%!

Tyson Foods is getting hammered by rising costs and softening demand. Unfortunately, the latter is a direct result of rising costs. Unfortunately though, if the cost of beef rises too high, consumers will look elsewhere or substitute the product. Especially consumers that have a tightening budget themselves.

With these trends in place, the company’s stock price has taken a beating so far over the last 52 weeks. When we run Tyson through our stock screener, I’m going to keep a close eye on the payout ratio. If there is earnings compression, I will definitely want to make sure Tyson’s dividend is safe. No, lets run TSN through our Dividend Stock Screener.

Tyson’s stock price is $60.39 per share at the time of this article. The company’s forward EPS is $4.64 per share and the annual dividend is $1.92 per share. Let’s see how the metrics shake out.

1.) Price to Earnings Ratio: 13.02x.

2.) Dividend Payout Ratio: 41.38%.

3.) History of Increasing Dividends: Tyson’s 5 Year DGR is 13.79% and the company has increased its dividend for 11+ consecutive years.

4.) Dividend Yield: 3.18%

Conclusion

Both companies performed very well in our stock screener. Quite frankly, both passed all three metrics with flying colors, as you can see in the summary chart below.

What am I going to do? Well, as I discussed in our latest YouTube Video, I’m going to buy shares in both companies this upcoming week. At least 3 shares of Tyson and 4 of Pfizer. Most likely, we will continue this over the next few weeks as we look to build our positions in both stocks!

What do you think of Pfizer (PFE) and Tyson (TSN)? Are you adding them to your dividend stock watch lists? If not, what other two companies are you watching instead?

Bert

Bert,

Nice watch list. Coincidentally, I just added to my position in PFE earlier this week!