2022 continues to fly by. So much so that it has taken a little extra time for me to prepare my monthly dividend income summary. June is the last month of a quarter. Therefore, the dividend income we received is always off the charts due to mutual fund and ETF payments. Our June dividend income is exciting and hopefully, shows some solid growth. Let’s dive into the detailed report!

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income. One day, my dividend income will be large enough to cover my monthly expenses. That is why we are relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We save a high percentage of our income each month, to help fuel our dividend stock portfolio. Having a high savings rate is a key pillar of our strategy and helps fuel the fire and push the snowball further down hill. While we are waiting to invest our money in the market, it is earning a high interest rate in accounts such as Yotta (1% – 2% APY, on average, with their weekly cash prises) or SoFi (1.8% APY on all checking and savings accounts. Yes, you read that right!). If you are looking to earn more on your cash, it is definitely worth checking those products out!

Read: Interest Rates on High Yield Savings Accounts Are SOARING!

We use our dividend stock screener with every stock purchase. Our stock screener continues to help us find undervalued dividend stocks to buy. This simple, 3 step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Watch: Dividend Diplomats’ Dividend Stock Screener

Building a large dividend income stream takes time, consistency, hard work, saving, and most importantly, investing. I have been investing in dividend growth stocks since 2012. Saving a high percentage of my dividend income allows me to invest as much as possible, so we can retire as soon as possible.

Slowly, but steadily, my income has grown. Brick by brick. DRIP by DRIP. It is really exciting to see the growth and larger dividend checks trickle into my brokerage account.

Each month, we share our dividend income summaries to highlight our growth and progress. It is a fun and helpful excercise that holds us accountable. Further, it helps you, our followers, see the stocks we are purchasing.

Bert’s June Dividend Income Summary

Now, this month, the rest of this article is going to look different. I’ll be experimenting with different charts and ways of presenting the information. Would love everyone’s feedback to gather their thoughts!

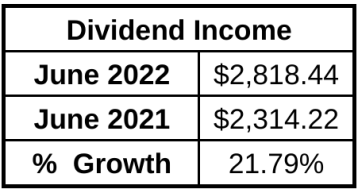

We received $2,818.44 in May dividend income! This was a 21.79% year over year increase. Another month of a strong, double digit percent dividend growth. I’m pretty pumped up to be closing in on $3,000 in dividend income in a non-December month as well!

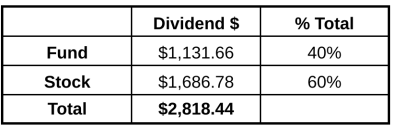

Now, I mentioned that the dividend income for this month is higher due to the receipt of dividends from our various ETFs and mutual funds. However, I’ve never easily shown what percent of dividend income was received from funds versus individual dividend stocks.

In total, as you can see in the following table, individual dividend growth stocks paid us $1,686.78. This represented 60% of the total dividend income received! ETFs and mutual funds accounted for 40% of our total dividend income for the month.

Transparently, these amounts are very encouraging to see. Albeit, it was a little shocking. In a month like June, I love the fact that dividend stocks covered 60% of our total dividend income. That means that all of this hard work and individual stock purchases are starting to add up. The majority of the ETFs and mutual funds are held in our retirement accounts. Accessing these funds, especially when we retire early, will not be as easy as the individual stocks held in our brokerage accounts. I’d love to see this number grow to 65% and 70% in the near term as well.

June 2022 Individual Dividend Stock Payments

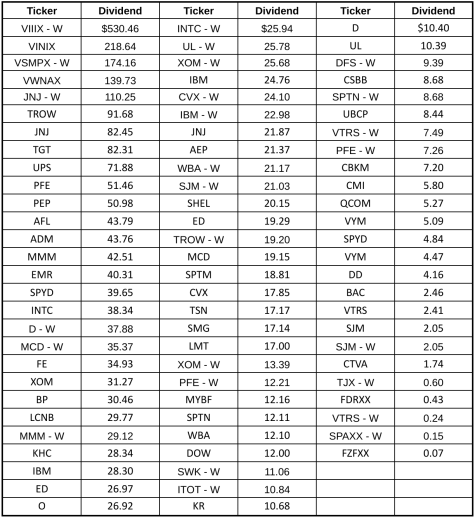

Now that we looked at the total dividend stocks paid in a given month, let’s see our favorite chart. The following chart will show the individual dividend stock payments received during the month.

Look what is the first thing that jumps off the page. As you all know, my wife and I have been buying 1 share of Johnson & Johnson (JNJ) EVERY SINGLE WEEK. Now, through dividend purchases, dividend increases, and reinvestment, my wife and I are closing in on receiving nearly $200 per quarter from the healthcare giant.

In addition, our combined position in TROW price is producing over $100 per quarter. That is a huge benefit of the large position I established several years ago and the recent TROW purchases we made in my wife’s portfolio.

Summary

It just makes me smile seeing so many great dividend growth stocks on this list. Visualizing our dividend income really helps motivate me to continue buying and building our positions. Especially those positions on the right side of the chart! I should really continue attacking those positions to build our income, increase our income and future dividend reinvestment.

The goal is to keep pushing ourselves and investing every dollar possible. Let’s keep rolling up our sleeves and doing what we need to do to reach financial freedom.

How was your month of June? Did you have a strong month? What were you largest dividends received during the month?

Bert

That is a nice JNJ payout for sure! Great job closing in on $3K, keep it up! I almost hit $2K in June. 🙂

Thanks MDD! We’re getting closer, right?! Time for all of us to keep pushing.

Bert,

Wow that’s a very nice increase year over year! Definitely nice to see the hard work paying off.

The Dividend SWAN

Thanks SWAN! Very much appreciated.

Bert

Bert,

Congrats to you and your wife on clearing over $2,800 in dividend income last month. Keep it up!

Thank you very much Kody! Lets keep pushing

Great job Bert! Over $2.800 is huge. It might seem like it’s slow at times, but being consistent with investing really starts to pay off once you reach that point where compounding can really take hold. Our main account is on track to give us just shy of $900 per month of dividends on average which is really exciting. Can’t wait to get that up to the $1k mark though.

JC – You’re absolutely right. Slow and steady wins the race, especially once we need to get that snowball rolling. You’re so close there, on the verge of crossing it.

Congrats you can definitely see those results start to come in. That snowball is gaining steam. Keep it growing.

Thanks Doug!

Hey, Bert! You are throwing me off with this late report. 🙂 I can see why it might take so long though… look at all those dividend payers. Three columns worth… Nice!

Impressive YoY growth, too. Any time you crack 20% you know you are working hard to grow that portfolio.

Keep doing your thing… $3K is around the corner.