Another fascinating month of dividend investing is in the books. 2022 is proving to be a crazy year for the S&P 500 and the economy. Interest rates and inflation are rapidly rising while the housing market and S&P 500 are cooling off. It continues to remind me about the importance of building a strong, growing passive income stream. This article is one my favorite articles because it helps show the results of our hard work, and holds me accountable to keep pushing and growing our income stream. Don’t miss my May dividend income summary!

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income. One day, my dividend income will be large enough to cover my monthly expenses. That is why we are relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We save a high percentage of our income each month, to help fuel our dividend stock portfolio. Having a high savings rate is a key pillar of our strategy and helps fuel the fire and push the snowball further down hill. While we are waiting to invest our money in the market, it is earning a high interest rate in accounts such as Yotta (1% – 2% APY, on average) or SoFi (1.25% APY on all checking and savings accounts). If you are looking to earn more on your cash, it is definitely worth checking those products out!

Read: Interest Rates on High Yield Savings Accounts Are SOARING!

We use our dividend stock screener with every stock purchase. Our stock screener continues to help us find undervalued dividend stocks to buy. This simple, 3 step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Watch: Dividend Diplomats’ Dividend Stock Screener

Building a large dividend income stream takes time, consistency, hard work, saving, and most importantly, investing. I have been investing in dividend growth stocks since 2012. Saving a high percentage of my dividend income allows me to invest as much as possible, so we can retire as soon as possible.

Slowly, but steadily, my income has grown. Brick by brick. DRIP by DRIP. It is really exciting to see the growth and larger dividend checks trickle into my brokerage account.

Each month, we share our dividend income summaries to highlight our growth and progress. It is a fun and helpful excercise that holds us accountable. Further, it helps you, our followers, see the stocks we are purchasing.

May Dividend Income Summary

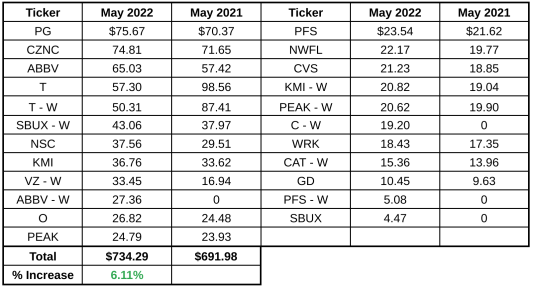

We received $734.29 in May dividend income! This was a 6.11% year over year increase. Another month of a solid percent increase, despite some significant headwinds (discussed below). The following chart summarizes each individual dividend payment we received during the month.

I always like to include a few observations in the remainder of the section about our dividend income, growth, and any trends worth highlighting!

Observation #1: AT&T’s Dividend Cut Finally Sets In

We’ve covered AT&T relentlessly on our website and YouTube Channel. Last year, it was announced that AT&T would spin-off WarnerMedia, and WarnerMedia would subsequently merge with Discovery. Now, we own shares in both AT&T and WarnerMedia Discovery.

The most heatbreaking part of the transaction was that AT&T announced that the company would cut its dividend post split. The news that AT&T shareholders feared was finally a reality.

May 2022 was the first quarter of AT&T’s reduced dividend. Overall, the impact on my forward dividend income was brutal. The cut reduced our May dividend income by $78.36 compared to last year. That’s a lot of freaking money that disappeared. While it was the right term in the long run for the company (as it will allow T to clean up its balance sheet), that is a tough pill to swallow in the short term. Luckily, we were able to more than offset this decrease with new investments.

Observation #2: New Positions Kicked Some Butt This Quarter

Thank goodness for dividend from new positions. We continued to build up two solid positions in my wife’s portfolio. New dividends received from AbbVie, Citigroup, and Provident Financial added $49 to our forward dividend income. Oh yeah, let’s not forget about the extra $4.47 we received from my new Starbucks position.

This is why it is so critical to conitnue investing and building your passive income. We were able to overcome the AT&T setback because we are continuously looking forward.

There is still work to be done. We will continue to buy Citi at these rock bottom prices (See YouTube Video below discussing why), along with building our Provident Financial position!

The Impact of Dividend Increases

We love dividend increases. We can’t say it enough (want proof, we talk about them ALL THE TIME on our Twitter feed). Who doesn’t love the feeling of seeing your dividend income grow without lifting a finger? That’s part of the reason why we think dividend investing is the best, and easiest, form of dividend income. That’s why we are always writing about dividend increases and recording videos about the recent dividend increases announced!

Watch: YouTube Playlist – Recent Dividend News

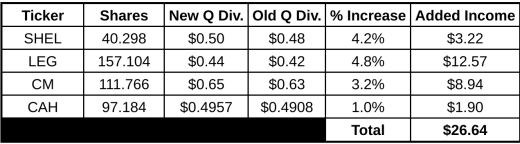

Each month, in our dividend income summaries, we demonstrate the impact each dividend increase has on our forward dividend income. The following chart discusses the impact of the May dividend increases we received.

Not a terrible month. The increases weren’t large. In fact, all four dividend increases received were less than 5%. However, the overall dollar impact of $26.64 of new forward dividend income is pretty solid. I can’t complain too much, right?!

Summary – May Dividend Income

Another solid month. Over $700 in dividend income received plus four solid dividend increases?! What is not to love? In all seriousness, this is why we love dividend investing. The results speak for themselves. All of these benefits were received without lifting a finger. I’m looking forward to the day where my wife and I receive $1,000 in forward dividend in every month during the year. We still have some work to do; however, this month was another step closer to reaching that goal.

Did you have a strong month of May? How much dividend income did you receive? What dividend increases impacted your forward dividend income?

Bert

Congrats on another great month Bert! The T cut slashed my dividends in May as well. At least you came out ahead with a 6.11% YOY growth. Good job! 🙂

hank you very much MDD! I’m assuming EVERY blogger is in the same AT&T boat right now.

Still managing solid year over year growth. That’s great especially during these shaky financial times. Love seeing ABBV paying us both and like you I’m still figuring out how to bump up T’s passive income after that wonderful spin off “cut.” For me, I’m looking to bulk up on my VZ and SBUX. Thanks for sharing.

Thanks Keith. That’s exactly why we buy stocks that have grown their dividends through good times and bad. Those are both excellent stocks and I don’t think you can go wrong.

Hey Bert!. Congrats on over $734 in dividend income this month. The 6%+ growth was nice considering the reduction from T. A handful of raises is always good, too. Your wife’s new stock positions added a good pop to this month’s income, but let’s not forget about your SBUX either. SBUX is a position I added to in the past quarter.

Thanks ED!! My wife has been crushing it and I’m pretty pumped that her income has been growing like this. SBUX will be a stock that we look at 10 years from now and thank ourselves for taking action TODAY to buy.

Bert,

Congrats to you and your wife on surpassing $700 in dividend income last month. Keep it up!