November produced some very strong dividend income results for family. We joined the four digit club in an off month! In this article, we will detail our November dividend income summary in detail and show just how much dividend income we received this year!

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income with dividend income. One day, my dividend income will be large enough to cover my monthly expenses and allow us to retire early. That is why we are always relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We save a high percentage of our income each month, to help fuel our dividend stock portfolio. Having a high savings rate is a key pillar of our strategy and helps fuel the fire and push the snowball further down hill. While we are waiting to invest our money in the market, it is earning a high interest rate in accounts. There is NOTHING more critical than maximizing EVERY DOLLAR in your savings account.

READ: How To Maximize Your Cash – 4 Simple Methods!

The 3 primary savings accounts I use are:

- SoFi – 4.6% APY on all savings accounts (lower for your checking account). The race for deposits is INTENSE! Banks and credit unions are offering great savings rates.

- Capital One 360 Savings – 4.35% APY – We use Capital One for our checking and savings account.

- Weathfront – 5.0% without promotion. 5.5% with an extra .5% by signing up using my referral link (Click Here).

Read: Interest Rates on High Yield Savings Accounts Are SOARING!

How Do We Find Dividend STocks to Buy?

That’s easy. We use our dividend stock screener with every stock purchase! This simple, 3 step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Watch: Dividend Diplomats’ Dividend Stock Screener

The three metrics of our screener are:

- Price to Earnings Ratio less than the S&P 500

- Payout Ratio less than 60%

- History of Increasing Dividends

- Dividend Yield (BONUS)

We use this stock screener for each purchase and have consistently done so for 10+ years on our journey to financial freedom!

Bert’s November Dividend Income Summary

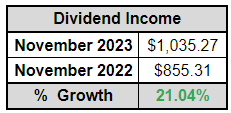

We received $1,035.27 in November dividend income. This was a 21% dividend increase compared to November 2022.

A 21% dividend growth rate is not too shabby! I can’t complain about it, especially after a tough year of dividend growth for many of the stocks in my portfolio.

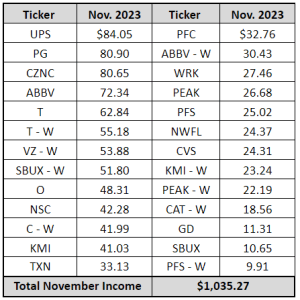

The following chart details each individual dividend payment my wife and I received. In total, we received 26 individual payments.

As always, we share a few observations about our September Dividend Income totals.

Observation #1: Another $1,000+ Dividend Month

While I didn’t post an October dividend income summary on our website (I know, I know – I dropped the ball), we were happy to clear the $1,000 last month. Then, to add to it, we were even more excited when we cleared it again in November!

This means that in both “Off Months” for dividend income, we finally pushed into the 4 digit club. The first two months of the quarter are difficult to increase your income due to the fact that so many more companies and ETFs pay dividends in the third month of the quarter.

Finally, after many years of trying, we crossed this mark in the two off months of the 4th quarter. We are pretty freaking stoked!

Observation #2: Realty Income’s Dividend Was Awesome

I’m very happy that I loaded up on Realty Income when the stock was trading in the low $50s and high $40s. The stock price for Realty Income has taken off lately due to the expectations that the Fed will cut rates in 2024. REITs have a lot of debt on their balance sheet due to the real estate acquisitions. Hence, if there is one sector that is set to benefit from lower rates, it is this one!

At the start of 2023, I was only receiving between $23 – $25 per month from Realty Income. In November, we received a $48 dollar dividend from the monthly dividend paying company. Now, we are DRIPing just under 1 share per month due to the heavy capital infusion in the position during the year.

If there was one position I am happy I was aggressive in building during the year…it was Realty Income!

November Dividend Income Summary

All in all, it was a great month. Earning over $1,000 in dividend income with a 21% year over year growth rate is phenomenal. We have been investing for over a decade and it feels awesome to finally see the strong, consistent results that I once dreamed about actually happening.

In 2024, we need to keep pushing harder. What I have learned is that when you see a stock you love at a great price, don’t over think the situation, just build the position. If you invest in the long run, you will never remember your entry price from over 20 years ago. You’ll just be happy that your past self made the decision to invest and grow your income stream!

How much dividend income did you receive in November? Did you cross $1,000? What is one of your main goals for investing in 2024?

Bert