This was a record setting September for our family. My wife and I crossed a BIG dividend income threshold, as we rounded out the third quarter. In the following article, we will share our September dividend income and review our major portfolio changes during the Q3 2022!

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income. One day, my dividend income will be large enough to cover my monthly expenses and allow us to retire early. That is why we are relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We save a high percentage of our income each month, to help fuel our dividend stock portfolio. Having a high savings rate is a key pillar of our strategy and helps fuel the fire and push the snowball further down hill. While we are waiting to invest our money in the market, it is earning a high interest rate in accounts. The two primary savings accounts I use are:

Read: Interest Rates on High Yield Savings Accounts Are SOARING!

How do we find undervalued dividend stocks to buy? That’s easy. We use our dividend stock screener with every stock purchase! This simple, 3 step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Watch: Dividend Diplomats’ Dividend Stock Screener

Building a large dividend income stream takes time, consistency, hard work, saving, and most importantly, investing. I have been investing in dividend growth stocks since 2012. Saving a high percentage of my dividend income allows me to invest as much as possible, so we can retire as soon as possible.

Slowly, but steadily, my income has grown. Brick by brick. DRIP by DRIP. It is really exciting to see the growth and larger dividend checks trickle into my brokerage account.

Each month, we share our dividend income summaries to highlight our growth and progress. It is a fun and helpful exercise that holds us accountable. Further, it helps you, our followers, see the stocks we are purchasing.

Bert’s September Dividend Income Summary

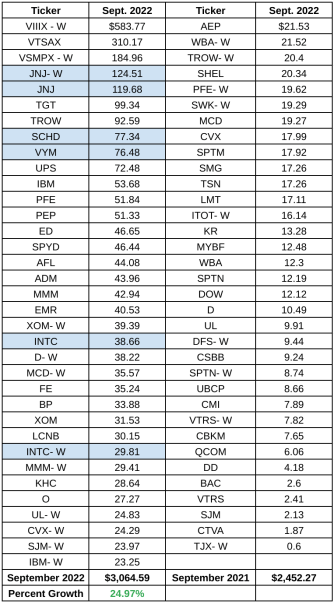

We received $3,064.59 in September dividend income! This was a 24.97% INCREASE compared to September 2021. This was a BIG month for us and a very strong dividend increase. It was a blast to put the following chart together detailing each individual dividend payment received in September. The stocks and funds highlighted in blue will have an observation written about them below the chart!

Here are a few observations about our $3,000+ September dividend income month!

Observation #1: The Impact of our 401k Rollover was immediate

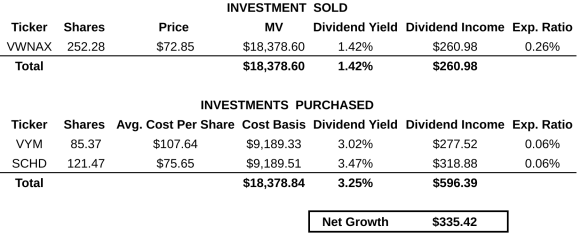

Last month, we produced a YouTube video detailing part of my 401(k) rollover from Vanguard to Fidelity. With the Rollover, I took the funds invested in VWNAX (1.4% dividend yield) and split the investments evenly into VYM and SCHD. Both were yielding over 3% at the time! The move immediately added $335 to our forward income!

One of the benefits of the transaction is the frequency in which we will now receive dividend payments. VWNAX was a semi-annual dividend paying mutual fund. We received a small payout in June and a large payout in December.

VYM and SCHD, on the other hand, pay quarterly dividends. The transaction was completed before the September ex-dividend date for the two funds. Therefore, we received the September dividend.

In September, we received a $77 dividend from SCHD and a $65 dividend from VYM (we have a few shares of VYM in another account, which is why our total VYM dividend is higher in the table above). It was very exciting to receive $142 from these two funds in September and to start realizing the fruits of the move immediately!

Observation #2: Our Johnson & Johnson (JNJ) Dividend Is Getting LARGE

Now this is starting to get fun. My wife and I have been buying 1 share each EVERY WEEK of Johnson & Johnson. We will continue to buy shares of this Top 5 Foundation Dividend Stock until our taxable portfolio positions reach 100 shares each. As of September 30th, we each have 93 shares of the healthcare giant. By the end of November, our positions should be filled.

Why is this getting fun? Well, look at the dividends received from Johnson & Johnson this month. We are both receiving over $100 EACH every quarter. Heck, at the current share price, we are receiving nearly .75 shares of JNJ.

I can’t wait to finalize our next weekly purchase plan and put that plan into action once we hit 100 shares of JNJ. Here are the 3 current options I’m considering.

Observation #3: Intel’s DRIP is WILD

Intel has been on a wild ride on 2022. The stock price is down over 50% over the first 9 months. The stock price is now trading below $26 and was featured on our YouTube channel recently as a dividend stock that is TOO CHEAP to ignore.

At the company’s current share prices, my wife and I each received over 1 share of Intel via dividend reinvestment during the month. Anytime you receive 1 share without lifting a finger, it is worth calling out. Especially with a company like Intel. It is crazy just how much the share price has fallen during the year.

Bert’s September Portfolio Update

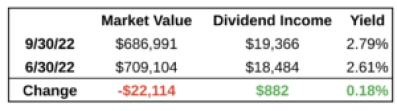

At the end of each quarter, I’ll provide a snap shot of our family’s portfolio total market value and dividend income to see the growth.

Not surprisingly, our portfolio’s market value declined in the third quarter and our portfolio’s average yield increased as a result. Our market value decreased 3.1% and our portfolio’s yield increased .18%. It was actually less than the S&P 500, however, due to the fact that we continued to invest new dollars into the market during the period.

The big leap for our portfolio was in dividend income. Our dividend income grew $882 over the last 3 months. The increase was due predominately to our 401k rollover and reinvestment into higher funds. In addition, we did also sell my wife’s Delta position ($0 of dividend income) and purchased LyondellBasel (6%+ dividend Yield) with the proceeds. That also created significant dividend income. This was a huge amount of dividend income to collect. Now, my wife and I are closing in on $20,000 dividend income across our entire portfolio!

Summary – September Dividend Income

Our house is all smiles after receiving $3,000 of September dividend income. Results like these help motivate us to continue pushing ourselves to invest more and continue growing our dividend income. This journey to financial freedom is a marathon, not a sprint. That’s why its important to celebrate the milestones when they come in and to use each milestone as motivation to hit the next one. By next September, I’d love to see this number increase to $4,000 in dividend income! How cool would that be?!

How did you perform this September? What was your September dividend income total? Did you see strong growth compared to last year?

Bert

Oh man oh man! Congrats on break the $3K mark Bert! Way to go! I recently bought more JNJ and INTC was to cheap to ignore so I bought more of that too. Lot’s of stocks trading at a discount which means more dividend income up for grabs! Keep up the great work Bert!

Congrats on that super strong month. We all love those end of quarters for the big payouts but your Sept. was just waaay up there. One observation…. I know that anything with the word crypto is taboo these days after the BTC fall and everything else, but have you considered putting a small amount of USD into a stable coin instead of those savings accounts you mention. Specifically, GUSD from Gemini. Just a thought. It has a yield over 7% and it compounds daily and is redeemable any time you want. No lock up. Try it with a couple hundred just to test out, or less even to get a feel. Just my two cents.

It had a yielf over 7%. Rates change ;(

Bert,

Congrats to you and your wife on exceeding $3,000 in dividend income last month. Keep pushing!

Great job this month, Bert!

Great job Bert! It’s awesome to see you guys cross $3k. The market decline this year sure has brought about a lot better opportunities.