2022 continues to present great buying opportunities. Today’s article will feature one of the two major delivery companies. Look out your window and chances are, you’ll see one of Fedex’s trucks driving by. Heck, they may run up to your porch and deliver you a package. Here is the question…will Fedex be delivering you dividends for year’s to come? Let’s jump right in and review Fedex to determine if it is an undervalued dividned stock to buy and we are buying the dip!

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income. One day, my dividend income will be large enough to cover my monthly expenses. That is why we are relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We save a high percentage of our income each month, to help fuel our dividend stock portfolio. Having a high savings rate is a key pillar of our strategy and helps fuel the fire and push the snowball further down hill. While we are waiting to invest our money in the market, it is earning a high interest rate in accounts such as Yotta (1% – 2% APY, on average) or SoFi (Recently announced a 1% APY on all savings and a $15 bonus for signing up). If you are looking to earn more on your cash, it is definitely worth checking those products out!

Watch: Dividend Diplomats’ Dividend Stock Screener

Building a dividend income stream takes time, consistency, hard work, saving, and most importantly, investing. I have been investing in dividend growth stocks since 2012. Saving a high percentage of my dividend income allows me to invest as much as possible, so we can retire as soon as possible.

Slowly, but steadily, my income has grown. Brick by brick. DRIP by DRIP. It is really exciting to see the growth and larger dividend checks trickle into my brokerage account.

That’s why we are always looking for undervalued stocks to buy using our stock screener. When a company like Fedex falls, we have to take a look, right? Let’s see what is causing Fedex’s stock price to fall prior to running the company through our stock screener.

Why is Fedex’s Price Falling?

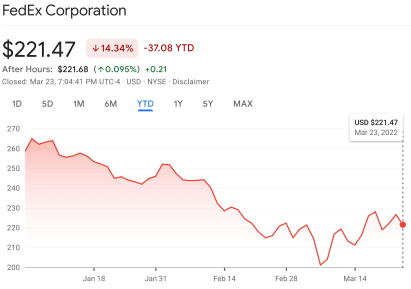

Fedex is down over 14% year to date. This is more than double the decrease of the S&P 500, which is down 7% year to date. The shipping and delivery sector thrived during the pandemic. So what is causing the company’s stock price to fall?

The company’s recent earnings release included some positive news that was unfortunately, overshadowed by the update in guidance. Quarterly revenue was $23.6 billion, a 10% increase compared to the same quarter the previous year. Net income was $1.1 billion over the last 3 months, a 25% increase compared to the same period last year. The company realized strong top and bottom line growth during the period.

There was some bad news though. Results were dampened by the Omicron variant due to a decline in consumer spending. On top of it, inflation and the rising cost of gas flexed its muscle. Unfortunately, management stated that the headwinds weren’t isolated to this quarter. Rather, increased costs are going to impact the company’s results over the next several quarters.

After the earnings release in March, the company’s stock price held in line with the price over the last few weeks. Turns out, the negative news was already build into the company’s stock price before earnings.

Dividend Diplomats Dividend Stock Screener

Time to run through the Dividend Diplomats Dividend Stock Screener. We use 3 SIMPLE metrics to evaluate every dividend stock. The goal of our stock screener is to identify if a stock is an undervalued dividend growth stock to buy.

Watch: Our Simple, 3 Step Stock Screener

Here is a rundown of the 3 metrics of our stock screener:

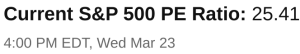

1.) Price to Earnings Ratio Less than the S&P 500. Currently, the S&P 500 is trading at a P/E Ratio of 24.67X. Last year, the S&P 500 was trading at a multiple of 35x – 40x, which is insanely high! Historically, on the other hand, forward earnings are between 20X and 25X.

2.) Dividend Payout Ratio Less than 60% (Although we think a perfect payout ratio is 40% – 60%). The payout ratio measures the safety of the dividend. This ensures the company can continue growing its dividend during good times and bad. That’s why it is a critical metric in our stock screener that we must evaluate!

Read: Dividend Aristocrats with a PERFECT Dividend Payout Ratio

3.) History of Increasing Dividends. We review this metric by reviewing the company’s five-year average dividend growth rate and consecutive annual dividend increases. Since we are long term investors, it is important that a company increases its dividend consistently!

Bonus: Dividend Yield. We like to also throw in a bonus metric to our dividend stock analysis. Yield does not drive our decision; however, we would be lying if we said we completely ignore dividend yield.

How Does Fedex (FDX) Perform in Our Stock Screener?

For this analysis, we will use Intel’s stock price $221.47 (March 23, 2022 close). Analysts are projecting forward EPS of $20.59 per share. The company’s annual dividend is $3.00 per share. Now that we have the inputs for our analysis, let’s dive into the results.

1.) Price to Earnings Ratio: 10.7x. The stock is trading at less than half the valuation of the S&P 500. Check!

2.) Dividend Payout Ratio: 14.5%. Very, very low payout ratio.

3.) History of Increasing Dividends: Fedex has only increased its dividend for one consecutive year. The company did not increase its dividend between 2018 and 2021. In June 2022, we are expecting Fedex to increase its dividend for the second consecutive year. Still, despite that, the company’s five-year average dividend growth rate is 14.08%.

4.) Dividend Yield: 1.35%. Right in line with the S&P 500!

Summary

Right now, I’m going to watch Fedex. The company’s trading at a discount compared to the market, and its peer, UPS. The company continues to show strong revenue and earnings. We will see the true impact of the rising cost of fuel in the next quarterly earings release. After all, oil crossing $100 per barrel has to have an impact on the company’s costs and revenue (as it becomes more expensive to ship). I do wish the dividend yield was higher though. Yield isn’t the end all be all. However, a yield in line in the market isn’t what I like to see, especially when the company has plenty of room to grow its dividend going forward. If the price does slide further though, I’ll be inclined to initiate a position!

What are your thoguhts about Fedex? Are you buying or watching? If you are passing, what companies are you watching instead?

Bert

That’s a lot to spend for the dividend payment. I’d look to companies like ABBV for a better deal.

Nice post. FDX is a stock I’d definitely like to own. FDX looks reasonably priced right now compared to the broader market, but elevated fuel costs could certainly drag the stock down further. I’ll wait on the sidelines for now as well.