All, I’ve been very intense lately talking to friends, peers and co-workers about dividend investing. Not purely because of this, but I come home from work in a haste, not happy and very mentally drained. Even writing articles, which I love to do, ends up being very difficult and even connecting with loves ones results in stress. It would be one thing if I was drained from doing something I love so much that it wears me out, but that is not the case. I’m exhausted in a prison-like manner and that is why I am even more energized at the same time to continue my build up of forward dividend income.

THe 7-6 Day that needs to go

What? Not the 9-5 job? I wish. When you are a CPA, typically, your days are longer and the stress is higher (for no real reason, trust me). Funny thing, I have fought to MAKE my days shorter and somehow, I must be very bad at it. Here is a brief background on my typical day if I am in the office and it is non-busy season (i.e. April – December). Further, I live only 7 miles from our downtown office, please keep that in mind. I leave my house roughly at 7:00 A.M. most days. I drive through frustrating traffic, construction on each and every corner and 30-35 minutes later, I am now “early” arriving to my office (do the math on what my average miles per hour ends up being…). So much for my imaginary idea that I could leave at 7:00 and arrive in 15-20 minutes. Already frustrated, I pour myself one glass of water and a cup of awful coffee from our office machine. Its the ” it turns green after it sits for a few hours” type of awful. My day is starting off as a real winner, let me tell you. Now, I choose to arrive early to “avoid” even worse rush hour that occurs after 7:30 a.m. and to gain a “head start” before being asked questions by 15-20 people at our company, not including the 15-20 different personnel from clients that I service (funny, right?). Don’t get me wrong, I love helping and socializing with people, but wow, whatever agenda I had is probably sitting under an orange cone (cough, construction joke, cough) on my way into this wretched place.

After answering the questions from everyone in the morning, I am able to eat my sandwich at my desk and work on my items during lunch. Remember that powerful lunch hour I talked about? Yes, occasionally I choose to work through my lunch to work on areas I needed or wanted to get through (though sometimes I do personal things for the blog, investments, etc.). How lucky am I? I am now able to work through these tasks that I felt were important, even though we all know this (for the most part) brings very minimal joy to our lives, except reduces the stress that we’ve placed on these matters and/or have let others have influence on our stress levels with mostly internally “fluff” deadlines (clients, partners, other managers, you know the drill). Ah, yes, just how lucky could one employee be at this accounting firm to work on these prized tasks.

Around 1:00 PM it is time to grab another cup of the joyous discolored pouch of coffee that, oddly enough, can stay “fresh” in packets that have been in a drawer for years. You know the Keurig? Picture a machine that someone made in their backyard after mowing grass, to have the machine perform the same tactics as the Keurig (which could be where the discoloration comes from), with a very “harmonious” yet screeching sound. Now THAT is the machine we have in our office. I do try to make my own coffee every morning, but then that actually takes away from enjoying what a “good” coffee tastes like. Heck, this coffee makes the Maxwell House blend taste like fresh espresso grounds from an organic crop in Italy at this point. I digress… (plus my mom will hate me for knocking her Maxwell House, as well as the Kraft (KHC) stock that I own)

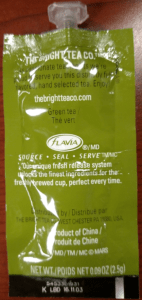

(This is a tea example that expired one year ago, which had been in the drawer for over 4 years)

(This is a tea example that expired one year ago, which had been in the drawer for over 4 years)

After going through part 1 again in the 2nd party of my day, I am caught by a few partners when I try to leave at “a decent hour”. By “decent hour”, I mean sometime after 5:00 P.M. but before 6:00 P.M., during non-peak hours. Now, if I didn’t take any breaks that day and was able to start around 7:30, this already marks 9.50 hours straight of smacking my fingers on keyboards and going through 8x too long meetings (any meeting that is longer than 15 minutes should really think about what we are meeting on). Needless to say, partners start to question, “Why are you leaving?” or make explicit questions such as, “Cutting out early now?”. Are you serious? Not only do I work, on average 70-85 hours per week for 3 months out of the year, but during non-peak when I try to have some form of sanity, but still work more than a full-day in comparison, I’m questioned? Bring on the dividends, is what my response wants to be, very badly. Or better yet – my dividends will soon answer to you bye saying “sayonara”. Here is the funny thing, that drive to work was exciting right? Guess what? I get to do the SAME THING on the way home! YES! Oh wait… doesn’t that lead to just fumigation coming from my mouth/mind when I walk into my front door? You betcha. If I’m lucky, I am home by 6:00 P.M. to cap an overall, with driving, 11 hour day. What is one of the things that keeps me going? The capability that dividend investing has on this situation, that’s for damn sure. (I also won’t say THE one thing, as I have a loving girlfriend, family and friends, but how often do I even get to see them…)

Taking back controL w/ Dividend investing

Now, for the better part of 7+ years, I have been dividend investing. Every career/job I’ve had, I’ve made a commitment to have an exorbitantly high savings rate (above 60% everyone!) in order to fuel my dividend investing portfolio. I’ve been lucky in that I make a decent wage at my employer, for constantly being stressed out (yes, self-induced primarily, as this is my current choice/decision I am making to stay here) and that the cost of living in Cleveland is far less, when compared to other cities. Dividend investing, from back then, gave me a form of income that could allow me to control my own day, my own week, my own destiny. Guys, I tell you, I am gosh-damn passionate about dividend investing, it’s not even funny! Just ask Bert and our countless drives for hours when we worked on client engagements together. Ask family members and close friends. Heck – I know my girlfriend receives the continuous update on the dividend investing portfolio (and she’s starting to make some moves herself!). You may ask – but why are you so excited about dividend investing? How can dividend investing really provide that control? I will try to break that down in a simple, but yet, methodical way.

1.) Dividend investing was very easy for me to understand, due to the business background I had. However, I will say that anyone can truly be a dividend investor and it is not hard or complicated! Getting started and making your first investment is the hard part. That is one of the reasons, however, is that it fundamentally made sense to me. If you are starting out, please read these few articles:

Welcome to the World of Dividend Investing

Power of Dividend Reinvestment

Dividend Diplomat Stock Screener

Milestones of a Dividend Investor

2.) Dividend investing provides INCOME or CASH FLOW to you as the investor. When companies continue to perform well financially, you are rewarded as a shareholder, typically, in the form of a dividend. You made an investment in THEM and they are returning that investment back to YOU. Look at my June dividend income totals, how the heck did I get so lucky to receive almost $1,500 from over 20 different companies?! I have to smack myself often when I see these figures. I know I’ve paid my dues and have worked my ass off to build this machine and it truly pays you back.

3.) Dividend Investing does take up-front research, but monitoring your dividend stock investments is not as burdensome, when compared to growth, penny or even stock options,etc.. Most companies I own have been around for 50-100+ years and have had records of growing dividends for almost as long as they’ve been around. Ever hear of Johnson & Johnson (JNJ), AT&T (T) or Consolidated Edison (ED)? These are a few names in our top foundation dividend stocks if you are starting out, but that’s because of a few things – they have VERY easy to understand businesses, they’ve been around longer than the time I’ve been alive and they’ve increased their dividends the same, consecutively. What if you could go into your day-to-day job and perform quite a bit of research up front, but then the company pays you, year, after year, because of that investment you made into them? (Some could say this is what Pension funds were for, well, those aren’t really around too much any more!) That is what dividend investing does – up front capital, research and an action to purchase, and for some companies – you can do little monitoring and the checks will keep coming your way.

4.) Dividend investments, typically also equate to dividend increases, for the most part. Most dividend investments I make into companies, increase their dividend consecutively, year after year. Now, I’ve had 3 instances where dividend cuts occurred and more instances where dividend increases did not occur. However, for the majority of my portfolio, the companies that I own shares in, continue to increase their dividend ever year. Going back to point 3 above, what if you worked at a company, where not only they paid you every pay period for work you did in the past or your investment of time in the past, but they also gave you an increase every yea because of it? Similarly, that’s what happens here with dividend investing.

5.) Therefore, each dollar that is being saved and then investing into a dividend producing stock, is now producing an income source that can begin to cover you daily/monthly expenditures. For example, when combining my taxable and retirement accounts, I have a projected monthly dividend income (as of this writing) in the amount of $755 per month! What would you be able to do or not do with that? I know I am getting closer to dropping that “7-6” lifestyle above. Dividend investing will buy you time and allow to take back CONTROL of that time! Isn’t that what we truly want? Control of your day. No more 4-10 “bosses” telling you what needs to be done or what to do (unless you love that sort of thing); or driving a pain in the ass commute in construction just to get to the office to do something you tremendously dislike.

6.) Lastly, each added income from dividend stocks (as long as expenses remain in check), helps reduce stress from work, as you become LESS dependent on the “job” that you have. Control begins to shift your way, as you know that you have a monthly income stream from dividend stocks to back you. The closer you are able to find your basic necessities & the cost of those necessities, one could aim to produce dividend income in that amount. Therefore, once you are done dealing with the BS at work, you know that your basic needs will be satisfied with dividend income. What I have found out, as well, is that you tend to do “better” at work when you don’t rely on your work income as much… it’s actually quite funny. Therefore, more control begins to shift in YOUR direction, for YOU to do what YOU want to do with your time and energy.

Why dividend investing has me more energized than ever

Why am I now more energized than ever before? My days are becoming so brutal to get through, that I am now very Black and White about what dividend investing can truly do with your time and control. I want to invest into dividend paying companies more than I can imagine each day that I come home, knowing I’ve spent the last hour in a car or dealing with unnecessary stressful situations. Why? Because I don’t want to even know that I have to do that anymore. I don’t want to answer to 45+ different people every day, that is why this is so important, today, right now.

Dividend investing truly can give you back the control that you are looking for. In some cases, it may not give you back 100% of the control when you first start, due to the steep capital requirements to have enough dividend income to fund your full lifestyle desired, but in time, it starts to revert back to your favor. However, like the wise statement says, the first best day to start was yesterday, but the next best day to start is today/now. I used to collect below the three digits in dividends when I first started, on a yearly basis. Now, I am on average of collecting almost $800 per month going forward (when my individual and retirement accounts are combined, see my portfolio). Here is the kicker – it grows faster and faster every year, the snowball is bigger and has more speed, simple as that (Power of the DRIP). In addition, it’s almost like a sport, once you start, you realize you want to keep going harder and be better with capital infusions. WE owe it to ourselves to set ourselves in the best position to impact the most lives that we can with what we truly value, and add value to others. Dividend investing is one avenue allows one to take control back to do that.

Now, the question is – are you ready to take control?

-Lanny

Love it man! Keep on grinding and you will get the control you want. Temporary sacrifice for a lifetime of paradise!!

Chris –

You are right, the sacrifices now are definitely going to shorten my time to having that control. It’s happening, I can feel it and I want it now more than ever.

-Lanny

Lanny – You have this great passion in your writing and you show the same passion in your Dividend Investing. It’s apparent that your current “9-5” (LOL) is a burden to you, and though it’s helping fuel your desire to get ahead and away, perhaps a change in firms is an option. Would a smaller firm (read less folk, better coffee, and less meetings) take some stress away? Keep up the passionate and motivating writing. – Brian

Brian –

Thank you, very, very much. It’s funny you brought up a different firm, as an option. I have always thought that if I leave public accounting, that it would be to completely leave a service profession. I haven’t given as much in-depth thought to another firm. Have you been in a similar position before? I appreciate that you can see the passion, heart and fun/love I have in writing and dividend investing. This means a great deal that you do see this. Hope to hear back Brian!

-Lanny

Lanny,

I had a job that got me reading stuff and thinking about investing – because like yours – the commute sucked, the bosses gave me a strange look if i left before 5:30, and the office was weird anyway (I am not a coffee drinker really). It pushed me to get all of the certifications they offered for free, then bouncing somewhere better, which I got into last summer (mo’ money, fewer problems).

Keep grinding. One day you will mic drop well before they anticipated and your leadership will wonder how the hell you did it.

– Gremlin

Gremlin –

I appreciate you describing what you went through, especially helps knowing I’m not the one. It sounds like you accomplished what you wanted while you were there and knew you were going to be somewhere better. I am excited to drop the mic, no doubt about it.

How is the new place? Better?

-Lanny

The new place is much better – it pays way more, less stress, yet stuff feels more interesting and more important. Its strange to work somewhere, which features an immediate team that values what you do.

You got this Lan-Man! You’re one step closer to freedom everyday.

Thanks David –

Loving your bathroom renovation and what you are doing from a side-hustle perspective down there in the middle of Ohio. Excited to hear the return on the investment and your Air-BNB endeavors. Pumped to see some posts on the cash flow optimization stand point on your end. Keep staying hungry, my friend.

-Lanny

That was a pretty depressing description of what you go through on a day to day basis. It’s good that you are keeping your eye on the prize in the form of dividends and increased passive income earned. Every dollar coming in is one less dollar you have to physically work for or put precious time in. Keep that focus strong, which I have no doubt after following you for a while, you have.

DivHut –

Ugh.. yeah, I don’t know how else to explain it. However, I am glad I am public with it. It’s my choice, at the end. No one needs to feel sorry. Just want to share the “why” I am very passionate about investing, the community here and everything. You and everyone are a great source of what drives me, and I can’t thank everyone here, for being here, essentially. Excited to keep going through this adventure and work through what I’m going through. Each day, dollar, hour has mattered. Looking forward DH, looking forward.

-Lanny

Nice post Lanny. I drive a half hr each way to work. Listen to a podcast and enjoy the “me” time. Right now i get home and have atuff to always do. The kid always wants to hangout. Walk dog etc etc learn to enjoy the drive its nice quiet time.

PCI –

Thank you for the post. 1 hour per day, for 250+ hours a year. Damn, damn. Podcasts are awesome. Do you typically delete them after you are finished? So you never take work home, then? Curious! I like that you have things lined up for you to quiet your night down, that’s for sure.

-Lanny

Thanks for sharing, describing your work days. A high savings rate and the compound effect are your strong allies when it comes to gain flexibility over your life.

I like my job, the people I work with, but it can get pretty stressful too. A few months ago I took the decision to reduce my work pensum to 90 % to have more time with my family. My long term pursuit of FI gave me a clear focus in life, time and freedom are tremendously precious. And here comes the funny thing: although my income fell a bit (by 10%), savings rate actually increased giving me the possibility to put even more money to work. We get more conscious regarding our spending habits.

Take care.

Cheers

FS –

Very nice comment. So you were able to reduce stress, take slightly less money and because of that – corrected your budget and now – no change in lifestyle for you & your family, but instead you are saving more? WOW. How awesome is that? What was the big correction you made in your monthly budget?

-Lanny

Yes, it’s just amazing, by reducing my working pensum we significantly improved our household’s bottom line. The first spending position we could reduce: costs for day care center for our children (my wife works 50 %). 1/2 day including lunch and dinner costs more than usd 100, so usd 400 per month. and of course less commuting, less stress, much more time and more quality of life. Around two years ago, my wife and I systematically tackled our fixed cost block, our mantra: compare, (re-)negotiate, substitute, slash. That constant process is pretty successful. And with regard to discretionary spendings there is an interesting thing: I tend much less to mindless spending when I feel less stressed. So it literally leads to a virtuous circle: less work, less spendings, more savings, more financial flexibility …

Cheers

Shaper –

Thank you very much for these full details. You’re right… less hours at a place of employment, less time on the road, less transportation costs and repairs and in your case – less money spent on day care. And I like your mantra – I am very similar here, but need to do this more often. Do you look at your fixed cost block annually?

-Lanny

Yes, we look at our fixed costs at least once a year, e.g. with regard to insurances (car, health etc.) we have quickly go through the contracts whether everything is still suitable to our needs. Although we don’t have a budget, we have a kind of “Zero Base-Budgeting-Approach” in which we scrutinise (especially the larger) cost positions. It’s a great process and we tend to make it fun. For instance my wife and I lately had a conversetion whether we really NEED a car and how our lives would look like “car-free”. We have a great infrastructure with very good public transportation (bus, train etc.) and we love riding our bikes so it would certainly be feasible. To some extent it could improve many things.

For the moment though, with two little kids and my wife and I working, we have tremendous flexibility with a car so we will certainly keep it for a while. But it makes us strong kowing that we could be withouth a car. We are perfectly fine with cost positions we DECIDED TO KEEP unchanged as we see value for us. The process of questioning cost positions helps us to value what we have. It’s about optimising costs, not (necessarily) minimising. We certainly want to avoid deprivation.

Cheers

It’s so awesome to see how far you got already and that investing is really something to be passionate about!

Too bad for the dwelling office days, though. I’ve noticed at my own job, that the further we got with investing, the more distance I created at my work. With time, the dislike is/was growing. Not only because of the investing, part, but also because my view on life/work was changing. I’ve started to make some steps to change that, but will take up some time. I’m focussed on making my working career the best one possible 🙂

Nomics –

Very huge point there. With writing, investing and a new outlook on life/value/meaning behind it all – my distance from work definitely became further apart than ever before. What did you do/are doing to either – bring that distance back and/or did you end up changing where you were working for the time being?

-Lanny

I would definitely suggest looking into another firm. I’m a CPA in central California and we have several local firms in town, all with drastically different workplace cultures. Network and setup some interviews to find a place with a better fit. Those hours outside of busy season don’t seem necessary to me, and the passive aggressive comments from partners show they don’t want their people well rested or fulfilled outside of work.

Karl –

Thanks for the comment. I agree completely on the passive aggressive comments on those areas that we also want to pursue in life. Have you ever switched to a different CPA firm?

-Lanny

I did five years in audit at D&T, then moved to private industry (two different companies). Now I’m self employed (taxes and business consulting), but I work on a part time basis for a few different firms while I try to build my client base. Each of the three firms I’ve worked at in my career has been a drastically different experience. Thankfully I never worked for any partners like what you’ve described, but I have heard of many like them. Don’t be afraid to make a jump, you may even be able to negotiate a pay raise. But even if you take a pay cut, that may be worth it to improve your quality of life.

Karl –

Appreciate your insight, describing your path and history. I am on the pursuit, no doubt, to work for a better purpose with better people, you know? Those that do what’s right and also have a heart. I’ll be writing on this topic further, it seems, to describe the actions that happen here. Excited, Karl, pumped.

-Lanny

Great post Lanny. What a great reminder for me to keep my eye on the prize and keep building my dividend machine. In the end, it will be all worth it!

Oh and also remember this, you and Bert both have an amazing following here. I can’t tell you how many times I have visited this site to read your posts for additional motivation on my own personal finance journey.

Larry –

Thank you so damn much for this comment! It will be worth it, but you know what’s worth it – seeing if we can add value to others out there and I hope that we can continue to provide that for you, provide any additional motivation and it’s comments such as this – that provides us/myself with motivation. Thank you Larry, onward!

-Lanny

First you need to stop ASAP to drink that “coffee” stuff and get some green smoothie instead. A healthy nutrition is key for your body and it will heavily impact your motivation positive. And don’t take your break in the office! Go outside and make some steps.

Trust me, just this two things will change your daily office feeling dramatically.

And then start looking for another job. I agree that for the short term someone has to sacrifice things to win in the long term. But what you told us in your article is already beyond the red line in my opinion. Live now a good and balanced life. Life is too short to wait …

CU Ingo.

Ingo –

Agreed. No more of that vacuum sealed death trap. Something better for the body overall is the best route to go and I cannot agree more. I do need to go outside and walk more like I used to, will take you up on that (problem is traveling all the fricken time…).

I will be on the hunt to improve every aspect of life here going forward. I appreciate this feedback and seeing others viewpoints on the matter. Hearing/seeing that yourself and others state that this is beyond the red line and it’s time to for sure make a change, further supports where I’m headed. So thank you for that. Looking forward to the next step.

-Lanny

Lanny,

I mean this in the most respectful way but your work sounds like hell. You should seriously consider going industry or another firm. I am at a smaller regional firm and it is not like that at all. For example, I am getting ready to go on vacation and have been feeling burnt out. I was talking to my office manager about extending my vacation a few days. There is no issue in my extending the vacation there is just a request to be mindful of my emails, which are on my phone. If an important email comes in I am to forward the email to him so he can keep my jobs moving. He knows my workaholic tendencies so he has encouraged me to not taking my laptop on vacation.

As with any public accounting firm there is a busy season but on average the work week for the year is 45 hours. And before you start thinking I have grown into a slacker since college that is not the case. I in-charge/manage the firm’s largest job. I am not saying this to brag but to show you there is another way. Workplaces are driven by their cultures and from the routine you explained your culture sounds toxic.

While you understand the importance of being financially responsible are you being responsible with your time? Time is the only asset you can’t buy more of. We only get one life.

BFtP –

Thank you for commenting, truthfully. I can def. extend, if I didn’t have client deadlines or meetings, but it has been very dark lately in my life here.

Have never truly considered another firm, until reading these comments. Industry, yes; but a different accounting firm, no. This is interesting and I’m keeping this now all in mind. Thank you very, very much.

-Lanny

Great post!!! I am incredibly fortunate to first have a commute of 15 minutes and then be able to work 8 hours each day. Having that balance at work definitely helps me feel energized to do other things so I commend you for putting in such long days and then coming home and writing. Definitely a huge effort!!!

MSD –

Very good to hear and sounds very nice. It’s harder than hell to work these days, and to think – these are non-busy season days, and to come home – work on the articles, blogging, tweeting, researching and then there’s the other thing called relationships, working out, eating, sleeping haha. Not sure how it all happens, but it does, and damn.. I’m tired. Haha.

-Lanny

Lanny – most of the things sound so familiar! Terrible coffee in the office, constant talks to my wife about changes of my tiny portfolio (I am so grateful for her patience of listening to my dreams of becoming financially independent one day)… At least I am lucky enough to be able to go to work on foot in 10 minutes.

You guys were one of the biggest inspirations when I started dreaming about FI myself and I am loving the process (even though it’s just a beginning for me). Thanks for your example!!

BI –

WOW, sounds eerily similar. Only difference is I talk to the girlfriend instead of the wife right now. Currently, I am out of town, traveling for work, of course. Monday I had a flight at 6am, which means I was up at 4am, worked until only 5:45 central time i.e. 6:45 eastern time and then drove the 25-30 minutes back to the hotel. Felt great, real, real great. Haha.

Keep me posted and we’ll be doing the same here, of course. Want to be an inspiration, but we are all here to help one another, tha’ts for sure.

-Lanny

Hi Lanny,

I really hope you change something in your life, I really fear you will have a burnout before you meet your FI goal otherwise. You should start to enjoy your life now and not in 20 years, you will never now what will happen till then.

I changed my life 7 years ago, I worked a lot on the weekends till late in night and I made much more money but I was unhappy. Nowadays I work only like 30 hours a week make only 50 % money, but I have time for family, friends and sport.

I life more frugal then 7 years ago but I am happy now and I will reach FI a few years later, but much more healthier and I am sure that I will have More Time to enjoy my FI.

I wish you the best.

K –

Appreciate the comment. How did you make the transition? Did you go out searching or did something come up/reached out to you? Curious, as it’ll help to decipher the plan of attack.

And you are right. Never about the money, and heck, already save such a HIGH percentage as is. Everything will be okay, always.

Excited to hear back and talk soon!

-Lanny

I decided that I wanted to change something, I searched for another occupation. I calculated my financial situation and found out that I made a lot of money but had to pay very high taxes and tried to find out where I could save money.

If you have a saving rate of 60 % and already some passive income you will maybe find out that if you change some things and give yourself a longer timeline to reach your goal of FI that you can start to enjoy your life more nowadays.

I wish you the best

Killepitsch

Hi Lanny, thanks for your insightful and honest post.

I agree with getting another job, but I also believe that you can already take more control of your current job. I don’t really know you but you seem very passionate and willing to help. That tendency to always help people is what probably is causing all these people to flock to you for help. Learning to say NO is one of the greatest things you can do for yourself and your productivity. No to unnecccesary emails (are you in the cc and no action item, delete), no unneccesary meetings (no clear agenda or desired output, no meeting) and teaching people that your time is valuable and with all there questions you can’t do your actual work.

Just my 2 cents, it has helped me tremendously in the past years.

Man I can definitely relate. I need to invest aggressively if I am to break free of the 9 to 5 shackles. So much, that I have an article posted on similar lines as you.

As someone who has just begun his journey to financial freedom, it feels far, further away than the farthest….

Love DGI investing. So easy to explain and understand. Once you stumble upon it, everything clicks. It makes the investing decision for you basically. So many benefits. It is easy to start, and the community is very educational and supportive, if not just downright inspirational. The only down side is it requires so much money to build your portfolio. However, that money isn’t a cost. It is just growing as long as you have the discipline to let it grow and not touch it. Very inspirational piece. Keep taking back the control!

Lanny great post. Your passion has taken you this far and is sure to get you further. When you’re free to choose going to work or enjoy other pursuits you’ll have your hard work ethic and smarts to thank. Keep at it!

Hi Lanny,

So glad I discovered your site. It is so motivating to hear how you want better for yourself than just working that miserable job. FI will be worth it so keep grinding! You are definitely inspiring many of us to do the same.

Taylor –

Love that you stopped by a few articles! Need to keep the goals in mind, the desire to be better and be in a better place, stay consistent with what works and do more of it!!!

-Lanny

Oh man, I love a good rant! I am telepathically sending you some of my mental capacity to deal with all this bullshit. Stay strong brother. ????

You are on a yacht that needs to turn into a luxury cruise liner for you to cross that ocean safely and sail into an early retirement. Though, it seems you are on a pretty crappy yacht that could fall apart before it turns into a cruise-liner. A rubber band can only stretch so far before it breaks.

You should look into jumping ship/yacht, literally! or you may end up abandoning it prematurely and forego that luxury cruise liner to early retirement.

Mr. ATM –

Cheers and appreciate the sound/valid tips, no doubt. Gosh, life is crazy. I did end up switching jobs approximately a year after this article. More to come on how it’s been.

-Lanny

I finally saw this piece after seeing your Twitter post today. Crappy grind made bearable with a log term goal of escaping it sooner than later…

Are you still doing this?

I have been in this sort of grind on 2 separate occasions already. I had an accounting job at a “major major internet retailer in Seattle that pays no dividends” (easy guess there, huh..) No coffee… just pinball machines. The company mantra was “everyday was Day 1. Wake up every day in fear of your job and work to always raise the bar.” Oh, and there is no appreciation for achieving that. Just admonishment if you don’t break your own productivity metric records. In short, an impossible end result. I fully maxed my stock options and walked away. A huge weight lifted off my chest immediately.

Left that for an administrative job in a drug/alcohol rehab center. Great feeling getting personally thanked with quotes like “You saved my life. If I did not hear your empathy, I would not be here and most likely dead. My family is ever grateful” Great feeling for sure….UNTIL the moment the mom & pop company got bought out by a major public behavioral health company. Back to the stress. Every empty bed was my fault, even though the prices were raised 50%. I hated getting out of bed. One by one, all of the tenured employees were forced out. They tried to force me out by switching me to nights and weekends when they knew I had a 2 year old at home. A few months later, I was fired for skipping my lunch because I was helping a patient make living arrangements. At least I got 230 hours of vacation paid to me since they denied all vacation requests for over a year… Awful coffee and was told I had to pay for it after 1 cup…

Now I work for my next door neighbor who owns a high end construction company. I’m the office manager. Often all alone. And get 100% more pay than the rehab job. My customer interaction is with multi-billionaires (some you happen to know) and their first world problems, like sourcing $1.2 million dollar windows from Milan for their 15 million dollar home….maybe a visit to the shop for some QC? (Would have gotten an ok if I had asked earlier.) Once, I did to a quick trip to a soundstage in Hollywood where a house was outfitted with the Tesla Solar Roof for some photos (a house from Desperate Housewives, which was next door to The Munsters’ house!) Best latte in town across the street. And hours ( 6:30 – 3pm) with a 10 minute commute give me my life back.

I can stay, but I still have that goal of doing the big mic drop once my dividends surpass my income. My neighbor boss knows my dividend situation and has requested that I give a 1 year notice when I plan to retire so they can let me train my replacement.

Looking back, I regretted not walking out of the shitty jobs earlier. The stress, drama, and exhaustion is not worth it.

The point I’m trying to make is that even though you have the goal of getting out sooner than later, sometimes it’s worth the mental health just making a change to something with less stress. If it means delaying retiring by a couple of years, at least you would have more control of your life in the meantime. Quality of life when you are young is a one time shot. My job change let me realize I was escaping low grade depression that hung over my head like a cloud. And with the second job, it happened worse. At least I knew the cliff was coming…

Im 50 now and with what I have learned over the years is that I would not have put up with the stress if I could do it again. Just something to think about. You cannot buy happiness.

cheers, extra beer for you…

John