July is in the books. We are cruising through 2021. The dividends continue to roll in like clockwork. Just the way we like it. Further, companies continue to announce strong dividend increases. It is just more evidence that DIVIDENDS ARE BACK! Each month, we share the results with the community, so you can see how we are growing our dividend income. This month was exciting for several reasons. Here is Bert’s July Dividend Income Summary!

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income. One day, my dividend income will be large enough to cover my monthly expenses. That is why we are relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We use our dividend stock screener with every stock purchase. Our stock screener continues to help us find some awesome undervalued dividend stocks to buy. This simple, 3 step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Watch: Dividend Diplomats’ Dividend Stock Screener

Building a large dividend income stream takes time, consistency, hard work, saving, and most importantly, investing. I have been investing in dividend growth stocks since 2012. Saving a high percentage of my dividend income allows me to invest as much as possible, so we can retire as soon as possible.

Slowly, but steadily, my income has grown. Brick by brick. DRIP by DRIP. It is really exciting to see the growth and larger dividend checks trickle into my brokerage account.

Each month, we share our dividend income summaries to highlight our growth and progress. It is a fun and helpful excercise that holds us accountable. Further, it helps you, our followers, see the stocks we are purchasing.

Bert’s JuLY Dividend Income Summary

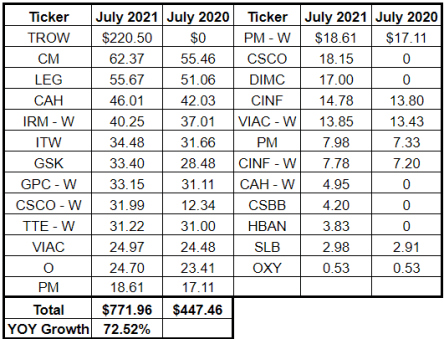

In June, we received $771.96 in dividend income! This was a 72.52% year over year increase compared to last year. The following chart summarizes each individual dividend payment we received during the month.

I always like to include a few observations in the remainder of the section about our dividend income, growth, and any trends worth highlighting!

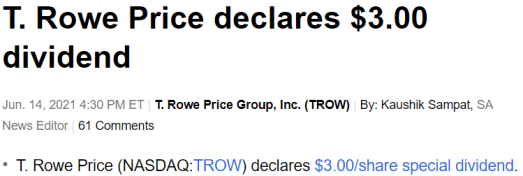

Observation #1: T.Rowe price Group’s Special Dividend Was Insane!

Our top dividend payment for the month was a HUGE special dividend payment from T.Rowe Price (TROW). This year, they announced a $3 per share dividend paid in July! Typically, the company pays its dividend in the third quarter of the month, so it was a treat to receive another dividend from them this month. I always forget how many shares I own of T.Rowe Price. It is easy to remember when the special dividend produces a $220.50 payment! Cha Ching.

The special dividend did help inflate the annual dividend growth rate. Without the payment, my dividend income would have been $551.46, or a 23% growth rate compared to last year. Still a great growth rate, but definitely not as strong as 72.52%. That’s for darn sure!

While it is great to receive a special dividend, I always prefer dividend increases because the impact is recurring. Next year, I can’t count on receiving $220 from T.Rowe Price.

Observation #2: New Bank Purchases Made a Big Impact

I have enjoyed building positions in bank stocks over the last few years. Lanny and I always talk about banks, particularly, community banks. There were some great values in the sector over the last year. Many great dividend growth bank stocks, yielding over 3%, were trading at a discount. Some of the banks, in fact, had Price to Book ratios below 1X. How crazy is that?!

It was great to see that we received 3 new dividend payments compared to last year from new bank positions. In total, this accounted for over $25 in additional dividend income. The 3 new bank positions were Dimeco, Huntington, and CSB Bancorp.

The Impact of Dividend Increases

We love dividend increases. Who doesn’t love the feeling of seeing your dividend income grow without lifting a finger. That’s part of the reason why we think dividend investing is the best, and easiest, form of dividend income. That’s why we are always writing about dividend increases and recording videos about the recent dividend increases announced!

Watch: YouTube Playlist – Recent Dividend News

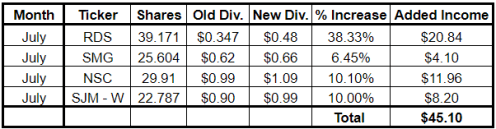

Each month, in our dividend income summaries, we demonstrate the impact each dividend increase has on our forward dividend income. The following chart summarizes the impact of each dividend increase:

In July, the exciting dividend news came at the end of the month. It was an action packed week that featured 9 dividend increases (video below). The featured dividend increase was Royal Dutch Sheel (RDSA). The company continues to rebuild its dividend after cutting it during the pandemic last year. This was the third dividend increase since the company’s dividend cut. Man oh man was it a banger. Shell’s dividend increase was 38%. How freaking sweet is that?! Obviously, a dividend increase that large is going to have a huge impact on our forward income. The Shell dividend increase added over $20 alone.

Read: 3 Dividend Increases Expected in August 2021

Let’s not pretend that Shell was the only company that made moves. We received two other dividend increases of 10% or great (thank you Smuckers and Norfolk Southern). In addition to those two, Scotts-Miracle Gro rounded out the month with a nice 6.45% dividend increase.

The four dividend increaess added $45.10 to our forward dividend income. I’m pumped up that all four were greater than inflation as well. Bodda bing, bodda boom.

Summary – July Dividend Income Summary

Another month is in the books. We experienced some massive dividend growth, both when including and excluding T.Rowe Price’s special dividend payment. Each month I say it, but I leave my dividend income summary article more motivated than ever. We have been dividend growth investing for nearly a decade. The results are really starting to show. The income growth is real. Each DRIP and dividend increase helps motivate me to keep going and invest as many dollars as possible into this stock market. We are getting closer to financial freedom with each passing month. Now is the time to be as aggressive as ever and KEEP PUSHING!

How were your months of July? What company paid you the largest dividend? How many dividend increases did you receive in July?

Bert

my-oh-my, TROW killed it for you! They definitely did a mic drop moment for your portfolio in July.

TROW’s special dividend was HUGE! Congrats on an impressive month Bert! 🙂

Great month. That dividend from Trow made a big impact. Keep

It up.

Congrats to you and your wife on another strong month! I loved the TROW special dividend. Let’s keep it up!

Hey Bert

Organic dividend growth is just amazing. And seeing Shell returning to „normalizing“ its payout is just great to see. 2021 is gonna be a great dividend year.

Cheers

That trow special divvy was awesome, why don’t I have some shares! 🙁

Other than that a great month all around, increases and a nice growthbrste even without the special dividend. We share 5 companies paying us, that’s always comforting to see.

Keep up the great work!