I have an old 401k plan. A 401k plan is an employer-sponsored retirement plan that the employer may or may not provide a match in and may or may not have a vesting schedule that also is part of the plan.

After checking my Vanguard 401k account today, as Vanguard houses my old 401k from when I left my employer almost 6 years ago, I was shocked when I saw the value.

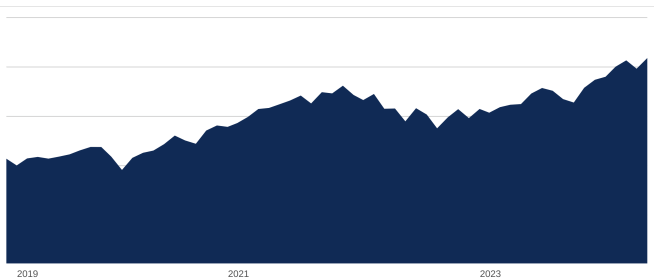

I was able to filter their time-frame to see the returns over the last 5 years and…

my 401k doubled in 5 years

I noticed my 401k has had immense growth. In fact, since May of 2019, my portfolio has doubled in value. What have I done to this old 401k plan since I left my old employer?

Nothing.

I have not done a single thing. I have not rolled my 401k, yet. I have not added anything to it since then or kept it at Vanguard in an IRA, nor have I changed it’s investment from what mutual fund I currently have.

What mutual fund am I invested in? Vanguard Institutional Index Fund Institutional Shares (VINIX) is my sole investment within this 401k.

What activities have occurred in the 5 years?

Market Appreciation.

Dividends.

Patience/Buy and hold.

Those 3 areas of investment are what catapulted my old 401k to new heights! What does the chart look like?

The 401k chart

There she is! What a beautiful chart. That was a 5 year time frame you see above. May 2019 to May 2024.

Along the way, I have gone back and forth with moving out of Vanguard and going into Fidelity or SoFi. However, I haven’t and the results are still rock solid.

The most difficult part was being patient and not moving this into another stock or ETF or other asset class. I know many that have moved and tried to jump on the hot stock pick or another investment class, which has not gone well at all.

There are a lot of lessons from just this one snapshot everyone.

lessons

Buy and hold for the long-term works. If the above chart isn’t evidence enough, I am not sure what is. Being patient, limited on emotions, will help you achieve incredible results.

Boring is good. The investment in and of itself is super boring. The VINIX mutual fund tracks and aligns with the S&P 500. On average, the investment should return between 8%-12% per year, like clockwork.

Dividends are powerful. Over the course of this time period, over $20,000 in dividends were earned and reinvested. The power of accumulating more shares, which again produces more income and also can appreciate is powerful. Compound interest baby!

conclusion

Now that I am on to almost my 6th year removed from the old 401k, where do I go from here?

Let it ride baby! I’ve come this far and results of being patient are well produced here. In the next 5-10 years, I am going to assume this account will double again. I’ll be in my 40’s. What will be wild is when this account somehow becomes a million dollar valuation. It’s possible.

What would you do in my position? Would you continue to let the compounding happen? Would you withdraw the old 401k and pick a different investment?

If you would go to a new investment – what asset would that be? In addition, if you are leaving Vanguard, where or what brokerage would you take it to?

Appreciate the feedback. Stay patient. Stay invested and let’s get to financial freedom everyone.

-Lanny

IMHO dividend investing is only one part of a three-part investment strategy.

Dividends stocks – (never made any money in bonds) What I call my paycheck stocks. Kings and Aristocrats. 20-22 individual stocks, if you’re going to have over 40 stocks you might as well own a dividend ETF. Why would you want to put money in your 40th best idea instead of your top 20.

Growth mutual fund/ETF’s or stocks – ( all US based companies ) Most big companies are international.

Emergency Fund – mix of money market and CD’s. About 1 year’s worth of living expense.

We didn’t start dividend investing until my wife retired and I was getting close to retirement. Our portfolio of investments during our working years consisted of growth mutual funds/ETF’s through IRA’s, Roth’s 401k’s and an emergency fund.

Keeping money in a company 401k plan that you are no longer employed at has it advantages and disadvantages.

Advantage – The rule of 55 is an IRS provision that allows you to withdraw money from your 401k if you leave your job at the age of 55 without penalty. An IRA requires you to be 59 ½. You will have to determine if this might be worthwhile in your future situation. Keep in mind that a lot of employers are letting older employees go from their companies in record numbers and finding decent paying replacement jobs for people over 50 is difficult. It might be a worthy back-up plan to consider. ( of course no one admits to this age discrimination, YOUR position was eliminated and that you are over 50 while others in similar position under 50 kept theirs is just a coincidence, good luck with healthcare insurance )

Disadvantage – Most 401k’s have very limited investment options and higher hidden fees. Most 401k’s have a S&P 500 Index maybe a blue-chip fund, mid-cap fund, a stable value option and many target date funds and that’s all. Rolling it over to a traditional self-directed IRA gives you many more options.

We primarily used the 401k’s S&P 500 index and owning the majority of the stock market. Accepting the market average return. But each year we maxed out our IRA’s with Fidelity, whom we had been with since the 1980’s. We invested in Magellan, Contra, Puritan ( more of a G&I fund ) and individual sector funds.

Not including our emergency fund we are 70% individual dividend stocks and 30% growth mutual Funds/ETF’s. With a good amount in sector funds. I know a bunch of people or going to say that the sector funds are too high risk, especially for retirement. When you look at the long term buy and hold return’s the Technology sector (and even the Mid Cap) beats the returns of the S&P 500 over the 1,3,5,10 year and life of fund. Where’s the risk? Daily price volatility maybe but based on performance it is just as risky as the S&P 500 but beats it’s returns.

Even a high dividend ETF (FDVV) matches VINIX S&P 500 return but pays a dividend that is double VINIX’s 1.39% vs 3.31% dividend.

So the only advantage of keeping the old 401k is for the ability of penalty free withdrawals at 55 if you meet the requirements.

Go to the MarketWatch Fund Comparison Tool https://www.marketwatch.com/tools/fund-comparison and punch in; VINIX, FXAIX, FNCMX, FSELX, FSPTX, QQQ, FSCSX, FDVV, VYM and for Healthcare FHLC.

( LIfe of fund you will need to get from another source )

Symbol 1 yr 3 yr 5 yr 10 yr Life of Fund Type Dividend

VINIX 26.36% 9.24% 15.28% 12.57% 9.81% S&P500 1.39%

FXAIX 26.4% 9.27% 15.3% 12.59% 10.9% S&P500

FNCMX 29.93% 7.84% 18.24% 15.78% 12.2% Mid Cap

FSELX 55.93% 30.62% 39.53% 27.87% 14.89% Semi Conductor

FSPTX 33.04% 11.37% 24.27% 20.20% 14.06% Tech

QQQ 29.91% 11.33% 21.44% 18.32% 9.91% Tech

FSCSX 14.94% 3.62% 14.65% 16.47% 16.26% Software

FDVV 28.48% 11.14% 14.62% NA 12.09% Dividend ETF 3.31%

VYM 22.05% 7.17% 11.22% 9.61% 8.39% Dividend ETF 2.93%

Past results are not an indicator of future returns. Consult your financial professional prior to making any investment. I am not an investment professional.

Recommend Reading List;

Richer Wiser Happier by William Green

Dividends Still Don’t Lie by Kelly Wright – (Adapt to buy and hold)

Mastering the Market Cycles by Howard Marks

Thinking in Bets Making Smarter Decisions When You Don’t Have All the Facts by Annie Duke