My wife and I had a long discussion in early February, I believe February 3rd was the date. This was after the stock market surged through the first month of January. We could not find an undervalued dividend stock that fit perfectly in our portfolios. Furthermore, we had quite the position in the equity market. On the other hand, this is not specifically a bad position, but it was truly weighing on my mind for quite some time. Then, we found and researched the real estate investing platform of Fundrise.

Fundrise background

Fundrise has been around since 2012, investing over $2.5 billion into real estate. They are a premier, real estate crowdfunding investment platform. Interestingly, I knew of Fundrise for well over two years but never decided to open an account. Reason for the delay, I was not educated enough and had concerns after RealtyShares announced their closing. However, even with the news there, I knew Fundrise has been around for quite some time and has a different investment approach.

You can review Fundrise service and approach to investing here.

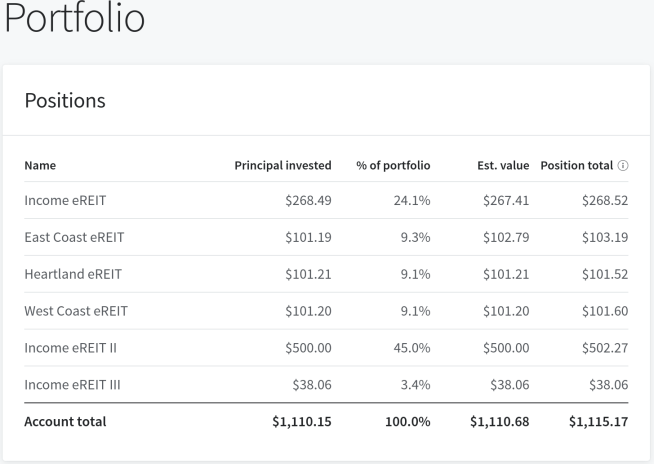

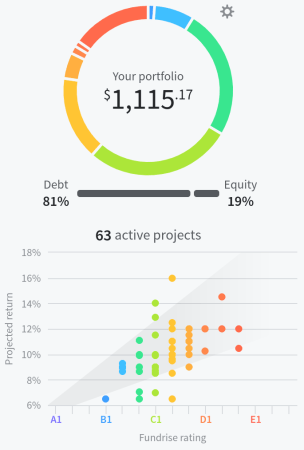

They have 3 different plans to invest and non-accredited investors can start with a minimum $500. Their fees are approximately 1.00% and your taxation, luckily, can be a 1099-DIV. It can be a 1099-DIV, if you select the appropriate plan (plan I chose has eREITS), which is what us dividend investors want to see! Here is an example of my investment portfolio with Fundrise:

The three plans are listed below and you can guess which plan we invested into (hint – it is the one with the longest dividend meter).

After we selected the Supplemental Income plan and invested our first $1,000.00, everything has been very easy. Fundrise sends communication letters throughout the process and they even send you updates on each project within your investment. Here is one example of a Fundrise message regarding a recent project within our investments:

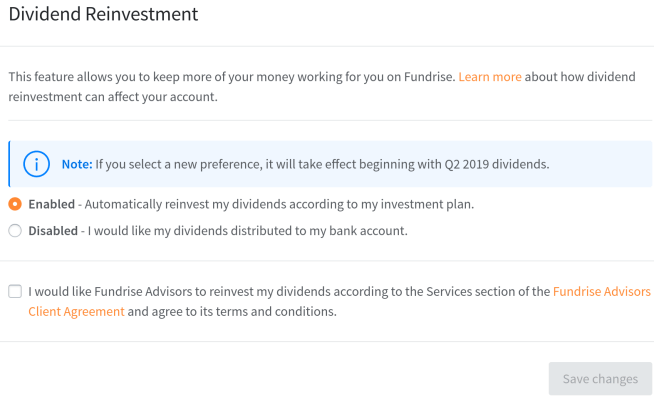

Additionally, I received a few questions regarding dividends and if you can reinvest those dividends. In order to answer, I decided to take a screenshot of our settings within our profile. Below, you will see that we have enabled our dividends to be automatically reinvested. The dividends reinvest into the same investment plan you are in (i.e. Supplemental Income plan for us). However, you can opt to receive the dividends in your bank account. The choice is YOURS!

Sign Up to see the projects within your investments!

Fundrise Performance

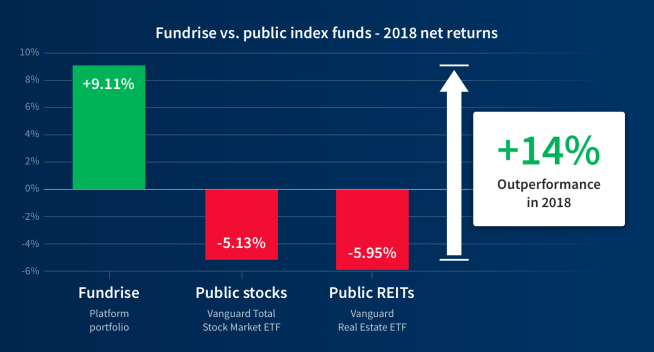

Their performance has ranged from 8.76% to 12.42%. Here is how Fundrise did in 2018:

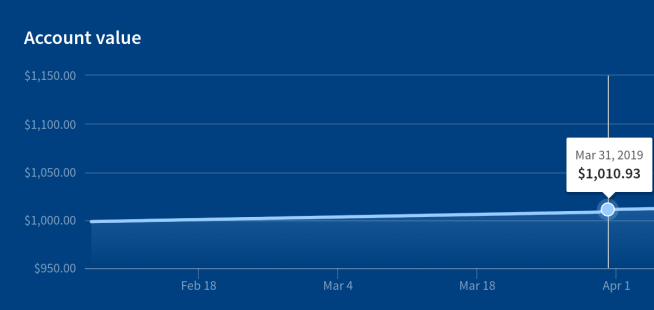

Notably, here is our performance through March 31, 2019 from our initial $1,000 investment. The return has been over 7%, which is primarily through dividends and one can expect an over 7% yield on the investment:

Pros, Cons & Summary

Pros:

1.) Easy to use with a low barrier cost to entry, at $500 and for non-accredited investors.

2.) Consistently informed regarding your application and afterwards, your projects within your investment portfolio.

3.) Provides diversification from the traditional stock market with dividend income.

4.) Provides you a real-estate experience without having to be hands-on with significant capital.

5.) Outside of the 1% management fee, there are no further trading costs. The 1% management fee can be waived if you have referrals, for 90 days per sign-up, as an FYI!

Cons:

1.) There is a chance your taxation could be different, depending on your investment. This can be the case if you aren’t invested in the eREITs and instead are invested in eFunds. The eFunds are structured as partnerships. Therefore, you more than likely will receive a K-1, instead of a 1099-DIV.

2.) Not as liquid as an equity investment. You typically are looking at a 5-year investment, unless you want to sacrifice 1-3% of your investment if redeemed earlier.

3.) Similar with any investment, there is no guarantee on your returns.

In summary, we are pleased with Fundrise over the last 3 months. Seeing this performance, our goal is to have $5,000 invested into the platform. Provided that, we are adding $100 per month to the account, automatically. In order to achieve this goal, we may have to increase our contribution after another phase of 3 to 6 months. We started the routine contribution, after the first two months of testing out the platform. Therefore, we will continue to review and adjust accordingly.

Ready to start with Fundrise? At only $500 to begin, it may be worth looking into and may be able to add to your diversification! Please share feedback, comments and experiences below.

-Lanny

Disclosure: This is a testimonial in partnership with Fundrise. We earn a commission from partner links on our website. All opinions are our own.

I invested a small amount in Fundrise just to check it out and was pleasantly surprised how easy it was to use the site and see your performance over time. Fundrise does a nice job of informing shareholders what properties they are investing in which is cool. I mean I have no idea if those properties are a good investment or not but it’s nice to see that disclosure and transparency. I don’t know if I will continue to invest or not however as I can just put money to work in Realty Income (O) or another REIT and have that liquidity you mentioned. It is a nice option though for sure.

Captain Div –

Cool that you wanted to test out their product. The transparency is very prevalent with them and understandably so. I would believe they have many small investors, such as ourselves (for now), that don’t have the high expertise level in real estate. Therefore, the updates provide clean information, while providing peace of mind.

Do you consistently add funds in there? One benefit or drawback, this shouldn’t tie to the stock market, but I guess we’ll see if times go south for real estate or the stock market to find out!

-Lanny

Too bad it’s not available for Canadians. Once all our registered accounts maxed out, most likely I will look into similar crowdfunding projects for Real Estate.

German –

I am sure that’s just around the corner – unless Canada has another platform?

-Lanny

Nice review. Seems like more and more people are looking at real estate crowdfunding as an option for their money outside of financial markets. It’s a pretty high fee, however, this may come down as the market matures and more competition gets in. On the other hand, it will be interesting to see how such platforms perform during the next recession. I think we know our dividend stocks will weather the storm reasonably well. But diversification is good. Tom

Thank you Tom for the comment, I appreciate it.

I do see more and more gravitating towards an alternative platform. Luckily, most don’t have significant parts of their net worth invested, but do a slice of the pie.

Yes, there is a 1% fee. I will say, we are still generating over a 7% yield on the investment with their fee, so far.

I would love to see competition, so long as the expertise and customer care/service remains in tact; with a slight decline in the fee. I don’t mind it, but obviously always am open to lower costs : ) However, I hope we are paying the fee to have experts & high technology backing the investments.

-Lanny

P.S. – yes, dividend stocks have stood the test of time!

I enjoyed your review of Fundrise and found it informative.

I have been investing with Fundrise for 2 years now. One of the coolest things about my account is having a fund with properties in my area that I can feel like I’m a partial owner because I technically am.

Sometimes I want to visit the apartment complex and walk in like I own the place – haha!

Bryan –

Thank you for your comment. Nice job with the longevity, from my standpoint, and I haven’t been lucky enough to have a property near me! That is pretty sweet though. Question – do the photos they share in the updates, match what they look like in reality?

-Lanny

I’ve been considering crowd funding. I think the knock on most of them is that your money is tied up long term (i.e. no liquidity). Curious, are the dividend payments at least liquid or are they reinvested.

Brent –

Looks like you and Calvin asked the same great question, to which my response was fairly easy. I’ll bring in the same response and will update the article, but, “but you have the option, to reinvest or not – automatically. It is a setting you choose for your profile – of course, mine is set to reinvestment : ) I’ll add a picture above, as well.”

-Lanny

I might be reading over this, but are the dividends automatically invested or how does that part work?

Calvin –

Great question! I will update this article – but you have the option, to reinvest or not – automatically. It is a setting you choose for your profile – of course, mine is set to reinvestment : ) I’ll add a picture above, as well.

-Lanny

Is this a sponsored post?

Bob –

Nope, this is me – Lanny, writing about my experience and investment in Fundrise! Let me know if you have any questions. I’ve been using it for 3 months and so far, so good. The daily status updates are great and transparency with the properties is very nice & reassuring.

-Lanny

Thank you for posting about it. I was wanting a detailed outlook from someone expert as to know the view regarding it. I believe that 5 year commitment is one thing stopping me. Also if you dont mind can you tell me if I can add monthly extra money to fundrise after my initial investment?

Dharit –

Thank you for the comment and glad you stopped by! Yes, you can. My wife and I are doing $100 per month into the same investments automatically. Seamless and easy. Keep the questions coming!!

-Lanny

I invested in Fundrise over a year and a half ago now and have also been happy with my experience! I also invested with two other crowdfunding REITs as I wasn’t sure with what was the best to go with. The reason I chose not to reinvest my dividends is because I learned about penalties for withdrawing your money in a certain timeframe. I’m fine with that for my initial investment, but I thought the clock for dividends may start at the time each were distributed.

Wow, thank you for this. I have been looking into Fundrise for a while now, but was just hesitant on pulling the trigger. You clearly explained the Core plan types and how they are taxed, leading me to the Supplemental Income plan since it was similar to REITs that I already own. Also, I can say that anything Diplomats invests in gives it a level of credibility in my eyes.

-DS

DS –

Thank you for coming by the blog! Pumped you liked the article. I appreciate the comment, big time and hope it was helpful. It’s been all steady on FundRise for a few months and it’s been great. Let me know if you have any questions if you end up signing up! Thanks again.

-Lanny

I started with $200 in April 2022. They were offering a promotion. I received a $10 bonus as well. I plan to add more money as I do my stock investments. I am shooting for $1,000 by the end of 2022. Until I get to $1,000 (I think?) I am limited to their Starter Portfolio and the Flagship Real Estate Fund. Currently with just $276 invested to date I have not lost any money but it is slow moving. I am going to give it time and continue to DCA into it as I get the funds to do so.