“I didn’t know it before.

Surprised when you caught me off guard.

Ice keep dropping and the drink keep flowing; try to brush it off, but it keep on going. All these scars can’t help from showing, whippin’ in the foreign and the tears keep blowing” – Post Malone

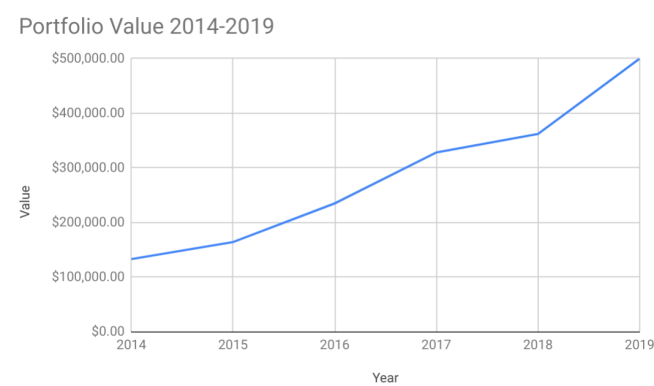

How Did I CRUSH $500,000?

The figure is hard to believe, as I listen to my motivational music. Damn, wow, half a million. I couldn’t have gotten here without saving AT LEAST 60%+ of my dividend income. I know I talk about fighting to keep each dollar, tracking all bills, watching your spending, etc.. but that has played a significant part in my journey.

However, one major item is overlooked in that process. You also should strive to create and earn as much income as possible. That will ultimately allow you to be in a better position to save. However, we all have the individuals in our lives whom are making way too much and somehow their spending consistently exceeds those marks. Therefore, I do focus each day on keeping expenses low. So much that we have many articles on the topic, such as:

5 Ways to Save $500, Starting Today

Top 5 Ways to Save on Energy during the Winter

Three Frugal Habits to Save on Energy ALL year

There would be a huge elephant in the room if I didn’t talk about Mr. Market. The stock market has pushed to new highs, which directly impacts my portfolio. Heck, the S&P 500 alone is up 21%+ YTD so far in 2019. However, for each and every year (over the last 3, at least), there has been intense discussion about a stock market decline, a recession, insert negative downturn phrase here. Guess what? Didn’t happen. Can it happen tomorrow? Yes. Can the market go up tomorrow? Yes. That is exactly why I don’t try to time or predict the market and, instead, stay invested and consistently purchase dividend stocks.

Consistently buying Dividend Stocks. That is also at the top of the list here. From saving a great deal of my income, this allows me to have the ability to invest. By using the Dividend Diplomat Stock Screener, I have been able to find undervalued dividend paying stocks out there in the market place to purchase. Here are examples, with links to the purchase articles:

October: Invested $3,300+ in 3M Company (MMM), Delta AIrlines (DAL).

August: Invested $4,700+ in Cummins, Inc. (CMI) and 3M Company (MMM).

May: Invested $4,000+ in Archer Daniel Midland (ADM), Lyondell Basell (LYB) and United Parcel Service, Inc. (UPS).

These purchases have all been updated within my Dividend Portfolio. This is a simple taste to show you that consistently buying into the market will push your portfolio higher, add dividend income and launch you closer to Financial Freedom.

However, I couldn’t have gotten to $500,000+ by just one year of investing, alone. Those that have been following this blog, know that this has been a multi-year journey. I have consistently placed capital into the stock market, each and every month, quarter, year, etc.. It’s one thing to make investments throughout 2019 and to save 60%+ of your income, but it’s also another thing when you live by the words of, “Save. Invest. Repeat.”. For example, not including 2019, I have invested $194,000 over the last 4 full years! See the listing below:

2018: $64,325.16

2017: $47,189.95

2016: $45,229.41

2015: $37,242.72

What does this include? This includes investing in my taxable, IRA, 401K and Health Savings (HSA) account. Further, this also includes reinvestment of dividends. As you can see, each year there is improvement. This is a result of a combination that includes higher income and more dividends each year being reinvested. This doesn’t include my wife’s account, just an FYI.

Why do I show this? Staying invested into the market is key and consistently buying/contribution to investments, regardless of what noise is occurring outside, no matter what. For 2019, I am currently at the same pace as last year, but may end up slightly behind that number.

What’s Next

Well, I think there’s, “only one thing left to do” and that’s, “win the whole f*ing thing”. Seriously, though, you know what’s next. 7 Figure mark. That would be the next likely destination, on this road to financial freedom.

I have been investing for 10 years and really investing with significant dollars for approximately 8 years. That’s not to discount my first few years, but I just didn’t have as much capital back then, however – those initial investments have been insanely incredible for my portfolio. If it took 10+ years to get to this point, will it take just as long to get to $1,000,000? The short answer no, but the long answer is it depends.

I actually crossed $400k and $500k in this single year alone. I crossed $300k back in 2017. The market will be the ultimate deterrent with the direction of my portfolio’s market value. What can I control?

I would say – rewind back up to the middle part of my article. I am going to consistently keep saving at least 60% of my income, each and every month. You know I will consistently invest into the stock market, specifically undervalued dividend paying and growing stocks. I will continue to repeat this.

What can’t I control? The stock market price fluctuations. I do not and will not get caught up with that, in fact…

The number does not matter

Yes, in fact, the number does NOT matter to me. It’s a symbol, it’s a milestone and I don’t want to fully downplay it, because it’s doing something that my family would never have thought would be possible, reachable, attainable or even “dream-able”. I cannot wait to look back on that and say, especially for the naysayers, “I’m just a kid from Akron, I f*ing did that.”. Goosebumps. I F*ING DID THAT. Silence.

The only number that’s important is Dividend Income.

That is the number that will take you to Freedom. That’s what you can use to pay the monthly expenses to live the life that you want. As of today, I am currently at a projected $15,566 going forward, on just my portfolio (not including my wife’s). Here is where my projected income has been at each December 31st (i.e. year end):

2018: $12,722.30

2017: $9,732.01

2016: $8,066.78

2015: $6,504.97

2014: $5,062.32

That’s what I’m really talking about! In the matter of ~5 years, I have been able to triple the amount of income going forward.

Progress is being made, each and every month. Dividends, savings turning into investments and turning off the noise to the market.

Will I get to $1,000,000? More than likely. Does it matter when, though? Nah. Not to me. It’ll be really cool to see the commas, but ultimately – it’s the income that will be used and what matters!

Also… thank YOU for following ALL of these years. Literally, this community is on fire and I love it. The passion, the knowledge, journeys and experiences has been incredible. Thank you, thank you!

What do you think? Crossing milestones? What matters the most to you? Anything you want to know about investing, saving, etc.? Please share below or message us!

-Lanny

CONGRATS LANNY!!! Wow! Amazing milestone to have crossed. All the years you have put in are paying off tremendously! The $10K mark is coming up for me, but I am hoping to cross the $250,000 mark in portfolio value in the next two years and break the $12K mark in dividend income in two years. We shall see. But really, Congrats on $500K! Well done, keep it up! 😀

Congrats on the milestone on your journey! What is your next goal?

PM –

Onward to $1M, but truly would like $24,000 in dividend income from the taxable account. If you combine both my wife and I – we are about halfway there. My accounts, in total with retirement-based, are rocking out almost $16k per year. Combined we are $20-$21k. Love seeing THAT number go up!

-Lanny

Congrats at the major milestone! Look forward to reading about more investments that you make in the coming future.

IP –

Thank you very much. Further, continue to write – I shall. The journey has been quite the ride and I know my 40 year old self will be happy with all of the saving & investing. Blessed, without a doubt.

-Lanny

What a great achievement Lanny! The 500K are huge, but even more impressive is the 60+% savings rate. This really fuels your portfolio and ultimately your passive income. Keep going and keep motivating the community with your posts and progress.

DGJ –

Thank you, thank you! Happy you notice the savings rate. Honestly, it may be even over 70% on average, at this point. Our lifestyle truly doesn’t change year in and year out. I am lucky to have a wife that doesn’t increase spending with increased wealth/income.

2019 is almost over and the portfolio continues to chug and churn. One step at a time.

-Lanny

I’ve been investing for longer than you or most of your readers have been alive and I do worry a little about how the next bear market will affect this generation who have done most of their investing in the longest bull market in history. About the time I first hit 500k a major dot com crash took about 40% of my portfolio value away. I didn’t sell anything. Then in 2008 it happened again and my net worth dropped by over 500k. I didn’t sell anything. And now I have millions, but only because I did nothing during those crashes. It’s so important to never sell at the bottom of the market out of fear, which you won’t because you’ve studied this intensely. But I fear many others will, emotions are difficult to control. Although I am not strictly a dividend investor your overall message is very sound and I think you are a positive influence on your readers to not be reactive, but to be proactive and to have a sound plan to follow.

Steve –

I love your comment. You are evidence of what happens when you brush off what’s happening on the outside.

If you consistently save a high % of your income and invest into fundamentally sound companies, all SHOULD be OK. My wife and I could weather a few storms via dividend income. It wouldn’t be easy, but it would be doable.

I look forward to how my brain reacts to a down turn. It shall be great experience, crazy as that sounds!

-Lanny

Congrats on a huge milestone! The $500k is nice and it reflects your ability to save 60%+ of your income for years now, but the most incredible thing to me is the $15k+ in annual forward dividends that your portfolio alone is producing at such a young age in the grand scheme of things. You and Bert are even more proof that aggressively saving and dividend growth investing really works! Keep it up!

Kody –

Thank you. You’re spot on. Time + High savings rate + consistent investing.

Dividend investing is so wild. My personal portfolio has $15k+. Since my wife and I have been together, I have helped spark hers to generate almost $5k in dividend income. We have quite the powerful portfolio going forward.

Back to dividend investing – it’s incredible how awesome it is that it’s a self propelling engine by way of dividend increases and reinvestment. Pure joy seeing the machine work.

-Lanny

Congrats Lanny! $500k is huge! And you’re 100% right that it takes hard work and dedication to your saving plan to be able to consistently invest and build up your investments. I don’t think theres,any major milestones coming up for us but I’m hoping $300k in our taxable account within the next 6 months. But most importantly we should be crossing $8k in forward dividends for our taxable account in the time frame possibly before the end of the year but realistically probably January or February! Keep it up and you’ll be at $1MM before you know it.

JC –

Conversation with my wife tonight about it. Honestly, from when I was young in my career, I bought stocks instead of clothes, going out to a ridiculous level and never bought anything significantly fancy or lavish. Therefore, it’s all of that snowballing/compounding/discipline that lead me here. The funny part – is I don’t think I missed out on life or didn’t do something I wanted to do, you know?

Excited for you to cross the $8k mark, that’s what matters : )

I am considering hiding/removing the MV column on my personal spreadsheet, but we’ll see!!!!

-Lanny

GREAT Milestone. The next $500K will be easier since you have learned a lot along the way.

Just wait ’till you get to say “One Miiilion Dollars” like Dr. Evil.

– John

CW –

I’ll video record it when I get to say that, haha. Honestly, it’ll be easier, but also, could be longer/shorter – depending on what Mr. Market decides. Either which way, I am pushing for that dividend income to go…UP.

-Lanny

You got to live milestones 🙂 Congrats Lanny!

What’s your overall portfolio yield now?

Mr CF –

As I posted before about it, Milestones are a GREAT part about being a dividend investor, for sure.

Yield is only around 3.00-3.10%, fluctuates quite a bit with what the market decides to do, but am in that range.

-Lanny

Great job man,Huge Milestone,hopefully you will very soon cross the 1M. Dividends are working Hard to generate money.Its nice that you were able to invest close to 194k.

Desi –

It’s just a number!! Joking, it’s crazy to see where I’ve been and where I am. However, it’s all about where you’re going to go.

I should delete the market value column, what do you think?! Hmm…

-Lanny

yes ,if you are not comfortable with it

This is a great post, and congrats!! I’m going my best to stay on your heals. I like the annual contributions summary. Like it or not, we are still at a point where contributions can make the most difference in our portfolio values. Putting in 64k in a single year when income is 13k – you’re accelerating yourself by five years compared to just passively letting it grow. Stay on the gas!

Hey Lanny,

This is exactly the sort of article I like to read. What you’ve done demonstrates the value of setting a proper strategy and sticking to it. You’ve been as consistent and now you’re reaping the rewards.

My guess is the million dollar mark will come easier and faster than you might have dreamed ten years ago. Now that you’ve got the snowball started (okay, more than a snowball), it’ll keep rolling and picking up even more steam at a faster rate—market downturn be damned.

Keep reinvesting and I’ll keep following.

Take care,

Ryan

Lanny,

Nice mic drop. Love the Major League reference too!

– Gremlin

Nice job Lanny, keep up the good work. You will hit the 1 Mil club in no time.

-The Expat Investor

Expat –

Thank you, thank you. It’ll either be VERY Soon or it may take a while – depending on the market. Aiming to keep the income going up along the way, that’s a certainty.

-Lanny

Congrats Lanny! What a fantantastic accomplishment. 500k wow. So cool to hit numbers like that. That’s some serious cash you have working for you.

Dividend Seedling –

Thank, it’s surreal still. However, still work to be done DS!

-Lanny