What is a Health Savings Account (H.S.A.) and how do you qualify?

A Health Savings Account (or HSA) is a tax-advantaged savings account that allows individuals to save for medical expenses. It is great vehicle to help you save money, reduce taxes, and even, grow your dividend income!

Can anyone contribute to an HSA? Unfortunately, no. In order to contribute to an HSA, you must participate in a high-deductible health insurance plan at your employer.

Let’s use the two of us as examples. Lanny’s employer offers a high-deductible health insurance plan and therefore, he contributes to an HSA. On the other hand, Bert is on his wife’s employer’s health insurance. They do not offer a high deductible plan. Sadly, he cannot contribute and take advantage of these tax breaks.

In addition to the employer requirement, there are a few other eligibility criteria: You can’t have any other supplemental health insurance coverage, you can’t be claimed as a dependent on someone else’s tax return, you can’t be enrolled in Medicare (Part A and Part B) or Medicaid, and you must be under the age of 65

Therefore, if your employer offers a high-deductible plan and the other eligibility requirements, you are in luck! You can begin contributing to your HSA and tax advantage of the awesome tax benefits!

There is a maximum contribution cap annually. The tax benefits are not unlimited. In 2021, the HSA contributions limits are as follows:

- Single: $3,600

- Family: $7,200

For the two of us, we always maximize the contributions (when available). We strongly urge people to do so as well, if it fits their individual financial situation!

What are the Benefits of an H.S.A.?

We have already mentioned the tax benefits of a Health Savings Account. However, that is just the tip of the iceburg. There are a lot more benefits. In this section, we will highlight some of our FAVORITE benefits of a health savings account.

Triple Tax Benefits – That’s right, contributing to an HSA allows you to save taxes in not 1, not 2, but 3 different ways! You don’t just save on federal income taxes, after all. We have already stated that your HSA tax contributions are tax deductible. Further, the withdrawal of funds for health-expenses is tax free AND your investment earnings are tax-free on the way out. That is an awesome trifecta of tax benefits!

Ability to Invest Funds – A unique feature of an HSA account is that you are able to invest the funds in your HSA account to help grow your cash. Many HSA brokerages offer the ability to invest your cash. Lanny uses Lively for his HSA and Bert uses Fidelity for his HSA (Although he formerly used Lively). We both have invested the cash, earned dividend income, and have now watched the balance on our cash grow. We will discuss Lively and the investment options later in this article!

The Funds Are Always Yours, Regardless of Employer– This may seem like a strange statement to read. However, since HSA’s are tied to your employer’s health insurance plan, it is important to note that the funds in your account are YOURS and not your employers. If you leave one workplace, you take your HSA funds with you. You have the ability to keep your account at their HSA broker or transfer your funds to a no-fee, indepednent HSA provider such as Lively. That is how both of us ended up using Lively. We left our previous employer and transferred the funds to Lively.

Your HSA can Become a Retirement Account – We love this aspect of an HSA. Similar to a 401(k) or IRA, once the account holder turns 65 years old, HSA funds can be used for non-health-related expenses without any penalties. That is why we have maximized our contributes at every chance we can get. Regardless of whether the funds are used on medical expenses, or not, we are also taxing advantage of tax benefits to build a retirement account!

Lively review – Pros and Cons

For those that don’t know, Lively is a servicer of Health Savings Accounts. In fact, we have them as one of our Financial Freedom Products and originally did a review, that you can go to at that page. However, we wanted to refresh the community on the benefits of using Lively! Here is the Lively Review, below!

Lively Pros

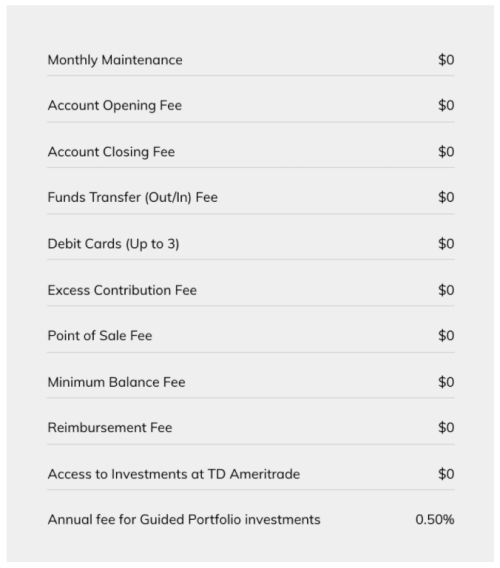

1.) Their Fee Structure. Lively’s fee structure is the BEST out there. Why? See the chart below that is fairly self-explanatory. I love the price of $0!

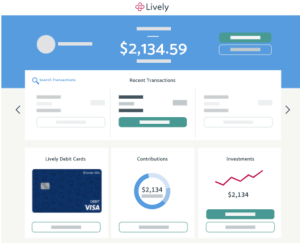

2.) Lively’s Account was VERY simple to open and Rollover. We all hate headaches for closing and/or rolling over prior accounts. Lively makes it easy and THEY work with the other financial institution if you are rolling it over. In fact, this only took a few days for both of us (Bert and Lanny). Therefore, we both enjoyed switching to Lively easily AND saving on monthly fees our prior H.S.A.s were costing us. Here is a dashboard screenshot from their site:

3.) Investment Options. Our favorite part. As dividend investors and generating income off of any asset we each have. That’s where Lively’s investment option comes into play. Here are their options:

Self-Directed Brokerage Account (by TD Ameritrade) provides investors with a wide range of stock, bond, and fund options they need to design and manage their ideal portfolio how they want.

- Cost: $0 access fee, no minimum

- Enjoy $0 commissions for online trading of US exchange listed stocks

- Access a wide variety of investment options, including individual stocks, bonds, CDs, over 550 commission-free ETFs, and more than 13,000 mutual funds

- Grant your financial advisor access to your portfolio by completing an “Advisor Authorization Form”

OR

HSA Guided Portfolio (by Devenir) makes it simple for investors to receive personalized suggestions based on their individual risk preferences and time horizon.

- Cost: 0.50% annual fee, no minimum

- Choose from a curated menu of high-quality, low cost funds across asset classes

- Enable automated rebalancing to keep your portfolio on track toward your goals

- Maximize long-term returns through a low maintenance investing strategy

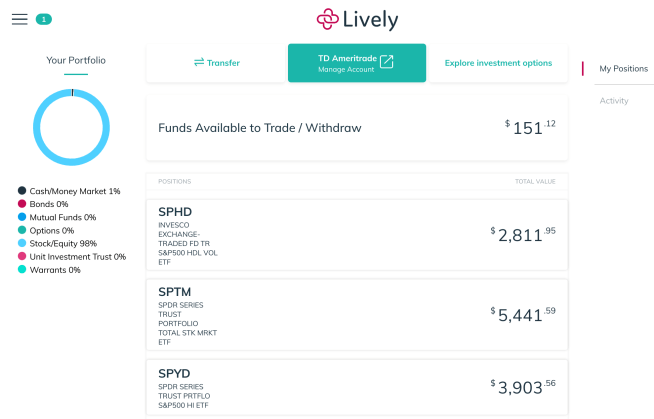

Bottomline, this puts your H.S.A. dollars to work. Personally, have them in ETFs, at the moment, due to not wanting to have to monitor them as closely as individual dividend stocks! Here is the latest sample of Lanny’s portfolio with Lively:

Lively Cons

Here it comes. There are FOUR letters representing the Cons we have experienced with Lively so far. We seriously mean this. The cons are…

NONE.

It’s that simple. There has not been a single thing/item to complain about with having Lively has the H.S.A. servicer. They make it easy, their platform is easy to use, their customer service has been great with any questions we have had. You benefit from a ZERO cost H.S.A. provider with investment options from a reputable brokerage at TD Ameritrade with, again, ZERO trading fees.

Bert switched from Lively to Fidelity due to the fact he wanted to consolidate all his investment accounts under one platform. He did not leave because he had any issues with the service provided!

Lively Review and H.S.A. Conclusion

Again, we have reviewed them many times before but wanted to provide another FRESH look at Lively and the incredible benefits of the H.S.A. account! We have used Lively now for a few years and the amount of money we have saved in fees, and value we have added from the investment options are incredible.

You can see the investments and dividend income from the investments at our Portfolio page. In addition, as linked earlier, please check out Lively at our Financial Freedom Products page, as well as other sources/resources we use. We would NEVER talk about a company or product, if we do not use them!

Please share your thoughts below on the Lively Review and if you have a current and/or old H.S.A. account – what’s holding you back from rolling to Lively? Thank you for stopping by and let us know if you have any questions for us!