There is an ETF in this dividend investing, social media driven world at the moment. No, today’s video isn’t about Charles Schwab’s SCHD! Today’s video is about the premium income ETF – JEPI from JPMorgan Chase. This high yielding, almost 10%, ETF has garnered the attention of many investors portfolio.

Therefore, today, we unpack the ETF, what is composed of this exchange traded fund and – is there a spot for it in your portfolio? Let’s dive in.

JEPI ETF – JPMorgan chase

What is the JEPI ETF that JPMorgan manages? That’s the start, JPMorgan owns and manages the Premium Equity Income ETF called JEPI. Not to be confused with Starwars JEDI, trust me, I’ve been there.

First, this ETF pays monthly. That is awesome! When you have the likes of Realty Income (O), the monthly dividend paying REIT, who doesn’t like an ETF that pays monthly?! That is one big draw to the ETF, monthly cash flow.

Second, the ETF holds stock positions! In fact, the to 10 are HUGE names that we all have in our dividend stock portfolios. Big dividend growth stock names, such as: AbbVie (ABBV), Coca-Cola (KO), Visa (V) and MasterCard (MA), to name a few. Then, they also hold alternative/option based assets in their ETF.

Third, piggy-backing off of the last point made is the option approach within the ETF. The managers, whom have over 60 years of experience with options, write out of the money S&P 500 call options in order to produce and provide monthly income on the ETF. Obviously, that is where the increased risk of the ETF is and you are not 100% sure of what dividend/distribution you may be receiving.

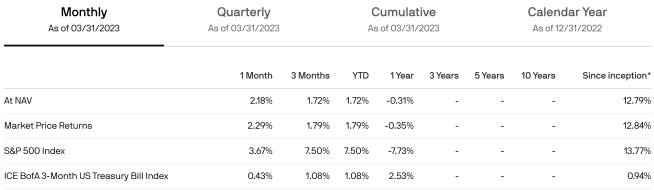

Lastly, the fund has ONLY been around for 2 years. Per their website, here is how the fund has performed thus far:

JEPI ETF – Monthly Income

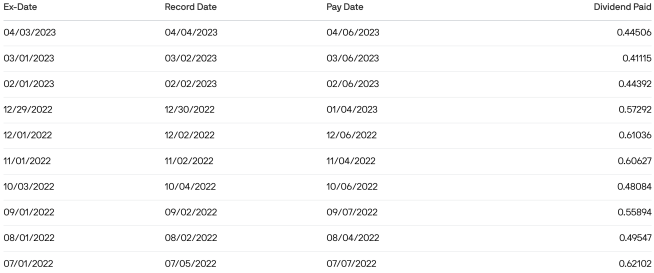

Now, the “fun” part and that’s why everyone loves JEPI – the INCOME this ETF provides. Let’s look at the last plethora of distributions:

Interesting. The monthly distribution has fallen throughout the last year. From $0.62102 down to a recent $0.44506, that is a decline of 28%, rough.

In addition, stock price for JEPI has also declined close to 9% in the last year:

In effect, the ETF distribution has been declining along with the share price. The price being down 8.54% is worse performing than the S&P 500, which is down 3.34% during the same time period. Now, granted, you have also received monthly distributions along the way.

Now, the rolling 12 months, per the JEPI website, is yielding 11.31% with a 30-day SEC yield of 9.59% AND a published dividend yield of 8.88%. Therefore, one could more than likely say, your yield will average between 8.50% and 11.50% while owning the ETF, if we use the range of yields published.

Investing $1,000 into this ETF could easily produce you $85-$115 in income terms. However, what about taxes?

Jepi ETF – taxes

You are receiving this high yield, wheeling dealing, girl stealing, Ric Flair WOOOOING ETF, but what about at tax time? How is this monthly income taxed?

In short, you will be taxed at ordinary and qualified dividend income levels, aka at your ordinary income rate and at your long-term capital gains tax rate. More than likely, majority of the income will be taxed at your ordinary income rate, due to the income earned from the options that are being written by the managers in the ETF.

To provide an example, if Verizon (VZ) 7%, the after-tax yield is approximately 5.95%, if you pay 15% taxes on the qualified dividend income.

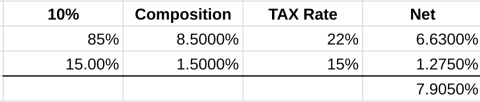

With JEPI, let’s argue they have a 10% yield and the combination of income is 85% ordinary and 15% qualified. If we take 10% x 85% x (1- 22%) (ordinary income tax rate) = 6.63% + 10% X 15% X (1-15%) = 7.90% overall yield, after tax.

Therefore, you can see, the yield after tax will be ~2% lower than what the published yield is, from a taxable account standpoint, where is the yield on a qualified dividend from owning dividend stocks is reduced by ~1%. Again, using a 15% dividend tax rate (might be lower or even 0% for some!).

In point, I wanted to showcase the true net yield after taxes on the JEPI ETF, to help those understand where a break-even point may be, when compared to a company that produces a dividend vs. an ETF that has an ever changing monthly distribution!

conclusion on Jepi… for now

Will I be buying JEPI right now? More than likely not. Do I see a spot in portfolios that can benefit from JEPI? Absolutely. If you are in a lower to 0% income bracket, then investing in JEPI may actually increase your income, without impacting your taxes. Now, I don’t recommend 100% allocation, but something at or below a 5% allocation to juice up income, may not be a bad idea.

In addition, from talking with Bert, if you are on the verge of being financially free and need a bump in passive income towards the tail end, without sacrificing a significant amount of future long-term dividend / passive income total, investing in JEPI towards the end, to not deal with the taxes, also may be a great idea, especially if it closes the gap to reach financial freedom.

$10,000 invested would produce close to $800 per year and imagine if you could spend/invest $30,000 and produce $2,400 or $200/month in income from this ETF? It could be a strategy, to close the gap if you need just a few more hundred or thousand to reach financial freedom, without sacrificing your total portfolios ability to grow income and value!

What are your thoughts on JEPI? Do you own this ETF? If so, how much and have you been buying this ETF in 2023? Are you a JEPI believer?! Let me know in the comments below.

As always, good luck and happy investing! Thanks for stopping by!

-Lanny

I am wondering about it? Is it too good to be true?

I’ll take VZ over JEPI any day of the week. These covered call ETFs are all yield traps as far as I am concerned. If you are retired and want juicy dividends, get VZ, MO, MMP, EPD, O among other higher yielding instruments. SPYD is solid, SCHD and VYM are of course fantastic.

Go with quality and be patient building out that income.

The decreasing dividends by JEPI makes me wonder how much lower can the dividend payout go down. If the dividends are mostly from the covered call writing (which I am guessing is based on the lower payouts), then this wouldn’t be a good cash flow generator when the market is grinding up since the VIX will be lower and the covered call premiums will be lower too.

Thanks for sharing your perspective on $JEPI and I agree with your perspective! I don’t see JEPI replacing traditional safer, quality dividend ETFs (VYM, SCHD) but more as a short-term income enhancer, augmenting existing portfolio income strategies. I think investing in JEPI depends on each investor’s investment objective, amount of ordinary income and their tax status. Additionally, the options premiums that represent 15-20% of the portfolio that generate 80% of the income is variable and while it has been declining, it could also easily flip as well. It all depends on the volatility.

If you or your readers are interested on my recent take, please check out my 2 cents on whether I think JEPI is worth it not, especially during a choppy market ahead:

https://stretchmypenny.com/jepi-how-to-evaluate-if-its-worth-it/