LyondellBasell (LYB) is becoming QUITE the dividend growth stock and is making headways into dividend investors’ portfolios. In fact, they JUST announced a solid dividend increase of 5.3%. It didn’t end there. LyondellBasell also announced a $5.20 special dividend to each shareholder.

Therefore, it’s time to dive into LYB to see if they are becoming quite the Dividend Growth stock as we are mid-way though 2022.

LyondellBasell (LYB) Stock

LYB is based on the U.K. but they do have their U.S. headquarters in, none other than, Houston, Texas. LYB is one of the largest manufacturers of chemicals in the world. They compete against Dow Chemical (DOW) and Ecolab (ECL), to name a couple.

LYB is firing on all cylinders in 2022. In fact, their first quarter earnings were off the charts, literally. LYB had over 44% of revenue growth vs Q1 last year and grew from the recent Q4-2021 quarter last year. Net income also was $1.3 billion vs. $1.07 billion in the linked quarter, up over 20%. That has sent, as oil and other prices have been higher, the stock soaring this year – up over 25%! See LYB’s stock chart, below:

Management also updated their outlook to CONTINUE to see margin improvement, which should lead to greater net income. This is no wonder why the stock has been performing well, when the S&P 500 is down still over 13% through May 27th.

Then, LYB did announce some impressive news on May 27th. LYB increased their dividend from $1.13 to $1.19 or 5.3%. Lastly, to add a little icing or cherry on top, LYB announced a $5.20 special dividend to each shareholder. Talk about Dividend GROWTH!

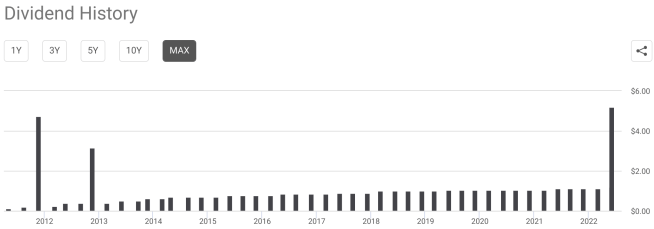

Let’s look at the dividend payout chart for LYB. LYB has paid out special dividends below, which makes the chart slightly harder to read. Overall, the dividend has been trending hire for the past ~ 10 years. Nice to hold LYB stock!

I believe it’s time to look at LYB stock through the Dividend Diplomats Stock Screener, right?!

LyondellBasell (LYB) dividend stock analysis

I cannot wait to put LyondellBasell stock through the Dividend Diplomat Stock Screener! Here, we focus on 3 main dividend stock metrics:

1.) Price to Earnings Ratio (P/E): We look for the price to earnings ratio < the S&P 500 and the competition.

2.) Dividend Payout Ratio: The preferred dividend payout ratio is < 60%. In fact, we believe the perfect payout ratio is between 40% and 60%.

3.) Dividend Growth Rate: Given we are dividend investing on our way to financial freedom, as we believe dividend income is the best source of passive income, we look at the 5 year dividend growth rate. In addition, we review how many years the company has increased their dividend.

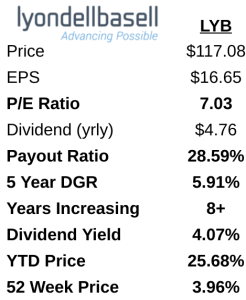

1.) P/E Ratio: Analysts are expecting $16.65 in earnings for this large chemical company. Based on LYB stock price of $117.08, the P/E ratio is SO LOW at only 7.03. WOW. The S&P 500 p/e ratio is currently 21x earnings.

2.) Dividend Payout Ratio: They didn’t land in the “perfect” payout ratio, BUT they are actually better – as it’s lower than the 40%, versus being higher. LYB has an extremely safe dividend payout ratio of 28.59%. Think of it like this – LYB retains 70% of their earnings to develop, invest and research new products and pays out almost 30% of their earnings to shareholders. If earnings were cut in half, the dividend would still be… SAFE!

3.) Dividend Growth Rate: LYB keeps is consistent. Though they just announced a MASSIVE special dividend, the dividend growth rate has trended just under 6% over the last 5 years on average. Solid overall.

Lastly, we’ll take a look at the dividend yield. As an investor, you want to know how much owning this dividend stock pays you now! The yield for LY is 4.07%. That is higher than the S&P 500 by approximately 250 basis points. Not too shabby. This is also higher than most CDs and high yield savings accounts!

is LYB Stock a Stock to buy…now?

Now that we’ve gone through the metrics, is LYB a stock to buy for the dividend stock portfolio?

At this time, I am going to keep watching LYB. If they dip below $110 – I will be adding to my already over 100 share position. I believe they’ve been an extremely well run company, with consistent growth in their dividend and have persevered through tough times recently.

If you head over to our YouTube channel, you’ll find other undervalued dividend growth stocks that are higher on my list for stocks to buy now!

How about you? Do you own LyondellBasell stock? Do you think LYB is a stock to buy now in this significantly volatile stock market? Share your comments and feedback below!

As always, thanks for stopping by, good luck and happy investing!

-Lanny

Loved reading that announcement yesterday only own 59 shares but that special dividend sure helps out. Can’t believe how they have sky rocketed up in price though

Doug –

59 shares is a ton. Nice job! Would love them lower, but their price still has good value!

WOO HOO!! Way to go LYB!

I own 343 shares, so I’m looking forward to my big payday on June 13th. I am also stoked that after the increase my yield on cost is now 4.94%. This is definitely becoming a dividend growth stock.

I own 40 shares of LYB and I am ecstatic! I had to read that twice to make sure my eyes weren’t deceiving me. That was the highlight of the week for sure! 🙂