Today, I wanted to put on paper and provide details to the plan I have to re-finance my mortgage on my house! This is not a 100% certain action that I am taking, but the mortgage rate market is dropping low enough for me to look into, run the analysis on the numbers and potentially re-finance the mortgage.

My Current Mortgage Balance, Maturity Time and Interest Rate

I have currently lived in my house for 8 years, how crazy is that?! Further, I have made plenty of extra payments to the mortgage over my time here (not too many, and truly 0 extra in the last 3+ years), which has reduced my time to maturity. When I purchased my house in the fall of 2011, I received the lowest rate possible, at that time, which was 4.375%.

Currently, my mortgage balance (as our house is small, with an “ok” plot of land) sits at $70,251. Yes, we can easily pay that off in 12-24 months time if we were aggressive/crazy enough, but choose to not do so, in favor of investing into dividend stocks. Tagging along with my extra payments above, all calculators (my own and external) show that we only have 19.5 years left to the mortgage.

See – Interest Rate Cuts, Your Investment Portfolio & Your Mortgage

Obviously, I do not want to go any longer than 20 years if I re-finance. Further, re-financing my 19.5 year into a 20 year “extends” my maturity slightly. However, with cost savings in one month alone, I could reduce that to being back on track.

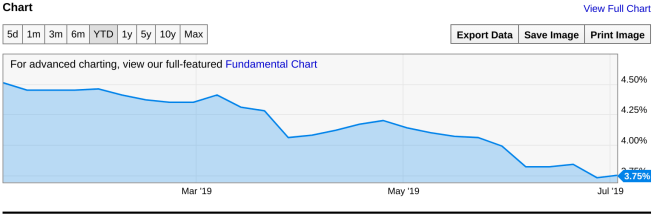

Lastly, the reason I want to re-finance is the mortgage rate market has taken a nose-dive since the Fed froze rates and there is high probability of a rate-cut this month, despite there being a strong jobs report. Here is the chart of the mortgage rate this year alone:

Mortgage Interest Rate Needed

Now, I currently am at 4.375% and am “only” paying ~$447 in principal and interest per month. Lucky, no doubt, and I did buy just shortly after the recession/before the housing market had a chance to change in pricing. Therefore, it is hard to find the right rate to make sure that it ends up being worth it.

The desired rate is in the 3.30-3.35% range as my mortgage re-finance rate. Further, I would prefer to do the 20 year. What is funny, is my Credit Union that I work at, our 20 year mortgage rate is currently at 3.475% and we are inching closer and closer.

To keep the calculations rounded, let’s assume an $1,750 closing cost on this and that is ADDED to my loan (See also – my previous taken unsecured bad credit loans) making the balance $72,000 in the end. Further, for the rest of this article, let’s assume 3.35% is used.

See – Pay Down the Mortgage or Invest, That is the Question

Mortgage Re-Finance Break-Even Point

At 3.35% with a 20 year mortgage life, my payment would drop to $412 per month, principal and interest. Now, the big factor is the $1,750 in closing costs on the re-finance. The fun part is calculating how long to hit what we call the “break even” point. The calculation is cost divided by recurring savings and this will output how long to re-coup that cost.

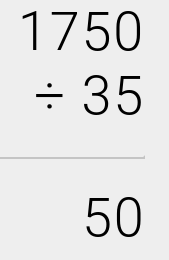

In my case, $1,750 is my cost. The savings per month would be ~$35.00 on the mortgage payment. Therefore, you simply take the $1,750 and divide that by $35. Below, from my calculator, you will see that it will take 50 payments, or 50 months, until I hit my break-even point. This is a little over 4 years.

Other Re-Finance Things to Consider

There are other mortgage re-finance items to consider, prior to going into doing this. Here is everything on my mind, as I step through (potentially) the process:

- Know your credit score – Knowing your credit score is the factor that will play into the interest rate you will receive! Therefore, I am using my assumption that I am in the highest credit rating bracket possible. However, if you are not, you have to be cognizant of what rates fall into the tier that you are in, from a credit score stand point.

- Closing costs – Similar to my example above, closing costs are crucial! This is what will depict your break-even point or payback period. I assumed a 2.50% closing cost for my loan, but it could vary 0.50-1.00, in either direction.

- Home Equity – I wouldn’t be re-financing if I didn’t have sufficient home equity, i.e. amount of loan remaining to the value of your house. I know I have at least 35-40% of home equity, therefore, no concern for me. However, this is a point to keep in mind, as you go through the re-finance route.

I know there are other areas to think about when going through the process, but these were the big 3 items on my mind, outside of everything else above.

Conclusion

This is my goal. I would LOVE to accomplish a re-finance 10 years into my mortgage. I never imagined I would be in a position to perform this, as my rate was low, with a low balance and I had already applied extra mortgage payments in the earlier years. Those extra payments, surprisingly, have snowballed into saving over 2.5 years off the mortgage already. Therefore, even if you don’t re-finance, the extra payment being made here or there, goes a LONG way.

I am not sure how long a typical re-finance takes, but I am looking forward to testing out these waters (hopefully). The better than expected jobs report may have delayed the rate cut, as the probability is 95% for no-rate cut in July, but still there is an aim for lower rates over the next 6 months. You better believe I am glued to this and will be quick to make a move on any sign/display of that 3.30-3.35% 20 year rate.

In the end, it’s all about saving money. If the rate was 3.35% vs. where I am at now (and not considering anymore extra payments), I would save $6,600 in interest over the life of the loan WITH a lower payment. I love it.

What are your thoughts? Are you re-financing your mortgage? Are you in the market looking to buy, now that rates have decreased this year? Would love to hear your feedback, your experience doing a re-finance and anything else that would be valuable! Thank you for stopping by and talk soon!

-Lanny

Totally agree and I’m in the same boat with a rental property I have. I almost refinanced a few months ago but didn’t want to “start over” with a 30 year so I’m now looking at 15 or 20. I will probably refi regardless of rate cut because it’s also a 5/1 ARM I’ve had since 2009 that has been starting to creep up. Anyway, I’ll be keeping a close watch too! Thanks for the insight…

Jesse –

Nice and smart idea, without resetting that clock. Rates just bounced a smidge the last two days. Keeping my eye keen to the markets, that’s for sure. Any specific institutions you are looking at and/or specific rate?

-Lanny

I tend to shop around and get quotes from various places, even the biggies like Chase and BOA. The 5/1 is currently at 4.375 but I have to keep in mind that to refi for a rental will have a higher rate than if it was my primary residence.

Jesse –

Very interesting. Any thoughts on using a broker in your case?

-Lanny

I am in the process of refinancing as well. Our rate will be reduced by 0.5%, saving us around $200 per month.

JB –

Thank you for the comment and awesome, that is a TON of savings for only a 0.50% reduction. Let me know when it closes. What closes costs as a % are you paying? Also – 30, 20 or 15 year?

-Lanny

I lie on the side of paying off the debt as quickly as possible. Much of that is due to the rate I had and the interest payment total..

In your case, if you get a 20 year $72,000 loan at 3.35% at $412 per month, your total interest would be $26,880 making your loan $98,880. That’s a much better ratio than I had.

I had a 30 year loan of $347,604.11 at 5.50%. If I had ridden out the whole 30 years, my interest payments would have been $363,691.09, making the mortgage total $711,295.20. I paid the house off in 24 months and my interest only totaled $32,604.81. That’s over $330K I did not pay the man…

I wish I could attach the spreadsheet outlining the interest payments…

I do understand investing and getting a higher return than interest paid on the house. I was more in the camp of knowing I am free and clear of any future interest payments hanging over my head. No worries about job loss or illness, etc.. Now I am able to invest the money I would have otherwise spent on the mortgage and it’s interest. It lowered my stress level 1000%.

Cheers,

John

John –

Now THAT is some serious pay down you went through. Goodness!

I am sure you are stress-free and just fueling investments now, how old were you when you did this?

-Lanny

I was 42 when I paid it off. At the time, my mortgage nearly equaled my retirement fund.

One of the big factors wasweI had just had our child and we decided that my wife would be a stay at home mom. Losing her income made it rough to make all ends meet. So I took what I had saved up from my years at amazon and paid off the house. It left me with 28,000.

Then I just started my retirement over.

I’m 50 now and have just got back to where I was in 2011, but with zero debt and a house that is at 198% equity gain so far (Seattle has crazy home prices now – I mean crazy crazy)

Potentially look into a no closing cost loan? I think US Bank offers a product for it and I’m looking into a company called RP Funding for mine, but I think they may only do Florida. My first quote was a 30 year for 3.875%, no closing costs at all on my primary. Now I gotta look into the rentals, would be nice to reset them to 30 years again to improve cash flow. Still waiting to see what happens this month though.

Good luck with what you choose!

Stacker –

Not too shabby, especially with no closing costs. Was that your ending rate with the no closing cost option then??

-Lanny

I think refinancing is a great idea. I have actually debated refinancing again!

last time the bank paid all the costs to get us to move our mortgage over to them at a 2.85% interest rate.

I used the equity we pulled out to buy our solar panels, stocks and private investment. They all pay alot more than 2.85%.

Certain podcasts i listen to, stress how bad it is to have alot of your equity in your house. ( claiming its a bad use of money)

Of course id love a paid off house though, but the numbers tend to push me the other way.

Credit is easy and cheap these days. Pull some equity out now and save it for a “recession” to stock up on deals in whatever asset you choose. Get those drips and snowball moving even faster.

But if you want to refinance just to have a cheaper rate, thats good too.

Looking forward to hearing about what you decide to do.

cheers man!

PCI –

That’s awesome, getting the costs all covered and down to a rate you want it.

I have my ear to the floor, watching rates like a mad man. I want it so bad – as it can help in all facets, as you’ve stated.

-Lanny

Lanny,

Good stuff in that write-up. We are only 2 years into ours, which is at 4% – so it might be hard to beat that for a while. We have been adding a few extra dollars each month towards the principal too, shaving it down faster and faster.

– Gremlin

Gremlin –

Gotcha. The institution I work for has a 3.725% 30 year, therefore, with a rate cut, you could be at 3.60% – I would be shocked if that wasn’t worth it, so early on in your mortgage too. Have you calculated it out??

-Lanny

Lanny,

Not yet, we need a little more equity and I plan on letting a few years pass before I look at it.

– Gremlin

This is one of those weird questions.

The math typically says it’s “better” to refinance, or rent vs buy, etc…

That said, I can’t even begin to imagine the freedom and piece of mind you’d feel once your mortgage is paid off. Personally I’d go the route of paying off the entire mortgage if you can actually do it in a year or two. It may not be the BEST return – but it would allow me to switch careers if I wanted, do something that pays less that I love, etc.

That said, that’s just me. Only you truly know what you should do.

My brain says invest more – my heart says pay down the mortgage..haha

Best of luck whichever you choose.

Jordan –

It always comes down to that, doesn’t it?

First, invest or pay down the mortgage? The brain vs. the heart… every single time.

Then, do you look at the math and say – yes, that makes sense, what am I waiting for?

It’s a dirty game Jordan. Bottomline, it’s about getting into a better situation, right? Either saving money, or shortening the time to maturity. If I refi into a 20 year, I would make an extra payment and be right back where I was headed.

Bring on the rate cut, that is one thing I still wish, in any scenario, would happen.

-Lanny

I’m looking into this as well, but at 4.18% there’s not a lot of room to work. In our prior home we had an ugly rate that I was able to refi into a $350 per month savings after 5 years in the home without adding any time to the length of the loan. I doubt I’ll be able to see that type of win again, but if not I’ll just keep on LTDD’ing, Living The Dividend Dream!

DivDug –

We are in similar boats, no doubt, and yours – a little more difficult due to lower rate. How much time do you have left on your current loan?

-Lanny

I think the answer to your question is, likely, more simple than you may realize. I respectfully don’t see value in waiting for interests rates that may never materialize, and in the process, pay above-market rates (i.e. unless you know where interest rates are heading, this thinking could persist ad infinitum). Keep in mind that you can always refinance if rates drop to your target range.

Assuming one does not know the eventual direction of interest rate movements, in your calculations simply roll the closing costs into a new loan amount (in essence pay down the fees with this larger amount), keep the equivalent loan term, and compare the ongoing monthly payments to your current situation. Designate a monthly savings number (e.g. $50, $100, $500, etc.) that would justify your time and effort to refinance (keeping in mind a longer term amplifies the benefit of a recurring, monthly savings), and pull the trigger any and every time you are able to save the given amount on a monthly basis.

*Your situation is slightly more complicated given the 19.5 year time horizon, but this can be taken into account.

*In terms of your question of how long the process takes, this is entirely dependent on your own financial situation (e.g. 1099 vs W2)

*Next steps: I would advise you have a conversation with a mortgage broker. Look to decrease monthly costs while having fees covered (i.e. “no-cost loan”).

Disclaimer: I don’t work in this industry but know several individuals who do. The process is fairly cut and dry based upon YOUR family’s goals and what YOU are trying to accomplish. I think I’ve presented the high-level ideas fairly, but I would still suggest you speak with a professional for specifics.

Where do you live that closing costs are only $1,750?! In New York my closing costs on my HELOC were more than that!!! I just got the estimated closing costs on my new home and they are firmly above 5 digits.

At $70k, I think I would be trying to aggressively pay that down and clear that portion of the monthly nut up. But to each their own.

Evan –

Thank you for the comment, helpful still. Have to love Ohio and low prices here, that’s for sure. Paying down $70K or investing $70 is the question, always… kills me!

-Lanny