With a name like Smucker’s, it has to be good, right? Today, we go over a dividend growth stock that has 22 yeas of dividend increases.

Not only that, but Smucker’s also announced a newly minted acquisition. Just when you thought the combination of peanutbutter and jelly could not get any sweeter, Smucker’s said, “hold my beer”.

Therefore, time to see if Smucker’s is a stock to buy, after announcing the upcoming acquisition of Hostess (TWNK)! Let’s dive in.

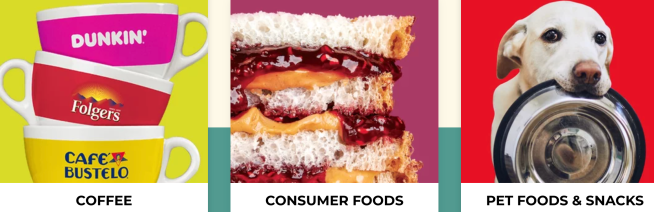

JM Smucker CO (SJM)

Talk about iconic brands! I know we eat plenty of peanutbutter and drink plenty of coffee in our house. In addition, I know the kids love Smucker Uncrustables!

Now, Smucker’s earns over $7 billion annually in net sales, as well as is a $12 billion by market cap company. Talk about getting large.

A nice consumer branded company. Consumer brands do well during inflationary time periods, as they typically can pass on any additional increase to the consumer.

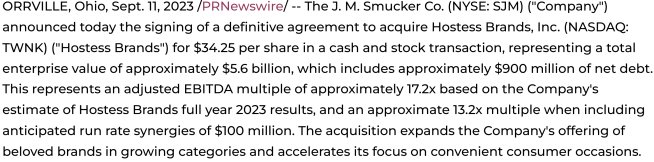

A HUGE acquisition for Smuckers. This transaction is valued at $5.6B, which is almost half the market capitalization of Smucker’s in and of itself.

Smucker’s is buying Hostess for $34.25 per share. This sent the stock up 22% the day of the announcement, though TWNK’s shares were increasing leading up to the official announcement, interesting…. right?

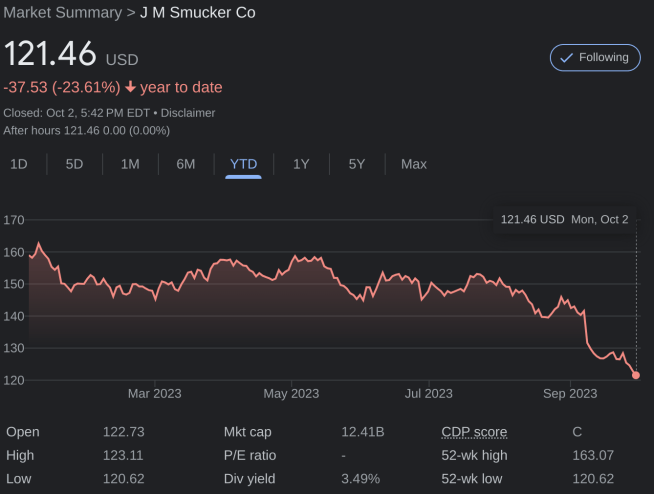

Given the acquisition announcement, how is SJM’s stock price performed during the volatile stock year of 2023?

SJM is down 23% this year! WHOA! Usually with an acquisition, the buyer suffers a price decline. In addition, they are at their 52-week low, essentially.

SJM is looking for synergies and continued growth with their acquisition of Hostess.

Further, their current ratio, based on the latest earnings release, appears to be 1.3x. However, the quick ratio shrinks to 0.72x. Not the worst, and is above the 0.50x threshold I like to see.

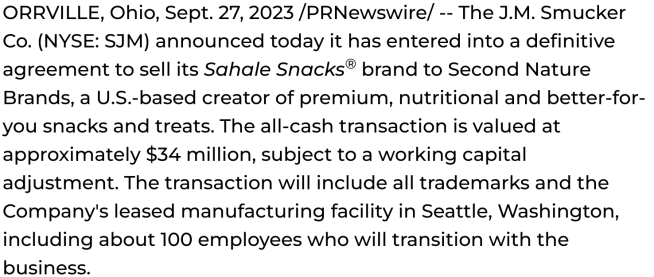

Lastly, SJM also announced a divestiture of Sahara foods for a cool $34 million.

Now that we see what Smucker’s is up to, let’s go run SJM through the dividend stock metrics!

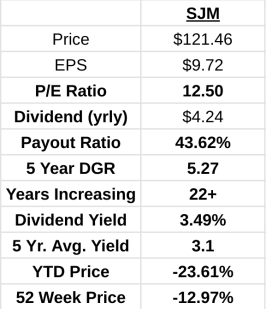

SJM dividend stock metrics

Smucker’s, you are going through the Dividend Diplomat Stock Screener! Here, we focus on 3 main dividend stock metrics:

1.) Price to Earnings Ratio (P/E): We look for the price to earnings ratio < the S&P 500 and the competition.

2.) Dividend Payout Ratio: The preferred dividend payout ratio is < 60%. In fact, we believe the perfect payout ratio is between 40% and 60%.

3.) Dividend Growth Rate: Given we are dividend investing on our way to financial freedom, as we believe dividend income is the best source of passive income, we look at the 5 year dividend growth rate. In addition, we review how many years the company has increased their dividend.

1.) P/E Ratio: A low p/e ratio for Smucker’s (SJM) at 12.5x. Extremely low, in fact, especially for a consumer good stock.

2.) Dividend Payout Ratio: Extreme safety here, at only 43.62%. Typically, consumer goods are much higher, due to low growth prospects, but that’s not the same for Smucker’s, hence their Hostess acquisition.

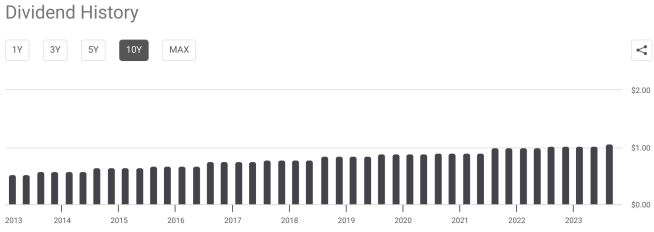

3.) Dividend Growth Rate: 22 years and counting for Smucker’s! Though I anticipate dividend growth to be lower/slower, due to the upcoming acquisition of Hostess, that’s solid progress. Look at the chart below.

Lastly, we’ll take a look at the dividend yield. As an investor, you want to know how much owning this dividend stock pays you now! The yield for JM Smucker Company is now at 3.49%. Only a tad below 3.50%.

Is SJM a stock to buy now?

Now that we’ve gone through the metrics, is Smucker’s (SJM) a stock to buy for the dividend stock portfolio?

The metrics are looking solid. No question there for Smucker’s stock.

If you are in the market for a consumer goods and use their products, I don’t see why you shouldn’t start an entry price here.

For me, I think $120 is the target stock price for adding to our current position.

If you head over to our YouTube channel, you’ll find other undervalued dividend growth stocks that are higher on my list for stocks to buy now! Funny enough, we featured them on one of our latest videos:

How about you? Do you own Smucker’s stock? Are you finding it hard to find an undervalued stock, as the stock market has been bump has heck lately? Share your comments and feedback below!

As always, thanks for stopping by, good luck and happy investing!

-Lanny