Starbucks (SBUX) had a marvelous 2021 year. Further, quarter-1 2022 has already provided significant and promising results. Starbucks coffee lovers are still waiting in long-lines in a post-pandemic, inflation infiltrated time period that we are in. Revenue is up over 19% for quarter 1, bringing in over $8 billion of revenue, net earnings up 30% since the same-linked quarter, BUT one item doesn’t make sense.

Starbucks stock is DOWN 20% so far in 2022! Hence why this might be a great dividend growth stock to buy now! Check out the article!

Starbucks (SBUX) Stock

Talk about falling from highs. In fact, the 52-week high for Starbucks stock was $126. The stock is now down almost $33 per share or 26%! What is going on with Starbucks stock?!

Investors and analysts are predicting lower earnings for this coffee and global icon giant. Starbucks slightly reduced their guidance for 2022, though they crushed quarter-1 for 2022, which is interesting. The company is facing strong headwinds from supply chain and – due to that – inflation, aka rising costs. In addition, the labor market is absolutely crazy right now, with unions and employees with almost all of the leverage.

Therefore, the stock price has plummeted in 2022, which has dividend investors very happy. Why? Dividend investors love when dividend growth stocks go on sale. Could this be a chance to buy passive income, for less, relating to Starbucks stock? Time for a dividend stock analysis on Starbucks stock.

starbucks dividend stock analysis

As you know it’s time to review Coca-Cola with the Dividend Diplomat Stock Screener! Here, we focus on 3 main dividend stock metrics:

1.) Price to Earnings Ratio (P/E): We look for the price to earnings ratio < the S&P 500 and the competition.

2.) Dividend Payout Ratio: The preferred dividend payout ratio is < 60%. In fact, we believe the perfect payout ratio is between 40% and 60%.

3.) Dividend Growth Rate: Given we are dividend investing on our way to financial freedom, as we believe dividend income is the best source of passive income, we look at the 5 year dividend growth rate. In addition, we review how many years the company has increased their dividend.

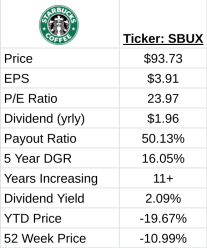

1.) P/E Ratio: Starbucks has a price to earnings ratio, as of February 11th of 23.97. This is right under the S&P 500 p/e ratio of 25x earnings. McDonald’s (MCD) p/e ratio is also around 23. Therefore, fairly valued right here.

2.) Dividend Payout Ratio: Starbucks pays a nice $0.49 per share, per quarter dividend or $1.96 per year. Given the expected earnings are $3.91, Starbucks has a dividend payout ratio of 50%, perfect! Still room to grow and definitely room to maintain their dividend.

3.) Dividend Growth Rate: Though not a dividend aristocrat, Starbucks has increased their dividend for 11 straight years, at a growth rate of 16%. Now, the last dividend increase stood at 9%, going from $0.45 to $0.49. If Starbucks elects another $0.04 increase, that is 8% and a $0.05 increase is 10%. What will Starbucks do in 2022?!

Lastly, we’ll take a look at the dividend yield. As an investor, you want to know how much owning this dividend stock pays you now! The yield for Starbucks is 2.09%, which is approximately 70 basis points higher than the market. In addition, their currently yield is 22 basis points higher than their 5 year average, very good indeed!

is starbucks a dividend stock to buy?

Now that we’ve gone through the metrics, is Starbucks a stock to buy for the dividend stock portfolio?

What an iconic brand and logo, that Starbucks (SBUX) has. As an investor, you have to love the brand loyalty and recognition that Starbucks commands. Those lines definitely do not ever become any shorter, by any means.

There are plenty of negative headwinds right now for Starbucks. You have 3 massive items – supply chain issues that is causing inflation and rising costs. You then have the union and labor issues, causing increases in price (due to paying more for hourly rates and salaries), not to mention a possible lower quality. Then, you also have rate increases on the horizon.

All this has sent Starbucks price to the sub $95 mark. I have been buying a share here and there of Starbucks at $95.00. To buy more, I’d consider a price point of $92 for my next purchase point on Starbucks.

If you head over to our YouTube channel, you’ll find other undervalued dividend growth stocks that are higher on my list for stocks to buy now!

How about you? Do you own Starbucks stock? Do you think Starbucks is a stock to buy now in this significantly volatile stock market? Share your comments and feedback below!

As always, thanks for stopping by, good luck and happy investing!

-Lanny

Thanks for the review guys. I believe they will be able to pass labor and inflationary costs onto customers. I don’t own any shares in SBUX currently but now that the yield is above 2% I would consider buying. It definitely has the potential to become a dividend aristocrat. I will be watching closely over the next while to see if there is an opportunity to start a position.

Londoncalling –

I am realllly hoping it hits $92, come on!

-Lanny

Order filled this afternoon on my initial purchase. Will add more if it goes down to $91.

Climbing on my soapbox for a second in regards to your thoughtless aside of”union and labor issues, causing increases in price (due to paying more for hourly rates and salaries), not to mention a possible lower quality. Do you have the same concerns with other unionized companies in your portfolios such as Delta and AT&T? At SBUX it appears to be more about work rules and training than salaries. Getting off my soapbox …

Yes we own the stock and just moved a chunk from one of the IRAs to the taxable account as part of the 2022 RMD (old cost basis $3.22, new basis: $100.12). Other than dividend reinvestment, I don’t expect to buy more as there is plenty more waiting to be moved with future year’s RMDs. My example does prove your point on low current yield, high DGR stocks.

Charlie –

Love the comment. Luckily, I did sell my DAL position earlier this year and outside of reinvestment, not buying AT&T for the time being. Obviously – airfare prices are sky high right now and something has to give in the telecommunications industry again from a data plan and internet costs. Price increases coming there? Less competition too…

What do you think will happen in the telecom industry over the next 90-180 days?

Appreciate the perspective.

-Lanny

Sorry about the rant but the first quarter of my career was as a union officer with T before accepting a promotion into management prior to retiring (early) as a mid-level manager. I view T’s spin/merge of the content division as the latest in a long series of missteps for the company as I ultimately think content will be king – particularly with the metaverse evolution.

The big three carriers are now essentially commodity purveyors and IMHO will be fighting to retain subscribers throughout the 5G rollout keeping price increases in check (less than inflation) for the next year or two. (Look at the upgrade deals available). It will be interesting to see how – or if – T grows the dividend after this spin and initial associated div cut.

Charlie –

Agreed. Another commodity you can move/switch from. Here’s a take – what about home internet – does Verizion starting winning customers over from that? Does T Mobile offer that, yet? What’s the “differentiator” here? Hmm…

Still own years of building your T Shares?

-Lanny

No – sold all years ago at about $70 and reinvested most in bonds (~8.5% yield until they were called). Only began re-nibbling a little about 2018.

Yes (like the others), TMUS offers home in some areas, so no real differentiator that I can tell.

Nice post. I own fractional shares of SBUX, but I don’t yet own a meaningful amount of the stock. However, I do plan on changing that in the next few weeks.

Kody –

Keep us posted, I love it. LET’S GO!!

-Lanny

Love me some SBUX. Added some for myself and “baby” DivHut after their earnings miss. Long term, I think they’ll be able to adjust pricing to meet inflation concerns. Dividend growth is still strong and you have to love a high margin business like SBUX.

Just a follow up question. SBUX is trading at $77.98 as of 4/25. The ‘buy point’ you were hoping for back in February was $92 when it was $93.73. Back up the truck and load up on the stock at $78ish or are the issues facing the company worth pausing for now?

Thanks!

M