Welcome back! After the first two posts, I can see now the heat coming from the articles and the insight that individuals are also providing through their comments. We all want to save on taxes, reduce the liability, invest more money and keep more of that money, which we earn through our sources of income. Here we are… Part 3 to reduce taxes and invest MORE. This is possible everyone, VERY possible. The first portion of my strategy was to maximize my 401(k) with my employer, which will result, in this first year, a savings of OVER $5,000 and the second portion of the strategy led to tax savings of over $1,000 MORE! However, as you guessed it, it does NOT end there.

The Strategy, continued

As I had begun in my first post on maximizing my 401(k) through my employer, to save just over $5,000 in taxes, it leads to another portion of what more we can do. It leads to another avenue of investing, tax savings and building assets that produces cash flow for you. Is there more? What else could you do? Someone may ask. In my eyes, as with life itself, there is always something more that you can do.

Carried forward from that first post — > To begin, I save approximately, at a minimum, over 60% of my income each and every month. Therefore, investing capital, luckily for me, has never been a huge problem. Looking back, I had over $37,000 invested (including dividends) from my two hands into the market, without considering part 1, this part and further portions of my strategy. If you strip out dividends received last year, I still eclipsed almost $32,000 – to me, that’s a fricken ton of money! Now what if, WHAT IF, I could have more funds at my disposal without negotiating my salary or shaving any further of my living expenses? We all know that I believe, wholeheartedly, in the concept of every dollar counts, and this is no different. Taxes. The biggest expense I have, Uncle Sam’s taxes. We all know about my struggles during the first 4 months this year, having some big tax payments in April to make (let’s say over $2K I owed). I looked back at 2015, and I paid a whopping $19,046 in state/local/federal taxes! This doesn’t even include FICA, Property or other form of taxation throughout the year. How amazing is that? Well, I guess not too amazing, since that’s almost $2K per month gone, out the window.

Now what could I do to reduce that, without reducing the money coming into the pocket? Well, to reference portions of “The Strategy” (as I like to call it):

Part 1 – Maximize your Pre-Tax 401(k)

Carried forward from the second post –> For starters – H.S.A. (Health Savings Account) is a tax-advantaged medical savings account available to taxpayers in the United States who are enrolled in a high-deductible health plan (HDHP). The funds contributed to an account are not subject to federal income tax at the time of deposit (Wiki). I know my current employer offers one and also, if you are single, contributes to my account at $500/year or $1,000/year for a family. The maximum amount you can contribute in 2016 is $3,350. Therefore, in my scenario – i can contribute $2,850. On top of this – I will save over $1,000 by maxing out the health savings account!.

How? See my link below for part two of my strategy:

Part 2 – Maximize your Health Savings Account (HSA)

I will still provide a link to MadFIentist – as he shows the way on how to access these funds earlier – > LINK

Strategy 3 – Maximize or contribute to traditional ira

Now that saving over $6,000 was discussed from the two articles above, we will talk about what more you can do. This will be strategy 3 or part 3 to save more in taxes, so that you can invest more. We will talk about the best case scenario and my real-life scenario.

So there is the individual IRA account that you can also establish. Now – what TYPE of account you can invest in depends on your Modified Adjusted Gross Income (MAGI), as there are different thresholds that could prohibit you to invest into one or the other, or both account types. There are two account types – Traditional IRA and a Roth IRA. It becomes less likely to not be prohibited form investing into a Roth IRA, but please resort to IRS websites for this information and more likely if you have a moderate income to be prohibited to invest into the Traditional IRA. The difference between the two accounts are one is deductible from taxation – the traditional IRA (you can deduct your contributions from reported income), and one is non-deductible, the Roth IRA (aka, you pay with after taxed-dollars). Additionally, if you are under 50, you can contribute $5,500 for the 2016 year into one/combination of the two accounts, and over 50 – that limit increases to $6,500.

What does this mean? Well, as I said, we will go over two scenarios – the picture perfect scenario, where you can invest the full $5,500 into a traditional IRA vs. my scenario. The picture perfect scenario will kick start us:

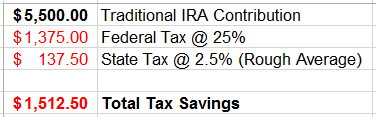

You are able to invest $5,500 into a traditional IRA. After maximizing your 401(K) and your Health Savings Account (HSA), your MAGI was just reduced by $20,850 ($18,000 for 401(k) and $2,850 for HSA as the employer kicked in $500) and you are able to be within the threshold to maximize your traditional IRA. If you invest the $5,500 into the traditional IRA, here would be your tax savings using a 25% federal and 2.5% state tax rate (rough average):

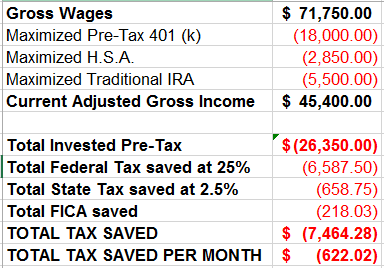

That is a whopping $1,512.50!!!! Now… let’s combine what we did in part 1 and part 2, to really bring it to life. This chart will be similar to the chart that I placed in the part 2 of the strategy:

DAYUM! Total to be saved in this normal perfect scenario is $7,464.28 when you combine all 3 strategies into one. That is an extra $622 to invest in, on a per month basis. So here you are, investing $26,350 already in pre-tax dollars, which then allows you to invest an additional $7,464 into the market, for a total of $33,814. Holy smokes. Since I already invested that much with after-tax dollars, this would essentially bring me closer to $40,000 invested in a single fricken year! It is insane. As a status check, with dividends reinvested, I have invested $21.2K into the market through the 10th of August. With implementing the bulk of these strategies, I’ll be cruising over $40K.

My situation. My situation is a tad different, as I won’t experience the full tax benefits laid out above. Why? I know I talked a little bit about this in the first article, but in the first part of the year – I contributed a few thousand to a Roth IRA already (Yes I could always pull the contributions out and re-direct, but don’t feel like making a few transactions), and had invested into my Roth 401(k) for a portion of the year. Therefore, my tax savings will be roughly $6,625 in the first year of deployment of my strategy. It’s not the full benefit, but hey – that’s over $550 extra per month for me to invest!

How do you access these funds earlier than what is required or mandated via the IRS? Definitely read Madfientist’s article located HERE. As this article describes the systematic approach to doing so, based on the tax code today. Reading his article has been one of the best things I’ve done, hands down.

Conclusion on the tax strategies

With all of this being said, now that we are three articles down – how does everyone feel? If you invest into a Traditional IRA and are in the 25% tax bracket – you can save a load of money here. Further – I used a conservative tax rate of 2.5% for state, where based on my income level – I actually pay 3.465%, so my tax savings are even higher and I am sure you can too. There are ways and methods in accessing the funds earlier, as well, as I have linked above. Here is what I also have truly realized. Saving and investing is amazing. The methods for tax strategy that we choose to perform are our own decisions and is definitely based on what works with you in your situation. We are all doing the most important thing when we read these articles and consider them – and that is the pinnacle of the path to financial freedom – SAVING & INVESTING. No matter what we are making great decisions, and that’s what I truly want to say. In my situation, I believe I can use these strategies to be financially free, smarter and potentially faster. This will continue to evolve, I am sure, as tax rates, brackets, maximized amounts, etc., will all change with time. And guess what? I am looking forward to it all.

Thank you everyone for reading. Please share your thoughts, conclusions and assessment from the items listed above and in previous articles. I cannot wait to read them and have deep discussions on the pros/cons and methods of the strategies listed. Keep on saving and stay consistent with investing everyone! We are all doing great and God bless.

-Lanny

These accounts are really magical when you approach them this way. Congrats on figuring out how to reduce your tax burden. Many happy investment returns!

ZJ,

Pumped you stopped by. Yes, very magical and very interesting, especially when you look at the pure numbers. It took just a full day of review and dedication, as well as the commitment. Commitment will be the ticket right now and will become more normalized once 1/1/17 hits, that’s for sure. As I had to “catch up” to my investing – I am currently doing $2900 per month in the 401K and $520 almost in the HSA through December, Yikes!

-Lanny

Hey Lanny,

I love the articles you have written on reducing tax burden! I completely agree that the best strategy is to max out traditional 401k/IRA for someone who can keep ordinary income below a certain threshold during the conversion (Traditional -> Roth). A question I had pertains to individuals who expect to have a higher income in retirement. My employer, thankfully, has negotiated a 401k plan with the brokerage administrator such that employees can roll over all employee contributions to their 401k to an IRA once per calendar year. Many at my company do not know of these feature (I know it doesn’t apply to every company’s 401k plan) but for a dividend growth investor, I can make the maximum $18,000/year contribution to my 401k, get the company match, and then roll-over my $18,000 into an IRA. Then I can max out the IRA contribution of $5,500.

If someone expects to be making more during financial independence than the ordinary income threshold, whether it be due to a business or inheritance, doesn’t it make more sense for them max out their Roth 401k, roll that over, and max out the Roth IRA? If they use the Traditional 401k/IRA strategy, when it comes time to ladder/convert to a Roth, their ordinary income will be over the threshold and they will then be taxed on the conversion. Would love your thoughts. Thanks!

KB,

I will definitely have to look into to see if my employer, who uses Vanguard, has the option to transfer/roll into my IRA account. As that, of course, would be awesome! I assume you are rolling it into two choices – the same investment or in cash?

Roth IRA MAY make more sense, however – you are still paying ~30% in taxes before you invest that money, whereas – the income you may be producing if you contributed to a traditional 401k/IRA may be taxed at lower levels (think dividend taxes, etc..) even if you are in a higher bracket! Does that make sense?

-Lanny

Lanny,

Yes, you should check into that. What I had been doing is contributing enough to get the company match and the rest went to max my Roth IRA then taxable account. Once I found out I could do this rollover, I started investing as much as possible into the Roth 401k and when January 1st hits, I initiate a rollover from the Roth 401k into my Roth IRA. If I remember correctly, I have the option with Fidelity to rollover into the same investments but I choose to get cash because it doesn’t cost any fees. You are just selling your mutual funds at whatever market value they happen to be at.

Forgive me but I am not sure I follow. Currently, ~20% of my income goes the gov’t: Federal (7%), FICA (6%), Medicare (1.5%), State (5%). The plan for my wife and I is that we want her to retire before 40 and myself before 50. Based on projected expenses, we will not be able to live within an ordinary income tax bracket that allows us to convert a traditional IRA into a Roth without incurring taxes/penalties on the conversion. Then when you add in additional income sources, that conversion is taxed even higher. Does that make sense? Hopefully we are understanding each other correctly.

KB Holden,

I will definitely check into it. No fees, right? Not a one time cost to transfer? Wonder if my Vanguard employer account would do it.

To go from Traditional IRA into a Roth IRA without penalties/cost and a reduced tax burden, this is from MadFientest, so that I don’t have to re-create the wheel:

“Roth IRA Conversion Ladder

The first method for accessing tax-advantaged money early is the Roth IRA Conversion Ladder.

Here’s how it works…

Step #1 – When you leave your job, immediately roll your 401(k)/403(b) into a Traditional IRA. Since all of these accounts are very similar, tax-wise, this conversion can be done immediately and there are no penalties or tax consequences to worry about.

Step #2 – If you think you’ll need to access some of your retirement account money in five years, convert the amount you think you’ll need from your Traditional IRA to a Roth IRA. You will pay tax on the amount you convert so make sure you’re in a low tax bracket when performing the conversion and only convert as much as you need.

Step #3 – Wait five years. While you’re waiting, you can do additional conversions so that you have money to access in years 6, 7, etc.

Step #4 – After five years, you can take out the amount you converted without paying any additional penalties or taxes (you were taxed in Step #2 when you executed the Traditional-to-Roth conversion).”

So essentially you perform a conversion of 401K – > Traditional if needed; then from Traditional – > ROTH. Wait 5 years and then you can start accessing them. You pay tax on the conversion from traditional to Roth, and believe you avoid the penalty if you wait 5 years to access the Roth account.

-Lanny

Hey Lanny,

That makes perfect sense! Apologies for the delay in response. Dividend Growth Investor pointed me to Root of Good (rootofgood.com) and his article on the conversion ladder: http://rootofgood.com/roth-ira-conversion-ladder-early-retirement/

The biggest key to the conversion ladder when maxing out your 401k and traditional IRA is that you need to be able to save enough in a taxable account that you can cover your expenses the first 5 years of the conversion. That’s the caveat with this strategy. I think a lot of people will find themselves in a situation where they are either not able to max out the pre-tax accounts and/or do not have enough left over to save in a taxable account to cover the first five years without dipping into the Roth conversion early.

This might help some folks but since my wife and I fall into this middle ground territory, one thing we are doing is dollar cost averaging into BRK.B each month in our taxable account. It is the closest individual equity to a mutual fund and since they pay no dividend and reinvest internally, it acts like a pre-tax tax-deferred account. Enough of BRK.B investment and growth should cover 5 years of expenses.

Mad Fientist has had some truly amazing tax articles. Your strategy is one I will be giving a lot of thought into in the coming months but I do not plan on living in the US forever so this puts a huge question mark on all tax advantage accounts thanks to the early withdrawal penalty. I know that I can just leave the money in the accounts and let everything compound but that may be slightly unrealistic.

Hope this strategy works out well for you! Can’t wait to see the progress and how your portfolio takes shape with the new strategy.

Stef,

MadFientist was the first blogger/author/poster who could truly show that it is worthwile. You do have a few other steps to walk through, but I know you’re smart enough to find the best set up for you. Let’s just say – my portfolio has cruised over $200K and I have almost $6K in capital built up for additional purchases. My contributions have been pumped up into low index areas automatically, as I don’t time the market, all while reducing my tax burden and building up further capital. It’s been quite interesting. I’ll know more how it really is once I am through September. Good times!

-Lanny

I’m really loving this series of posts. Anytime you can put the middle finger in Uncle Sam’s face, I’m all for it. Nice work sir. I wish you all the best with this strategy.

Hunting,

HAHA. That is too funny. Yes, I love the analytics to it all, the pure stats, as well as the strategic component. My tax returns are going to look quite different from 2015 to 2016, wonder if I’ll be more susceptible to an audit… haha. I hope not!

-Lanny

Great post Lanny! This year is our first year of really going all in on the tax efficiency! Although, I do contribute to a Roth IRA, I mainly do it for the future tax diversification. Otherwise, on pace to max out 401k and hopefully HSA this year!

IPD,

Thank you for coming by. What do you find to be the hardest thing here? What has been the biggest hurdle or struggle point as you go full tax-efficient, well almost (Roth IRA)? Excited to hear what you think!

-Lanny

Excellent post again! Great to see all the opportunities we have and everyone can decide depending on their situation! Definitely will consider these for myself; although, I do not publish my retirement accounts.

-TDM

Mogul,

Thanks for coming by. There are a few avenues, obviously, but maximizing these 3 are HUGE! 2017 will be a very different year as well, as my personal IRA account will have to be on hold until I see where the AGI hits, should be interesting.

-Lanny

Haha – guess who is the accountant here??

Nice post Lanny, that’s a lot of savings! Your system seems like it has a huge amount of different options, very interesting and I’m glad you’ve found a way to make it work for you 🙂

Tristan

DDU,

Hahaha, exactly. The number crunching is hard core, but it is actually very simple. What ends up being the hard part is the freedom aspect to it. As I will have to convert and ladder when it’s time to retire and access the funds early. I have stayed committed so far, and so far, so good, eh? haha. What are your thoughts with it? What’s your favorite out of the 3? OR do you not like any of them?

-Lanny

Lanny,

Your 3-headed tax attack is swell. It is something that is difficult to explain, until you see the hard results it makes.

I just got my first HSA with my new job, and it added a better 401K match. I am not yet at the point of maximizing all of these, but that time will come.

Much appreciated article(s),

-Gremlin

Gremlin,

AWESOME! Mad at you!! Joking, pumped for your better match. But yes – the 3 headed dragon: Maximizing 401K, HSA and Traditional IRA. AKA insane! The savings and further investing is such a beautiful thing! Congratulations, as well on the HSA on the new job. Do they add any themselves? Also, what’s the match you are getting now??

-Lanny

Oh yea, the new 401k is 6% – one to one. I was get 4% – one to one, but the extra % plus the big salary raise goes a long way.

Gremlin,

You suck. Kidding. 6% match one to one is INCREDIBLE. You don’t see that too often at all, WAYYYY better than what I’m getting. And yes – causes you to put more in and with a bigger salary, that match is plenty better : ) Congrats on that, very, very good stuff.

-Lanny

Nice work – good stuff on a tricky topic!

Libre,

Thank you very much, let us know if you have any questions, and I’ll be sure to jump in and answer them!

-Lanny

Hi Lanny,

Great article and it shows the benefits of finding a good tax strategy! The tax savings are also higher when you include the tax-free dividends within an IRA before distributions are taken.

I’m not a tax expert but there are income limits for when you can make deductible Traditional-IRA contributions. For single filers in 2016, deductible contributions start phasing out above $61,000 AGI and are prohibited above $71,000; for married filings it starts above $98,000 and stops at $118,000. Although you can still make non-deductible contributions to a Traditional-IRA.

Best wishes,

-DL