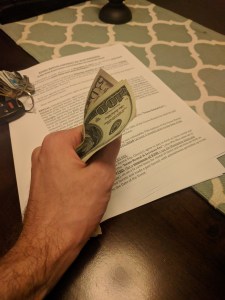

We all know this is the time of the year, especially for us Northerners, Easterners and Mid-Westerners, when the weather can be all over the place, similar to the stock market. We literally had record-setting freezing temperatures, where if you were outside for minutes, frostbite would occur. Only to have 60+ degree weather and be able to be outside with shorts and a t-shirt. The topic of energy preservation, frugality and saving money really hit home from this, as well has assisting a few families on how they can save, each and every month. Therefore, it’s time to list out THREE EASY habits to introduce, if not already, that will reduce energy and money, each and every month!

Continue reading →