If you do not know by now, my wife and I have been buying Vanguard’s High Dividend Yield ETF (VYM) for almost 3 years straight, on a weekly basis.

We did this ETF for a few reasons – to acquire shares in a yield that is usually north of 3%, with a dividend growth rate in the 6%-8%.

It’s Q2 and Vanguard announced the dividend distribution for the quarter – so how does it look?

Vanguard’s High dividend Yield ETF (VYM)

This ETF has been around for almost 20 years and boasts a very low 0.06% expense ratio, slightly higher than the Vanguard S&P 500 (VOO) ETF.

The 10-year average rate of return is over 9%, and for that to be an average return, I love it and nod my head with it, even if there are other ETFs that return higher – again – all about goals and perspective here.

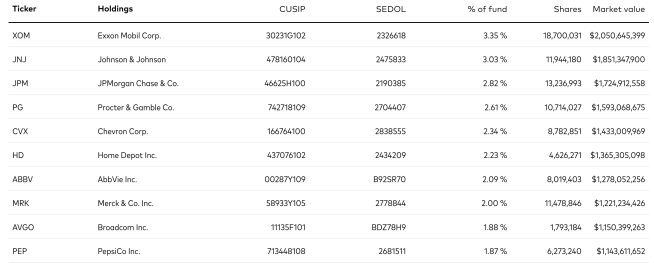

There are 466 different dividend stock holdings in the portfolio with a heavy concentration in financials and consumer staples. Think – JP Morgan (JPM) and Procter & Gamble (PG). In fact, here are the top 10 stock holdings of the ETF:

Do you see how many dividend aristocrats there are above? Technically, if you count AbbVie (ABBV), I count 5 of the top 10 are dividend aristocrats. These are stocks that have increased dividends for 25+ years, without break. In addition, there will be more to join that group, too.

Fairly diversified among equities, how about that dividend?

Vanguard’s VYM Dividend

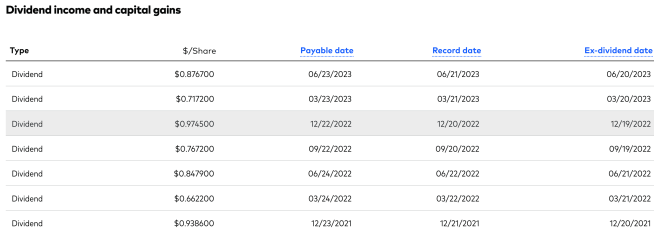

As you can see they announced an $0.8767 dividend for the second quarter of 2023. This is favorable against the prior year dividend of $0.84790 or 3.40% higher than last year’s Q2 dividend.

In fact, the year before that, the Q2 2021 dividend was $0.7523. We are really starting to see growth in quarter 2 for VYM.

Year-to-date, the dividend totals are ($0.8767+ $0.7172) $1.5939 vs. $1.5101 ($0.6622+$0.84790) in 2022. This is 8.38 cents higher or 5.55% higher in 2023 vs. 2022 so far.

Why does that matter? Though you can’t predict future results, but an annualized 11% growth rate is fairly strong for dividend investors. My overall, average dividend growth rate, is around 6% this year. Therefore, this is looking to possibly 2X that!

What does that mean? My income, my forward passive income, from VYM can grow 11% this year without doing anything. In addition, I dividend reinvest (DRIP) my shares when dividends are hit. This adds another 3%+ to the overall forward income, on top of the dividend growth.

As a conservative, dividend investor with deeper diversification than other ETFs, VYM fits the bill, 100%, for me.

Vanguard’s VYm is my dividend beast

Now that my wife and I own well over 1,000 shares, the dividend income increase from the Q2-2023 announcement was materially felt for us. This dividend announcement added over $30 to our forward dividend income. That is on top of the 8 potential shares we are about to receive from reinvestment once the 2nd quarter dividend is paid (which will add over $25 in forward income!).

VYM is my dividend beast on my pursuit to financial freedom. The combination of dividend growth, dividend yield and diversification just does it for me.

At this rate, we will be dripping over 32 shares per year, which that alone adds $107 in forward passive income. Then, as a baseline, 1000 shares produces over $3,300 in dividend income. At a conservative dividend growth rate of 7% (projected to be 11% this year based on first two quarters), that adds almost $250 in forward income.

Therefore, my dividend beast stands to add over $350 in additional income per year. There is no stopping that and my investment with VYM will compound for decades and generations to come hopefully.

How about you? What is your dividend beast? Do you own Vanguard’s VYM? Let me know in the comments!

As always, good luck and happy investing!

-Lanny

VWELX in the IRAs and VEIRX in the 401k. Less Divs then VYM, and Mutual Funds… not ETFs. So far so good though. Why VYM as opposed to VHYAX? Do you simply prefer the ETF route over the mutual?… Why?

Thanks for the review of VYM. VYM is one of my primary holdings and have been buying it since 2015. While there are other higher yield dividend ETFs, VYM is more diversified and protects you more on the downside vs. other ones out there and their dividend in terms of yield and growth are great (like you mentioned above).