The name of the game is dividend investing. For nearly 6 years, we have talked non-stop about dividend growth investing on this website. We are always talking about Dividend Aristocrats, as we always focus on finding companies that increase their dividend. However, I realized that we have never taken a step back to explain what companies are Dividend Aristocrats and discuss what makes them so desirable. So today, we will do just that. Enjoy the next installment of our Investing 101 series!

Who & What Are Dividend Aristocrats?

No, we aren’t asking “What is a dividend?” We covered that topic in our very first Investing 101 post! As a refresher, a dividend is a money paid to a shareholder, most commonly in the form of cash or stock.

While there are thousands of companies that pay dividends, Dividend Aristocrats are an elite subset of the dividend paying population. A Dividend Aristocrat is a company that has increased their dividend for at least 25 consecutive years and are a part of the S&P 500.

Dividend Aristocrats are companies that have increased their dividend for 25+ consecutive years.Click To TweetAs of April 2020, there are 64 Dividend Aristocrats. The list is not stagnant either. Each year, companies are added based on their dividend excellence or removed if they had to break their dividend streak. An example of a former Dividend Aristocrat is Pfizer (PFE), a company that we both own. Pfizer cut their dividend during the financial crisis in 2008. The company is slowly rebuilding their dividend increase streak; however, they are a long way away from earning the Dividend Aristocrat title once again.

See Sure Dividend’s Full Listing of Dividend Aristocrats

See – Our Dividend Stock Portfolios, Which Include Many Dividend Aristocrats

And if you are more of a visual learner, stop by our Youtube Channel to view our video about Aristocrats!

What is So Special About Owning Dividend Aristocrats in Your Portfolio?

The two of us, and so many in the dividend investing communities, have a long-term investing mindset. In addition, as we both relentlessly pursue financial freedom, we are looking to build a growing, passive income stream by investing in dividend growth stocks.

A Dividend Aristocrat could not be a better poster child for this investment strategy. Companies that are Dividend Aristocrats have demonstrated their ability to not only pay a dividend through tough economic cycles, but also GROW their dividend during the challenging times. These companies have demonstrated their ability to think long term, build steady, growing cash flows, and find ways to grow their businesses, revenues, income, cash flows and most importantly, their dividend.

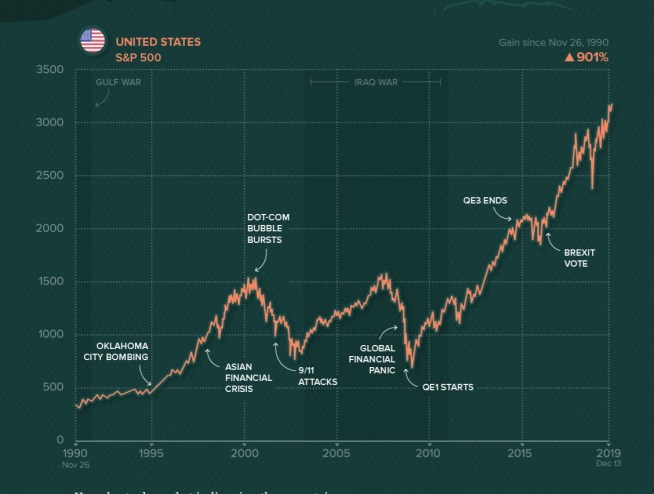

Companies on this list have increased their dividend annually since 1995 (I was six at that time, by the way!). Since then, these companies still increased their dividend through two major financial downturns: The Dot Com Bubble and the Great Recession (i.e. Financial Crisis). Below is a chart of the S&P 500 from 1990 through today, showing each of the major events that have occured since 1990 (Source: Visual Capitalist)

For those that are looking to build a growing income stream for their retirement, whether it is early or late, you would be crazy not to build your portfolio’s foundation around companies that have also demonstrated their ability to plan for the long term. That’s what excites me every day and is why we monitor dividend increases so closely on this website.

Investing in Dividend Aristocrats

Now that you know about Dividend Aristocrats, are you ready to run out and buy all 64 of them?? Of course not! That is because each investment decision should account for a multitude of factors. Some may be overvalued while others may have too low of a dividend yield for your appetite. After all, there is no rule that says a Dividend Aristocrat has to have a high dividend yield. There are plenty of Aristocrats that have low dividend yields.

Over the years, we have championed our Dividend Stock Screener and written many articles about investing about dividend growth stocks. Naturally, many of the articles have focused on Dividend Aristocrats. So if you are looking to start investing in dividend growth stocks, here are some articles from our website that would be a great starting point.

Our Dividend Stock Screener – This page on our website discusses how we initially screen for dividend stocks. We use 3 simple metrics (hint: one of which is dividend growth history). If a company meets our metrics, we will then proceed with performing further investing research to arrive at a decision. Our screener is designed to always identify Dividend Aristocrats if they pass the first two metrics.

Top 5 Foundation Stocks for a Dividend Investors Portfolio – Lanny wrote this legacy article in 2014 and the list has remained the same ever since. Starting your dividend growth stock portfolio can be very difficult, especially if you are new to investing. Lanny identifies his Top 5 stocks to help build that solid foundation for your portfolio and allow your passive income stream to really start rolling (and growing). All 5 of the stocks on the list are Aristocrats too!

Dividend Aristocrats with Low Debt – Bert put this list together after receiving several dividend cuts from non-Aristocrats with a lot of debt on their balance sheet. After being burned by these companies during the Coronavirus pandemic, his refined his investment strategy to focus on investing in Dividend Aristocrats with low debt on their balance sheet.

The Power of Dividend Reinvesting (DRIP) – Okay, so this article isn’t exclusively about Dividend Aristocrats. However, are you still not sold on the dividend growth investing strategy? One of the first articles on our blog explains why dividend reinvestment is such a powerful. It also provides a great example demonstrating the math behind the madness.

There are also countless bloggers out there that also write about dividend growth stocks and Dividend Aristocrats, like us. We’ve listing many (but not all) on our Blogroll page. We also write an article each month summarizing the dividend income summaries from many of the other bloggers in the community. Trust us, we don’t know everything about investing. So stop by their websites so you can learn as much as possible.

Lastly, for those that do not have the stomach to invest in individual stocks but want to own Dividend Aristocrats…do not worry! You can still get exposure to these great companies by investing in a Dividend Aristocrat ETF! Two example ETFs are SPY – SPDR® S&P Dividend ETF. and NOBL – ProShares S&P 500 Dividend Aristocrats.

Summary

In conclusion, I hope you learned a little more about Dividend Aristocrats today. If you haven’t, I hope you at least come away with a better understanding and appreciation for why us and investors focused on financial freedom and early retirement love investing in Dividend Aristocrats. We are all long-term investors here. Having a long term mindset allows you to focus on the companies that may not be sexy, but will allow you to build a reliable, growing income stream. In the end, the name of the game is financial freedom baby!

Do you invest in Dividend Aristocrats? If so, which ones do you currently own? Do you have any additional questions about Dividend Aristocrats that you would like answered in the comments section?

Bert

I’m a huge fan of Dividend Aristocrats Bert. Currently, there are 20 stocks in my portfolio. I just counted. Of the 20 stocks, 15 of them are on the Dividend Aristocrat list. And one of the companies that didn’t make the list is Altria Group, which I believe is a Dividend King, but somehow not on the Dividend Aristocrat list.

You mentioned PFE. That was one of my original stocks and it sucked when they had to cut their dividends during the recession. But, as you mentioned, it’s on its way to rebuilding its dividend and I’m still invested in the company.

This is a great refresher post for me. That’s because I’ve started over rebuilding my portfolio from scratch. It’s always good to get back to the basics.

-Stay safe.

Dividend Aristocrats are great. I love them. That’s why I’ve created a nice monthly updated Excel-table with over 1.000 of the best long-term dividend growth stocks. All Dividend Aristocrats are incluced :-). You find them on my blog. Altria is the top yielding stocks but more important than a high dividend is dividend growth. It’s good to see that there are still low debt-loaden Dividend Aristocrats. Thank you for the great article.