April was a great month for dividend income! We had over 20% growth and nearly crossed a milestone number. In this article, we detail our April dividend income summary in detail!

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income with dividend income. One day, my dividend income will be large enough to cover my monthly expenses and allow us to retire early. That is why we are always relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We save a high percentage of our income each month, to help fuel our dividend stock portfolio. Having a high savings rate is a key pillar of our strategy and helps fuel the fire and push the snowball further down hill. While we are waiting to invest our money in the market, it is earning a high interest rate in accounts. There is NOTHING more critical than maximizing EVERY DOLLAR in your savings account.

READ: How To Maximize Your Cash – 4 Simple Methods!

The 3 primary savings accounts I use are:

- SoFi – 4.6% APY on all savings accounts (lower for your checking account). The race for deposits is INTENSE! Banks and credit unions are offering great savings rates.

- Capital One 360 Savings – 4.25% APY – We use Capital One for our checking and savings account.

- Weathfront – 5.0% without promotion. 5.5% with an extra .5% by signing up using my referral link (Click Here).

Read: Interest Rates on High Yield Savings Accounts Are SOARING!

How Do We Find Dividend STocks to Buy?

That’s easy. We use our dividend stock screener with every stock purchase! This simple, 3 step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Watch: Dividend Diplomats’ Dividend Stock Screener

The three metrics of our screener are:

- Price to Earnings Ratio less than the S&P 500

- Payout Ratio less than 60%

- History of Increasing Dividends

- Dividend Yield (BONUS)

We use this stock screener for each purchase and have consistently done so for 10+ years on our journey to financial freedom!

Bert’s April Dividend Income Summary

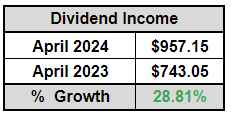

We closed out the month in style, that is for sure. In April 2024, we received $957.15 in dividend income! This was a nice 28.81% increase compared to last year. This is going to be a short lived celebration. You will see why later in the article!

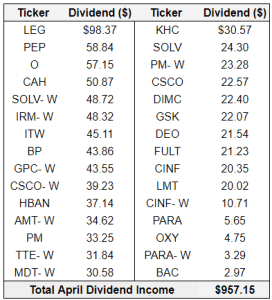

The following chart details our individual dividend stock holdings. This shows every single dividend we received during the quarter!

Dividend Income Observations

Well, this is going to be short lived. Why is that? Courtesy of Leggett & Platt, this dividend income will come crashing down. Leggett & Platt chopped its dividend down 90%! Unfortunately, this large item is the only observation that really matters. On top of it, the SOLV payouts is not recurring since it was made in conjunction with the MMM and SOLV. My July dividend income will look much different than this month after all.

There were still some positives, even with the negative news. We have successfully grown our Medtronic Dividend due to our purchases in 2024. The $30 dividend for this Dividend Aristocrat is oh so sweet!

In fact, there were only 5 companies that paid us less than $20 in quarterly dividends. That is what is freaking sweet. Slowly, but surely, we are trying to make sure income from our positions is substantial. We have been closing out smaller positions and investing them in the current positions we hold. That hard work is finally starting to pay off. This will hopefully continue if Paramount will ever get acquired!

Summary

There are still a lot of positives despite the negatives headwinds that will be coming my way in July. Our dividend income continues to trend upward, and that is what really matters. The goal is to ignore the noise and the bad news and focus on the long term goals instead. That’s what it is all about! Nearly hitting $1,000 in my lowest paying month was exciting. We look forward to working our tails off to get back after the dividend cuts!

How much dividend income did you receive in April? Did you set a record?!

Bert