This is what dividend investing is all about! Investing in dividend stocks allows YOU to earn dividend income, the best passive income stream! Bias, you better believe it.

Time to dive into Lanny’s April 2024 dividend income results! Were records set? Love the end of the year Dividend Tally, as the retirement account is PUMPED UP. Almost to financial freedom? One day and one month at a time!

Dividend Income

Dividend Income is the fruit from the labor of investing your money in the stock market. Further, Dividend Income is my primary vehicle on the road to Financial Freedom, which you can see through my Dividend Portfolio.

How do I research & screen for dividend stocks prior to making a purchase? I use our Dividend Diplomat Stock Screener and trade on Ally’s investment platform (one of our Financial Freedom Products) and on SoFi.

Related: Dividend Diplomat Stock Screener

Related: Financial Freedom Products

Related: 3 Financial Freedom Products

I also automatically invest and max out, pre-tax, my 401k through work and my Health Savings Account. This allows me to save a TON of money on taxes (aka thousands), which allows me to invest even more. In addition, all dividends I receive are automatically being reinvested back into the company that paid the dividend, aka Dividend Reinvestment Plan or DRIP for short. This takes the emotion out of timing the market and BUILDS onto my passive income stream!

Related: Tax Strategy – Part 3 to Reduce Taxes & Increase Investment.

Related: The Power of Dividend Reinvesting

Related: Why I Don’t Time or Predict The Market

Growing your dividend income takes time and consistency. Investing as often, and early, as you can allows compound interest (aka dividends) to work it’s magic. I have gone from making $2.70 in a single month in dividend income to well over … $10,000+ in a single month. My dividend income record was set in December of 2021. Was it broken this month?! The power of compounding and dividend reinvestment is a wonderful component to the portfolio. Each and every month, whether big or small, I continue to report the passive income that dividend investing provides me. Why?

*Not pictured is my wife’s dividend income above*

I want to show YOU that dividend investing makes it possible to achieve financial freedom and/or financial independence. We all start somewhere, but consistently investing, compounding (reinvesting) dividends and keeping it simple, allows you to be in a significantly better position than most. Further, if I can grow this portfolio and income stream, YOU can too.

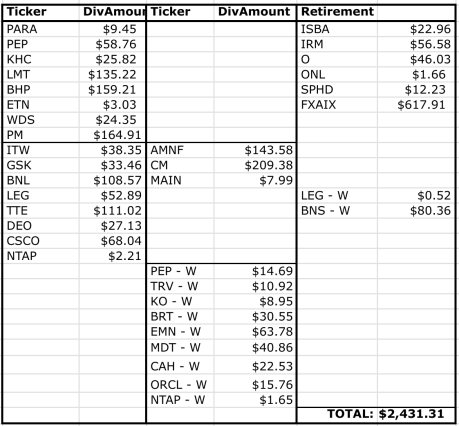

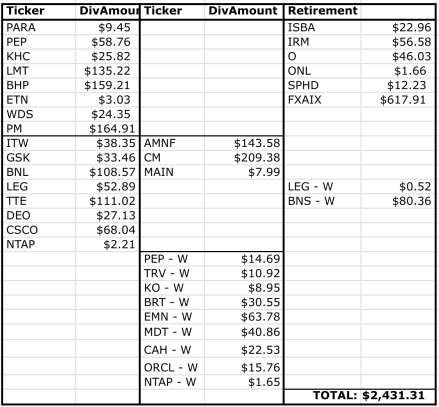

dividend income – April 2024

Now, on to the numbers… In Aprl, we (my wife and I) received a dividend income total of $2,431.31. SO close to $2,000 in an off-month. Soon, very soon. I’ll continue to build the passive income levels to get there.

The amount and number of stocks listed below show you what it means to buy and hold for the long term. Most of the positions I have owned for YEARS, letting dividend growth and reinvestment do it’s thing. This is what dividend investing for financial freedom is all about. The passive income stream is growing at a RAPID pace.

2023 was up 24%. 4 months down in 2024 and the S&P 500 is up between 7% and 8%. Consumers are still strong but earnings have been mixed, to say the least.

The fed has now paused for 7 months, as they let data and the interest rate hikes they’ve done over the last 2 years really sink in. Expectations are rate cuts next year. Will it be 2? Will it be 3? Who knows, I turn off the noise and keep investing.

Here is the breakdown of dividend income for the month, between taxable and retirement (far right column, under “Retirement”) accounts. In addition, “W” means my wife’s account:

Pepsi (PEP) stock paid in April vs. March like they usually do, so that helped prop this figure up. In fact, Lockheed Martin (LMT) and their dividend arrived in my portfolio on April 1st. Really throwing my results out of wack!

In addition, my real estate investment trust (REIT) in Broadstone Net Lease, at over $100 in dividend income, is really starting to show the power behind them. In addition, even though they have a dividend yield close to 8%, BNL just increased their dividend this past week, as well.

Big Oil was carrying the torch, with BHP Billiton (BHP) and Total Energies (TTE), sending massive dividend payments my way. I’ll take it.

Then there’s the sin stock with Philip Morris (PM), sending over $160 my way, all reinvested at over 5%, picking up more PM shares.

I also split out my retirement accounts in the far right column and the taxable account dividends are in the left two columns. The retirement accounts are composed of H.S.A. investments, ROTH and Traditional IRAs, as well as our work 401(k) accounts. In total, the retirement accounts brought in a total dividend income amount of $838.25 or 34.47% of the dividend income total. Therefore, almost all of the dividend income came from my taxable account. LET’S GO!!

Related: Maximizing your Roth for 10 Years… Then Set It & Forget It!

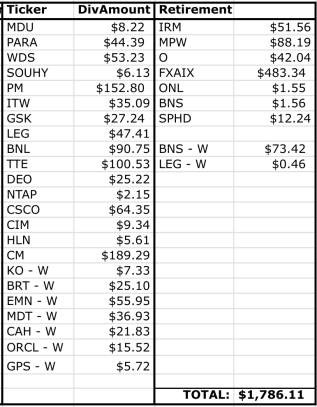

Dividend Income Year over Year Comparison

2023:  2024:

2024:

Our dividend income is up… $645.2, a 36% increase from last year. Now.. that’s due to Pepsi and Lockheed paying in April vs. March. If I strip those two dividends out, dividends were up $451.22 from the previous month. Still solid!

Next, the 401k investment of Fidelity’s S&P 500 – FXAIX has picked up steam, as it’s a whole year later, meaning one more year of investing I was able to do. Therefore, that dividend is way up!

Now, there are dividends that paid in May vs. April, such as MPW.

Much of what you see, year to year, is all about dividend growth and dividend reinvestment.

Lastly, this will be the last dividend you see from Leggett & Platt (LEG) and be that large. They had an 89% dividend cut. Just great.

Time to make up for the lost dividend income from LEG’s dividend cut and keep moving onward.

Dividend Increases

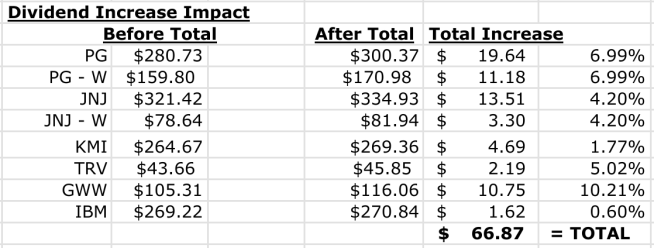

I received 6 dividend increases in April 2024, 2 more than last month! Which one was the best of the month?

Tipping my cap to Procter & Gamble (PG) with a surprise 7% dividend increase, HUGE! This added $30 to the forward income between my wife’s account and mine.

Another great dividend increase came from Grainger (GWW). A solid 10% increase for this dividend growth stock!

Related: The Impact of The Dividend Growth Rate!

In total, dividend increases created $30.41 in additional passive dividend income. I would need to invest $1,910 at a 3.50% dividend yield in order to add that income. Thank you for the increases, as I didn’t have to come up with the capital to create that form of income!

Dividend Income Conclusion & Summary

The name of the game is to apply what you learn through financial education. The next steps are to maximize every dollar for investment opportunities and live life on your own terms. Therefore, my plan is to demonstrate that dividend income can be a revenue engine. A revenue engine that allows you to take back control of your life. A revenue engine to help you reach financial freedom. Dividend investing, once you learn the right way, becomes easier and starts to immensely make sense!

Excited for the future, no doubt. Furthermore, all of the investing from last year and moves this year, shows that my aim to save 60% of my income, and making every dollar count, has provided the dividend growth.

If you are just starting out on your investment journey and you aren’t sure to start – please see the articles mentioned throughout this post. We are trying to bring you financial education and help you reach your financial goals.

Further, if you are interested in our dividend stocks to buy, dividend news, stock purchases, etc., please see our YouTube video (below), subscribe to our channel and check us out! Accordingly, we’ll help break down further investing topics not only on this blog, but by showing you through video!

As always, thank you for stopping by, leave your comments and questions below. Good luck and happy investing everyone!

Lanny buried the real lead which should be:

“Lanny Quits Coffee & Starbuck Stocks Tanks.” (not a coincindence)

Analysts think the stock price will remain depressed until he starts drinking Starbucks again…..

Mike –

You might be on to something… haha!

-Lanny