Now I know I am one to fully dive into research, use calculators and figure out the, hopefully, most efficient and effective way to get to a goal. Today I want to show you that if you maximize your Roth IRA contributions, currently at $5,500 per year, you can do so for 10 years and then all of a sudden you can STOP contributing… Yes – STOP placing more funds into your personal Roth IRA. This is the “set it and forget it” model and I will show that through dividend reinvestment and a conservative market return allows you to no longer need to really contribute after 10 years, as you’ll have quite a “hefty” nest egg and will be able to use the $5,500+ on other investments – like your individual-taxed stock portfolio. Read more to discover the benefit of maximizing your Roth IRA.

Age 24.5 Years Old – January 1, 2014

Let’s say you are 24.5 years old (coincidence, right?) on the 1st of January and you have exactly 35 years until you can receive the benefit of your Roth IRA. I like the Roth IRA option, as you pay with after tax dollars now and receive distributions/withdrawals tax-free in retirement – “paying it forward” as one could say. You decide to contribute the $5,500 (current IRS maximum for those under 50, $6,500 for those 50+) on the 1st of every year into the S&P 500 index, which yields 1.87%. You think – ‘wow, here comes my investment! I will do this every year until I am 59.5!’. You begin accumulating your shares. You do this every month for every year until you are 34.5 years old…

Age 34.5 Years Old – January 1, 2024

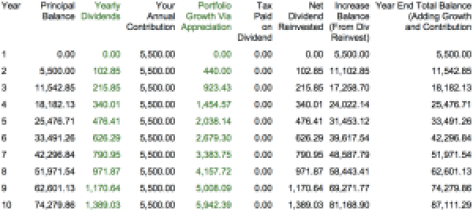

Okay, phew – it’s been 10 long years. You are making more money than ever before and, for the sake of not predicting the future, you have contributed the maximum $5,500 every year at the beginning for the last 10 years into the S&P 500 index fund, that has always yielded 1.87%. You have received a conservative 8% return and have reinvested every dividend you received. After 10 years, your account will look like this:

You are at $87,111.29 and just received $1,389 in dividends for the year. From here, you think, gosh I need the $5,500 to fund another project and could use that instead of placing it into my Roth IRA. What happens if I let this sit by itself for the next 25 years with no more contributions, but still maintaining the DRIP and the long-run appreciation of 8% per year. Let’s fast forward to 59.5 years…

Age 59.5 Years Old – January 1, 2049

You just woke up after going to bed at 10:30PM and think – oh shoot, I better catch the highlights of the ball dropping at TimeSquare in New York Playhouse Square in Cleveland, Ohio! You decide, however, to check your account where your Roth IRA is to see where it stands, as you realize you can begin taking dividends & distributions tax-free. You remembered you went on never-to-forget vacations using the $5,500 you have had every year, as well as invested in other areas – stock market, rental properties, start-ups and even help fund your children’s 529 plans and grandchildren’s plans. You are so happy and are retired. Let’s see what the account shows now on what happened over those last 25 years:

Wow! Your account is at $916K and is yielding approximately $16,000 in dividend income for you on an annual basis! All you did here was invested $5,500 for 10 years of your life and that effort produced an account worth over $916K. You only had to invest $55,000 of your working dollars to produce that, and now you have a nice supplement to your retirement income to the tune of $1,333 per month or $16K per year. What’s funny – is this keeps the 1.87% constant and historically a no-tax effect 8% return is quite conservative.

Using my ROTH IRA 2.95% yield

For a quick change of value and income – my Roth IRA (not including my 401k at work) yields 2.95%. Using that, the value reaches $91,750 after 10 years of contributing and after I stop – $1,232,505.13 in value and produces $32,770 in dividend income! It’s phenomenal.

To conclude – if you push yourself to invest into your Roth IRA option for 10 straight years – you can essentially “set it and forget ” your way to a $1M portfolio that yields you over $2.7K per month in dividend income. Dividend reinvestment, appreciation and discipline will pave a path for you to a sure way of financial freedom. I plan on stopping after my calculations show that, as I want to place that $5,500 into other cash flowing assets – like the individual/taxed stock portfolio, rental properties, etc.. Also – would like to use some of those funds to have experiences – explore the world. Thanks for stopping by! Have ya’ll thought about this? What are your current plans for the contributions to the Roth? Invest early and Invest often everyone.

I always love reading these types of articles that show what small steps can leads to if you only let time work its magic. I guess you can summarize the effect of what happens to your investment over time with one simple word every dividend investor loves… “compound.” That’s really the key to success in every dividend portfolio no matter the rate of return. Compounding always works miracles on simple numbers given enough time.

DivHut!

Thanks for stopping by! It does show that small steps can lead to a handsome reward – and this handsome reward of almost $1M is a safety-net/cushion. And it only takes 10 straight years at the age of 24.5 to do so, which is even wild. Compound is a very close word held to the heart of us dividend investors, as the compound/reinvestment effect carries our investments further and further for our portfolio. Cheers to us, to the power of compounding/reinvestment and “time”. Excited for the month of June to finish, big things happening!

-Lannyp

Love these kinds of calcations! The link doesnt work.

Thanks for stopping by dutchdividend! The link has been fixed as well – thank you for the headsup!

-DD

I love the idea of compounding unfortunately individuals must have a long term mindset and few people possess the patience. I remember 20 years ago when I started my first job at age 22 my company just started a 401k. During the first five years the balances appeared to barely increase. In fact unless I made a contribution I couldn’t see the effects of the growth. After a while of seemingly invisible results, the balance started growing faster than my contributions. The best part is you really only need a small amount like in your example…for me it was 8% plus 2% match for a total of 10% of my salary.

MDP

MDP,

I agree – the patience and discipline is key. That’s great you started at the age of 22 – I bet you have seen quite the strong growth from that stand point. Now, 20 years later, I bet you look back smiling/snickering at yourself for making that investment decision, well worth it I’m sure. I hope that individuals do take the time to take care and balance out the financial aspect of their life – as in this case – you can have fun and experience mounds now, with the emergency Roth IRA as the back up plan when you’re older somewhat! All about taking risks in life itself (not investing – as this is a very “boring” type of investing to some) and balancing everything out. Thank you for the visit, take care!

-Lanny

I really like reading these kinds of article as well. This just gave me hope. My account balances are so small that I’m not sure if I’ll ever make it. But, reading your article just reminded me that it’s possible. Right now, I have the discipline where I am saving like there’s no tomorrow (even though I still waste money here and there). However, at the end of the day, I have less than $100k to my name, at nearly 40. So, I’m way behind schedule!

I started maxing out my 401k and my Roth IRA. It’s tough at first, but you get used to living without that income. Then, when you get your pay increases, it’s just a matter of figuring out how best to use the extra money for investing.

Using your numbers, imagine if you continued to contribute for those 35 years and didn’t stop after 10! wow!

Great post.

Hi Lanny,

I know this is a really old post but you referenced it from your current monthly posts. I think you should review the math in this article:

1) The S&P dividend yield is around 2% as you mention. Historically the stock market has returned 6.6% in real (after inflation) total return in average over the long term. But let’s stick with 8% total return for this example. However total return = capital gains + dividend yield, so if it’s paying out 1.87% in dividends, capital growth isn’t 8% as you show but 6.13%. Your model is calculating results from a total return of 9.87% over 35 years instead which is definitely not conservative, and doesn’t consider the effect of inflation.

2) The scenario describes paying $5,500 into the Roth at the start of the year. So the growth in each year should include the contribution amount. At the end of the 1st year the total should be 8% higher than $5,500. You’re really only showing 9 years of growth, not 10.

On the plus side, assuming an 8% total return growth and adding $5,500 every year results in $86,050 after 10 years, so your initial numbers are actually close (you modelled 9.87% over 9 years instead of 8% over 10 years).

But the following 25 years at 8% growth provides $589,312 – definitely not shabby, but not quite the $1M of the example.

I completely agree on all the other points you mention in the article – Roth accounts are great! Just wanted to comment on the math / assumptions used to illustrate it.

Best wishes,

-DL

Pingback: Dividend Income Summary: Lanny’s May 2021 Summary

Pingback: Lanny's January Dividend Income Summary - Dividend Diplomats

Pingback: Dividend Income Summary: Lanny’s August 2021 Summary

Pingback: Dividend Income Summary: Lanny’s September 2021 Summary

Pingback: Dividend Income Summary: Lanny's September 2021 Summary - News Fall Out

Pingback: Dividend Income Summary: Lanny’s October 2021 Summary

Pingback: Dividend Income Summary: Lanny’s November 2021 Summary – Dividend Growth Investors Daily

Pingback: Dividend Income Summary: Lanny’s December 2021 Summary

Pingback: Dividend Income Summary: Lanny’s December 2021 Summary - Stocks Trade

Pingback: Dividend Income Summary: Lanny’s December 2021 Summary – Dividend Growth Investors Daily

Pingback: Dividend Income Summary: Lanny’s January 2022 Summary – Dividend Growth Investors Daily

Pingback: Dividend Income Summary: Lanny’s February 2022 Summary – Dividend Growth Investors Daily

Pingback: Dividend Income Summary: Lanny’s March 2022 Summary

Pingback: Dividend Income Summary: Lanny's March 2022 Summary

Pingback: Dividend Income Summary: Lanny’s April 2022 Summary

Pingback: Dividend Income Summary: Lanny’s April 2022 Summary - Market Signals

Pingback: Dividend Income Summary: Lanny’s May 2022 Summary

Pingback: Dividend Income Summary: Lanny’s May 2022 Summary – Dividend Growth Investors Daily

Pingback: Dividend Income Summary: Lanny's May 2022 Summary

Pingback: Dividend Income Summary: Lanny’s May 2022 Summary - Newz Mania

Pingback: Dividend Income Summary: Lanny’s June 2022 Summary - Newz Mania

Pingback: Dividend Income Summary: Lanny's June 2022 Summary

Pingback: Dividend Income Summary: Lanny’s July 2022 Summary - Newz Mania

Pingback: Dividend Income Summary: Lanny’s July 2022 Summary – Dividend Growth Investors Daily

Pingback: Dividend Income Summary: Lanny’s July 2022 Summary

Pingback: Dividend Income Summary: Lanny’s August 2022 Summary - Newz Mania

Pingback: Dividend Income Summary: Lanny’s August 2022 Summary – Dividend Growth Investors Daily

Pingback: Dividend Income Summary: Lanny’s September 2022 Summary

Pingback: Dividend Income Summary: Lanny’s September 2022 Summary - Newz Mania

Pingback: Dividend Income Summary: Lanny’s September 2022 Summary - Stocks Trade

Pingback: Dividend Income Summary: Lanny’s September 2022 Summary - Finance Gurus

Pingback: Dividend Income Summary: Lanny’s September 2022 Summary – Dividend Growth Investors Daily

Pingback: Dividend Income Summary: Lanny’s October 2022 Summary - Newz Mania

Pingback: Dividend Income Summary: Lanny’s October 2022 Summary – Dividend Growth Investors Daily

Pingback: Dividend Income Summary: Lanny’s October 2022 Summary - Finance Gurus

Pingback: Dividend Income Summary: Lanny’s October 2022 Summary - Stocks Trade

Pingback: Dividend Income Summary: Lanny’s November 2022 Summary – Dividend Growth Investors Daily

Pingback: Dividend Income Summary: Lanny’s December 2022 Summary - Newz Mania

Pingback: Dividend Income Summary: Lanny’s January 2023 Summary – Dividend Growth Investors Daily

Pingback: Dividend Income Summary: Lanny’s February 2023 Summary - Finance Gurus

Pingback: Dividend Income Summary: Lanny’s March 2023 Summary – Dividend Growth Investors Daily

Pingback: Dividend Income Summary: Lanny’s April 2023 Summary – Dividend Growth Investors Daily

Pingback: Dividend Income Summary: Lanny’s May 2023 Summary – Dividend Growth Investors Daily

Pingback: Dividend Income Summary: Lanny’s May 2023 Summary - FileHog.com

Pingback: Dividend Income Summary: Lanny’s May 2023 Summary - Finance Gurus

Pingback: Dividend Income Summary: Lanny’s June 2023 Summary – Dividend Growth Investors Daily

Pingback: Dividend Income Summary: Lanny’s July 2023 Summary – Dividend Growth Investors Daily

Pingback: Dividend Income Summary: Lanny’s July 2023 Summary - Finance Gurus

Pingback: Dividend Income Summary: Lanny’s August 2023 Summary – Dividend Growth Investors Daily

Pingback: Dividend Income Summary: Lanny’s August 2023 Summary - Finance Gurus