This is what dividend investing is all about! Investing in dividend stocks allows YOU to earn dividend income, the best passive income stream! Bias, you better believe it.

Time to dive into Lanny’s March 2022 dividend income results! Were records set? Almost to financial freedom? One day and one month at a time!

Dividend Income

Dividend Income is the fruit from the labor of investing your money in the stock market. Further, Dividend Income is my primary vehicle on the road to Financial Freedom, which you can see through my Dividend Portfolio.

How do I research & screen for dividend stocks prior to making a purchase? I use our Dividend Diplomat Stock Screener and trade on Ally’s investment platform (one of our Financial Freedom Products) – commission free.

Related: Dividend Diplomat Stock Screener

Related: Financial Freedom Products

Related: 3 Financial Products to Create Wealth in 2021

I also automatically invest and max out, pre-tax, my 401k through work and my Health Savings Account. This allows me to save a TON of money on taxes (aka thousands), which allows me to invest even more. In addition, all dividends I receive are automatically being reinvested back into the company that paid the dividend. This takes the emotion out of timing the market.

Related: Tax Strategy – Part 3 to Reduce Taxes & Increase Investment.

Related: The Power of Dividend Reinvesting

Related: Why I Don’t Time or Predict The Market

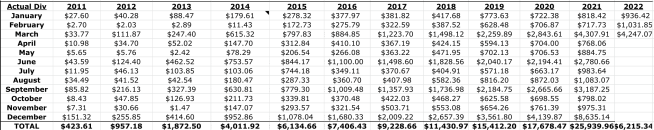

Growing your dividend income takes time and consistency. Investing as often, and early, as you can allows compound interest (aka dividends) to work it’s magic. I have gone from making $2.70 in a single month in dividend income to well over … $10,000+ in a single month. A NEW dividend income record was set in December of 2021. Was it broken this month?! The power of compounding and dividend reinvestment is a wonderful component to the portfolio. Each and every month, whether big or small, I continue to report the passive income that dividend investing provides me. Why?

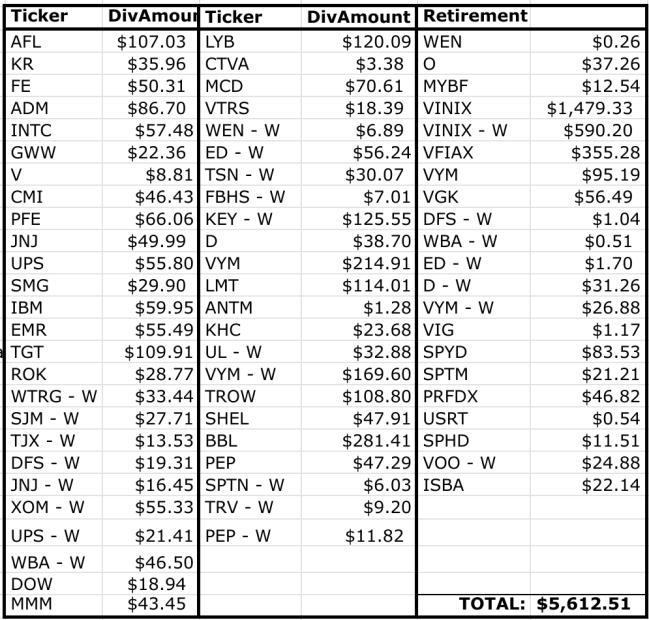

*Not pictured is my wife’s dividend income above*

I want to show YOU that dividend investing makes it possible to achieve financial freedom and/or financial independence. We all start somewhere, but consistently investing, compounding (reinvesting) dividends and keeping it simple, allows you to be in a significantly better position than most. Further, if I can grow this portfolio and income stream, YOU can too.

dividend income – March 2022

Now, on to the numbers… In March, we (my wife and I) received a dividend income total of $5,612.53. This is the FOURTH time we have crossed OVER $5,000! This has traditionally been done during the December year-end/quarter-end month. I did cross $5,000 in passive income last March, too. Love seeing the amount cross $5,000 in a different month. Still a quarter-end, though, which is usually higher than other months.

The amount and number of stocks listed below show you what it means to buy and hold for the long term. Most of the positions I have owned for YEARS, letting dividend growth and reinvestment do it’s thing. This is what dividend investing for financial freedom is all about. The passive income stream is growing at a RAPID pace.

2022 is off to a volatile start, stock market has roared up and also roared down. The war between Ukraine and Russia is wild, sending the interest rates and oil prices all over the place. In addition, the Fed has raised rates by 25 basis points and we are anticipating another 50 basis point increase in May. Time will tell.

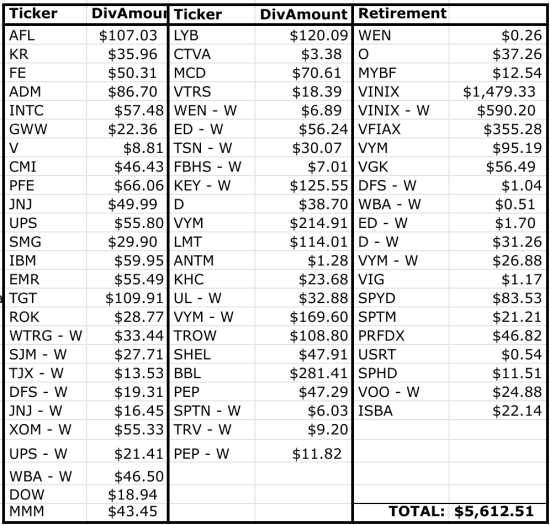

Here is the breakdown of dividend income for the month of March, between taxable and retirement (far right column, under “Retirement”) accounts. In addition, “W” means my wife’s account:

So what happened in dividend income this month? Look at all of the triple digit dividend payments, especially from Dividend Aristocrats.

Target (TGT), Aflac (AFL), LyondellBasell (LYB), Lockheed Martin (LMT), T. Rowe (TROW) and my favorite – Vanguard High Dividend Yield ETF (VYM), all sent over $100+ our way. That’s called dividend investing, in a nut shell. Consistently investing into dividend stocks, reinvesting dividends and receiving dividend raises – all adds to each snowball you see above.

I have to mention, what you see above is all being reinvested back into the same dividend stock position. Therefore, the snowball received a massive pump forward from March of 2022.

I also split out my retirement accounts in the far right column and the taxable account dividends are in the left two columns. The retirement accounts are composed of H.S.A. investments, ROTH and Traditional IRAs, as well as our work 401(k) accounts. In total, the retirement accounts brought in a total dividend income amount of $2,900 or 52% of the dividend income total. This still left over $2,713 in the taxable account! This passive income is definitely in the financial freedom category. If only the passive income stream was like this each month!

Related: Maximizing your Roth for 10 Years… Then Set It & Forget It!

DIvidend Income Year over Year Comparison

2021:

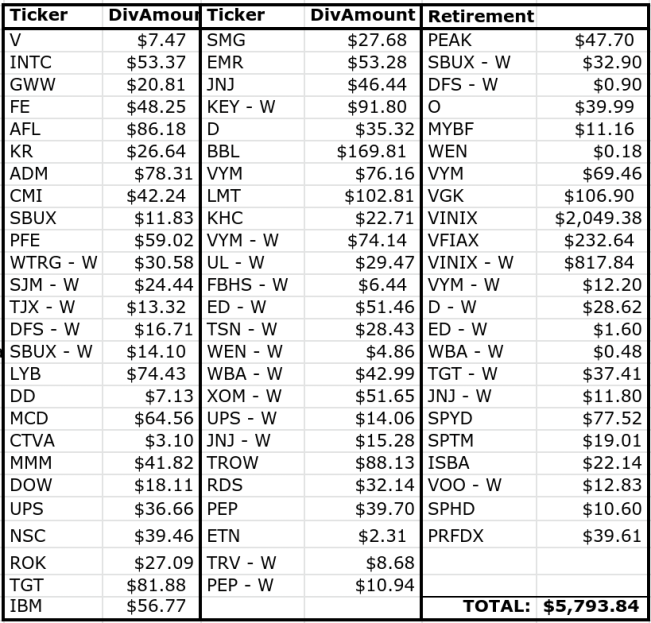

2022:

Whoa… do you see this? I crossed $5,000 BUT it was actually less than my total last March by $181 or 3%. What happened? Why the dividend income decrease?

A few positions paid in different months, such as Peak Properties (PEAK), a healthcare REIT. In addition, the dividends were not as strong from Vanguard’s VINIX, specifically. This is from old 401k’s.

However, HUGE dividend increases are coming in from my investment with Vanguard’s VYM, as well as a nice 25% bump up from Aflact. This is due to my weekly Vanguard VYM strategy, where both my wife and I purchase 2 shares each, each and every Monday. If you take a look at all positions, outside of ETFs and mutual funds, all dividends are higher vs. last year. Now THAT’s what it’s all about.

Lastly, it’s truly dividend reinvestment, dividend increases and consistently investing that fuels the growth.

Overall, a solid dividend month. Would love to see growth vs. the prior year figure, though! Time to keep investing if the market shows any signs of declining.

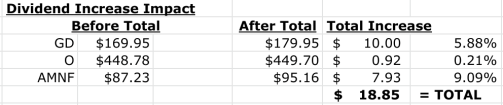

Dividend Increases

3 more dividend increases during March 2022! 2022 has been a solid year for dividend growth, to say the least.

My #1 pick obviously has to go to Armanino Foods of Distinction (AMNF). Their dividend has roared back since the pandemic and a 9% dividend raise is well above the rate of inflation. This small Italian foods company is firing on all cylinders, I love it!

Related: Earn up to 7.25% on your money with up to $250 sign up bonus!

In addition, General Dynamics (GD) and Realty Income (O) continue their dividend aristocrat streak, staying alive!

Related: The Impact of The Dividend Growth Rate!

In total, dividend increases created $18.85 in additional passive dividend income. I would need to invest $538 at a 3.50% dividend yield in order to add that income. Thank you for the increases, as I didn’t have to come up with the capital to create that form of income!

Dividend Income Conclusion & Summary

The name of the game is to apply what you learn through financial education. The next steps are to maximize every dollar for investment opportunities and live life on your own terms. My plan is to demonstrate that dividend income can be a revenue engine. A revenue engine that allows you to take back control of your life. A revenue engine to help you reach financial freedom. Dividend investing, once you learn the right way, becomes easier and starts to immensely make sense!

Excited for the future, no doubt. Further, all of the investing from last year and moves this year, shows that my aim to save 60% of my income, and making every dollar count, has provided the dividend growth.

If you are just starting out on your investment journey and you aren’t sure to start – please see the articles mentioned throughout this post. We are trying to bring you financial education and help you reach your financial goals.

Further, if you are interest in our dividend stocks to buy for April, please see our YouTube video (below), subscribe to our channel and check us out! We’ll help break down further investing topics not only on this blog, but by showing you through video!

As always, thank you for stopping by, leave your comments and questions below. Good luck and happy investing everyone!

Fantastic Lanny! Over $5k is a huge amount of passive income. It’s been great getting to see both you and Bert just consistently invest month in and month out and now look what y’all have. Huge portfolios spitting out more than a lot of people earn from their day job.

Thanks JC –

It’s hard to stay consistent, but I know in the “end” it will be worth it. Let’s GO!!!

-Lanny

Over $5K in dividends is awesome! Congrats Lanny! Aren’t quarter ending months great? 🙂

MDD –

I can’t wait for this quarter end to be the normal month!

-Lanny

Lanny,

Regardless of the timing on some of your dividend payments, congrats on receiving over $5,500 in dividend income last month. Reinvesting your dividends alone will make a huge difference without even considering dividend raises and new capital. Keep it up!

Kody –

Much appreciated. That’s one of the best parts… over $5,000+ was reinvested to buying more shares of assets that produce an even more growing dividend income stream. I love the cycle, time to keep adding more fuel to the FIRE!

-Lanny

Great job, Lanny!

I remember your numbers back when I first found you and the growth since then has been STAGGERING.

Waffles –

Thank you… it’s been one helluva journey. The journey is not even close to being over yet. Time to keep pounding the pavement.

-Lanny

Incredible job for the month of March. Dividend investors sure love those end of quarter months for good reason. You continue to make ‘every dollar count’ and the proof is in your real world results. Keep on buying, reinvesting and taking advantage of those dividend raises. Inspiring!

DH –

Much appreciated. You are darn right, putting every penny to work at this point. Going hammer, the only way that I know!

-Lanny

Hi, I see you/read you from Argentina. It would be great for your international viewers that you can explain the differences between taxable and retirement accounts. In many countries the retirement system is very different from yours.

Congrats on reaching $5k in dividends again!