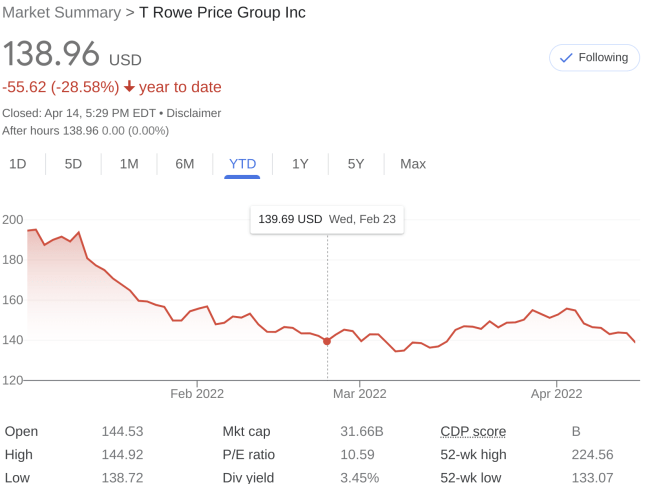

One of the largest asset management firms, T. Rowe Price stock has taken a beating in 2022. The stock is down almost 30%, the yield is almost 3.50% and T. Rowe Price (TROW) has also increased dividends for OVER 25 years. Is it time to Buy T. Rowe Price stock?!

T. Rowe Price (TROW) Stock

T. Rowe Price manages over $1.5 trillion in assets under management. They are a dividend darling of a stock, being a dividend aristocrat, increasing their dividend for 25+ consecutive years.

If you haven’t noticed from the stock chart above on T. Rowe Price stock, the 52 week high price is $224.56. Therefore, the stock is down ALMOST $100 in price since their most recent all-time high. That’s almost a 45% plunge from their high. However, they are still down 28%+ so far this year.

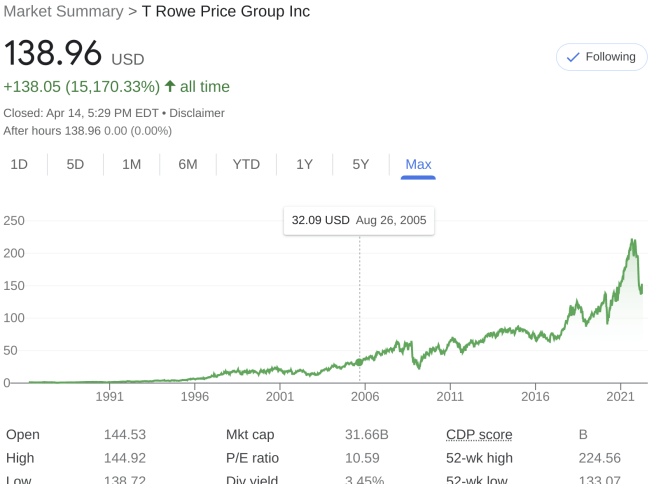

Since 1986, TROW stock is up an unbelievable 15,170% or 420% on average, per year, over a 37 year period. Not too bad, right? It comes down to earth over the last 5 years, as the average rate of return is 18.71% over the previous 5 years.

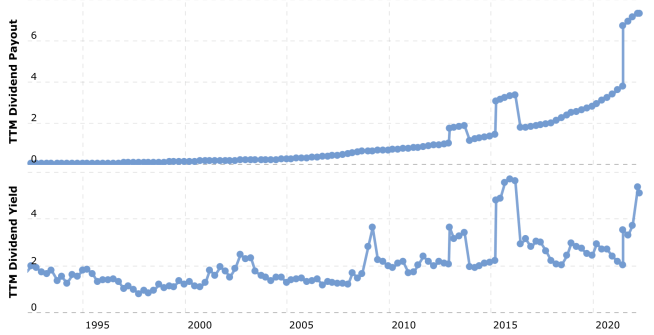

The dividend charts are phenomenal for T. Rowe Price stock. You can see the payout on a nice steady upward trend over the last 30 years. In addition, the dividend yield is really growing to almost an all time high here. KEEP in mind the SPECIAL DIVIDEND paid out in 2021 is definitely skewing the yield and payout! Check out this chart:

Paying now $1.20 per share, per quarter, a nice solid dividend payout. What do the rest of the dividend stock metrics look like?

T. Rowe Price dividend stock analysis

As you know it’s time to review T. Rowe Price (TROW) with the Dividend Diplomat Stock Screener! Here, we focus on 3 main dividend stock metrics:

1.) Price to Earnings Ratio (P/E): We look for the price to earnings ratio < the S&P 500 and the competition.

2.) Dividend Payout Ratio: The preferred dividend payout ratio is < 60%. In fact, we believe the perfect payout ratio is between 40% and 60%.

3.) Dividend Growth Rate: Given we are dividend investing on our way to financial freedom, as we believe dividend income is the best source of passive income, we look at the 5 year dividend growth rate. In addition, we review how many years the company has increased their dividend.

1.) P/E Ratio: TROW has a price to earnings ratio, as of April 14th of 11.89. This is significantly under the S&P 500, which trades at 25 earnings. In addition, this P/E ratio is a great sign of undervaluation for this dividend stock.

2.) Dividend Payout Ratio: A perfect dividend payout ratio at 41%. They are right in that sweet spot of 40-60%. Congrats T. Rowe Price stock owners!

3.) Dividend Growth Rate: A genuine dividend aristocrat, increasing their dividend for 36 years. In addition, the dividend growth rate currently is at 16%. The last increase was still over double digits at 11% earlier this year. Definitely appreciate the double digit increase, but notate that it is lower than the 5 year average. Still incredible and STILL above the rate of inflation. That’s exactly what you want your passive income stream to do – grow faster than inflation.

Lastly, we’ll take a look at the dividend yield. As an investor, you want to know how much owning this dividend stock pays you now! The yield for TROW is 3.45%, wow. Almost at 3.5%, which is significantly higher than the 5 year dividend yield average of 3.08%. This is also almost 3x the S&P 500 dividend yield.

is T. Rowe Price Stock a Stock to buy…now?

Now that we’ve gone through the metrics, is TROW a stock to buy for the dividend stock portfolio?

If you are looking for an undervalued dividend stock, you do not have to look too far. I would highly recommend looking at T. Rowe Price stock as a potential stock to buy for your portfolio. Obviously, as a disclaimer, perform your own research and make your own financial decisions!

I own T. Rowe Price stock and would consider adding to my position at these prices. The world is significantly volatile right now, with inflation, interest rates, housing bubble, war in Ukraine with Russia, the list really goes on

If you head over to our YouTube channel, you’ll find other undervalued dividend growth stocks that are higher on my list for stocks to buy now!

How about you? Do you own T. Rowe Price stock? Do you think TROW is a stock to buy now in this significantly volatile stock market? Share your comments and feedback below!

As always, thanks for stopping by, good luck and happy investing!

-Lanny

Hey Lanny

Found a tiny spelling mistake towards the end of the article.

Says Russie instead of Russia.

I own T. Rowe Price stock and would consider adding to my position at these prices. The world is significantly volatile right now, with inflation, interest rates, housing bubble, war in Ukraine with Russie, the list really goes on

Just wanted to let you know.

Great post. TROW is definitely a solid buy for dividend growth investors right now.