This is what dividend investing is all about! Investing in dividend stocks allows YOU to earn dividend income, the best passive income stream! Bias, you better believe it.

Time to dive into Lanny’s April 2022 dividend income results! Were records set? Almost to financial freedom? One day and one month at a time!

Dividend Income

Dividend Income is the fruit from the labor of investing your money in the stock market. Further, Dividend Income is my primary vehicle on the road to Financial Freedom, which you can see through my Dividend Portfolio.

How do I research & screen for dividend stocks prior to making a purchase? I use our Dividend Diplomat Stock Screener and trade on Ally’s investment platform (one of our Financial Freedom Products) – commission free.

Related: Dividend Diplomat Stock Screener

Related: Financial Freedom Products

Related: 3 Financial Products to Create Wealth in 2021

I also automatically invest and max out, pre-tax, my 401k through work and my Health Savings Account. This allows me to save a TON of money on taxes (aka thousands), which allows me to invest even more. In addition, all dividends I receive are automatically being reinvested back into the company that paid the dividend. This takes the emotion out of timing the market.

Related: Tax Strategy – Part 3 to Reduce Taxes & Increase Investment.

Related: The Power of Dividend Reinvesting

Related: Why I Don’t Time or Predict The Market

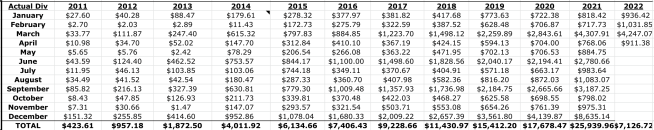

Growing your dividend income takes time and consistency. Investing as often, and early, as you can allows compound interest (aka dividends) to work it’s magic. I have gone from making $2.70 in a single month in dividend income to well over … $10,000+ in a single month. A NEW dividend income record was set in December of 2021. Was it broken this month?! The power of compounding and dividend reinvestment is a wonderful component to the portfolio. Each and every month, whether big or small, I continue to report the passive income that dividend investing provides me. Why?

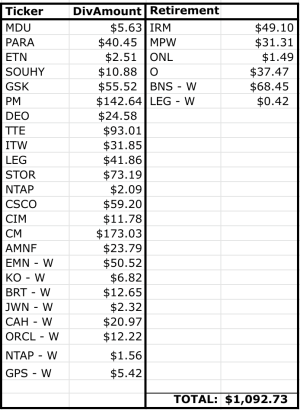

*Not pictured is my wife’s dividend income above*

I want to show YOU that dividend investing makes it possible to achieve financial freedom and/or financial independence. We all start somewhere, but consistently investing, compounding (reinvesting) dividends and keeping it simple, allows you to be in a significantly better position than most. Further, if I can grow this portfolio and income stream, YOU can too.

dividend income – April 2022

Now, on to the numbers… In April, we (my wife and I) received a dividend income total of $1,092.73. Very thankful to continue to cross the 4 digit threshold consistently. I just continue to buy assets that produce passive income. I reinvest the dividends and then have the 8th wonder of the world, dividend growth baby!

The amount and number of stocks listed below show you what it means to buy and hold for the long term. Most of the positions I have owned for YEARS, letting dividend growth and reinvestment do it’s thing. This is what dividend investing for financial freedom is all about. The passive income stream is growing at a RAPID pace.

2022 is off to a volatile start, stock market has roared up and also roared down. The war between Ukraine and Russia is wild, sending the interest rates and oil prices all over the place. In addition, the Fed has raised rates by 25 basis points and we are anticipating another 50 basis point increase in May. Time will tell.

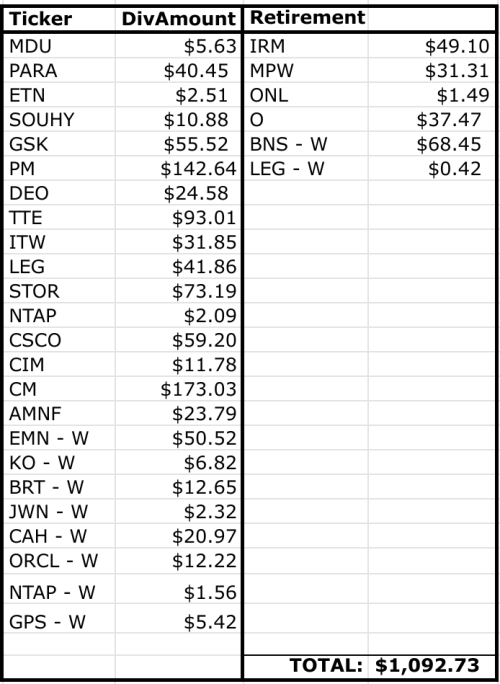

Here is the breakdown of dividend income for the month of April, between taxable and retirement (far right column, under “Retirement”) accounts. In addition, “W” means my wife’s account:

So what happened in dividend income this month? Look at all of the triple digit dividend payments, especially from Dividend Aristocrats.

Illinois Tool Works (ITW), Leggett & Platt (LEG), a couple of dividend aristocrats, sent dividend payments my way. Leggett (LEG) has been beaten up the last few weeks, keep your eyes out on their stock, as LEG now yields over 4.50%!

One thing to note is my massive dividend from the REIT – Store Capital (STOR). The dividend payment is almost $75 and will be approximately that amount on a go forward, basis. The reinvestment is no joke, acquiring a few shares each dividend round.

I also split out my retirement accounts in the far right column and the taxable account dividends are in the left two columns. The retirement accounts are composed of H.S.A. investments, ROTH and Traditional IRAs, as well as our work 401(k) accounts. In total, the retirement accounts brought in a total dividend income amount of $188.24 or 17% of the dividend income total. This still left over $904 in the taxable account! That’s a significant amount and allocation for a passive income stream, as most of the dividend income received can be used right away.

Related: Maximizing your Roth for 10 Years… Then Set It & Forget It!

DIvidend Income Year over Year Comparison

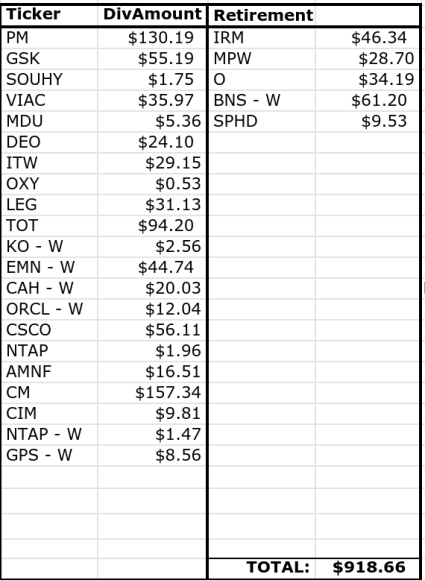

2021:

2022:

My dividend income is up approximately $174 or 19% from my dividend income in April 2021. For this type of “off-month” cycle, that’s a significant increase and is the first time we’ve crossed $1,000 in dividend income in April! What exactly happened?

Store Capital (STOR) is a huge part of this. I was buying the Warren Buffett invested company each and every week, to the point of owning over 200 shares. This was the first big dividend payment I received from them. Canadian Imperial (CM), one of Canada’s largest banks, started their dividend increase streak again in a post-pandemic world. Therefore, from reinvestment and dividend growth of CM, that led to an impact of $16.

The story is similar for Philip Morris (PM), as through dividend reinvestment plus dividend growth, led to a solid, positive impact of $12.

Lastly, it’s truly dividend reinvestment, dividend increases and consistently investing that fuels the growth.

Overall, a solid dividend month. If we are at $1,092 for April, would more than welcome a $1,250 next April. $1,500 would be the aggressive goal, too.

Dividend Increases

April is usually a strong dividend growth month. We had 5 dividend increases during April 2022 and dividend growth has been very steady and consistent in 2022.

My #1 pick obviously has to go to Johnson & Johnson (JNJ). During a volatile time period, JNJ delivered one of the most consistent and reliable dividend increases that there are. JNJ is a dividend king and absolutely loved their increase here.

Related: Earn up to 7.25% on your money with up to $250 sign up bonus!

In addition, Procter & Gamble (PG), Grainger (GWW), International Business Machines (IBM) continued their dividend streak alive as a dividend aristocrat!

Lastly, Kinder Morgan (KMI) still is embarking back on their dividend growth journey!

Related: The Impact of The Dividend Growth Rate!

In total, dividend increases created $38.87 in additional passive dividend income. I would need to invest $1,110 at a 3.50% dividend yield in order to add that income. Thank you for the increases, as I didn’t have to come up with the capital to create that form of income!

Dividend Income Conclusion & Summary

The name of the game is to apply what you learn through financial education. The next steps are to maximize every dollar for investment opportunities and live life on your own terms. My plan is to demonstrate that dividend income can be a revenue engine. A revenue engine that allows you to take back control of your life. A revenue engine to help you reach financial freedom. Dividend investing, once you learn the right way, becomes easier and starts to immensely make sense!

Excited for the future, no doubt. Further, all of the investing from last year and moves this year, shows that my aim to save 60% of my income, and making every dollar count, has provided the dividend growth.

If you are just starting out on your investment journey and you aren’t sure to start – please see the articles mentioned throughout this post. We are trying to bring you financial education and help you reach your financial goals.

Further, if you are interest in our dividend stocks to buy for April, please see our YouTube video (below), subscribe to our channel and check us out! We’ll help break down further investing topics not only on this blog, but by showing you through video!

As always, thank you for stopping by, leave your comments and questions below. Good luck and happy investing everyone!

Congrats on another 4-digit month Lanny! You crushed it on an “off month”! That is a great STOR payout. I bought more shares recently as well and I’m up to 156 shares of STOR. Keep the dividends rolling in! It’s great! 🙂

MDD –

Nice job – you can really load up on $STOR right now below $27! It’s wild that I was buying so much between $29 and $31. Discounts now baby!

-Lanny

Four digits is always nice in any month. Congrats on continuing to grow your passive income stream. Agree about LEG. That yield is really juicy now because of share price decline. There’s no shortage of better buying opportunities these days, that’s for sure. Keep up the good work.

DH –

I wish I had more cash/capital! Buying spree season on the dividend stocks Keith!

-Lanny

Lanny,

Congrats to you and your wife on surpassing $1,000 in dividend income last month. That’s impressive growth. Keep it up!

Thanks Kody –

Hoping to keep the ride going UP on the dividend income totals. I want financial freedom so, so so bad.

-Lanny

Great month you had. Getting to $1000.00 is a big deal in the first month of the quarter. Great month for dividend raises. Keep on addding.

Hi Lanny and Bert – have been watching many of your YT vids – love them! Keep it up. Also, congrats on another month with $1,000+ in passive income, bloody well done. When looking at your portfolio I noticed that there are some dividend payments that are rather tiny (like below $5). I set a rule for myself that each dividend payment should be $25 at the minimum. Otherwise, I feel like I am a slave to my portfolio, logging numerous small amounts and transactions. Anyways, just my two cents. Keep it up, guys! Greetings from Singapore.