2022 is coming to a close with just over 3.5 months remaining! In a world full of chaos and dozens of investing apps, fintech programs, influencers pushing every product, I wanted to end that.

I wanted to take the time to tell you about 3 financial applications, banks and investment options that has worked for me in 2022, and for many years before that. I plan to continue to use these products and investments going forward. That is why I consider them financial freedom products. The financial products are financial freedom promoters, as they ALL continue to better your financial position! Time to dive into the 3 financial freedom products I am using, as we close out 2022!

Excited to dive into the 3 financial freedom products I have used – some I started in 2021 and others many years before that. I like to share products that have worked for me, to develop a dividend income portfolio, increased my networth and the amount of income my dollars provides.

3 financial freedom products

1.) SoFi App/FinTech – Yes, it is no question that I love this bank/fintech application! Ever since they received their bank charter, acquired a bank and core processor, I feel like SoFi has many great things going. I am arguing it’s the best bank and investing app out there now. Why?

First – Free trades, partial shares and automatic daily trades can happen in any denomination! Free trades obviously does not mean much these days in the United States, as most brokerages offer free trades. However, it’s the partial, automated and any frequency that sweetens the deal with SoFi. This has allowed me to invest daily into Vanguard’s S&P 500 ETF (VOO), each and every day, at a fixed dollar amount. Dollar cost averaging during 2022 has proved to be a GREAT strategy. If you sign up, you also receive $25 in free stock to start out! Definitely recommend.

Second – SoFi does offer one of the highest yield savings accounts around, currently is 2% at the time of this writing. I know Ally is up to 2% now, with CapitalOne and Marcus at 1.90%, respectively. SoFi has been at 2.50% the longest out of the bunch and I can almost guarantee as we get closer to the Fed raising rates in September, that SoFi will be ahead of the curve, raising theirs. You can sign up and earn up to $275 as well! We keep our down payment fund here and let the savings earn interest at 2.50% on SoFi.

Lastly – ease and seamless application experience. Purely a fintech company, they have designed the app with the user in mind. I can make transfers between accounts easily, they urge you to be a digital consumer with their cards and they are cutting edge. In addition, though I haven’t gone the route yet, they have an enticing Credit Card to go with their ecosystem of products. Definitely am interested in moving financial products to SoFi soon.

Overall, a great product to use and help fuel your financial freedom journey. High rate, easy to use and you are able to dollar cost average into dividend income stocks, easily! Next up…

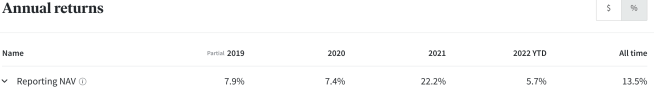

2.) Fundrise – The real estate, crowdfunding, investing platform that allows investors with as little as $10 get into real estate. My wife and I automatically invest $200 per month and have been on the Fundrise investing platform for 3.5 years. In fact, we are now over $15,000+ invested into real estate with Fundrise. There has NEVER been a down year. I love the exposure to real estate this investment offers me, without being invested into the modern equity market, of buying and selling on the stock market with real estate or REITs.

Invest with Fundrise and earn $50!

Fundrise has been as transparent as possible, showing each property that they own, that they sell and the performance they achieved with each property. In addition, Fundrise allows you to invest, one time per year, into the Fundrise Real Estate company in and of itself via an Internet Public Offering or their iPO. I go over my latest Fundrise investing update, as of Q2-2022, and show the strong performance of the real estate investment vs. the REIT index. This isn’t the first time that Fundrise has outperformed!

Fundrise also has announced their Innovation Fund, as Bert wrote an article about that recently. They are entering the venture capital / private equity space and have a pool of investors already to ask for additional investments from! Personally, I have another private equity / VC investment I have and I opted not to go through with Fundrise’s innovation fund, but definitely another great product for those looking to get started.

Therefore, I love Fundrise for their ease of use, transparency, consistent returns and the ability to develop another passive income stream, that doesn’t track the stock market. If you sign up, you also earn a $50 bonus in case you are interested!

3.) (TIE) Ally Bank and Digital Credit Union – There is a tie between two online heavy financial institutions. One is Ally Bank and the other is Digital Credit Union or DCU.

Ally Bank is a great alternative/conjunction account with our SoFi account. We maintain our emergency savings at Ally, earning also 2.00% currently. In addition, my primary brokerage account has been Ally for the better part of 4+ years, since the closure of Capital One Investing. Therefore, cash that is not being invested on Ally’s platform, is earning 2.00% in the interim period. However, I may end up transferring assets to SoFi at some point in the future.

However, Ally is a great bank and if you are weary of using a new Fintech app such as SoFi, Ally is a great alternative. Their application can use a refresh, to make it work a little smoother and to simplify transfer processes, but all-in-all, Ally has been a great bank to our family for earning on our savings and investing.

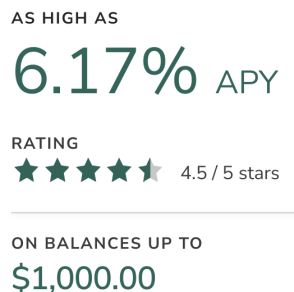

Digital Credit Union (DCU) has been a consistent credit union over the past 4-5 years. DCU has been offering a high yield savings account that has not faltered in low interest rate time periods, as well as in rising interest rate environments. In fact, DCU still offers up to your first $1,000 an interest rate of 6.17%. I have had at least $1,000 parked there for years, earning the 6%+ and then I transfer the amount of interest/dividends posted to my SoFi account, to continue to compound.

Very simply to open and anyone can be a member. I earn $60+ per year from keeping my $1,000 at Digital Credit Union – as I don’t think you can earn that on any liquid account (i.e. savings, money market, etc.). Very easy to open and only takes a few minutes. Definitely recommend!

3 financial freedom product conclusion

There you have it! Three great products to increase your income, diversify your assets and earn interest/dividends while your money waits to be invested.

The freshest product on the list is SoFi, since I have only been using for approximately 18 months or so. Fundrise is going on almost 4 years and I believe Digital Credit Union may be 4 years plus.

Again, this is to show you what financial products I use to generate wealth, you may have and use others, such as Robinhood, M1Finance, WeBull, Public, Fidelity, etc..

If you have your favorite financial accounting – please share which company/brokerage/bank that is in the comments. I would love to see why you believe it is a superior product and who knows – I may even open an account if it is worthy.

The name of the game is to earn as much money as you can and continue to make your dollars work for you! Thank you for stopping by, appreciate the support and – as always – good luck and happy investing!

-Lanny