2022 continues to fly by. Another month is in the books. The stock market had one heck of an August, as the impact of inflation, interest rates, and a potential recession started to flow through earnings. Still, despite the noise, the dividend checks continued to flow. That is why we love dividend investing. In this article, I am going to summarize the dividend income received in August. Let’s take a deep dive into Bert’s August Dividend Income Report!

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income. One day, my dividend income will be large enough to cover my monthly expenses and allow us to retire early. That is why we are relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We save a high percentage of our income each month, to help fuel our dividend stock portfolio. Having a high savings rate is a key pillar of our strategy and helps fuel the fire and push the snowball further down hill. While we are waiting to invest our money in the market, it is earning a high interest rate in accounts. The two primary savings accounts I use are:

Read: Interest Rates on High Yield Savings Accounts Are SOARING!

How do we find undervalued dividend stocks to buy? That’s easy. We use our dividend stock screener with every stock purchase! This simple, 3 step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Watch: Dividend Diplomats’ Dividend Stock Screener

Building a large dividend income stream takes time, consistency, hard work, saving, and most importantly, investing. I have been investing in dividend growth stocks since 2012. Saving a high percentage of my dividend income allows me to invest as much as possible, so we can retire as soon as possible.

Slowly, but steadily, my income has grown. Brick by brick. DRIP by DRIP. It is really exciting to see the growth and larger dividend checks trickle into my brokerage account.

Each month, we share our dividend income summaries to highlight our growth and progress. It is a fun and helpful exercise that holds us accountable. Further, it helps you, our followers, see the stocks we are purchasing.

Bert’s August Dividend Income Summary

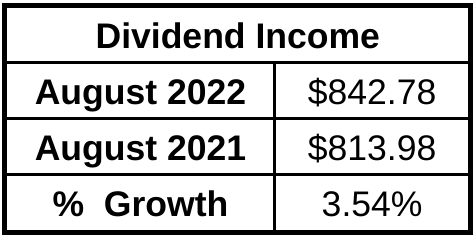

We received $842.78 in August dividend income! This was a 3.54% INCREASE compared to August 2021. The increase may not seem significant, but there was a lot of noise over the last 12 months. I’m excited to discuss the individual dividends received this month and start looking forward to the next quarter. Hey, at least this month increased compared to July (which saw a decrease in dividend income due to T.Rowe Price’s insane special dividend in July 2021).

August 2022 Individual Dividend Stock Payments

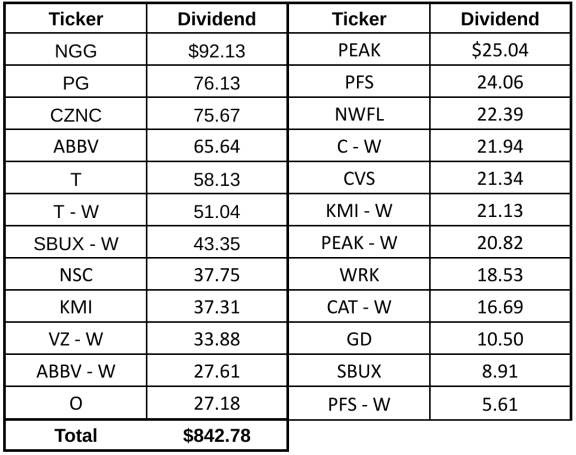

I mentioned in the last section there was a lot of noise. Now, let’s look at the individual dividend payments received during the month to see what caused some of this perceived noise.

First, let’s talk about the elephant in the room. We have a new Top Dividend Payer in August 2022 compared to August 2021. Last August, I received $100 from AT&T (T) and my wife received $89 for the troubled telecom and wireless communication giant. This August, I received $58 from AT&T while my wife received $51. In total, our AT&T dividend payout decreased $80. T continues to be one of the most frustrating stocks for dividend investors.

Second, let’s focus on the positive changes compared to last year. My wife started her AbbVie (ABBV) position in the last 12 months. That position grew and added $27.61 in new dividend income compared to last period. On top of it, the banking sector flexed its muscles. Citigroup (C) grew its payout to us by $8 due to additional stock purchases and Provident Financial (PFS) added another $6. There were new dividends from Starbucks (SBUX) as well, adding $9 of new dividend income.

Read: Starbucks is one of the 8 companies expected to announce a dividend increase in September!

Lastly, our dividend income increased compared to last year due to good old fashioned dividend reinvestment and dividend increases. The true fundamentals. Its like blocking and tackling! For example, my Procter & Gamble (PG) payout increase to $76.13 from $70.81 from DRIP and a Dividend Increase during the last 12 months!

Summary – August Dividend Income Summary

Another month and another round of all smiles. Despite a low dividend growth rate, I’m pumped up that our dividend income is closing in on $1,000 in an “Off Month.” Showing an increase wasn’t easy due to AT&T’s dividend cut. However, that is why it is important to continue investing and building your dividend income. That way, when something bad happens, you are diversified to not only withstand the blow, but come out ahead.

I’m particularly excited because I started building my position in Texas Instruments (TXN). The company pays its dividend in the second month of the quarter. Therefore, hopefully we will receive a nice, juicy dividend from the tech stock in our November dividend income report!

As always, lets keep pushing ahead and keep marching towards financial freedom. Let’s keep saving every dollar we can and invest as much as possible, so we can keep growing our dividend income!

Did you have a strong month of August? Did you set a personal record? What new stocks paid you a dividend for the first time in August 2022?

Bert

Still a nice chunk of change for the month of August despite that garbage T. Believe me, I feel you on that. Been adding to my VZ in recent months though to level out my telco plays. That T spin off is such garbage too but hey… we look forward and move on. At least we hold other gems like ABBV and SBUX and the like. It’s not all bad out there 🙂

That is a huge dividend haul for August! Congrats! Last month was my “off” month, but happily September is here as quarter ending months are my best. Keep up the great work Bert! 🙂

Excellent again Bert! Pushing up near $850 and I’m sure by this time next year it will be up over $900. We hit a personal best for August with $480 in our main account and over $800 for all of our accounts so I’m happy with the results. I’m definitely looking forward to September as it’s already been a solid month and the dividend increases are pretty much all backloaded.

From the Book “The Warren Buffett Way” by Robert Hagstrom

Buffett avoids purchasing companies that are fundamentally changing direction because their previous plans were unsuccessful. It has been his experience that undergoing

major business changes increases the likelihood of committing major business errors.

Buffett also tends to avoid businesses that are solving difficult problems.

Experience has taught him that turnarounds seldom turn.

“Charlie and I have not learned how to solve difficult business problems,” Buffett admits.

“What we have learned is to avoid them.

Sounds a lot like T to me.

Bert,

Congrats to you and your wife on growing your dividend income last month. Keep it up!

Great month and pushing close to 4 digits. You had an increase and that’s all that matters

Big news…. Mean Gene has to hand the mic over….

Bert has the real time head to head clinical trial of the two best dividend drugs out there: VYM and SCHD…

It’s the ETF version of Hulk Hogan v. The Ultimate Warrior for ETF supremacy…

It’s a dividend Pokemon battle for the ages…

Stay tune as these two vie to outperform in Bert’s portfolio as he buys in equal amounts at the same time to make it a fair fight.

Lots of fun videos ahead on this match up…