Intel (INTC) stock is down 45% this year. The dividend yield has SWELLED up to 5%. As a dividend investor, looking for iconic dividend stocks, Intel stock may have too low of a stock price to ignore.

Intel (INTC) stock is down 45% this year. The dividend yield has SWELLED up to 5%. As a dividend investor, looking for iconic dividend stocks, Intel stock may have too low of a stock price to ignore.

It’s time to dive into Intel’s performance, look under the hood, check their chips and see if they are a dividend stock to buy right now and if you should continue to buy the dip in stock price. Grab your coffee and LET’S GO!

intel stock

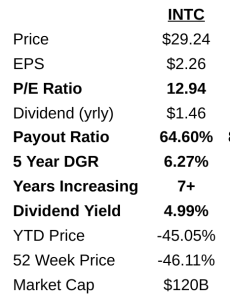

Intel, ticker symbol INTC, is a massive, global company with over $120 billion in market capitalization, as of September 16, 2022. Intel, in case you did not know, is the leader producer of chip processors, servers, memory, chipsets and many other products.

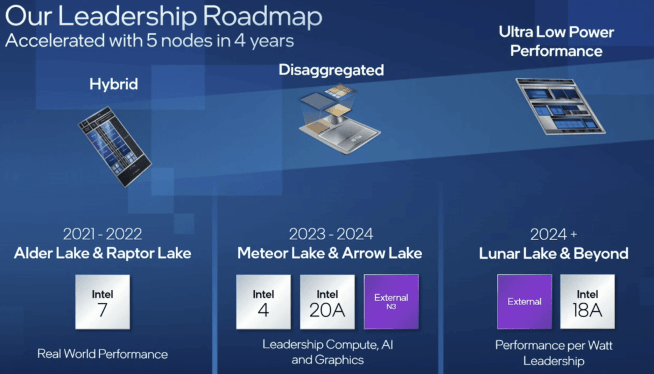

In fact, their revenue is projected to produce over $60 billion in 2022. Intel’s results will still be amazing, DESPITE the economic downturn we are in. Second quarter results were not good, showing a net loss, but there were many headwinds there. Intel is restructuring their business units, they took impairment charges on inventory (~$560M) but all was not doom and gloom.

Intel’s Mobileye business had record revenue, approaching $500 million in the quarter alone, which is set to produce over $2 billion in revenue for the future. Joe Biden cut the ribbon and put the shovel in at the Ohio-based manufacturing plant construction site. Intel is building a $20 billion plant in Ohio to produce semi-conductor chips. Intel is setting the stage for the future.

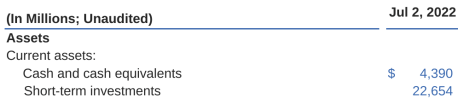

Therefore, it looks as though Intel is setting themselves up for a brighter future. As dividend investors, that matters. What also matters is, “how does their balance sheet look”? Does Intel appear to be a safe stock from a liquidity standpoint? For technology companies and capital intensive companies, such as Intel, cash and liquidity is king.

Therefore, it looks as though Intel is setting themselves up for a brighter future. As dividend investors, that matters. What also matters is, “how does their balance sheet look”? Does Intel appear to be a safe stock from a liquidity standpoint? For technology companies and capital intensive companies, such as Intel, cash and liquidity is king.

Intel is currently sitting on $4.4 billion in cash and over $22 billion in short-term investments. That is $27 billion of short-term, highly liquid assets. In fact, their current ratio, which is current assets over current liabilities, stands very strong at 2x. In addition, their quick ratio, which takes current assets less inventory, over current liabilities, stands insanely strong at 1.4x.

Intel is currently sitting on $4.4 billion in cash and over $22 billion in short-term investments. That is $27 billion of short-term, highly liquid assets. In fact, their current ratio, which is current assets over current liabilities, stands very strong at 2x. In addition, their quick ratio, which takes current assets less inventory, over current liabilities, stands insanely strong at 1.4x.

Therefore, Intel’s balance sheet and liquidity appears very safe. Now it is time to see if Intel is a dividend stock to buy, right now, as the stock is down 45%!

Intel dividend stock analysis

I cannot wait to put eBay stock through the Dividend Diplomat Stock Screener! Here, we focus on 3 main dividend stock metrics:

1.) Price to Earnings Ratio (P/E): We look for the price to earnings ratio < the S&P 500 and the competition.

2.) Dividend Payout Ratio: The preferred dividend payout ratio is < 60%. In fact, we believe the perfect payout ratio is between 40% and 60%.

3.) Dividend Growth Rate: Given we are dividend investing on our way to financial freedom, as we believe dividend income is the best source of passive income, we look at the 5 year dividend growth rate. In addition, we review how many years the company has increased their dividend.

1.) P/E Ratio: Intel (INTC) currently, based on a Yahoo estimate of $2.26 earnings for 2022, a P/E ratio of 12.94. Still relatively low and this number continues to fluctuate, as earning estimates continue to fluctuate.

2.) Dividend Payout Ratio: Intel’s dividend payout ratio, for the first time that I have seen, has now crossed above 60%. Intel can still pay and grow their dividend. However, the growth will definitely be SLOW going forward. As EPS goes down, the payout ratio goes UP. Not the best dividend payout ratio here, but not the worst and could be temporary for 2022/2nd half of 2023.

3.) Dividend Growth Rate: A strong history of growing dividends, 7 years is a nice path. Intel, however, will be slowing their dividend growth rate for the short-term. I anticipate 2-4% dividend growth rates for the next 1-2 years.

Lastly, we’ll take a look at the dividend yield. As an investor, you want to know how much owning this dividend stock pays you now! The yield for Intel has NOW SWELLED UP! The yield is at 5%, which is insane for this stock. You are getting paid now to wait for future/better results. A yield of 5% is well above their 5 year average and dwarfs the 1.4%-1.5% of the S&P 500.

is Intel Stock a Stock to buy now?

Now that we’ve gone through the metrics, is Intel a stock to buy for the dividend stock portfolio?

I think Intel’s stock is too low to ignore at below $30 per share. In fact, I have recently purchased a few shares below this price. Obviously do your own research and make your own decisions, but I am slowly buying a share here and there at these stock prices. I am buying Intel stock as they drop 2-3% each time. Example, I bought a share at $30 and then bought another share near $29. That would be my plan going forward.

If you head over to our YouTube channel, you’ll find other undervalued dividend growth stocks that are higher on my list for stocks to buy now!

How about you? Do you own Intel stock? Are you a believer in Intel’s future? Do you prefer Intel chips vs. AMD? Do you think Intel is a stock to buy now in this significantly volatile stock market? Share your comments and feedback below!

As always, thanks for stopping by, good luck and happy investing!

-Lanny

So many dividend stocks on sale! It’s like finding a pack of Pokemon cards stuffed with rare Charmanders at the yard sale.

Can these cyclical impacted companies keep the payout through a recession?.. INTC, LYB, MMM, C…. I have only had one minor position (AEO) stop the dividend (my research showed they even paid it through the GFC so I thought it would ride it out)…

Next episode: Dividend Stock Death Match… Put some of them in the Cage–Find Out Who Can Keep Paying Through the Post-Pandemic Bear (How Long?) and Who Might Tap Out (and lower or suspend)… Who shouts “no mas” and who pays cash when times are tough?

Run the classic stock screener with a twist, focusing on payout ratio, cash/debt, and how they paid in past recessions…

Thank you for the review of Intel. Always great content DD’s. I think Intel is a buy at below thirty but with a careful eye. I think Intel has potential but may face some more head winds going forward. I think tuff competition with perhaps a slowing economy can perhaps take a big bite out of there bottom line. I think the competition is making better and better chips out there so Intel has to keep a eye in the rear view mirror. That being said I own 220 shares and been adding shares as the price has been slipping for the last six months.