Fundrise continues to innovate and offer new and exciting investment products to individual investors. The company’s new opportunity, Fundrise Innovation Fund, will allow individual investors the opportunity to invest in privately held tech companies. That’s right, individual investors like us will have the chance to invest like a venture capitalist! In this article, I’ll review the Fundrise Innovation Fund and explain why I’m planning on investing in this new investment opportunity!

Note: This post may contain affiliate links.

Fundrise’s History

Fundrise changed the game when it opened its “doors” in 2012. The company’s mission is to allow individual investors the opportunity to invest in real estate. Historically, real estate investing is capital intensive and has high barriers of entry for investors like us. Before Fundrise, it was nearly impossible to invest a few thousand dollars into real estate (without investing in REITs).

That’s where Fundrise enters the equation. They built a low cost, online real estate investing platform for investors that are looking to invest at all investment levels. Whether you are looking to invest a few thousand or tens of thousands of dollars in Real Estate, Fundrise is a great option for you. Investors can select from one of their 5 investment funds (covered in detail in Lanny’s Fundrise Portfolio Update) that meet their investment objectives (appreciation, income, a blend, etc.).

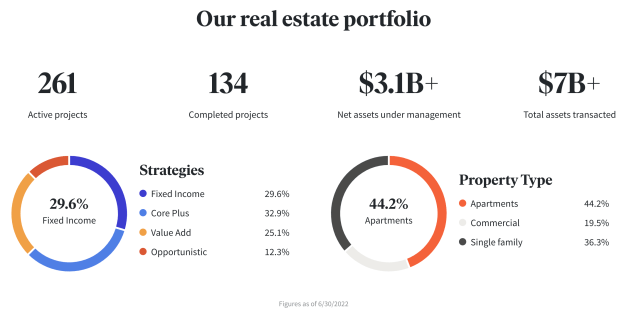

Now, Fundrise is a powerhouse that has over $3B of assets under management. They have from from $0 to $3B in a decade. Pretty impressive for a company that was laughed at and told that there was no way they could possibly break into the real estate sector.

Fundrise’s innovation didn’t stop with disrupting the commercial real estate market. Fundrise also set to disrupt the IPO market in 2019. They offered a unique, one of a kind Internet Public Offering (IPO). The IPO was available to all investors in the company’s real estate funds. Luckily, for the two of us, we have jumped on the opportunity to become shareholders of Fundrise and invest in each of the Fundrise IPO rounds over the years. For me, I’ve invested in 3 IPO rounds and have now seem my est. market value grow to over $3,000!

The company has successfully launched two innovative products. Now, it is time to discuss the company’s third innovative product for the remainder of the article.

Fundrise Innovation Fund

Enter the Fundrise Innovation Fund. The company is entering a new sector and launching an entirely new product. For real estate, Fundrise provided individuals an opportunity to own commercial real estate without investing large sums of capital. Low fees and access changed the game and helped the company’s valuation soar (as evidenced by the rising IPO valuations).

The goal of the Fundrise Innovation Fund is to invest in privately help technology companies focused in 5 sectors:

- Artificial Intelligence & Machine Learning

- Modern Data Infrastructure

- Development Operations (DevOps)

- Financial Technology (FinTech)

- Real Estate & Property Technology (PropTech)

The 5 featured sectors are particularly interesting. Why? The goal is to focus on sectors that Fundrise believes will grow and become major sectors for the next several decades.

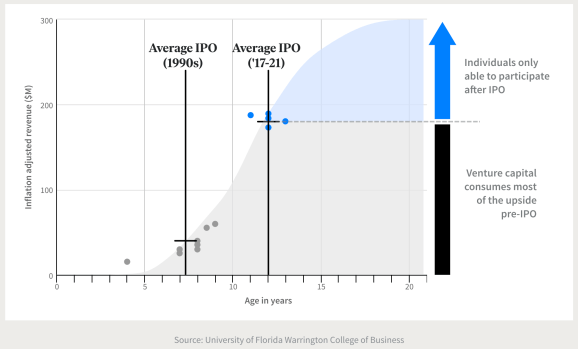

Historically, the individual investor has missed out on the returns for successful companies in these sectors. By the time a company reaches its IPO and an investor can invest in a company, venture capitalists and bankers have already benefited from large increases in valuation.  The timing of this fund is great. There will be a great opportunity for individual investors that participate in the Fundrise Innovation Fund to earn strong gains. Valuations for companies in the 5 focused sectors have cooled from their insane levels the last few years. Trust me, I can attest to this first hand via my current job. If Fundrise can pick the winners, the fund’s value could explode!

The timing of this fund is great. There will be a great opportunity for individual investors that participate in the Fundrise Innovation Fund to earn strong gains. Valuations for companies in the 5 focused sectors have cooled from their insane levels the last few years. Trust me, I can attest to this first hand via my current job. If Fundrise can pick the winners, the fund’s value could explode!

Picking winners requires an army of data, analysts, and research. Funding this is not cheap for Fundrise, or Venture Capitalists for that manner. One critical data point when deciding to invest in the fund are the fees.

The Fundrise Innovation Fund management fee is 1.85%. This is significantly lower than the fee that would be charged to participate in a venture capitalist fund. The company is replicating what worked with its real estate funds. Make investing affordable. With that, they achieved.

Sign Up For Fundrise by Clicking Here

Why I’m Investing & How Much Do I Plan To Invest!

After reviewing the opportunity, I’m planning on investing $1,000 into Fundrise’s new Innovation Fund to start. Although I may increase this investment to $2,000 to $3,000 by the end of the year.

You’re right. This investment doesn’t fit into my traditional portfolio. After all, I’m also building my dividend growth portfolio (Full portfolio disclosed here).

That doesn’t mean there isn’t room for some diversification. A small investment in a growth play is not going to sidetrack me from my overall goal of reaching financial freedom by building my dividend income stream.

A gamble with Fundrise is a gamble I’m willing to take. The company prudently build one of the most successful online real estate crowdfunding platform. Based on management’s track record, I’m confident in the company’s ability to replicate the playbook while launching the new Fundrise Innovation Fund.

Further, the 5 sectors that Fundrise will focus on are sectors that the company has some expertise in while building their current portfolios. There is some overlap. Therefore, Fundrise isn’t going to have to learn their focus sectors from scratch. They have a strong baseline knowledge for what may be successful and innovative going forward.

That is why I’m willing to invest an amount that represents less than 1% of my overall portfolio. Why not join the new wave of individuals that now have access to venture capital investing at an affordable cost.

Are you planning on investing in the Fundrise Innovation Fund? What are your thoughts about Fundrise’s new product? Should I be more skeptical than I am? What percent of your overall portfolio would you allocate to the Fundrise Innovation Fund?

Bert

For more information, visit Fundrise’s website

Fundrise? How about Bert-rise? We (the Youtube audience) are just hoping Bert’s wife will let him out of the basement where he now films.

Word on the street: Bert got locked down there until SWK (Stanley Black and Decker) hits $150!

Everyone buy tools (or SWK) to save Bert!

Bert-rise! Free Bert.