Bed Bath & Beyond Stock (BBBY)

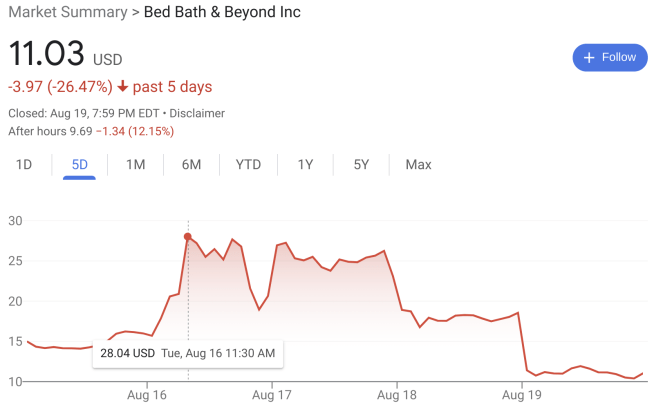

As you can see, the stock had a lot of fun this week – thanks to Reddit / Wall Street Bets… again! If you re-call, they did this to Bed Bath & Beyond Stock (BBBY) during the pandemic, along with GameStop and AMC.

As you can see, the stock had a lot of fun this week – thanks to Reddit / Wall Street Bets… again! If you re-call, they did this to Bed Bath & Beyond Stock (BBBY) during the pandemic, along with GameStop and AMC.

The pump of BBBY Stock

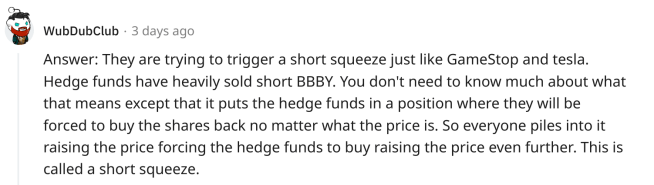

However, the band was back at it again, sending the stock price soaring during this past week, touching over $28 per share, which is essentially doubling the stock price. Why are they doing this? Here is a great Reddit response on the pump of BBBY Stock:

Therefore, it’s all about getting back at the Hedge funds and seeing if they can inflict monetary pain on them, by placing them in a short squeeze situation.

Therefore, it’s all about getting back at the Hedge funds and seeing if they can inflict monetary pain on them, by placing them in a short squeeze situation.

The dump of bbby stock

However, as you can see from the stock price for BBBY, the stock price was DOWN 26% over the last 5 days, despite the pump. Well, the other side of the pump and dump equation happened – dumping started.

Big activist investor, GameStop chairman, Ryan Cohen dumped his Bed Bath & Beyond shares and option contracts. In fact, he sold MILLIONS of shares outstanding, as you can see in the regulatory filing. Ryan ended up making tens of millions of dollars on the sale, I believe over $59 million. Not too bad for a week, right?

When an entity dumps this many shares, it is bound to plummet and punish the stock price, which is exactly what happened on the 18th and 19th of August. Down from the highs of almost $30 per share, the stock plummet back to reality, reaching lows of near $10 per share on Friday.

When an entity dumps this many shares, it is bound to plummet and punish the stock price, which is exactly what happened on the 18th and 19th of August. Down from the highs of almost $30 per share, the stock plummet back to reality, reaching lows of near $10 per share on Friday.

The fun part here is… my wife and I each owned shares of Bed Bath & Beyond stock. Therefore, the question is, what did we do with our BBBY Stock?

Exiting Bed Bath & Beyond Stock – at last!

Alright, here we go. From the beginning of the year, I wanted to exit positions that did not fit my dividend investing, passive income, financial freedom pursuing goals. Bed Bath & Beyond stock was one of the positions I wanted to exit at some point, when it felt right.

I had acquired shares of Bed Bath & Beyond stock many years ago, way before the pandemic of COVID-19 – possibly in 2018 and 2019. Outside of believing they could turn things around, I knew that this year, it wasn’t going to happen, especially due to the numerous changes of the CEO position.

In my dividend stock portfolio, I owned over 109 shares, everyone. My wife also owned almost 45 shares. In total, we are talking over 150 shares of these meme stock!

Therefore, on Tuesday, August 16, 2022 – we officially SOLD out of our Bed Bath & Beyond stock positions. Hallelujah! How did we do it? Well, I set limit orders for both of us that morning, to sell one part at $16 per share and then, putting in another for my wife’s account at $18 and then, $18.50 for my remaining position. Here are the screen shots of both of our account activity – the dark is mine and the light grey is hers:

![]()

![]() After the sales, that left us with approximately $2,668 of cash that we IMMEDIATELY put to use. It’s all about simplifying the dividend stock portfolio and investing into passive income producing stocks baby! Therefore, where did we deploy the “new found” capital after exiting the BBBY position?

After the sales, that left us with approximately $2,668 of cash that we IMMEDIATELY put to use. It’s all about simplifying the dividend stock portfolio and investing into passive income producing stocks baby! Therefore, where did we deploy the “new found” capital after exiting the BBBY position?

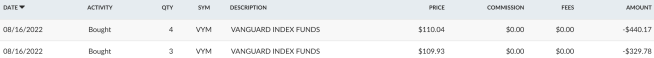

Easy – Vanguard High Dividend Yield ETF (VYM) of course! Did you really think I would invest into a different investment after exiting this meme stock? Here are the screen shots of the Vanguard ETF dividend stock purchase, similarly – the dark is mine and the grey is hers:

![]()

In total, we acquired 24 shares of VYM, investing $2,639. Therefore, we almost invested every single dollar we received from Bed Bath & Beyond stock. The 24 shares added $76.80 to our forward dividend income total baby!

In total, we acquired 24 shares of VYM, investing $2,639. Therefore, we almost invested every single dollar we received from Bed Bath & Beyond stock. The 24 shares added $76.80 to our forward dividend income total baby!

That is called going from $0.00 in dividends for owning BBBY Stock, to now adding $76.80, or almost $20 per quarter at this point. Extremely happy to be done with this beat-up stock.

Bed Bath & Beyond stock conlusions

Lessons were learned here. Simply because we have shopped somewhere and a company may have had a history of paying a growing dividend, does not mean they will continue to do that. Bed Bath & Beyond used to grow their dividend every year, but then the retail doom and gloom continued to impact them. The cost cutting strategies did not work out and sometimes, you have to learn from that.

In addition, cash, liquidity and balance sheets are key – especially during recession-like times. Over the last 2-3 years, that has been proven to be critically important.

Therefore, happy to have one position exited that produced no dividend income for that much capital and now – we added over $76 in dividend income!

What do you think of the investment activity here? Did you hold and exit your Bed Bath & Beyond stock? Are you somehow still holding their stock? Let me know your feedback in the comments below.

As always, good luck and happy investing!

-Lanny

I also got out Lanny. I sold all 260 shares in July of 2020 after the dividend was axed. Also, I noticed that the two BBY stores near my home were always empty. It’s hard to move inventory in a ghost store…

Since then, the nearest one closed.

I took the money and bought 39 shares if Tyson (TSN), which has done well since. Phew.

Cheers, John

CW –

That’s awesome you were out already – you didn’t have to worry about it and Tyson is a BEAST!

-Lanny