Let’s dive into a selling and re-selling platform that I use almost every single day. We are talking about eBay, not Amazon nor Facebook. I have used eBay as a reselling platform for more than 10 years.

Let’s dive into a selling and re-selling platform that I use almost every single day. We are talking about eBay, not Amazon nor Facebook. I have used eBay as a reselling platform for more than 10 years.

In fact, over the last 24 months, due to the Pandemic, I have used them more than ever. eBay has recently become a dividend GROWTH stock and I wanted to peel back the layers to see if this is an undervalued, cheap dividend stock to buy right now in this volatile stock market!

eBay (ebay) stock

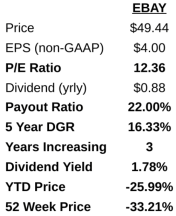

eBay (EBAY) stock is down 26% this year, surprisingly. Given the dramatic force of e-commerce, the Pokemon and trading card surge and having gone through the pandemic, this tech stock has been beaten down. In fact, the stock price was actually touching closer to $40 just a month or so ago. Since they are in Tech, they also have been dragged down by the industry in general. Companies, such as Facebook/Meta and Netflix are down 40%+.

eBay also has a LOT going on right now, on the positive news front. Here are a few bullet point items:

- eBay launched their eBay Vault program. This allows you to store, as a collector, your personal card collection in a secure, climate-controlled facility. This makes selling also easier, since it simply transfers ownership within the vault, reducing fees of shipping. eBay will earn shipping fees, if the card needs shipped, transfer fees and obviously storage fees (waived for year 1).

- They also have a partnership with Professional Sports Authority (PSA) for their Authenticity Guarantee on cards.

- eBay joined an investment consortium making a strategic investment in Funko. This strategic investment will allow eBay to become the preferred secondary marketplace for Funko. eBay also stated there should be upcoming, exclusive product releases. We all know Funko has a HUGE following.

- eBay also acquired KnownOrigin, an NFT marketplace. They have a perfect platform, process, technology and experience to have a great crypto powered, NFT marketplace.

Therefore, there is a lot in terms of fees/earnings and development for eBay. Net Revenues, though, were down approximately 9% for the 2nd quarter 2022. On a Non-GAAP basis, they earned $0.99 in earnings per share. eBay has experienced significant, operational performance fluctuations due to the stock market. Any equity investment they have, the change in value has to run through the Profit & Loss statement. I am assuming, if things ended today for the 3rd quarter, there would be a large gain due to the recent surge back of the stock market.

In terms of eBay’s balance and liquidity – they are rock solid. eBay is sitting on $1B of cash and their current ratio position is over 1.2x. eBay has no problem paying current bills. In fact, long-term debt is down $1.2B. Therefore, cash is up and debt is down. A great formula and recipe to protect the balance sheet.

Given what we know about their performance and balance sheet, is eBay a dividend stock to buy? We will review eBay though the Dividend Diplomat Stock Screener!

ebay dividend stock analysis

I cannot wait to put eBay stock through the Dividend Diplomat Stock Screener! Here, we focus on 3 main dividend stock metrics:

1.) Price to Earnings Ratio (P/E): We look for the price to earnings ratio < the S&P 500 and the competition.

2.) Dividend Payout Ratio: The preferred dividend payout ratio is < 60%. In fact, we believe the perfect payout ratio is between 40% and 60%.

3.) Dividend Growth Rate: Given we are dividend investing on our way to financial freedom, as we believe dividend income is the best source of passive income, we look at the 5 year dividend growth rate. In addition, we review how many years the company has increased their dividend. 1.) P/E Ratio: eBay stock is looking attractive at only 12x non-GAAP earnings. I believe this 3rd quarter, we should see the price continue to rise, due to the appreciation in the stock market having a positive impact on performance. In addition, many projects in the pipeline that should add revenue.

1.) P/E Ratio: eBay stock is looking attractive at only 12x non-GAAP earnings. I believe this 3rd quarter, we should see the price continue to rise, due to the appreciation in the stock market having a positive impact on performance. In addition, many projects in the pipeline that should add revenue.

2.) Dividend Payout Ratio: A dividend payout ratio that helps you sleep at night. eBay has a low dividend payout ratio at only 22%. This is critical for eBay, as they continue to invest into the company. The new projects and acquisitions are not cheap, therefore – using cash flow and earnings to grow is key. However, this is an extremely safe dividend based on the metrics.

3.) Dividend Growth Rate: eBay stock is a young dividend stock. eBay has paid out a dividend since 2019. Therefore, they’ve paid for 3 years and have grown their dividend for 3 years. The average dividend growth rate for eBay stock is over 16%! In fact, the last increase stood strong at 22%. Have to love that as a dividend growth investor.

Lastly, we’ll take a look at the dividend yield. As an investor, you want to know how much owning this dividend stock pays you now! The yield for eBay is 1.78%. That is higher than the S&P 500 by approximately 20 basis points. Therefore, the yield on eBay stock is more than the S&P 500, getting paid slightly more to hold.

is ebay Stock a Stock to buy now?

Now that we’ve gone through the metrics, is eBay a stock to buy for the dividend stock portfolio?

At this time, I do not think it is a bad time to buy this stock right now, while they are down 26% this year and 30% in the last 52 weeks. This may be a great entry point to owning a tech stock, that has a fairly easy to understand revenue stream. I am a big believer in investing into platforms that you use. Therefore, I may possibly buy eBay stock at these prices. I don’t want a new position in my dividend stock portfolio. Therefore, I may have to cut ties with a few that don’t fit my strategy anymore prior to investing (such as BBBY and others).

If you head over to our YouTube channel, you’ll find other undervalued dividend growth stocks that are higher on my list for stocks to buy now!

How about you? Do you own eBay stock? Do you sell on their platform? Do you like the services and the process of selling/buying on eBay? Do you think eBay is a stock to buy now in this significantly volatile stock market? Share your comments and feedback below!

As always, thanks for stopping by, good luck and happy investing!

-Lanny