Time to crank out an article, reflecting on the Banking Crisis that has now plagued the US and Global economy for the last 2-3 months.

We have had now, officially, 4 U.S. Bank failures with First Republic, Silicon Valley, Silvergate and Signature Bank. The most recent bank failure being First Republic.

Time to go over a few reasons why they failed AND what to look for when purchasing a bank stock!

Failed banks in 2023

First, Silvergate was one of the first and they actually through in the towel.

Then, when they decided to cease operations, more bank failures ensued. Silicon Valley and Signature bank happened on the same weekend on March 10th-March 12th.

Lastly, as we are now aware, First Republic failed recently on May 1, 2023.

Now, there are many other bank names in the mix. We have PacWest (PACW), Western Alliance (WAL) and Zions (ZION) are the next banks that are in discussion to be on the brink.

The question is, why are the bank stocks on the brink? What is going on and what to look out for?

What caused the banks to fail

Social Media & News. There is no question, the amount of media and news, social media specifically included helped create heightened panic. Hedge funds, venture capitalists and the rest is history. This didn’t help the customer base not pull funds out from the respective financial institution.

Investing into the lowest rate, longest term investments. During the Pandemic, banks had an insane influx of cash due to the economic stimulus funds, the PPP lending, SBA loans, you name it. The banks needed to invest it and had to look at mortgage-backed securities and US treasuries. Now, the short-term rates were paying close to nothing. you had to go out 5-10+ years, to receive yield on the investment and that is just what they did.

What occurs when interest rates rise? Those assets lose value. That’s exactly what happened with these banks, their assets valuation continued to decline. The funny part is – it is not required to be reflected on the income statement, only the balance sheet if available for sale. For those investments that are classified as Held to Maturity, you don’t even see that on the balance sheet or income statement.

Then, when you are in a liquidity crisis and meet the demands of customer deposit withdrawals, selling assets is an option. However, it doesn’t work well when your assets are underwater and destroys your capital. That is a significant component of what occurred amongst the institutions.

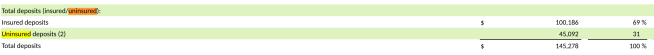

Uninsured Deposits Balances to the ROOF! This one gets tricky. We all know that FDIC & NCUA insurance protects up to the traditional amount of $250,000. The only time to be “nervous, per se, is when a banking institution goes through a liquidity crisis and you have more than that amount. Therefore, this metric became HOT under the microscope, due to “potential losses” that deposits were going to face, if a bank were to go under.

For some, over 80% of their deposit base was uninsured, i.e. over $250,000, such as Silicon Valley Bank. The dominoes fell from there and it was next bank that fell right behind it to fail and so forth. In addition, the upcoming banks are under scrutiny for this same metric; such as PacWest and Western Alliance.

Poor Management.. Similarly, the management teams of the financial institutions that failed also had poor management. It’s one thing for one of the items to happen, but for all to happen at once, is bad management. First, why would you invest a significant amount of your assets that long,if you knew rates would more than likely rise at some future point? Second, where were the contingency and liquidity plans in case you had no liquidity or capital was tarnished? Where are the marketing and public relations teams to battle social media and the news?

A lot has to do with the tone at the top, and the tone at the top, turned out to be nothing at the bottom, right where they ended up.

What to look for when researching a bank stock to buy

Now, for investors, what should they be doing now? Should you avoid the industry altogether? I’m not. Bert’s not. For the most part, community and local banks are just fine, without a blip of change. They simply aren’t in the news, don’t have uninsured deposits of any magnitude and their balance sheets and investment mix is rather boring and short-term in nature.

You can keep it simple and buy a too big to fail bank, such as JPMorgan (JPM) and believe in Jamie Dimon. You can look at other large banks, as well, in the top 20. The thought process is they are too big to fail, because if they did, entire financial ecosystems would collapse. Think real estate, mortgage, stock markets, etc..

If you want to go into the details, you can review a Bank’s 10-K / Annual SEC Filing and/or 10-Q SEC Filing and look for these metrics:

1.) The amount of uninsured deposits. CTRL+F – yes, go and type/search the word uninsured in the SEC filing to locate. Here is an example of Huntington’s (HBAN) 10-Q recently:

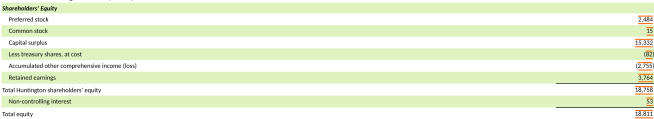

2.) Look at the unrealized loss position as a component of equity. Why? If a bank’s investments are so underwater, that if they sold to regain liquidity, would it demolish their capital? Going with the above example, here is Huntington’s; representing around 10% of equity:

3.) Test the book value against the share price. Try to grab a bank whom has a book value (Equity divided by shares outstanding) that is greater than their stock price. This means the market is valuing the bank less than what their equity is worth.

4.) Review liquidity from a high level. I usually like 5%. Huntington’s example, they have $500M in investments maturing in 12 months, cash on hand plus cash in interest bearing accounts and deposits at the Fed. In total, they have about $11B in liquidity, which covers between 7 to 8% of deposits.

Using those metrics, in addition to other dividend stock screening tools, should put you in a safer zone when considering a bank stock to buy.

Banking Crisis final thoughts

Here we are now, mid-May and we may have more bank failures upon us. However, I hope this provided clarity around why the banks were failing and what you can do as an investor.

I broke down a few of the reasons why I believe the banks failed, supported by financials, as well as by numerous articles and tweets related to the media front. In addition, I broke down the metrics I would use if looking for a bank stock to buy and a few other solutions, hopefully.

Again, not a financial advisor and would recommend conducting your own research.

I don’t believe we are out of the woods yet, not until we have a calm and more than likely not until rates flatten or come down from the Fed.

Stay vigilant, keep saving and keep investing. Good luck and happy investing out there everyone!

-Lanny

Diplomats, would appreciate an analysis (since you all use SoFi) of WKLY, a SoFi etf that gives out dividends weekly. Yes, weekly. It has a global dividend growth portfolio- think US stalwarts with European defensives and staples. Obviously small AUM so could eventually be scrubbed, but interesting concept. Disclosure, not a holder or affiliated with SoFi or WKLY. It ain’t no SCHD, but worth exploring, Wait, did I mention weekly dividends:)))

For those interested, Brad Thomas on Seeking Alpha wrote about this WKLY etf. Enjoy. Note after review, the turnover is remarkably high, jmho. GT