Interest rates are high, should remain high and even have a chance of going up, as the Federal Reserve tries to tame inflation still. Jerome Powell has done a number on the economy already ,raising rates 500 basis points in the last 14-15 months.

Rising interest rates has caused high yield savings accounts to sky-rocket, as you can earn anywhere from 3.85% up to 4.85%, fairly easily.

In addition, it isn’t just high yield savings accounts that are going up, so have certificate of deposits or CDs. Yes, the most boring product, ever. Well, almost as boring as U.S. treasuries. What no one is talking about is the NO PENALTY CD. I am here to tell you why I think it offers the BEST of BOTH worlds and why I use the No Penalty CD option right now.

The No Penalty CD

Have you heard of this product? If not, that’s okay. Many banks and credit unions offer them. In a nut shell, here are the main details of a No Penalty CD:

1.) It is a certificate of deposit at a fixed interest rate. Over the length of the CD, the interest rate will not change, it is fixed for the duration or timeframe of the CD, similar to a standard CD. Many are odd term lengths, such as 7 month, 11 month, 13 month and so forth.

2.) You can “break” the CD and move it back to your checking or savings account WITHOUT penalty. The key piece and major benefit is the ability to withdraw or break the CD “contract”. Most CDs have you pay a penalty of up to 6 months interest. Now, with a no penalty CD, you can withdraw before the maturity date without having to pay any fee or early withdraw penalty. The only caveat is there usually is a minimum holding period of 6 or 7 days or up to 30 days.

3.) If you withdraw, you withdraw the whole CD. The con is that you can’t treat it exactly like a savings account, by only withdrawing a portion of the no penalty CD. When you want to withdraw, you have to withdraw the entire CD, from my experience.

4.) The interest rate will be higher than a high yield savings, but lower than a normal CD. Here is a fun breakdown, currently at Ally as an example (rates are subject to change! I actually use a different platform, more on that later, a super high rate I receive, in fact!):

–> Online Savings = 3.85%, Money Market Account = 4.15%

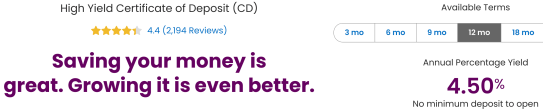

–> 12 Month CD = 4.50%

–> 11 Month No Penalty CD = 4.25% = 10bps higher than MMA, 40bps higher than savings, 25bps lower than the 12 month CD.

I hope that is enough information to share about what a no penalty CD is. Essentially, it will be a better product than a savings, but lower than a similar term CD! What exactly am I doing and why?

When it may be smart to do a no penalty CD

Here are the reasons that pertain to me and others, on when a No Penalty CD may make sense:

a.) You have an upcoming large expense, but not sure when. For us, in our household, this is an upcoming house purchase. We aren’t sure when exactly we are going to find the right house, but we want to stay liquid, but earn more than a savings account. This satisfies that objective.

b.) You believe that interest rates may drop in the near-term. I don’t necessarily mean interest rates dropping in a month or two months, but if the expectations are in month 3 and 4, months should be dropping, your high yield savings will drop with it. If you are in a no penalty CD, you are great plus you stay liquid.

c.) Maintain liquidity. Relating back to a and b, above, if you just want to keep your money as liquid as possible, but earn more, the no penalty CD is perfect.

Those are my 3 favorite reasons and essentially why I am choosing a No Penalty CD, but wait – what no penalty CD am I doing?

my current no penalty CD

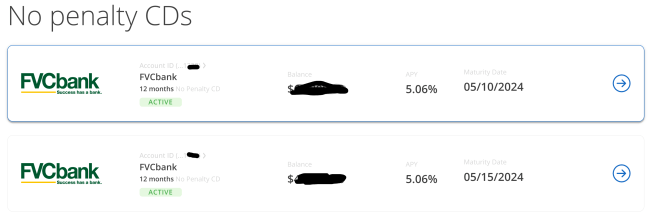

Without further-a-do here is my 12-month No Penalty CD, you read that right – not an odd-month actually!

I go through Save Better (clicking and using referral code: lannyb004373 gives you a bonus!), which is a platform that banks and credit unions use to solicit offers out to the masses.

I was fortunate where within the last two weeks, I was able to secure a 5.06% 12 month No Penalty CD. We have our down payment fund sitting here earning hundreds of dollars, and can be withdrawn at any time.

The economists and analysts are projecting interest rates to decline towards the end of this year. Therefore, if we still haven’t bought a house, we are locked in until May of 2025 with this rate, which I believe is fantastic.

The best part is, if we find a house, though, next month or next quarter, we can simply withdraw this – without penalty – to help pay for our house (that is a whole other story, as finding a house has been impossible).

Again, the no penalty CD offers us a higher interest rate than a high yield savings account, but slightly less than a normal CD you may find.

Save Better <– Use referral code: lannyb004373 when you register!

conclusion

What do you think of the no penalty CD? Do you use them? Do you pass on opening these accounts? Are you more of a traditional CD person or stick to buying US Treasuries or brokered CDs?

I look forward to your feedback!

As always, keep saving, good luck and happy investing!

-Lanny

All of this is brand new information for me. Thank you for the education on this Lanny. Great plan to put your house savings in there! Risk free 5.06% that can be withdrawn whenever you want? Great deal.

Wishing you and your wife luck finding a house. I am sure it is hard in this economy. Luckiest investment I ever made was buying a house in 2018 when prices were much more reasonable…then refinancing to 2.65% rate on a fixed 15 year in early 2021!

Colby –

Thank you, exactly and I check at least a few times per week if rates go higher on no-penalty CDs, that we can exit and go into.

Nice job with your house purchase AND refinance, 2.65%… W O W. You are going to be financially free in no time with that, jealous!!

-Lanny