6 years ago, I created a list of 5 stocks that I would always buy. I loved the companies on the list so much, that I purchased shares in all 5 and own them in my portfolio. Each stock was pre-vetted as a dividend growth stock that met my personal investing obective.

The reality is, however, that things change over time. The market conditions today are certainly different than they were 6 years ago. Consumer habits are evolving faster than ever. Therefore, 6 years later, I wanted to sit down and review the list. In this article, I will re-visit the 5 stocks and review their performance and dividend growth over the last 6 years. Then, I will determine which of the stocks I would still “Always Buy” and which stocks I may look to replace on this list.

Why I created an “Always Buy” List of 5 Dividend STocks

My initial 5 “Always Buy” list was publised on September 11, 2015. That is over 6 YEARS AGO! Here is a link to the initial article (updated several times since).

The intent of building the list was simple. Take the emotion out of investing. Build a list of stocks that I “pre-screened.” Therefore, when I wasn’t sure what stock to buy, or there was a sudden drop in the stock market, I would be able to make a quick decision to buy one of my 5 “Always Buy” stocks. After all, the goal is putting that extra cash to work in the stock market, or in places like Yotta (1% – 2% APY, on average) and BlockFi (Currently earning up to 9% APY).

The list was built using a combination of our Dividend Stock Screener, our Top 5 Foundation Dividend Stock List, along with the following specific rules specific for the list:

- The Company Has Increased its Dividend for 20 Consecutive Years

- Payout Ratio Below 60% (at the time of the article’s release)

- No Oil Companies

The 5 stocks I considered my “Always Buy” stocks are:

- 3M Company (MMM)

- Emerson Electric (EMR)

- Johnson & Johnson (JNJ)

- Pepsi (PEP)

- Target (TGT)

Additional detail about why each stock was selected, along with the more information about my methodology for creating the list, can be found in the original article.

How the Market Has Performed in the Last 6 Years

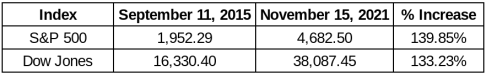

On the date the article was published, September 11, 2015, the S&P 500 closed at 1,952.29 and the Dow Jones closed at 16,330.40. Fast forward to today. Let’s just say, the stock market has been on quite a tear over the last 6+ years. The following chart shows the indices then and now:

Holy freaking cow. We all know that the stock markets have been on a tear over the last few years. It seems like the S&P 500 is setting a new record on a daily basis. You don’t realize just how much the stock market has appreciated though, until you compare the values over an extended period of time.

Over the last 6 years and 2 months, both the S&P 500 and Dow Jones have more than doubled. Absolutely wild!

The list has also been in existence for 3 presidents (Obama, Trump, and Biden) and the list has survived a global pandemic. The list was made with a long term mindset, one that will survive multiple economic cycles and different admistrations. It has succeeded in accomplishing just that!

How My 5 Always Buy Stocks Performed

The markets have obviously crushed it. It is still shocking to me that the S&P 500 has climbed nearly 140% since the list was published. It just goes to show the importance of moving your cash off the sidelines and into Mr. Market. So now, let’s see how each of the stocks have performed over the last 6 years and 2 months. In addition, we will take a look at the growth in dividend and look at the company’s dividend yield as well. Time to dive in!

Stock 1: 3M Company (MMM)

3M Company is one of the classic, original stocks in my portfolio. I love 3M’s diversification. They dominated in many sectors, including industrial, manufacturing, healthcare, energy, and others. Plus, 3M has a consumer staple portfolio that includes Post-it Notes, Scotch Tape, Filtrite, and Nexcare. Truth be told, I could even see 3M one day following the recent trend of conglomorate companies spinning off businesses. With GE, AT&T, and now Johnson & Johnson, it seems like many companies are slimming down, after years of growth and brand hoarding.

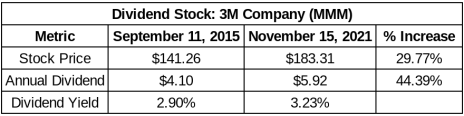

The following table shows 3M’s stock price growth, dividend growth, and the change in dividend yield that has occurred since my original list was published:

3M’s stock price appreciation has lagged the broader market significantly. The company’s stock price has only increased 30% since I published the list in September 2015!

The dividend growth, in aggregate, has been strong for 3M, as it has increased over 40% over the 6 year period. However, any 3M shareholder (like myself) will tell you that the company’s recent dividend growth history has been less than stellar. 3M’s 3 and 5 year average dividend growth rate are 4.04% and 6.38%, respectively. The reality is that the company’s dividend growth is slowing.

Another positive is that the company’s dividend yield has increased slightly over the last 6 years.

Dividend Stock #2: Emerson Electric (EMR)

Another Dividend King took the second spot on the list. Emerson Electric is a diversified industrial company. The company has two major divisions and classifications for the sectors they operate in: Automation Solutions and Commercial & Residential Solutions. Emerson operates worldwide. One feature that jumps out to me is the high sticking costs for Emerson Electric. Once they sell products and services to a large business, it is very difficult to move away from Emerson. That is a receipe for becoming a Dividend King….right?!

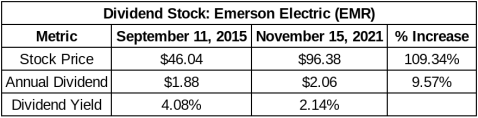

The following table shows Emerson’s stock price growth, dividend growth, and the change in dividend yield that has occurred since my original list was published:

Unlike 3M Company, Emerson’s stock price has appreciated significantly over the last 6+ years. Even though the 109% increase trails the broader market, it is still very strong. In my initial article, I mentioned that I intiated a position in 2015. Between DRIP and price appreciation, I am sitting in a very nice unrealized gain position.

However, unlike the stock price, the company’s dividend growth has been less than stellar. In fact, it has been down right infuriating. The company’s annual dividend has only grown 10% over the last 6 years. You read that right….just 10%! Lanny and I have always joked around about the company’s patheric dividend growth over the years. It is insane, though, when you see it written out like this.

Due to the strong price appreciation and pathetic dividend growth, it shouldn’t be a surprise that the company’s dividend yield has plummeted. Still, a 50% drop in dividend yield over 6 years due to low dividend growth is wild.

Dividend Stock 3: Johnson & Johnson (JNJ)

The third dividend king has a special place in my heart. In fact, I love Johnson & Johnson so much that my wife and I purchase 1 share every week of the Dividend King. Slowly, but surely, we are building a powerhouse position in the consumer and healthcare giant.

The third dividend king has a special place in my heart. In fact, I love Johnson & Johnson so much that my wife and I purchase 1 share every week of the Dividend King. Slowly, but surely, we are building a powerhouse position in the consumer and healthcare giant.

Read: Why I’m investing in Johnson & Johnson Every Week

Speaking of the company’s major divisions, Johnson & Johnson shook the investing world in 2021 when the company announced it is spinning of its consumer brands division. One division will consist of the company’s pharmaceutical and healthcare division and the other division will consist of the company’s consumer staple division. The consumer staple division will feature brands such as Tylenol, Band-Aid, Listerine, Neutrogena, to name a few.

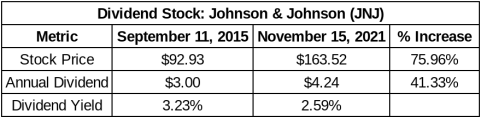

The following table shows Johnson & Johnson’s stock price growth, dividend growth, and the change in dividend yield that has occurred since my original list was published:

Upon first glance of the share price appreciation, you can possibly understand why management is spinning off a division to unlock growth. Johnson & Johnson’s stock price has lagged the broader markets over the last 6+ years. The company has also been bogged down with multiple litigations over the last several years as well.

Johnson & johnson’s dividend growth will never blow you away. In fact, that’s what I like about the company. Their dividend growth is steady and reliable, typically falling between 4% – 8% annually. That’s why Lanny and I call this company “old reliable!”

The dividend yield has decreased slightly due the dividedn growth that has lagged the stock price appreciation. Trust me, I wish JNJ was still yielding over 3%!

Dividend Stock 4: Pepsi (PEP)

Next up on the list…Pepsi. Pepsi is one of my favorite companies due to their diviersifed beverage and snack portfolio. The company’s brands speak for themselves, and are found in nearly every household. The Frito-Lay snack business, in fact, is part of the reason why I prefer investing Pepsi over Coke (which is exclusively beverage). Pepsi is on the doorstep of becoming a Dividend King as well!

Read: Who and What is a Dividend King?

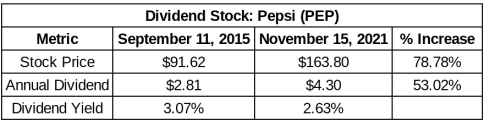

The following table shows Pepsi’s stock price growth, dividend growth, and the change in dividend yield that has occurred since my original list was published:

The stock price appreciation has been strong, but has not outpaced the broader market. Pepsi’s stock price has only increased 79% over the last 6+ years.

Pepsi is a rockstar in the dividend growth category. The company’s dividend has increased 53% over the last 6+ years. Like JNJ, the company’s dividend growth has been consistent. Their 3 and 5 year average dividend growth rates are 6.59% and 7.61%, respectively. Helping grow your income stream over 50% in a short period of time is excellent.

Dividend Stock 5: Target (TGT)

Target is a favorite in our household. We love the retailer. They do an excellent job of keeping shoppers committed to the store’s brand, with lucrative discounts and the great prices offered. We purchased all of our daughter’s diapers, formula, and other baby products at Target. We also had a wedding registry and baby registry at the large retailer.

Overall, the company has done a fantastic job fighting Amazon and Walmart over the years. Several years ago, Target was claimed “defeated” by Wall Street in the retail wars. Since then, management has invested significantly in technology and refreshing the company’s stores, along with establishing a high quality store brand!

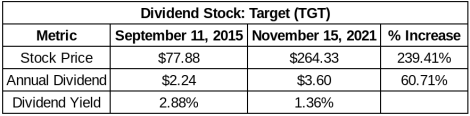

The following table shows Target’s stock price growth, dividend growth, and the change in dividend yield that has occurred since my original list was published:

Target’s stock price has absolutely crushed it over the last 6+ years. This was the only stock that blew the indices out of the water! It is still shocking that Target’s stock price has increased 240%. As a Target shareholder, you know that statistic makes me smile.

The dividend growth has been strong too. Although the dividend growth is weighted towards the company’s recent yearas. TGT announced a 32% dividend increase this year alone!

It doesn’t get any better than this, when reviewing the list. Amazing stock price appreciation and dividend growth. Can’t ask for anything more!

Analysis of the 5 Always Buy Stocks!

So now what? That’s the million dollar question. After performing a 6 year review…are the companies still considered stocks to always buy?! The intent of this list was to indentify high quality, long term investments in dividend growth stocks that I could reliabily invest in at any moment. Upon review of the companies, I still believe that each of the 5 companies included on the list are high quality stocks.

That being said, I’m not married to the 5 companies. Reviewing each company’s stock price appreication and dividend growth has been an eye-opening experience. Some changes to the list will definitely need to be made.

There are 3 companies that I consider “no brainers” to continue including going forward. The first is Target. The metrics speak for themselves. Despite a low dividend yield, the company’s stock price has soared and management has increased its dividend signficantly over the last 6 years.

Don’t Forget to Subscribe to our YouTube Channel!

The second and third no brainers are Pepsi and Johnson & Johnson. Both companies stock price appreciation trails the broader market; however, I love the consistent dividend growth and diversified brands for each of the companies. With dividend yields in the mid 2% range, consistently,

Now, on to the other two. It is time to revisit including 3M and Emerson on this list going forward. 3M’s dividend growth has been average over the last 6 years, but terrible of late. Further, the company’s stock price appreciation leaves a lot to be desired. Conversely, while Emerson’s stock price appreciation has been strong, the company’s dividend growth has been dismal. As a dividend growth investor, I need to see a balance of appreciation, dividend growth, and dividend yield.

In the end, I think I can find better options than 3M and Emerson, so I will begin the process of replacing them on the list. A company like Aflac immediately comes to mind as a potential replacement for 1 of the 2!

Summary

The quest to replace 3M and Emerson is on. Overall, conducting the exercise was a very fruitful exercise. Regularly checking in on your investments is an important exercise. Especially since so much has changed since September 2015. Armed with more facts and data, I have a plan to improve upon the list using the skills I have learned and acquired over the years. The beauty about dividend growth investing is that there is always plenty to learn. You never stop learning and growing. Now is the fun part. Its time to roll up my sleeves and start researching dividend stocks!

What do you think of my analysis? Do you agree with my conclusion to keep TGT, PEP, and JNJ on the list while looking to replace MMM and EMR? What would you do if you were me? Can’t wait to read your comments and see your thoughts!

Bert

One stock beat the market (although that may have been different if you had exited at different points and redeployed).

So you should have just indexed is the conclusion, surely.

I say that as a passive/active 50/50 investor.

Oh and thank you for taking the time to post and make the videos, I still follow, for a distance as I fell off the dividend wagon a while ago. But appreciate the content and effort all the same.

Thank you very much! We LOVE doing it Simon.

It definitely was eye opening in that respect. However, I do like the additional income that comes from owning dividend stocks with a highger yield than the market. It definitely crossed my mind as I performed the review though!

Bert,

I did a total shareholder return calculation on 3M to see how it truly would have performed if dividends were reinvested from 9/11/2015 to today. What I see is that a single investment in 3M back in 2015 would have grown at 7.05% a year and would be 52.4% more than the initial investment. This definitely doesn’t compare with the returns of the S&P 500, but some people may be very happy with an average 7% return.

Still, I’m interested to see what replacement you come up with.

Thanks Ron. When you show the return like that, it isn’t terrible. That’s for certain. You have to factor in the 3%+ yield you received for a while. However, it has been a frustrating stock to own of late, especially from a dividend growth perspective.

Bert,

AFL wouldn’t be a bad name to replace either MMM or EMR. The last couple of dividend increases have been insane and the company is really knocking it out of the park quarter in and quarter out.

Thanks Kody! AFL is looking very appealing now. Especially after that JUICY dividend increase.

Bert

Big fan of all of these. Got 26 of MMM, 34 of EMR, 49 of JNJ, 54 of PEP, and my favorite, TGT, which I’m up to 93 of. The big holding is from matching what I spent at the store. I only live 1.5 miles from a Target, so I got there quite a bit

I actually dumped my MMM for RIO recently. Might be a long shot, but prospects look good for the future and the dividend is nice right now.

Hey Bert,

Great to see the update and I remember when you came out with the list in the first place.

I don’t know EMR well enough to comment, but I do think replacing MMM is worthwhile. How about a tech name like MSFT? Low yield, but solid dividend growth and a runway for growth that’s hard to beat. Huge opportunity with their Azure Cloud product line.

JNJ is one of my top holdings and I’m interested to see how the split into two entities is going to go.

Take care,

Ryan

I would stick with all 5. For the most part all have their own sector. All are highly diversified.

Stay long predictions are a dime a dozen. SWAN

Is most important to us 63yr olds. Boots on ground family members with Medtronic’s (son)

P&G (sister in Asia). Maybe look at these 2 and have all 7 as nice core for a portfolio. Love you guys , always watching.