What a time it has been. For over 16 months, I have been consistently buying Vanguard High Dividend Yield on a weekly basis, at least 3 shares for my portfolio (now 4). We won’t even consider my wife’s Vanguard position, as we have been doing the same.

After 16 months of consistency, this position has been built up in my taxable dividend stock portfolio to over $26,000. I want to tell you how it’s going, what this feels like and what my dividend investment plans are, going forward. Let’s dive into the $26,389 Vanguard Dividend Investment position in my stock portfolio!

vanguard VYM – How it started & How it’s going

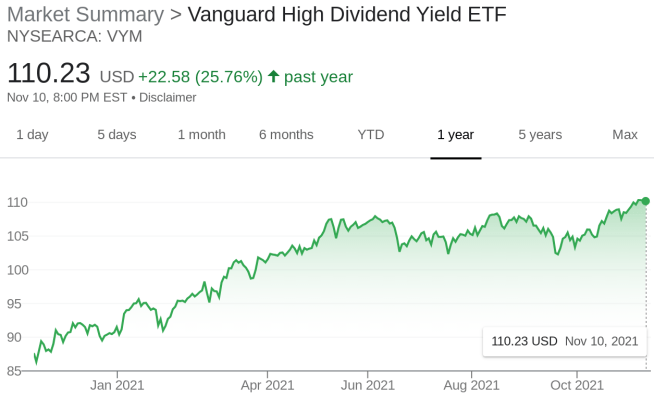

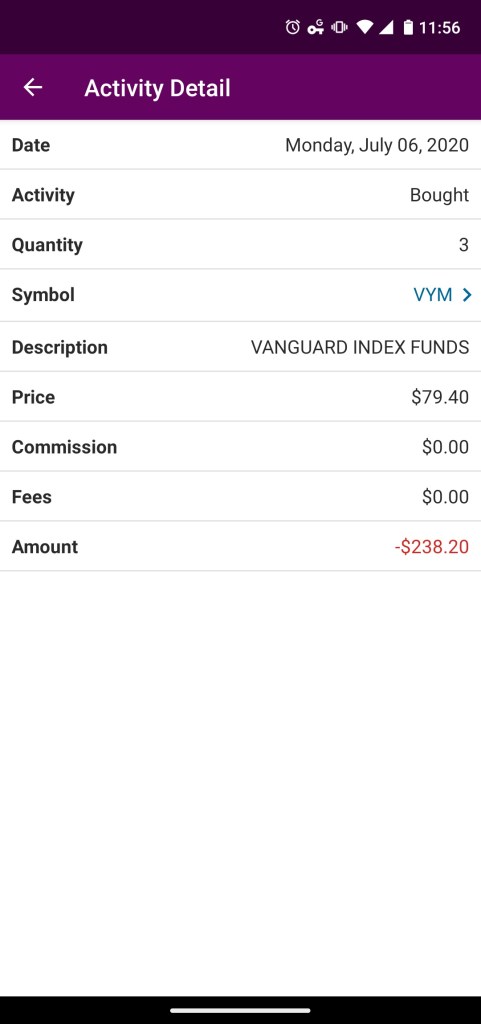

Just look at that stock chart for Vanguard’s High Dividend Yield ETF (VYM). You can see the insane trajectory – as the ETF is up over 25% since last year. In fact, the first time I started acquiring shares of this stock / ETF, was on July 6th and Vanguard’s VYM was only at $79.40 per share. The stock market has hit all time highs, each week I feel like. Have to thank the inflation concerns, as the Fed pumped the economy with not just billions but trillions of cash.

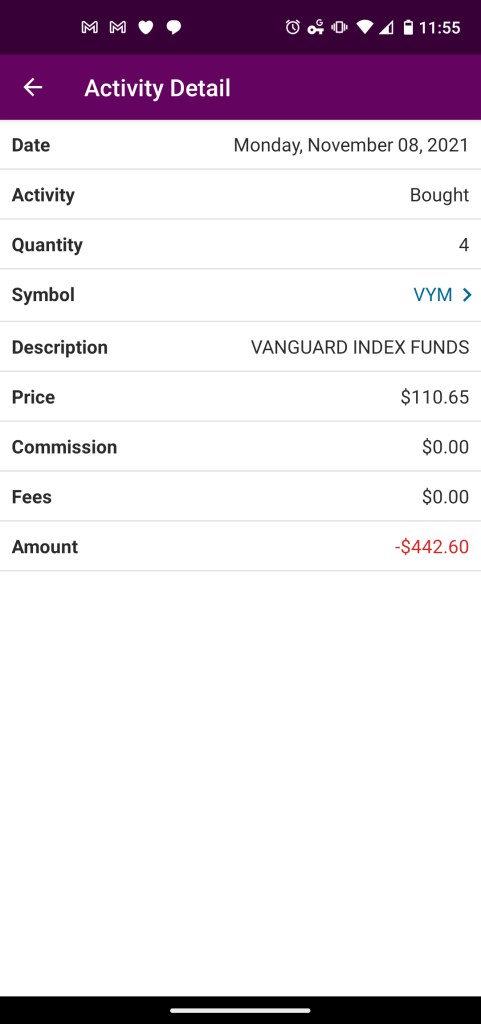

If you take a second and even round that to $80 per share, the price has risen $30 since then. The price of VYM since July of 2020 is up nearly 30%. This just goes to show you, you can never time the market. Half the population believes the next stock market crash is here; the other half believes we are just getting started. Since I showcased the purchase back in July of 2020, here is my latest purchase on November 8th, 2021:

Yep, from $79 to $110. That’s how it’s going here. The price has just skyrocketed from the lows of 2020 during the global pandemic. In addition, so many other areas propping the stock market. Think interest rates, as well. Borrowing at the lowest cost in history is making money flow into the markets, such as the stock market and the crypto market. Heck, the price of Bitcoin and Ethereum are at all time highs as well. I hold a little bit of both crypto-currencies, but also hold a large amount in GUSD Stablecoin, where I earn 9% on my money! See here, if interested.

So that is how it started with Vanguard and VYM, leading into how it’s going. A nice massive price appreciation. The stock market is at all time highs and shows no signs of slowing down. Passive income is being added each week from the purchase, but it’s costing a lot more capital to do so, that’s for sure. The road to financial freedom was not supposed to be easy, but I am here to battle.

Vanguard Investment Worth $26,000+

Time to talk to you about my current investment with Vanguard’s VYM. See the snip below. I have plowed in over $22,000 into this ETF investment. How does that even happen? Never stopping. No matter what, I was investing AT LEAST 3 shares per week, sometimes more when it would dip. Lately, I’ve been doing 4 per week, due to other circumstances. I want to be financially free so bad, that building up a consistent stream of passive income is all that is on my mind. My portfolio holdings are also publicly displayed.

Therefore, the consistency of investing in the stock market made this possible. I didn’t pay attention to the noise, such as the Fed, Presidency, elections, COVID-19 cases (though sad), market crashes, market bull runs, crypto currency, Tesla, Bitcoin, etc.. I kept my head down and kept investing. I didn’t time the market. If I did, I wouldn’t have built this HUGE of a position.

![]()

Do you see that far right column? That’s my forward / expected dividend income. $710.34 in forward income I am anticipating from VYM. This does not include my wife’s investment in VYM, which almost doubles this complete amount! My taxable, dividend stock portfolio is almost adding 2 shares of VYM per reinvestment. Around 8-10 weeks to go and that forward income will leap over $800 per year.

It’s wild seeing how much I have invested into one Exchange Traded Fund (ETF). Honestly, it’s so boring. However, the key piece here is that I have caught value each and every week, as the market continues to go up. I won’t have the regret of, “I wish I had invested more during that time period”. If the market dips, the dividend reinvestment will be that much sweeter, too. I welcome both sides of the market, a bull and bear baby!

Plans for Investing in Vanguard VYM

Each week, I receive comments of – will you keep going? Will you keep investing with Vanguard? The stock price on the ETF has risen from $79 to $110 since I have started. Literally, a $31 increase. To keep this in mind, the dividend has also gone up, as well. Therefore, the bullet has not been that difficult to bite when investing my cold, hard-earned money into Vanguard.

Since I am on my personal finance journey to financial freedom, I need passive income. I know viewers will state I should be just doing VTI, VOO or even SCHD. I wanted a good balance of yield and dividend growth. I am buying VYM due to a higher yield than the overall market for passive income income (financial freedom isn’t too far away) and I know the debate about SCHD. My one concern of SCHD is their long-term dividend growth sustainability. Both are great ETFs. I am choosing VYM due to the consistency in dividend growth, though!

You’re still wondering – do I keep investing in VYM? Will Lanny keep buying this stock today, tomorrow and next month, even next year? For now, that answer is YES. Will I keep investing at the hard pace I am doing, which has been 2-3 shares for my wife and 3-4 shares for my dividend stock each week? More than likely, yes.

If the price continues to surge, I may happen to pump the breaks slightly, as I will want to see the Q4-dividend. We are still 6-7 weeks away from knowing that fact about this ETF.

There you have it. My position is over $26,000 in value, producing over $700 in forward, passive income. I’ll keep buying, for now.

Conclusion on vanguard vym

Overall goal of this was to show you what consistently investing does in an ever-rising stock market. Do not ever try to time the market, as they say – it’s always about time in the market. I have had an emotionless investment with Vanguard’s VYM and am extremely pleased with the results. I’ll continue buying this stock / ETF for now.

How about you? What do you think of investing with Vanguard? Do you own and/or continuously buy an ETF each week, regardless of price? If so – how often are you buying/making that investment? I would love to hear your feedback on how you are growing wealth, reaching financial freedom and/or creating passive income.

Thank you all again for stopping by and, as always, good luck & happy investing.

-Lanny

I have at least half of our portfolio invested in Vanguard funds, I went back to look just now and surprisingly I don’t have any VYM at all. I’m agnostic when it comes to dividend investing, I get a lot of them anyway, more than enough to fund our retired lives but I just reinvest them and sell from our balanced portfolio for our monthly income stream. Our withdrawal rate is low so the portfolio keeps growing in spite of withdrawals. I think your approach works just as good, maybe better but it is way more hands on and in spite of blogging in this space I don’t really enjoy hands on investing with my own money. I do enjoy watching what the real investors, like you, are doing though!

Steveark –

Love the comment and your blog/website as well! Your articles are down to earth and you also – Tell it Like it is.

Yep – the Vanguard strategy for VYM was to provide current income now, vs. VTI or VOO, which will grow from appreciation, but the yield/income that it would provide would be appreciated at a much later time. Don’t get me wrong – my 401(k)’s, etc.. are primarily a single Vanguard S&P 500 / total market index and those perform – as you know – very well, keeping it simple, without paying much/if any attention to them.

Always appreciate the stop by and acknowledging the strategy in place here. Thank YOU!

-Lanny

Most of my retirement accounts are in VTI, VEU, and BSV. I’ve been investing my parents retirement accounts in target date retirement funds and some dividend paying stocks. This one looks great too. I may buy some VYM for them too, since I’ve been trying to give them enough dividends a year to cover their expenses.

DoD –

Nice! You simply can’t go wrong with VTI, I bet you are doing reallllly well there! Keep investing.

-Lanny

Congrats on crossing over $26,000 in value for your VYM position. Keep it up!

Thanks Kody –

It’s been a journey and I am STILL STACKING BABY!

-Lanny

Question I currently have vanguard and td ameritrade. In td I have a few dividend stocks and some etf. In my vanguard account I have vti in my index fund which is doing great but, I wondering is it better to put a vym in my td account to side together with the other dividend stocks I have or put it in the vanguard account 🤔.. hopefully I made since😬

This is a cool update! Regardless of the price growth, picking up 3+ shares per week is awesome. Very similar to what I’m doing with VTI. Someday your 3+ shares will be covered by reinvestments alone.

I like that you described it as boring. No excitement from price swings and stuff, just another few shares each week. It’s boring, but it’s more and more the strategy I’m heading toward.