We are cruising through 2021. This has been an amazing year to be a dividend growth investor. Why? Dividend growth stocks continue to perform well and announce some strong dividend increases. The dividend increases have helped Lanny and I continue to push our dividend income totals to record highs (here is Lanny’s amazing October Dividend Income Summary). Each month, we hold ourselves acocuntable by publishing our dividend income summaries, comparing the results to last year, and featuring the impact of dividend increases received during the month! Let’s dive in to my October dividend income summary.

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow a my passive income. One day, my dividend income will be large enough to cover my monthly expenses. That is why we are relentlessly searching for undervalued dividend stocks to buy. To put our hard earned cash to work.

We save a high percentage of our income each month, to help fuel our dividend stock portfolio. Having a high savings rate is a key pillar of our strategy and helps fuel the fire and push the snowball further down hill. While we are waiting to invest our money in the market, it is earning a high interest rate in accounts such as Yotta (1% – 2% APY, on average) and BlockFi (Currently earning up to 9% APY). If you are looking to earn more on your cash, it is definitely worth checking those products out!

We use our dividend stock screener with every stock purchase. Our stock screener continues to help us find undervalued dividend stocks to buy. This simple, 3 step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Watch: Dividend Diplomats’ Dividend Stock Screener

Building a large dividend income stream takes time, consistency, hard work, saving, and most importantly, investing. I have been investing in dividend growth stocks since 2012. Saving a high percentage of my dividend income allows me to invest as much as possible, so we can retire as soon as possible.

Slowly, but steadily, my income has grown. Brick by brick. DRIP by DRIP. It is really exciting to see the growth and larger dividend checks trickle into my brokerage account.

Each month, we share our dividend income summaries to highlight our growth and progress. It is a fun and helpful excercise that holds us accountable. Further, it helps you, our followers, see the stocks we are purchasing.

Bert’s October Dividend Income Summary

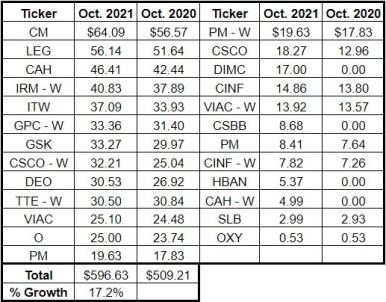

In October, we received $596.63 in dividend income! This was a 17.2% year over year increase compared to last year. The following chart summarizes each individual dividend payment we received during the month.

I always like to include a few observations in the remainder of the section about our dividend income, growth, and any trends worth highlighting!

Observation #1: Bank Stocks Dominated Our October Dividend Income

Looking at the chart above, it is amazing how many bank stocks we own in our portfolio. That shouldn’t be surprising though, given the fact that we love bank stocks. In total, we received four diivdend payments from banks (CM, DIMC, CSBB, and HBAN). The sector continues to perform well, as banks are well capitalized and are earning a lot of money.

Our largest dividend payment came from Canadian Imperial (CM). CM is one of the Big 6 Canadian Banks. If you aren’t familiar, the Big 6 are Canada’s six largest banks that are big time dividend growth stocks. All have very solid balance sheets, strong earnings, great dividend yields, and most importantly, strong dividend growth. If you are looking for a bank stock to buy, it can’t hurt to check out your options north of the border.

The other three banks that paid my wife and I a dividend this month were all new dividend payments compared to last year. Can’t be mad about that, right?

Observation #2: This Was a Boring Month…in a Good Way

Lanny and I always joke around on our YouTube Channel that boring is “great” when it comes to dividend investing. As long-term investors, we love investing in companies that consistently growth their earnings, and dividends. Frankly, most dividend stocks in our portfolio have around for decades, while increasing their dividend annually for longer than we have been alive.

I say this month is boring is because the chart above shows that our growth this month was predominately due to dividend increases and dividend reinvestment (outside of a few new bank stocks of course). Our income from LEG increased nearly $5 compared to last year without us having to even lift a finger. This was one of many dividend stocks that had “boring” months for us. I wouldn’t have it any other way.

The Impact of Dividend Increases

We love dividend increases. Who doesn’t love the feeling of seeing your dividend income grow without lifting a finger? That’s part of the reason why we think dividend investing is the best, and easiest, form of dividend income. That’s why we are always writing about dividend increases and recording videos about the recent dividend increases announced!

Watch: YouTube Playlist – Recent Dividend News

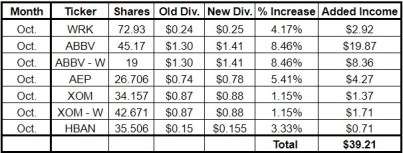

Each month, in our dividend income summaries, we demonstrate the impact each dividend increase has on our forward dividend income. October was a pretty exciting month of dividend increases, so we can’t wait to discuss them with you. The following chart summarizes the impact of each dividend increase:

We received dividend increases from 5 companies in October. In total, our dividend income increased $39.21 without lifting a finger. Interestingly, none of the dividend increases were large. I would have expected one of the companies to announce a 10%+ dividend increase after all!

The largest impact came from AbbVie (ABBV). It has been one of my favorite dividend stocks to own. I’m happy as heck that my wife and I increased our stakes in AbbVie when the company’s stock price dipped below $110 per share. Rarely do you find a company with a perfect payout ratio, a dividend yield of nearly 5%, that is trading at a P/E multiple of less than 10x. Thank goodness we scooped up as many shares as we did! As a result, the impact of AbbVie’s 8.46% dividend increase was huge!

In addition, I was pretty pumped up that ExxonMobile (XOM) announced a dividend increase and kept its Dividend Aristocrat status alive. A Dividend Aristocrat is a company that has increased its dividend for 25+ consecutive years. Turth be told, we were getting a little nervous about Exxon’s dividend increase. They waited until the last possible quarter to announce a dividend increase. If they didn’t announce and pay a larger dividend in 2021, they would no longer be an Aristocrat. Luckily, oil prices surged, allowing Exxon and other companies to announce dividend increases. The 1% increase wasn’t large…but I’ll take it!

Summary

My wife and I could not be happier with our results in October. Our October Dividend Income summary shows that we earned nearly $600 in truly passive income, while seeing our income grow over 17% compared to last year. Each month continues to show us that this strategy is working. Each month, we are that much closer to financial freedom. Now, lets finish the year strong and continue pushing harder than ever!

How did you perform in October? What was your dividend income total? Please share a link to your October Dividend Income summary article in the comment section!

Bert

Great month Bert! You will break $600 next time around for sure! I agree, boring is great in dividend investing. Strong consistent growth. Love it! 🙂

Nice, a 17.2% increase is nothing to sneeze at! $600/month is a lot of income, especially when it was done passively. Dividend income is a great strategy to get that passive income. Great call having XOM in the portfolio.

Bert,

Congrats to you and your wife on collecting nearly $600 in dividends last month. A double-digit growth rate on that dividend base is solid. Keep it up!

Congrats on a great October with nearly $600 in dividends. Come January $600 should be your new baseline for the first month of each quarter. October was a solid month for us with over $550 in our taxable accounts and over $800 including all of our accounts. Best of all we hit >$100 in forward dividends increase between purchases, reinvestment and dividend raises for the 7th time this year.

Great job! 17% increase is incredible.

Beautiful thing when those double digit increases come in! CSCO YoY was a nice improvement for you and CM wasn’t too shabby either. Nicely done

Double digit growth and almost $600 in dividend received is inspirational!

Great work you two!

Awesome update! I’ve got CM, LEG and O but might need to look into some of your other holdings.

Definitely gonna hit $600 next year congrats!